What will McKesson's stock price reach in the next year?

Apr 01, 2022 · Earnings for McKesson are expected to decrease by -5.06% in the coming year, from $23.91 to $22.70 per share. Price to Earnings Ratio vs. the Market. The P/E ratio of McKesson is 36.36, which means that it is trading at a more expensive P/E ratio than the market average P/E ratio of about 12.01.

Where can I buy McKesson (MCK)?

Why is McKesson Corp stock dropping? Earnings reports or recent company news can cause the stock price to drop. Read stock experts’ recommendations for help on deciding if you should buy, sell or hold the stock.

How much is a MCK stock worth?

Oct 21, 2019 · During five years of share price growth, McKesson moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other...

Why should you hold McKesson (MCK) in your portfolio?

Get the latest McKesson Corporation (MCK) stock news and headlines to help you in your trading and investing decisions.

Is McKesson a good stock to buy right now?

McKesson Corporation - Buy Its Value Score of B indicates it would be a good pick for value investors. The financial health and growth prospects of MCK, demonstrate its potential to outperform the market. It currently has a Growth Score of B.

Is McKesson a buy or sell?

McKesson has received a consensus rating of Buy. The company's average rating score is 2.85, and is based on 11 buy ratings, 2 hold ratings, and no sell ratings.

Is McKesson undervalued?

MCK's industry currently sports an average PEG of 2.81. Within the past year, MCK's PEG has been as high as 1.85 and as low as 1.19, with a median of 1.53. Value investors will likely look at more than just these metrics, but the above data helps show that McKesson is likely undervalued currently.Mar 26, 2021

Who owns McKesson stock?

Top 10 Owners of Mckesson CorpStockholderStakeShares ownedThe Vanguard Group, Inc.9.93%14,873,887BlackRock Fund Advisors5.13%7,679,809SSgA Funds Management, Inc.4.55%6,808,394Massachusetts Financial Services ...3.81%5,705,0256 more rows

Is McKesson publicly traded?

Is McKesson Corporation a publicly traded company? Yes. McKesson Corporation common stock is listed on the New York Stock Exchange (ticker symbol MCK) and is quoted in the daily stock tables carried by most newspapers.

Is McKesson a Fortune 5 company?

As of 2021, McKesson was ranked #7 on the Fortune 500 rankings of the largest United States corporations, with revenues of $238.2 billion....McKesson Corporation.FormerlyOlcott & McKesson (1833–1853) McKesson & Robbins (1853–1967) McKessonHBOC (1999–2001)Total equityUS$5.092 billion (2020)Number of employees80,000 (2020)15 more rows

Is McKesson a distributor or wholesaler?

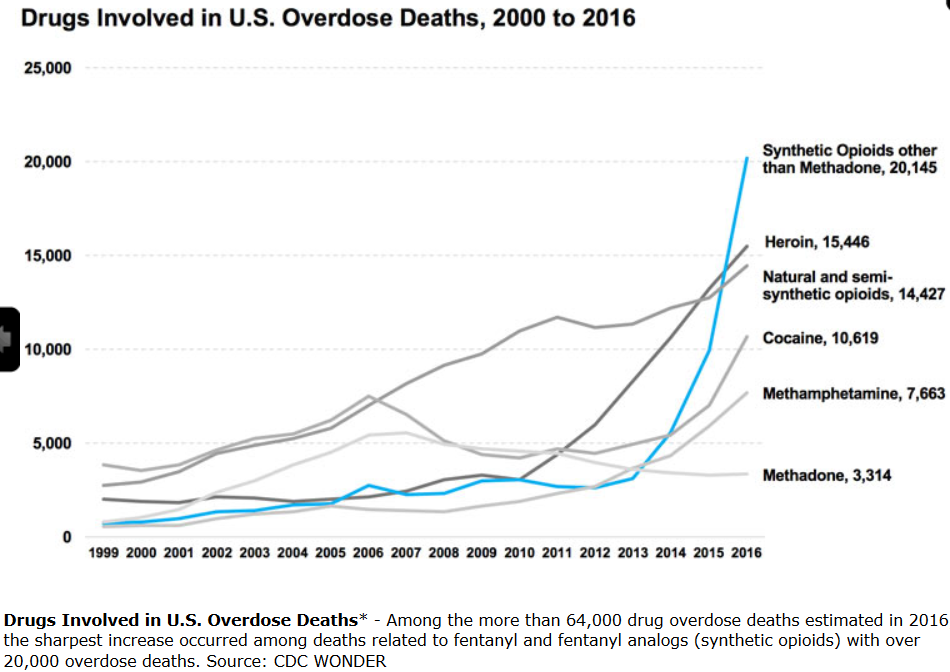

As a pharmaceutical distributor, McKesson operates as one component within the pharmaceutical supply chain, which also includes drug manufacturers, regulatory bodies like the U.S. Drug Enforcement Administration (DEA) and state pharmacy boards, insurance companies, prescribing doctors and dispensing pharmacists.

