Where to find the best earnings estimates for stocks?

Sep 14, 2021 · To determine the basic earnings per share you simply divide the total annual net income of the last year, by the total number of outstanding shares. Here is an example calculation for basic EPS: A company's net income from 2019 is 5 billion dollars and they have 1 billion shares outstanding. Basic earnings per share = (5 billion / 1 billion)

What is the formula for basic earnings per share?

May 04, 2021 · First, calculate gain, subtracting the purchase price from the price at which you sold your stock. Remember that if you took a loss, this number could be negative. Now, divide the gain by the original purchase price. Multiply by 100 to get a percentage that represents the change in your investment.

What is the formula for calculating earnings per share (EPS)?

This free online Stock Growth Rate Calculator will calculate the percentage growth of a company's earnings per share over time. You can select the time units you wish to use for entering the number of growth periods, and the calculator will calculate the periodic rate -- plus convert that rate into its annualized equivalent. Also on this page:

How can you calculate earnings per share?

Feb 25, 2022 · Written by the MasterClass staff. Last updated: Feb 25, 2022 • 4 min read. Net earnings is one of the most comprehensive financial metrics to assess a company's profitability.

What is source of income?

The source of income is the indicator that puts meaning in the EPS. Analysts inspect the complete balance sheet and income statement of a company to identify the results of its activity and the earnings for a specific period of time.

How to calculate earnings per share?

You calculate the earnings per share indicator by subtracting the preferred dividends from the net income of the company for a specific period of time and then divide the result by the number of common shares.

Is it good to trade stocks?

In stock trading, too good is never good. Instead, you should aim to reach consistent growth on your investments. Consider that to get a specific EPS you need to buy that respective stock. This is why you should always pay attention to the stock price, as it determines if you can afford the investment or not.

What does higher P/E mean?

A higher P/E ratio suggests that investors expect lower returns on their investments. A lower P/E ratio suggests that the returns on the investment are higher. To determine if you are getting a good or bad P/E ratio, compare one company to another in the same sector.

How to read stock market books?

Stock Market Books to Read 1 C = Current earnings, quarterly earnings per share has increase over 25% or more. 2 A = Annual earnings has increase over 25% for the past 3-5 years. 3 N = New product or service, events, or management that may push the company's stock to new high 4 S = Supply & demand, look for stocks that are accumulated by institutions where the volume is high especially during buy points. 5 L = Leader or laggard, buy the industry leaders, not the laggards. 6 I = Institutional sponsorship, institutions such as pension funds and mutual funds drives market activity, and a top performing stock needs institutional buyers. 7 M = Market direction, most stocks follow the direction of the market. When the economy is down, it is hard to find a stock that perform well.

How many entries are needed to calculate stock gain?

The stock gain calculator requires only three entries to calculate your stock profit, the buy price, sell price, and the number of shares. The symbol, buy and sell commissions are optional field. Many major online stock brokers are now offering $0 commission in trading stocks.

Why do people own stocks?

The main reason why people own stocks is to make money. Over the long term, many good companies' stock price appreciates and gives a good return each year. Some companies have an average annual return over 10% for many years. If you invest in one of these companies, you can double your money every seven years.

What is the difference between a stock and a bond?

This is different than purchasing bonds, where you are loaning money to the company, and you will be paid back by the company plus interest.

How long do investors hold their stocks?

Investors who use fundamental analysis usually hold their stocks for a long time, usually over a year, so that their stocks have time to appreciated. The most famous investor of all time, Warren Buffett uses fundamental analysis, and he holds stocks for decades.

Why do people lose money in the stock market?

In fact, most people lose money in the stock market because they never learn how the stock market works.

What are the two types of stocks?

If millions of people purchase the stock, there will be millions of owners of the company. There are two types of stocks, common and preferred stocks. Common stock gives you voting rights, whereas preferred stock has no voting rights.

Why is weighted earnings per share more accurate?

Weighted earnings per share is a more accurate calculation of EPS because it considers the dividends, also known as preferred stocks, that a company issues to its shareholders. A dividend is the amount of money a company pays out to its shareholders from its profit, usually on a quarterly basis.

What is EPS in accounting?

Earnings per share (EPS) is the portion of a company's net income, that would be earned per share if all profits were paid out to shareholders. EPS tells you a lot about a company, including a company's current and future profitability. EPS is easily calculated from basic financial information you can find online.

How to calculate EPS?

1. Determine the company's net income from the previous year. Using a company's net income or earnings for the primary number is the most basic way to determine EPS. This information is normally found on their website or a financial webpage. Be careful not to mistake quarterly net income for annual. 2.

Is EPS more reliable than declining?

A company with a consistently increasing EPS is considered a more reliable investment, than a company with a declining or unpredictable EPS. Analyzing a company on a per-share basis helps you track its performance over time to make informed investment decisions.

Why is it important to compare EPS?

Comparing the EPS of companies within the same industry will help you make smarter investments by seeing how a company performs relative to others. Also consider other factors when making investment decisions such as:

What is EPS in finance?

