What is the biggest problem when investing in stocks?

There are two major drawbacks to investing in stocks: 1. You can lose 100% of your money in an individual stock. Stocks earn what are technically known as "residual" cash flows.

What does it actually mean to invest in stocks?

- Voting rights: You may have the right to vote at the company’s annual shareholder meetings.

- Dividends: You may receive a share of the company’s profits.

- Capital appreciation: When the company’s stock price goes up, your shares increase in value (and when the price of a stock declines, the value of your shares fall).

What are the advantages and disadvantages of investing in stocks?

The Advantages and Disadvantages of Investing in the Stock Market With Personal Finances

- Return on Investment. Historical returns related to stock market investing outperform many other types of investments. ...

- Ownership Stake in a Company. Investing in the stock market is one of the easiest ways to become a minority owner within a company.

- Subject to Higher Risk. ...

- Time-Consuming Investment. ...

What percent of investments should be in stocks?

While you may not have much money to invest at first, in some ways you can think of that as an advantage. Experts say now is the time to be aggressive, with 85% to 90% of your investments in stocks, and 10% to 15% in bonds. Stocks offer more growth potential, along with more volatility, while bonds have less upside but throw off regular income.

What happens when I buy a stock?

So when you buy a share of stock on the stock market, you are not buying it from the company, you are buying it from some other existing shareholder. Likewise, when you sell your shares, you do not sell them back to the company—rather you sell them to some other investor.

What does it mean to invest into stocks?

Stocks are an investment that means you own a share in the company that issued the stock. Simply put, stocks are a way to build wealth. This is how ordinary people invest in some of the most successful companies in the world. For companies, stocks are a way to raise money to fund growth, products and other initiatives.

How do you earn money from stocks?

Collecting dividends—Many stocks pay dividends, a distribution of the company's profits per share. Typically issued each quarter, they're an extra reward for shareholders, usually paid in cash but sometimes in additional shares of stock.

Is it good to invest in a stock?

If you're taking a long-term perspective on the stock market and are properly diversifying your portfolio, it's almost always a good time to invest. That's because the market tends to go up over time, and time in the market is more important than timing the market, as the old saying goes.

How do beginners buy stocks?

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker's website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

How do beginners invest?

There are plenty of investments for beginners, including mutual funds and robo-advisors....Here are six investments that are well-suited for beginner investors.401(k) or employer retirement plan.A robo-advisor.Target-date mutual fund.Index funds.Exchange-traded funds (ETFs)Investment apps.

Can I withdraw money from stocks?

You can only withdraw cash from your brokerage account. If you want to withdraw more than you have available as cash, you'll need to sell stocks or other investments first. Keep in mind that after you sell stocks, you must wait for the trade to settle before you can withdraw money from your brokerage account.

Can stocks make you rich?

Investing in the stock market is one of the world's best ways to generate wealth. One of the major strengths of the stock market is that there are so many ways that you can profit from it. But with great potential reward also comes great risk, especially if you're looking to get rich quick.

Can you lose money from stocks?

Yes, you can lose any amount of money invested in stocks. A company can lose all its value, which will likely translate into a declining stock price. Stock prices also fluctuate depending on the supply and demand of the stock. If a stock drops to zero, you can lose all the money you've invested.

Do you get paid for owning stock?

There are two ways to make money from owning shares of stock: dividends and capital appreciation. Dividends are cash distributions of company profits.

What stocks are good buy?

Best Value StocksPrice ($)12-Month Trailing P/E RatioeBay Inc. (EBAY)44.182.6NRG Energy Inc. (NRG)45.812.8Cleveland-Cliffs Inc. (CLF)22.623.32 more rows

How much money can you make from stocks in a month?

The short answer to the question of, “how much can you make from stocks in a month?” is there is no max. You could make an infinite amount, theoretically. But you also could lose 100% of your investment as well, so it really is a risk reward situation.

Why is investing in stocks good?

Stock investment offers plenty of benefits: Takes advantage of a growing economy: As the economy grows, so do corporate earnings. That's because economic growth creates jobs, which creates income, which creates sales. The fatter the paycheck, the greater the boost to consumer demand, which drives more revenues into companies' cash registers.

What are the pros and cons of investing in stocks?

Stock Investing Pros and Cons 1 Grow with economy 2 Stay ahead of inflation 3 Easy to buy and sell

How to stay ahead of inflation?

Best way to stay ahead of inflation: Historically, stocks have averaged an annualized return of 10%. 1 That's better than the average annualized inflation rate. It does mean you must have a longer time horizon, however. That way, you can buy and hold even if the value temporarily drops.

What does "liquid" mean in stock market?

2. Easy to sell: The stock market allows you to sell your stock at any time. Economists use the term "liquid" to mean that you can turn your shares into cash quickly and with low transaction costs.

What does "cap" mean in stock?

The term "cap" stands for "capitalization .". It is the total stock price times the number of shares. 7 It's good to own different-sized companies, because they perform differently in each phase of the business cycle. By location: Own companies located in the United States, Europe, Japan, and emerging markets.

What is a well diversified portfolio?

