To put that number in perspective, Ford’s market cap was about $37 billion, and GM’s was about $50 billion. Add those numbers together, and Tesla had a higher market cap, by $2 billion, than Ford and GM combined. Tesla’s significant gain came thanks to a surprise Q3 profit combined with the progress at Tesla’s new Chinese factory.

Full Answer

Is Tesla better than Ford?

Tesla certainly seems to have more efficiency with its batteries, size/weight of batteries, cost, and range, leading me to conclude that Tesla has the advantage here. If Ford was able to produce more range from its batteries and have smaller batteries and better cost than Tesla, I would conclude that Ford has the advantage.

Will Tesla become more valuable than Ford?

Tesla had already surpassed General Motors, Ford, and Fiat Chrysler to become the most valuable carmaker in the US. But is Tesla really worth more than Toyota? Of course not.

Why is TSLA so overvalued?

The reason why Tesla has been able to secure such a high valuation over the past several months is that it is miles ahead of traditional carmakers in the electric vehicle industry. There is a strong perception that Tesla is more of a software company rather than a carmaker, which has contributed to the rapid expansion of the firm.

Is Tesla really bigger than Ford or GM?

Tesla's market value eclipses GM and Ford — combined ... That is $2 billion larger than General Motors' and Ford's combined respective stock market values of $49 billion and $37 billion.

Why is Ford stock so much lower than Tesla?

Due to a lower average selling price, Ford's revenue was around 2.5x higher than that of Tesla, at $136 billion versus around $55 billion. Ford's broader model line-up and its lacking focus on the premium segment explain why its margins are weaker than those of Tesla.

Is Tesla richer than Ford?

Tesla's market cap is roughly $900 billion, which is roughly six times the combined market value of GM and Ford.

Why is Tesla stock so high compared to other companies?

Key Takeaways. The increase in Tesla's stock price and market cap has created a financial complex of investment products that include or track the electric car maker's stock. Average trading volume in Tesla options exceeds that in S&P 500 options.

Is Ford a better buy than Tesla?

Crunching the numbers, it is possible to estimate that, based on each company's market cap and considering 2021 deliveries, Tesla's equity is valued roughly at $959,200 per car delivered, while Ford is worth only roughly $18,400 per car sold.

Will Tesla surpass Ford?

Tesla & Ford Unit Volume Unit volume will be the last of the 4 measures for Tesla to overtake Ford. In 2021, Tesla produced 930,422, over 9 times its total only 4 years earlier in 2017 (101,025). As we previously mentioned when discussing revenue, Tesla now has the factories built to make 3.7 million vehicles a year.

Is Ford stock undervalued?

