What's happening to CPNG stock?

CPNG stock has traded as high as $69 since its debut, but now changes hands just above $47. Coupang stock has pulled back more than 30 percent from its peak. More shares have been flooding the market because of early lockup expiry, which might explain the decline.

What's happening with C Coupang stock?

Coupang shares fell 1.50 percent on April 21 to close below $42. The stock has pulled back 40 percent from its peak and now trades just a few cents from its all-time low of $41.41. The company went public in March, selling shares at $35 apiece. CPNG stock had a strong debut, closing the first day of trading just shy of $50.

Is Coupang’s growth outlook positive?

As the market leader, Coupang is well-positioned to take advantage of the growth opportunities and its success should reflect in the stock price. Another sign of a bullish forecast can be gleaned from Coupang’s employment figures. The company expects to double its current workforce of 50,000 by 2025.

Is CPNG a good investment?

(NYSE:CPNG) is a fast-growing e-commerce player that has seen its shares get devastated over the recent past. With CPNG trading at the lowest price in its history, shares are worthy of a closer look. Since CPNG is not profitable yet, this isn't a low-risk investment.

What is happening to Coupang?

Coupang Posts a Narrower Loss. The Stock Soars as It Gets an Upgrade to Buy. The e-commerce company reports gross profit for the first quarter of $1.04 billion, an increase from $733 million in the same period of 2021.

Is Coupang undervalued?

It's also trading at just 0.4 times this year's sales -- while Coupang looks a bit pricier (but still fundamentally undervalued) at 1.7 times this year's sales.

Does SoftBank still own Coupang?

SoftBank sold Coupang shares worth $1.69 billion for $29.69 each in September. The conglomerate first invested in Coupang in 2015 before the launch of Vision Fund which holds the stake.

Will Coupang be profitable?

In year five, the company will generate about $56 billion in revenue and $15 billion in gross profit. That is compared to $18.4 billion in revenue and only $3.0 billion in gross profit in 2021. Looking to the stock, Coupang now trades at a market cap of $29.6 billion.

How did we ever live without Coupang?

We are Coupang Our mission is to create a world in which our customers ask, 'How did I ever live without Coupang? ' We place our customers first and offer them the best possible prices and selection within a highly convenient and personalized shopping environment.

How much of Coupang does SoftBank own?

a 29%SoftBank is Coupang's largest shareholder with a 29% stake, according to latest data complied by Bloomberg.

How can I buy Coupang stock?

How to buy shares in Coupang LLCCompare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. Complete an application with your details.Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

Is Coupang in English?

Currently, Coupang does not have an English version, but don't worry! You only need to know certain words and be familiar with the operations we guide below.

Who is shorting Coupang?

As of the most recent reporting period, the following institutional investors, funds, and major shareholders have reported short positions of Coupang: Bank of America Corp DE, Walleye Trading LLC, Jane Street Group LLC, Goldman Sachs Group Inc., PEAK6 Investments LLC, HAP Trading LLC, Bank of Montreal Can, Group One ...

Who is selling Coupang stock?

SoftBankCoupang sold shares for $35 a piece, raising $4.55 billion. Six months after the IPO, in September 2021, SoftBank started selling its Coupang shares when they were changing hands for $29.69, securities filings show.

Who has invested in Coupang?

SoftBankThe latest investment follows the $1 billion that SoftBank invested in Coupang in 2015 and values the eight-year-old startup at around $9 billion, a source close to Coupang said. Coupang has since grown rapidly to become the biggest player in South Korea's e-commerce market.