EPS carries significance in terms of a company's profitability, performance and value, which is important information for you as an investor. Here's how to interpret EPS results: A higher EPS means a higher payout. Use EPS to compare companies. Use EPS growth trends to forecast future profitability.

How to calculate dividends on preferred stock?

Here's how to calculate it: Determine the company's dividends on preferred stocks. Subtract the company's dividends from its annual net income. Divide the difference by the average amount of outstanding shares. 1. Determine the company's dividends on preferred stocks.

What is dividend in stock?

A dividend is a distribution of a portion of a company’s profits to a certain class of its shareholders. Dividends may be issued in the form of cash or additional shares of stock. While dividends represent profit from a stock, they are not capital gains.

How much tax do you pay on long term capital gains?

Long-term capital gains, on the other hand, are given preferential tax treatment. Depending on your income and your filing status, you could pay 0%, 15% or a maximum of 20% on gains from investments you’ve held for more than a year.

Do you owe taxes on capital gains?

Capital gains tax rates are the rates at which you’re taxed on the profit from selling your stock , in addition to other investments you may hold such as bonds and real estate.

Is short term capital gain taxed?

Short-term capital gain tax rates can be significantly higher than long-term rates . These rates are pegged to your tax bracket, and they are taxed as regular income.

What Is Net Earnings?

A company's net earnings—also called net income, net profit, or bottom line—is the amount of income left over after subtracting all business expenses from its total revenue.

Why Is Net Earnings Important?

The net earnings calculation is an important metric for assessing a business’s overall financial health.

How to calculate retained earnings?

If you happen to be calculating retained earnings manually, however, you’ll need to figure out the following three variables before plugging them into the equation above: 1 Your current or beginning retained earnings, which is just whatever your retained earnings balance ended up being the last time you calculated it. (If you create a balance sheet monthly, for example, you’ll use last month’s retained earnings.) 2 Your net profit/net loss, which will probably come from the income statement for this accounting period. If you generate those monthly, for example, use this month’s net income or loss. (Here’s how to calculate net income ). 3 Any dividends you distributed this specific period, which are company profits you and the other shareholders decide to take out of the company. When you issue a cash dividend, each shareholder gets a cash payment. The more shares a shareholder owns, the larger their share of the dividend is.

What is retained earnings?

Retained earnings are like a running tally of how much profit your company has managed to hold onto since it was founded. They go up whenever your company earns a profit, and down every time you withdraw some of those profits in the form of dividend payouts. Here we’ll go over how to make sure you’re calculating retained earnings properly, ...

How to calculate shareholder equity?

The formula for calculating it is: Shareholders’ Equity = Total Assets − Total Liabilities. Working capital is a measure of the resources your small business has at its disposal to fund day-to-day operations.

What is a stock dividend?

Sometimes when a company wants to reward its shareholders with a dividend without giving away any cash, it issues what’s called a stock dividend. This is just a dividend payment made in shares of a company, rather than cash.

How to calculate working capital?

To get it, you subtract all of your current liabilities from your current assets: Working Capital = Current Assets − Current Liabilities.

What does 5% dividend mean?

Companies will also usually issue a percentage of all their stock as a dividend (i.e. a 5% stock dividend means you’re giving away 5% of the company’s equity). So you have to figure out exactly how many shares that is. Put in equation form, the formula for retained earnings in a stock dividend is:

What is shareholder equity?

Shareholder’s equity measures how much your company is worth if you decide to liquidate all your assets.

Is investing in stocks a risk?

Updated May 3, 2021. Investing in stocks can be a risky business. One can research the market and specific companies, and then make an educated decision on how a stock will perform. But it's not an exact science.

Is a stock a winner or a loser?

As such, a stock can either be a winner or a loser and depending on the outcome, an investor will have to determine the gains or losses in their portfolio.

The Significance of Earnings Per Share

Calculating Earnings Per Share

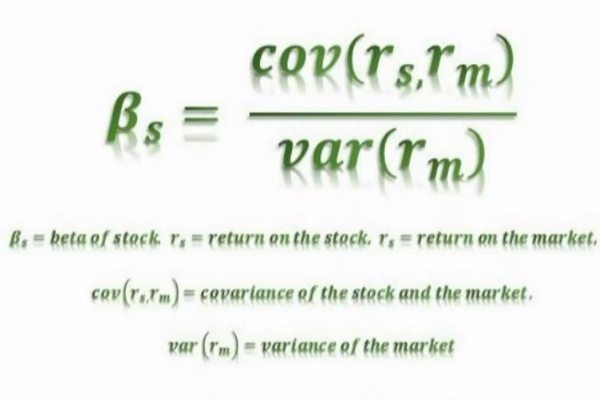

- EPS is calculated as follows: EPS=net income−preferred dividendsaverage outstanding common shares\text{EPS}=\frac{\te…

The Bottom Line

- EPS becomes especially meaningful when investors look at both historical and future EPS figures for the same company, or when they compare EPS for companies within the same industry. Bank of America, for example, is in the financial services sector. As a result, investors should compare the EPS of Bank of America with other stocks in the financial services field, such as JP…