Is McKesson a pharmaceutical company?

McKesson is a global leader in health care supplies, retail pharmacy, and pharmaceutical distribution.

Is McKesson a buy right now?

13 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for McKesson in the last twelve months. There are currently 2 hold r...

How has McKesson's stock been impacted by COVID-19?

McKesson's stock was trading at $135.17 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organization (WHO)....

Are investors shorting McKesson?

McKesson saw a decline in short interest in the month of February. As of February 28th, there was short interest totaling 5,030,000 shares, a decli...

When is McKesson's next earnings date?

McKesson is scheduled to release its next quarterly earnings announcement on Thursday, May 5th 2022. View our earnings forecast for McKesson .

How were McKesson's earnings last quarter?

McKesson Co. (NYSE:MCK) issued its earnings results on Wednesday, February, 2nd. The company reported $6.15 earnings per share (EPS) for the quarte...

How often does McKesson pay dividends? What is the dividend yield for McKesson?

McKesson announced a quarterly dividend on Thursday, January 27th. Investors of record on Tuesday, March 1st will be paid a dividend of $0.47 per s...

Is McKesson a good dividend stock?

McKesson pays an annual dividend of $1.88 per share and currently has a dividend yield of 0.66%. McKesson has been increasing its dividend for 15 c...

How will McKesson's stock buyback program work?

McKesson declared that its board has initiated a share buyback plan on Tuesday, February 2nd 2021, which allows the company to repurchase $2,000,00...

What guidance has McKesson issued on next quarter's earnings?

McKesson issued an update on its FY 2022 earnings guidance on Monday, February, 21st. The company provided earnings per share (EPS) guidance of $23...

What is McKesson Corp stock symbol?

McKesson Corp is a American stock, trading under the symbol MCK-N on the New York Stock Exchange (undefined). It is usually referred to as NYSE:MCK...

Is McKesson Corp a buy or a sell?

In the last year, 1 stock analyst published opinions about MCK-N. 0 analysts recommended to BUY the stock. 1 analyst recommended to SELL the stock....

Is McKesson Corp a good investment or a top pick?

McKesson Corp was recommended as a Top Pick by null on null. Read the latest stock experts ratings for McKesson Corp.

Why is McKesson Corp stock dropping?

Earnings reports or recent company news can cause the stock price to drop. Read stock experts’ recommendations for help on deciding if you should b...

Is McKesson Corp worth watching?

1 stock analyst on Stockchase covered McKesson Corp In the last year. It is a trending stock that is worth watching.

What is McKesson Corp stock price?

On 2022-03-11, McKesson Corp (MCK-N) stock closed at a price of $281.23.

Analysis and Opinions about MCK-N

McKesson Corp (MCK-N) Rating

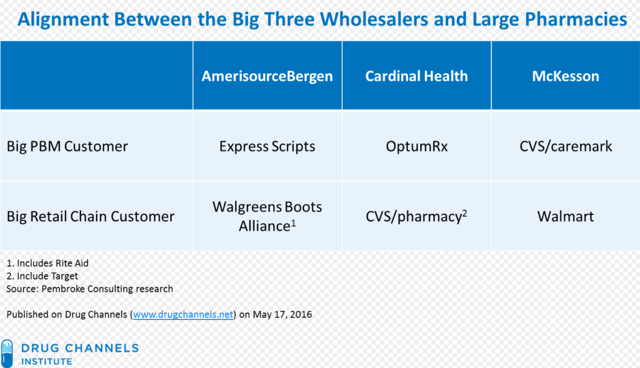

Peer Amerisource missed their report today and analysts may downgrade the entire group, which trades together. MCK is best in class, but let's see what happens tomorrow with downgrades.

McKesson Corp (MCK-N) Frequently Asked Questions

Stockchase rating for McKesson Corp is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock.

Here's Why You Should Retain McKesson (MCK) Stock Right Now

McKesson Corp is a American stock, trading under the symbol MCK-N on the New York Stock Exchange (MCK). It is usually referred to as NYSE:MCK or MCK-N

Is McKesson Corporation (MCK) Still A Great Buy?

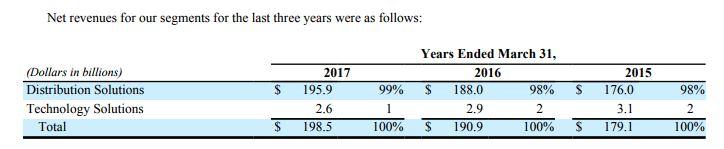

McKesson (MCK) continues to benefit from its robust Distribution Solutions segment.

Are You a Momentum Investor? This 1 Stock Could Be the Perfect Pick

Broyhill Asset Management, an investment management firm, published its second-quarter 2021 investor letter – a copy of which can be downloaded here.