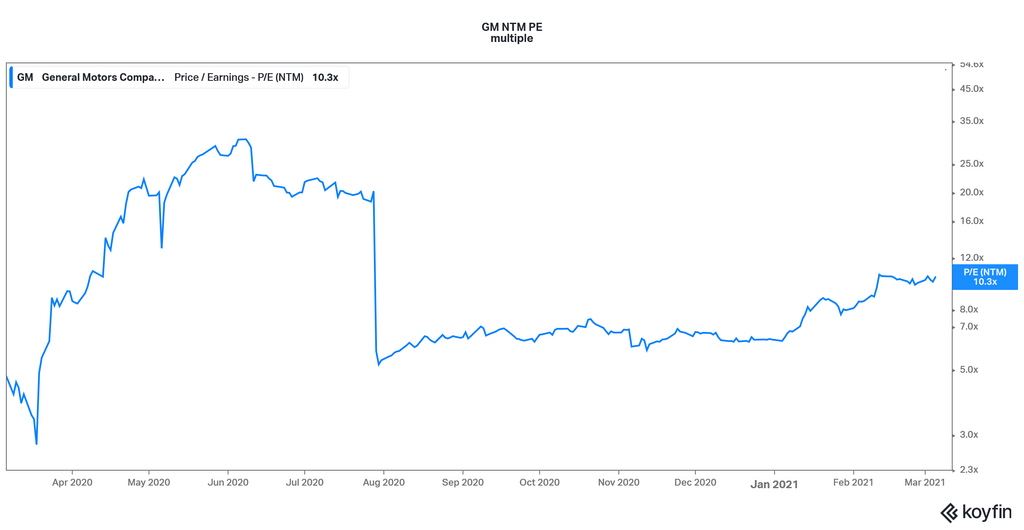

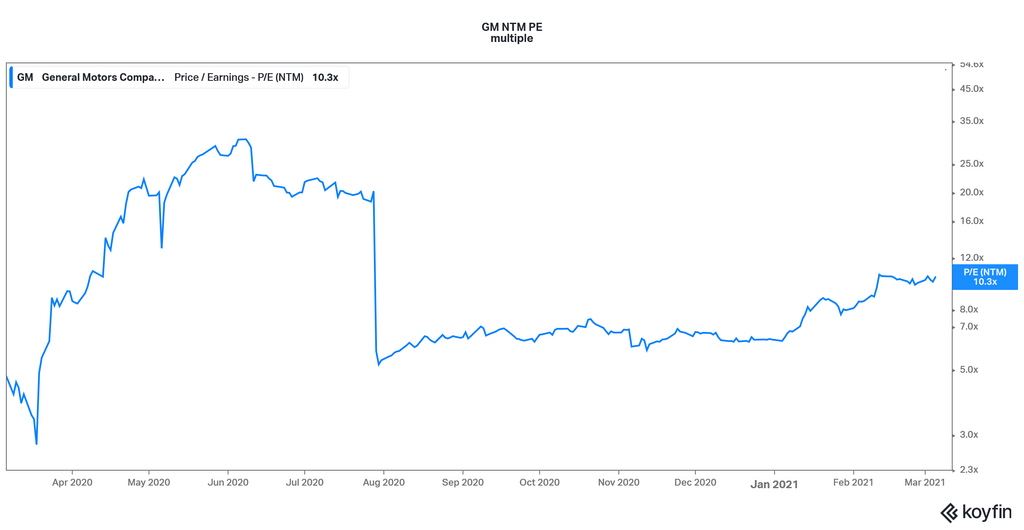

Ford's financials in focus Currently, Ford's shares look undervalued compared to its competition. Ford's P/E of 4.70 is well behind GM's (GM 2.95%) 6.2 P/E, much less Tesla's 98 P/E.

Why is Tesla so overpriced?

High demand has led to a problem keeping up with production, leading to a waitlist of vehicles. The high price for Tesla cars is also related to the high cost of the electric battery packs that supply the vehicles with power.

Is Tesla way overvalued?

At current prices, we view Tesla shares as overvalued, trading in 2-star territory. We think the market continues to price in a scenario where Tesla becomes a top-three automaker in global vehicles sold by 2030.

Who owns the most Tesla stock?

MuskMusk is Tesla's biggest shareholder, owning around 17 percent of the company's shares, or about 175 million shares in total. Musk has sold large batches of shares before. Last year, he sold 15 million shares, worth more than $16 billion, after polling his followers on Twitter.

Is Ford a good stock to buy 2021?

Today's market reaction to the first-quarter report gives long-term investors a better opportunity to buy Ford's stock to help diversify a portfolio of EV investments. The company maintained its outlook for the balance of 2022, implying an increase in operating income of between 15% and 25% over 2021 levels.

Is Ford a good stock for 2022?

Ford has big plans for 2022, with the release of its F-150 lightning truck, which is the number one selling truck in the United States. The automotive maker now expects to increase profits by 15% to 25% in 2022.

Is Ford worth investing in?

Bottom line: Ford stock is not a buy now. While Ford is above the 21-day line and a short-term trend line from the last few weeks, it has yet to break a downtrend line connecting its 17.80 and 16.57 peaks.

What are the similarities between Tesla and Ford?

Similarities between Ford and Tesla. First, as both are essentially selling to the global automobile market, there are many similarities that can be quite important to consider. Automobile markets are remarkably cyclical, which will, in the long run, have an impact on both companies.

How much will Tesla's EPS grow?

Tesla's EPS are forecasted to grow by 37% a year between 2021 and 2023, which is almost exactly on par with the growth that analysts are expecting from Ford. It has to be expected that Tesla's growth will be substantially higher beyond 2023, however, where Ford's growth will likely slow down considerably.

Is Tesla a good company?

Tesla's stock has been driven to an irrational level by emotional investors who are romanticizing the company founder and the company. Tesla is a fine company but has no sustainable competitive advantage. The EV market is getting crowded, actually saturated.

