Should you buy TD stock?

There are many reasons why TD Bank is a good stock to buy now. Let’s look at them. Toronto-Dominion Bank has recently received the title of “ Best Investment Bank in Canada ” by Euromoney’s Awards for Excellence 2021. TD Bank is a high-quality bank that trades for cheap, as the stock has a P/E ratio of only 10.7 and a five-year PEG of only 0.73.

How best to value bank stocks?

When trying to analyze a particular bank stock, it's a good idea to focus on four main things:

- What the bank actually does

- Its price

- Its earnings power

- The amount of risk it's taking to achieve that earnings power

What is the monthly fee for TD Bank?

Monthly service fee. $25 (may qualify to waive fee) $5.99. Minimum deposit to open account. $0. $0. ATM fees. $0. $0 at all TD Bank ATMs; $3 at non-TD ATMs.

Is TD stock a buy?

Toronto-Dominion Bank in Focus Based in ... investment opportunity with a Zacks Rank of #2 (Buy). Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

See more

/https://www.thestar.com/content/dam/thestar/business/2017/03/10/td-bank-stock-falls-on-sales-pressure-report/td.jpg)

Is TD stock a buy?

TD Bank (Toronto Dominion) is one of the best yield stocks in the financial sector and also offers the potential for attractive capital gains. With a steadily rising dividend and a yield close to 4%, this stock is suitable for investors who want to generate regular income.

Did TD Bank stock split?

The record date for this stock split was July 28, 1983. This split was done on a "call-in" basis....Stock Split Information.May 31, 19671Stock Split5-for-1 Stock SplitJuly 31, 199951 for 1 Stock DividendEquivalent to a 2-for-1 Stock SplitJanuary 31, 201461 for 1 Stock DividendEquivalent to a 2-for-1 Stock Split3 more rows

Is TD Bank a good long term investment?

TD Bank is one of the largest domestic banks and with a strong presence in Canada and the United States. TD stock has delivered great long-term returns in the past and has gained about 35% since the last year and 14% year to date. Here's why it remains a top buy right now.

How often does TD Bank pay dividends?

quarterlyDividends are often paid quarterly, but can be paid out on other frequencies (or even as a one-time payment, for special dividends). The amount received depends on the number of shares you own in that company.

What is a 100% stock dividend?

A 100% stock dividend means that you get one share of the "stock dividend" for every share you own. For example, Google did this in 2014 when they gave all of their Class A shareholders one class C share for every Class A that they owned.

Will BMO stock split 2022?

NEW YORK, April 1, 2022 /CNW/ - Bank of Montreal (TSX: BMO)(NYSE: BMO) announced today that it will implement a 1-for-50 reverse split of its outstanding MicroSectorsTM U.S. Big Oil Index -3X Inverse Leveraged ETNs due March 25, 2039 (the "ETNs"), expected to be effective as of April 11, 2022.

Are banks stocks a good buy now?

When interest rates are on the move, it's always a good idea to start considering the best bank stocks to buy now. Bank of America (BAC): One of Warren Buffett's favorite stocks....5 of the Best Bank Stocks to Buy Now.BACBank of America$35.40CCitigroup$52.33EWBCEast West Bancorp$68.82JPMJPMorgan Chase$125.16WFCWells Fargo$43.12May 24, 2022

Is TD Bank a blue chip stock?

In this article: TD. FHN-PE.

What is the best Canadian bank stock to buy?

Top Canadian Bank Stock PicksBank NameTickerPrice/Fair ValueThe Toronto-Dominion BankTD0.86%Royal Bank of CanadaRY0.88%Bank of MontrealBMO0.84%Bank of Nova ScotiaBNS0.88%2 more rows•Jul 4, 2022

What is the highest paying dividend stock in Canada?

Top Canadian Dividend StocksNameTickerForward Dividend Yield %Enbridge IncENB6.33%Great-West Lifeco IncGWO6.26%AGF Management LtdAGF.B6.14%Manulife Financial CorpMFC5.96%6 more rows•Jul 11, 2022

Which stock has the highest dividend?

9 highest dividend-paying stocks in the S&P 500:AT&T Inc. (T)Williams Cos. Inc. (WMB)Devon Energy Corp. (DVN)Oneok Inc. (OKE)Simon Property Group Inc. (SPG)Kinder Morgan Inc. (KMI)Vornado Realty Trust (VNO)Altria Group Inc. (MO)More items...•

How long do you have to hold a stock to get the dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

What is Toronto Dominion Bank?

What is retail banking?