McKesson (MCK) Earnings and Revenues Beat Estimates in Q1

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

McKesson (NYSE:MCK) Is Paying Out A Larger Dividend Than Last Year

McKesson's (MCK) fiscal first-quarter 2022 results benefit from strong performance across all segments.

What is McKesson's strategic growth initiative?

McKesson Corporation ( NYSE:MCK ) will increase its dividend on the 1st of October to US$0.47, which is 12% higher than...

What is the revenue of Zacks for 2021?

McKesson recently announced a multi-year strategic growth initiative, focused on creating innovative new solutions that improve patient care delivery and drive incremental profits. The plan is to implement differential pricing for brand, generic, specialty, biosimilar and OTC (Over-the-counter) drug classes in line with services offered to both customers and manufacturers.#N#As discussed in the fiscal first-quarter 2021 earnings call, McKesson continues to remain focused when it comes to its multi-year strategic growth initiative update that is currently expected to generate approximately $400 million to $500 million in annual pre-tax gross savings. This will be substantially realized by the end of fiscal 2021.#N#Moreover, the company is a major player in the pharmaceutical and medical supplies distribution market. The Distribution Solutions segment caters to a wide range of customers and businesses, and stands to benefit from increased generic utilization, inflation in generics courtesy of several patent expirations in the next few years, and an aging population.#N#McKesson Canada division plays a crucial role in providing solutions to manufacturers, pharmacies and hospitals, which cater to needs of patients in Canada every day. In fact, the company is expanding its pharmacy services to include virtual health offerings, home delivery in certain markets, and increased online pharmacy capabilities.

Does McKesson distribute generic drugs?

For fiscal 2021, the Zacks Consensus Estimate for revenues is pegged at $238.93 billion, indicating an improvement of 3.4% from the year-ago period. The same for adjusted earnings per share stands at $15.13, suggesting growth of 1.2% from the prior-year reported figure.

McKesson Media Sentiment

McKesson distributes generic pharmaceuticals that are subject to price fluctuation. The Distribution Solutions segment continues to witness weak generic pharmaceutical pricing trends, which can have an adverse impact on the stock.

Media Coverage

Each headline receives a score ranging from 2 (good news) to -2 (bad news). Our company news sentiment scores track the average news sentiment of articles about each company over the most recent 7 days in order to identify companies that are receiving positive press.

McKesson (NYSE MCK) News Headlines Today

We track news headlines from hundreds of news outlets and tag them by company. This chart compares the number of articles about this company in the last seven days compared with the average number of articles about this company on a typical week.

How much did McKesson make in Q2?

Sentiment refers to the positivity or negativity of each headline according to our language processing algorithm.

Does McKesson have a dividend?

For Q2, McKesson generated revenues of $50 billion which were 2% higher year over year. GAAP earnings per diluted share from continuing operations was $1.35, down 49% year over year.

Is McKesson a competitive company?

Although McKesson offers a dividend, it still yields less than 1% after the huge price decline. Moreover, its dividend growth has been lumpy (even though it still increased its dividend per share at a CAGR of 18.9% since 2008).

Disappointing quarterly results and a downbeat outlook from management are weighing on share prices

McKesson has always operated in a competitive environment, but instead of being concerned about customer pricing, it has always focused on delivering value. For example, it focuses on delivering exceptional service and innovation to help its customers to more effectively and efficiently connect with patients.

What happened

Todd has been helping buy side portfolio managers as an independent researcher for over a decade. In 2003, Todd founded E.B. Capital Markets, LLC, a research firm providing action oriented ideas to professional investors. Todd has provided insight to a variety of publications, including SmartMoney, Barron's, and CNN/fn. Follow @ebcapital

So what

After reporting fiscal-quarter results shy of industry watchers' expectations and offering a cautious view of future drug price trends, shares in McKesson Corporation ( NYSE:MCK) are falling 24% at 1:00 p.m. EST today.

Now what

McKesson is one of the largest drug distributors in the United States, and after the bell yesterday, management reported that fiscal second-quarter sales inched up just 2% to $50 billion, and that adjusted EPS was $2.94. Both of those figures were shy of analysts' consensus forecasts.

Signals & Forecast

McKesson inks contracts with brand-name drugmakers that include charges derived as a percent of revenue managed and delivered by McKesson. These charges vary by manufacturer and service level, but the tie to drug revenue means drug price inflation (or lack thereof) can meaningfully affect results.

Support, Risk & Stop-loss

The McKesson Corporation stock holds a sell signal from the short-term moving average; at the same time, however, there is a buy signal from the long-term average. Since the short-term average is above the long-term average there is a general buy signal in the stock giving a positive forecast for the stock.

Is McKesson Corporation stock A Buy?

McKesson Corporation finds support from accumulated volume at $194.36 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.