Key Takeaways

- Earnings per share (EPS) is the portion of a company's profit allocated to each outstanding share of common stock.

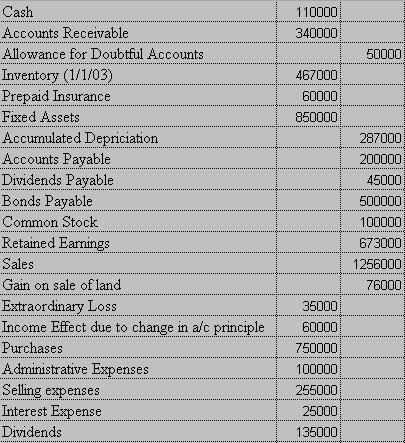

- EPS (for a company with preferred and common stock) = (net income - preferred dividends) ÷ average outstanding common shares

- EPS is sometimes known as the bottom line — the final statement, both literally and figuratively, of a firm's worth.

- Earnings per share (EPS) is the portion of a company's profit allocated to each outstanding share of common stock.

- EPS (for a company with preferred and common stock) = (net income - preferred dividends) ÷ average outstanding common shares.

What is the formula for basic earnings per share?

- Net Earnings of Starbucks in 2017 = $2,817.7 million

- Weighted average common shares 2017 = 1,471.6 million

- Basic EPS = $2,817.7/1,471.6 = $1.91

Which factors increase earnings per share?

- doing a better job at running their company - the best way!

- buying other companies - not always a good idea as many acquisitions do not achieve what they set out to achieve

- undertaking a share buyback to reduce the number of shares on issue - a great idea providing the shares are selling at below what they are worth when they are ...

What earnings per share (EPS) tells investors?

- In which direction is EPS moving? ...

- How much is EPS expected to move over the next year or two?

- How much investment was required by the company to generate the earnings?

- Is the company doing anything to change the calculation, such as increasing shares (perhaps through stock and options grants to executives)?

How do you calculate earnings per share?

- 25,000 shares * 12/12 = 25,000 outstanding entire year

- + 5,000 shares * 6/12 = 2,500 outstanding last 6 months

- Weighted average common shares: 25,000 + 2,500 = 27,500

How do you calculate earnings per share on common stock?

Earnings Per Share: Earnings per share reveals to shareholders how much money their shares have earned for the company. It's easily calculated by subtracting net income from the preferred dividends and dividing it by the number of common shares outstanding.

How do you find EPS on a balance sheet?

The calculation for earnings per share is relatively simple: You divide the net earnings or net income (which you find on the income statement) by the number of outstanding shares (which you can find on the balance sheet).

How is EPS calculated example?

To determine the basic earnings per share you simply divide the total annual net income of the last year, by the total number of outstanding shares. Here is an example calculation for basic EPS: A company's net income from 2019 is 5 billion dollars and they have 1 billion shares outstanding.

How do you find earnings per share without preferred dividends?

To calculate the EPS for common shares, subtract the preferred dividends from the corporation's net income and then divide the result by the number of common stock outstanding. You cannot calculate the EPS unless you know the number of preferred shares and the annual dividend payable to each preferred share.

How do I calculate earnings per share in Excel?

After collecting the necessary data, input the net income, preferred dividends and number of common shares outstanding into three adjacent cells, say B3 through B5. In cell B6, input the formula "=B3-B4" to subtract preferred dividends from net income. In cell B7, input the formula "=B6/B5" to render the EPS ratio.

How do you calculate earnings per share in an annual report?

Earnings per share are calculated by dividing the result for the year attributable to equity holders of the Company by the weighted average number of ordinary shares outstanding during the year.

Why do investors compare EPS?

Investors typically compare the EPS of two companies within the same industry to get a sense of how the company is performing relative to its peers. Investors may also pay attention to trends in EPS growth in order to get a better idea of how profitable a company has been in the past and to get a sense of its future prospects.

What is EPS in stock?

Earnings per share (EPS) is the portion of a company's profit allocated to each outstanding share of common stock. EPS (for a company with preferred and common stock) = (net income - preferred dividends) ÷ average outstanding common shares. EPS is sometimes known as the bottom line — the final statement, both literally and figuratively, ...