What happened

So what

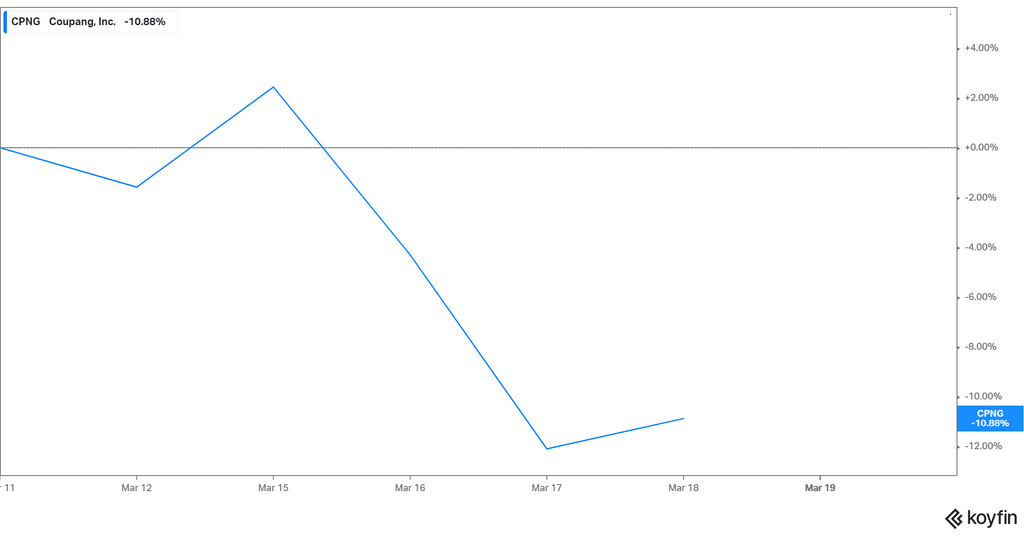

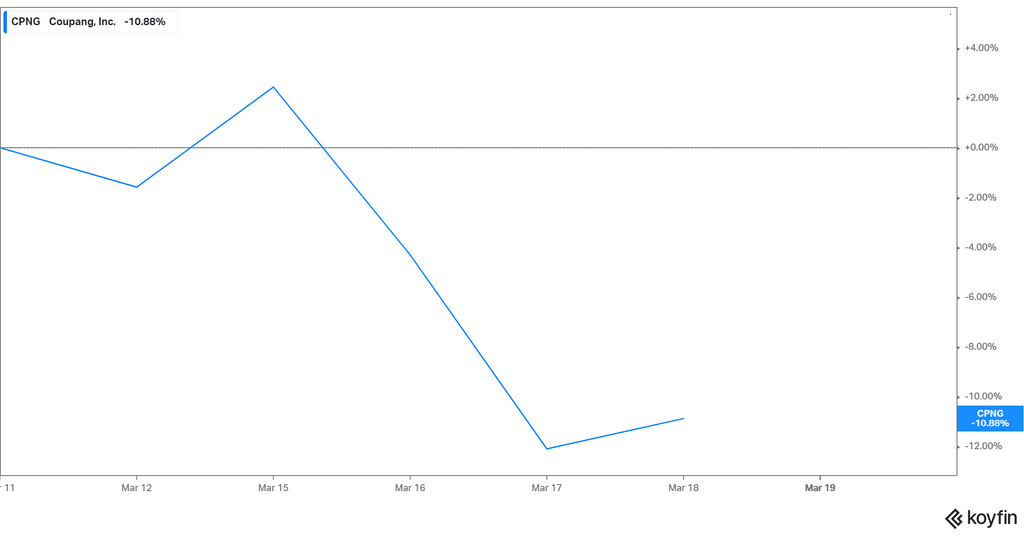

Shares of South Korean e-commerce leader Coupang ( CPNG -1.20% ) fell as much as 20% this week, before bouncing slightly to finish the week down 18.3%.

NYSE: CPNG

On Wednesday, the consumer price index (CPI) for December was released, which showed inflation rising 7% over the prior year. Excluding food and energy, "core" CPI came in at a lower 5.5%. The overall CPI was the highest on record since 1982 and the core number was the highest since 1991.

Now what

The potential for rates rising faster than many expect usually means growth stocks will fall, and that's exactly what Coupang did. Last quarter, Coupang recorded solid revenue growth of 48%, but its net losses actually increased by an even greater 87% as the company invested in growth.

Premium Investing Services

This bad week came on the heels of a 12.7% decline last week, so investors may be wondering if we are near a bottom. Currently, Coupang trades at $21.20, down 60% from its IPO price last March.

How much did the company lose in the first quarter of 2019?

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Who is the CEO of Coupang?

The company reported a loss of nearly $295 million in the first quarter of this year, down from a loss of nearly $105 million in the first quarter of 2019. Total revenue in the quarter of roughly $4.2 billion grew 74% year over year, while active customers climbed 21% year over year to top 16 million. Image source: Getty Images.

Is Coupang going public?

Image source: Getty Images. Despite the losses, Coupang CEO Bom Kim said on the company's earnings call that the company planned to further invest to strengthen its infrastructure in order to enhance its fast delivery model and wide selection of items.

Why is Coupang stock falling?

So what. Coupang, which recently went public in March, gives customers the ability to get millions of items delivered on the same day they order them online. The company reported a loss of nearly $295 million in the first quarter of this year, down from a loss of nearly $105 million in the first quarter of 2019.

What is the Coupang market share?

Coupang stock is falling because supply is exceeding demand as the lockups expire. Bargain hunters are watching the stock closely and will pounce on the opportunity to buy the dip when it looks like investing in the IPO. That would allow the stock to recover from its lows.

Why are more shares flooding the market?

Coupang is the top e-commerce company in South Korea with a market share of 24.6 percent. It’s also growing faster than the competition. Its market share expanded 6.5 percent in 2020, while many competitors saw their share of the market stagnate or shrink. Coupang is diversifying into other businesses.

Why is Coupang a diversified company?

More shares have been flooding the market because of early lockup expiry, which might explain the decline. The company’s IPO came up with a lockup preventing insiders like staff and early investors from selling their shares for up to 180 days. However, the lockup would end early if the stock traded well.

Does Coupang offer food delivery?

Operating a diversified business minimizes risks and also allows for faster growth . Coupang's IPO raised about $5 billion, which gave the company more cash to invest in expanding its business quickly and pull further ahead of its competitors. The company’s opportunities go beyond South Korea.

Is Coupang the next Amazon?

In addition to e-commerce, it also offers food delivery and online advertising services. The company has more growth opportunities to exploit. For example, the major e-commerce companies have ventured into the cloud computing business, which remained an untapped opportunity for Coupang.

How much did Coupang stock fall on April 21?

Article continues below advertisement. Coupang is a South Korean e-commerce company. Many investors think that it could be the next Amazon (AMZN) because the companies have many similarities. Amazon stock has returned more than 160,000 percent since its IPO. Coupang priced its shares at $35 apiece for the IPO.

Is Coupang a victim of its own success?

Coupang shares fell 1.50 percent on April 21 to close below $42. The stock has pulled back 40 percent from its peak and now trades just a few cents from its all-time low of $41.41. The company went public in March, selling shares at $35 apiece.