That means a mix of stocks, bonds, and commodities. Over time, it's the best way to gain the highest return at the lowest risk. 6.

Is the stock market volatile?

However, the stock market can be volatile, so returns are never guaranteed. You can decrease your investment risk by diversifying your portfolio based on your financial goals.

Can you lose your principal if you invest?

You could lose your “principal,” which is the amount you’ve invested. That’s true even if you purchase your investments through a bank. But when you invest, you also have the opportunity to earn more money. On the other hand, investing involves taking on some degree of risk. Printer-friendly version.

Is investing in mutual funds federally insured?

Unlike FDIC-insured deposits, the money you invest in securities, mutual funds, and other similar investments are not federally insured.

Everyday-life examples of investing

Most people make investment decisions on a daily basis -- even if they aren't putting money into assets like stocks or real estate. If a person pays college tuition and attends classes with the hope of gaining knowledge and skills that will benefit them in the future, that person has made a decision to invest in themselves.

Time plays a crucial role in successful investing

Building the foundation needed to make well-informed investment moves can take a lot of time. If a person is considering college to gain a particular skill, that person should be looking at the salaries of professionals in their field and thinking about whether demand for their chosen profession is likely to increase.

What does it mean to own a stock?

Most people realize that owning a stock means buying a percentage of ownership in the company, but many new investors have misconceptions about the benefits and responsibilities of being a shareholder. Many of these misconceptions stem from a lack of understanding of the amount of ownership that each stock represents.

Do stockholders own shares?

Stockholders own shares of a company, but the level of ownership may not present the benefits and responsibilities sought after. Most shareholders have no direct control over a company's operations, although some have voting rights affording some authority, such as voting for the board of directors members.

Does a discount affect C's stock?

Since revenue is the main driver of stock price and the loss from a discount would mean a drop in stock price, the negative impact of a discount would be more substantial for C's Brewing. So, even though an owner of stock may have saved on a purchase of the company's goods, they would lose on the investment in the company's stock.

Does ownership in a company translate into discounts?

Another misconception is that ownership in a company translates into discounts. Now, there are definitely some exceptions to the rule. Berkshire Hathaway (BRK/A), for example, has an annual gathering for its shareholders where they can buy goods at a discount from Berkshire Hathaway's held companies.

What is a buyer of a company's stock?

Stocks. A buyer of a company's stock becomes a fractional owner of that company. Owners of a company's stock are known as its shareholders and can participate in its growth and success through appreciation in the stock price and regular dividends paid out of the company's profits.

When did investing start?

While the concept of investing has been around for millennia, investing in its present form traces its roots back to the period between the 17th and 18th centuries, when the development of the first public markets connected investors with investment opportunities. The Amsterdam Stock Exchange was established in 1787, followed by the New York Stock Exchange (NYSE) in 1792.

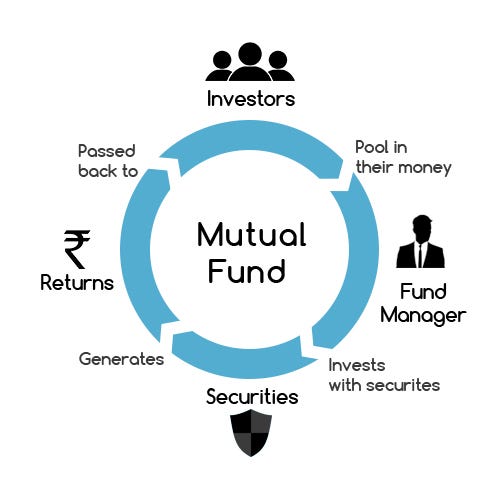

What are mutual funds? What are their functions?

Funds are pooled instruments managed by investment managers that enable investors to invest in stocks, bonds, preferred shares, commodities, etc. The two most common types of funds are mutual funds and exchange-traded funds or ETFs. Mutual funds do not trade on an exchange and are valued at the end of the trading day; ETFs trade on stock exchanges and, like stocks, are valued constantly throughout the trading day. Mutual funds and ETFs can either passively track indices, such as the S&P 500 or the Dow Jones Industrial Average, or can be actively managed by fund managers.

How has technology helped investors?

Technology has also afforded investors the option of receiving automated investment solutions by way of robo-advisors. The amount of consideration, or money, needed to invest depends largely on the type of investment and the investor's financial position, needs, and goals.

What is the core premise of investing?

The expectation of a return in the form of income or price appreciation with statistical significance is the core premise of investing. The spectrum of assets in which one can invest and earn a return is a very wide one.

What is low risk investment?

Risk and return go hand-in-hand in investing; low risk generally means low expected returns, while higher returns are usually accompanied by higher risk. At the low-risk end of the spectrum are basic investments such as Certificates of Deposit (CDs); bonds or fixed-income instruments are higher up on the risk scale, ...

What is a bond?

Bonds. Bonds are debt obligations of entities, such as governments, municipalities, and corporations. Buying a bond implies that you hold a share of an entity's debt and are entitled to receive periodic interest payments and the return of the bond's face value when it matures.