What is trailing EPS?

Trailing EPS. A company's trailing EPS is based on the previous year’s number. It uses the previous four quarters of earnings in its calculation, and has the benefit of using actual numbers instead of projections.

Why use average EPS?

Typically, an average is used, since companies may issue or buy back stock throughout the year making the true EPS difficult to pin down . Since the number of shares can frequently change, using an average of outstanding shares gives a more accurate picture of the earnings for the company.

What is EPS in accounting?

EPS is one measure that can serve as a proxy of a company's financial health. If all of a company's profits were paid out to its shareholders, EPS is the portion of a company's net income that would be allocated to each outstanding share.

What is forward EPS?

Forward EPS. Forward EPS is based on future numbers. This measurement includes projections for some period of time in the future (usually the coming four quarters). Forward EPS estimates can be made by analysts, or by the company itself.

Does Bank of America increase EPS?

In fact, Bank of America actually did this in 2017. 3 In doing so, a company can improve its EPS (because there are fewer shares outstanding) without actually improving its net income. In other words, the net income gets divided up by a fewer number of shares, thus increasing the EPS.

How to calculate dividends on preferred stock?

Here's how to calculate it: Determine the company's dividends on preferred stocks. Subtract the company's dividends from its annual net income. Divide the difference by the average amount of outstanding shares. 1. Determine the company's dividends on preferred stocks.

Why is weighted earnings per share more accurate?

Weighted earnings per share is a more accurate calculation of EPS because it considers the dividends, also known as preferred stocks, that a company issues to its shareholders. A dividend is the amount of money a company pays out to its shareholders from its profit, usually on a quarterly basis.

Why do stocks use trailing EPS?

Most stock market values use trailing EPS because it uses actual figures. However, investors may not look much at trailing EPS since it does not project future EPS figures.

What is EPS in accounting?

Earnings per share (EPS) is the portion of a company's net income, that would be earned per share if all profits were paid out to shareholders. EPS tells you a lot about a company, including a company's current and future profitability. EPS is easily calculated from basic financial information you can find online.

How to calculate EPS?

1. Determine the company's net income from the previous year. Using a company's net income or earnings for the primary number is the most basic way to determine EPS. This information is normally found on their website or a financial webpage. Be careful not to mistake quarterly net income for annual. 2.

What is EPS based on?

Current EPS is based on numbers from the current year, which include projections. This calculation uses figures from the four quarters of the current fiscal year. Some quarters already passed, providing actual figures, while some quarters remain projections.

What does higher EPS mean?

A higher EPS means a higher payout. A bigger EPS number means a company is more profitable and able to pay out more money to you as a shareholder. It's important to note, however, that no specific fixed number indicates you should buy shares or sell your shares.

Why is earnings per share important?

It's important because, usually, when a company has a high earnings per share, it also has a high stock price, which makes investors happy. The equation for calculating earnings per ...

What is the final piece of information we need to calculate the earnings per share?

The final piece of information we need to calculate the earnings per share is the number of common shares outstanding. Common shares are another class of stock. A company usually issues many more shares of common stock than it does of the more expensive preferred stock.

What is the net income of a company?

Net Income. One of the factors used to figure earnings per share is the company 's net income. Net income is the profit left over after deducting the company's expenses and is sometimes referred to as net profit or the bottom line. Net income can be found on the company's income statement.

What is preferred dividend?

Preferred dividends are the second item used to calculate earnings per share. Dividends are a share of the profit that is sometimes paid to shareholders. Preferred dividends are dividends paid to the owners of a class of stock called 'preferred' stock.

The Significance of Earnings Per Share

Calculating Earnings Per Share

- EPS is calculated as follows: EPS=net income−preferred dividendsaverage outstanding common shares\text{EPS}=\frac{\te…

The Bottom Line

- EPS becomes especially meaningful when investors look at both historical and future EPS figures for the same company, or when they compare EPS for companies within the same industry. Bank of America, for example, is in the financial services sector. As a result, investors should compare the EPS of Bank of America with other stocks in the financial services field, such as JP…