Is Ford a legacy company?

Ford is an embodiment of legacy auto -- the company, which was founded more than 100 years ago, belongs to the largest players in the automobile industry, with annual sales of around $150 billion. The company has, however, not experienced a lot of growth in recent years, which is why its shares also have not performed too well -- investors have, at least, gotten a high dividend in most years.

Is Tesla more relevant to investors?

Tesla, on the other hand, is more relevant for those that want to have a stake in a highly ambitious company with great plans for the future, while Tesla's investors will in most cases not focus on valuation, instead opting to believe that Tesla's growth plans will eventually justify its current price.

Is Ford still dependent on ICE?

Ford, on the other hand, is still mostly dependent on ICE-powered car sales. The company has ambitious goals for its nascent EV business, but so far, ICE-powered cars are where the company generates most of its revenues and profits.

Is Tesla a pureplay company?

Tesla is the best-known and largest EV pureplay in the world , and not surprisingly, its stock benefited a lot when investors got more interested in EV stocks during the pandemic:

Tesla Valuation: Market Cap

Tesla is the most valuable automaker by far. Its market capitalization (stock price times shares outstanding) of $629 billion ranks it sixth among companies on the U.S. stock market. The electric-car company is worth almost 8 times GM and nearly 13 times F.

Cash Flow Generation

Aside from earnings, analysts can also use cash flow to value Tesla shares. Cash flow adjusts net income to remove accrual accounting mechanisms and gains from investing activities. Analysts can also use cash slow to compare stocks prices.

Is Tesla Overpriced?

One major reason why Tesla is valued so much higher than its peers is growth. The electric-car maker increased its sales by 45 percent last year. Wall Street analysts anticipate another 55 percent of upside this year.

Tesla Valuation: Stores and Units

Investors can also use non-financial measures to compare Tesla with other car makers. How many cars does it sell? How many locations does it have to reach customers?

Shifting gears

What Ford needs to do is prove that with real results. During the last couple of years, the automaker has declared a shift from simply building and selling cars to providing various types of mobility, which might include Uber-style rides, shuttles, shared vehicles and even bicycles.

Challenges ahead

Meanwhile, Wall Street analysts worry that US car sales, while still strong at more than 17 million per year, may have peaked, forcing Ford and other automakers to discount more in order to move the metal.

Moving forward after a breakout year

Howard Smith (Tesla): Every prospective stock investment should be part of a larger strategy. Otherwise, one could just buy mutual funds or exchange-traded funds that track the overall market. When considering whether to invest in Tesla or Ford, the strategy would presumably be based on gaining exposure to the EV sector.

Ford is at the top of its game

Daniel Foelber (Ford): During its fourth-quarter 2021 earnings call, Ford said that it now expects semiconductor challenges to persist throughout 2022, damaging its ability to ramp up production fast enough to satisfy high demand. Throughout 2021, Tesla showed impressive resolve in navigating the crisis.

Two great buys for the long haul

Tesla and Ford stock have both sold off and could keep selling off in the short term due to a mix of industry headwinds and broader market volatility. Investors interested in the EV space should approach a prospective investment with a long-term time horizon.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.

How much is Tesla's market cap?

This is the market cap. Less than $37 billion market cap for Ford, $613 billion market cap for Tesla right now. Tesla's selling $5 billion of stock right now because the stock is so rich right now. That is the smartest way to raise capital.

How many Ford plants are there in the world?

Ford has a couple hundred plants around the world.

Is Tesla an outsider?

Tesla has already disrupted the industry as an outsider. The next big step is to change it from the inside, while gaining what Ford is also really good at. Jason Hall. (TMFVelvetHammer)

Is Tesla in good shape?

Jason Hall: Tesla is in a pretty good shape as far as their balance sheet, they have a good bit of cash. Not a whole lot of debt. But that's going to be changing over the next few years because the company has to build out scale.

Is Tesla the most valuable automaker?

Tesla ( NASDAQ:TSLA) has disrupted the global auto industry, and is easily the most valuable automaker on earth. However, investors are also giving the company a lot of credit for what they expect it will do, not what it's already done. In coming years, the company will need to spend enormous amounts of money to build out its manufacturing ...