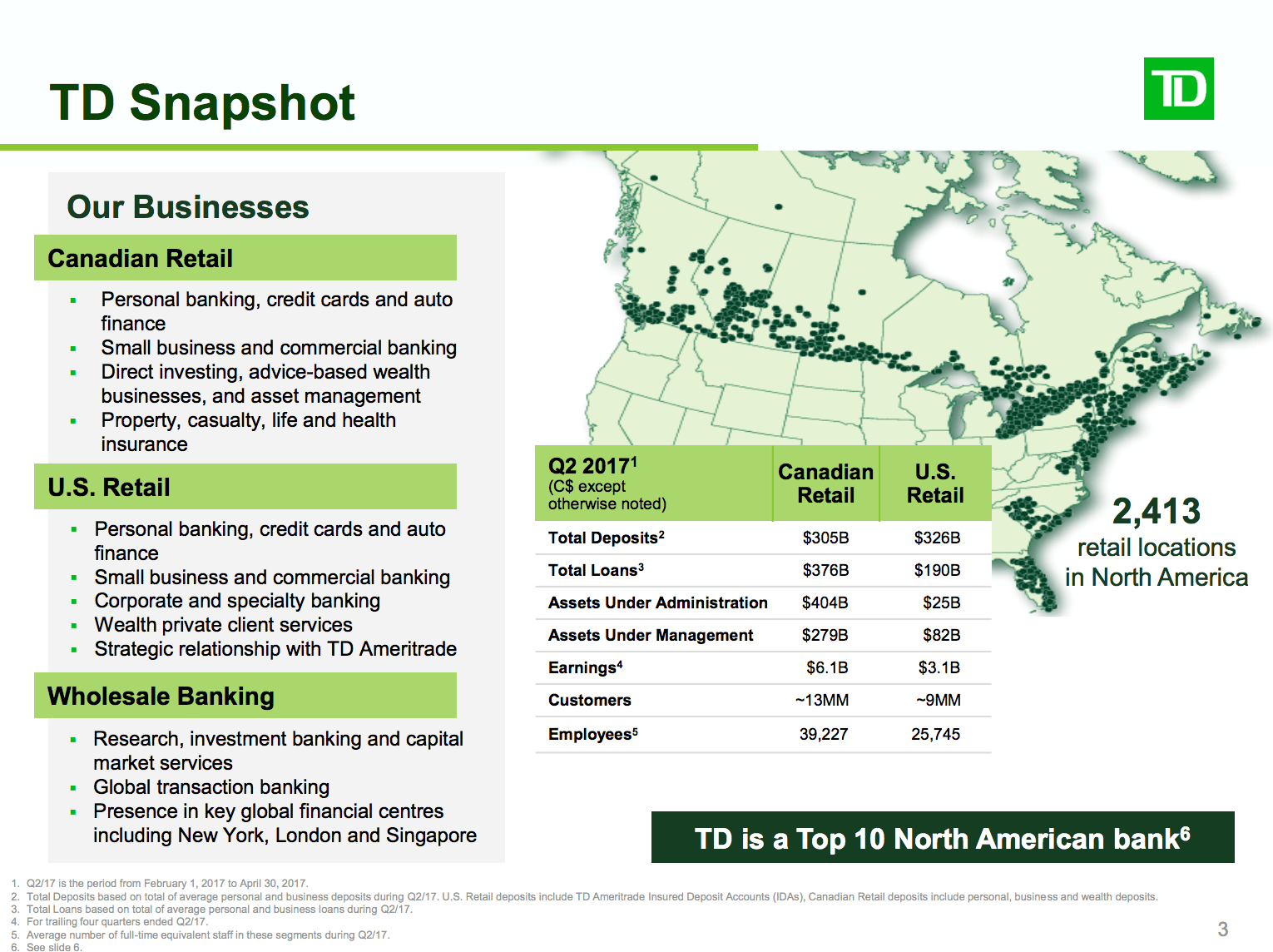

The Toronto-Dominion Bank engages in providing financial products and services. It operates through the following segments: Canadian Retail, U.S. Retail, and Wholesale Banking. The Canadian Retail segment offers various financial products and services, as well as telephone, Internet, and mobile banking services. The U.S. Retail segment provides retail and commercial banking services, as well as wealth management services in the United States. The Wholesale Banking segment provides capital markets, investment banking, corporate banking products and investment needs to companies, governments, and institutions in financial markets. The company was founded on February 1, 1955 and is headquartered in Toronto, Canada.

Who is the CEO of TD Bank?

The U.S. Retail segment provides retail and commercial banking services, as well as wealth management services in the United States. The Wholesale Banking segment provides capital markets, investment banking, corporate banking products and investment needs to companies, governments, and institutions in financial markets.

How much money does TD Bank donate to McGill University?

TD Bank Group on Thursday named Chief Financial Officer Riaz Ahmed chief executive of its securities unit and head of wholesale banking, a move some investors interpreted as a sign he will succeed CEO Bharat Masrani. For Ahmed, 58, the change marks a return to his TD roots.

When will TDAM support TCFD?

To help improve equality in access to health care, TD Bank Group is proud to donate $1 million to the McGill University Health Centre (MUHC) Foundation for an innovative project focused on helping health care access for remote communities.

What is Toronto Dominion Bank?

On June 1st 2021, TDAM declared its formal1 support for the Task Force on Climate-related Financial Disclosures (TCFD), joining more than 2,000 organizations, including TD Bank Group (TD), in demonstrating a commitment to building a more resilient financial system and safeguarding against climate risk through better disclosures.

What is retail banking?

The Toronto-Dominion Bank engages in providing financial products and services. It operates through the following segments: Canadian Retail, U.S. Retail, and Wholesale Banking. The Canadian Retail segment offers various financial products and services, as well as telephone, Internet, and mobile banking services. The U.S. Retail segment provides retail and commercial banking services, as well as wealth management services in the United States. The Wholesale Banking segment provides capital markets, investment banking, corporate banking products and investment needs to companies, governments, and institutions in financial markets. The company was founded on February 1, 1955 and is headquartered in Toronto, Canada.

MEDIA ADVISORY - TD Bank Group Executive to Present at the RBC Global Financial Institutions Conference

The U.S. Retail segment provides retail and commercial banking services, as well as wealth management services in the United States. The Wholesale Banking segment provides capital markets, investment banking, corporate banking products and investment needs to companies, governments, and institutions in financial markets.

Most traders believe meme stocks will impact markets: Charles Schwab

Kelvin Tran, CFO, TD Bank Group will present virtually at the RBC 2022 Global Financial Institutions Conference on March 9, 2022. His presentation will begin at 9:20 a.m. ET. A live audio webcast will be available on the Investor Relations section of TD's website at www.td.com/investor.

2 Canadian Banking Giants to Crush Inflation

Having been around a year since GameStop’s stock gained notoriety through the infamous short squeeze, “meme stocks” continued their rise to prominence throughout 2021 and remain at the forefront of investors’ minds today.

About Toronto-Dominion Bank

TD Bank (TSX:TD) (NYSE:TD) and Bank of Montreal (TSX:BMO) (NYSE:BMO) are intriguing Canadian banking studs that may be worth loading up on here. The post 2 Canadian Banking Giants to Crush Inflation appeared first on The Motley Fool Canada.

Headlines

The Toronto-Dominion Bank, together with its subsidiaries, provides various personal and commercial banking products and services in Canada and the United States. It operates through three segments: Canadian Retail, U.S. Retail, and Wholesale Banking.

Toronto-Dominion Bank (TSE:TD) Frequently Asked Questions

Are Banks Closed on Presidents Day? Chase, Wells Fargo, Bank of America and More

When was TD Bank founded?

13 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Toronto-Dominion Bank in the last year. There are currently 1 sell rating, 3 hold ratings and 9 buy ratings for the stock.

What is a Toronto Dominion Bank?

Commonly known as TD and operating as TD Bank Group, the bank was created on 1 February 1955, through the merger of the Bank of Toronto and The Dominion Bank, which were founded in 1855 and 1869, respectively. It is one of two Big Five banks founded in Toronto, the other being the Canadian Imperial Bank of Commerce.

Is TD Bank a big bank?

The Toronto-Dominion Bank is a Canadian multinational banking and financial services corporation headquartered in Toronto, Ontario.

What time do you trade in the pre market?

It is one of two Big Five banks founded in Toronto, the other being the Canadian Imperial Bank of Commerce. In 2017, according to Standard & Poor's, TD Bank Group was the largest bank in Canada by total assets, the second largest by market capitalization, a top-10 bank in North America, and the 26th largest bank in the world.

Does market cap include convertible securities?

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment.

Earnings

It does not include securities convertible into the common equity securities. "Market Cap" is derived from the last sale price for the displayed class of listed securities and the total number of shares outstanding for both listed and unlisted securities (as applicable).

Analyst Research

Corporate earnings are provided from Morningstar, including Income Statements,Balance Sheets, Cash Flow Statements, and Statement of Retained Earnings.

StockCalc

Analyst Ratings and Earnings Estimates are provided by Zacks Investment Research.

ValuEngine

What is this stock worth in intrinsic value? View this premium StockCalc report to see this stock's valuation and how it was calculated using fundamental analysis. For subscribers only.

Latest Press Releases

A stock valuation and forecasting report include rating, fair value assessment, return forecasts, market ratio-based valuations and comparable analysis. Available for free with registration.

/https://www.thestar.com/content/dam/thestar/business/2017/03/10/td-bank-stock-falls-on-sales-pressure-report/td.jpg)