Shares of Cheetah Mobile (CMCM -4.20%) tumbled on Tuesday after the mobile app company responded to allegations laid out in a BuzzFeed article published on Monday. The article accused some of Cheetah Mobile's Android apps of exploiting user permissions as part of an ad fraud scheme.

Full Answer

How did Cheetah's revenue decline 56% in Q4?

Cheetah's revenue plunged 56% annually to 612 million yuan ($87.9 million) during the fourth quarter. Excluding the deconsolidation of revenue from the live streaming platform LiveMe, which it no longer holds a majority stake in, Cheetah's revenue declined 47%.

Is Cheetah Mobile the most shorted mid-cap stock?

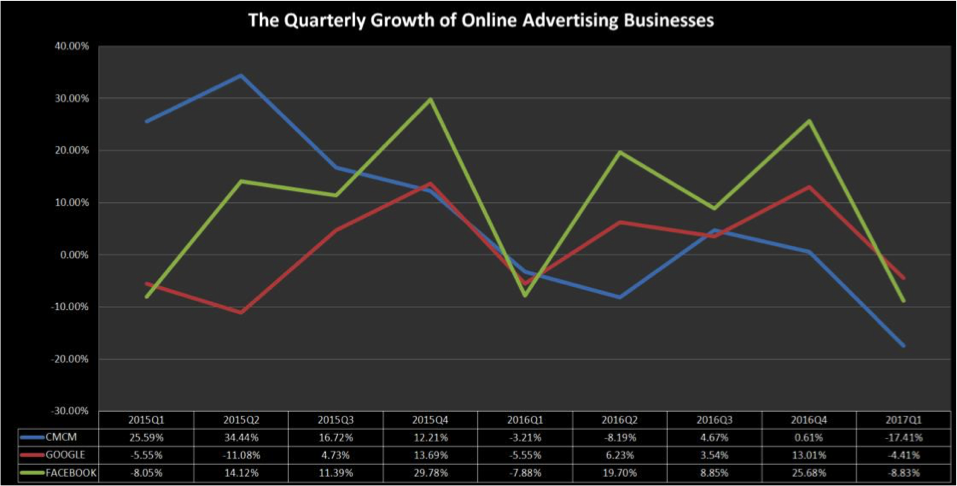

Shorts started to pile on in many names in the sector and kept the stock prices low for an extended amount of time. Cheetah Mobile made it to the list of one of the most shorted mid-cap stocks and its price hovered in the range of $15-20 over the next six months.

Is Cheetah's stock headed lower?

Those problems caused investors to dump Cheetah's stock, which currently trades 85% below its IPO price of $14. Unfortunately, Cheetah's latest fourth-quarter report suggests that the stock could head much lower in this ugly market. Image source: Getty Images. How bad were Cheetah's numbers?

See more

What happened Cheetah Mobile?

In March 2020, Cheetah Mobile was banned from Google Play due to their scheme of ad fraud, resulting in all of their games being removed as part of a 600 app deletion.

Is Cheetah Mobile a good stock to buy?

The 1 analysts offering 12-month price forecasts for Cheetah Mobile Inc have a median target of 1.48, with a high estimate of 1.48 and a low estimate of 1.48. The median estimate represents a +108.38% increase from the last price of 0.71.

Who made Cheetah Mobile?

Company founder and CEO Fu Sheng said during the call on Tuesday evening that its sinking revenue was due to a dropoff in online advertising income from its utility apps, which accounted for 80.4% of its total revenue in the quarter.

Should I buy CMCM stock?

CMC Markets has received a consensus rating of Buy. The company's average rating score is 3.00, and is based on 2 buy ratings, no hold ratings, and no sell ratings.

Is CMCM stock a good buy?

CHEETAH MOBILE Stock Forecast FAQ Out of 1 analyst, 0 (0%) are recommending CMCM as a Strong Buy, 0 (0%) are recommending CMCM as a Buy, 0 (0%) are recommending CMCM as a Hold, 1 (100%) are recommending CMCM as a Sell, and 0 (0%) are recommending CMCM as a Strong Sell.

Is SkidStorm gone?

Publishing deal turns into an offer too good to turn down Finnish developer Immobile Games has sold its unreleased arcade racing title SkidStorm to Chinese publisher Cheetah Mobile for an undisclosed sum after the game was pirated and launched in China without the developer's knowledge.

Why is clean master removed from play store?

In 2014, it was found that ads promoting Clean Master tried to scare users into downloading the app with pop-ups that told them a virus had infected their device. In 2018, the corporation was accused of conducting ad fraud which led to Google removing all of Cheetah Mobile's applications from the Play Store.

Why was Rolling Sky removed?

Due to ad fraud, Cheetah Mobile was banned from Google Play forever, so all its games, including Rolling Sky itself, were removed from Google Play on February 20th, 2020. Thus, no more new levels can be updated on Android after that.

What happened

Shares of Cheetah Mobile (NYSE: CMCM) were up 30.3% as of 1 p.m. EDT Tuesday after the China-based mobile internet tools company announced mixed second-quarter 2019 results and a large special dividend.

So what

CEO Sheng Fu noted the company's top line arrived above the high end of its own guidance range, as a 44% decline in revenue from utility products and services (to $61.7 million) was almost offset by a combination of nearly 50% growth from the mobile entertainment segment (to $72.5 million) and sales that more than tripled from artificial intelligence and other products (to $7.1 million)..

Now what

"Our special cash dividend payment demonstrates our commitment to delivering shareholder value, and our confidence in our business model, our execution capabilities, and the long-term outlook of the company," Fu said.

Advertisement

Chinese app giant Cheetah Mobile told investors that it is "very seriously" examining the allegations in a BuzzFeed News story that reported the company was exploiting user permissions as part of an ad fraud scheme. Cheetah's stock is down more than 30% since the story was published Monday.

Advertisement

BuzzFeed News reported that seven Cheetah Mobile apps with more than 1.5 billion total downloads were using an ad fraud technique called click injection to claim credit and a share of revenue for the installation of other apps. This behavior was detected by Kochava, an app analytics and attribution company.

Advertisement

BuzzFeed News also asked Praneet Sharma, the CTO of ad fraud investigation firm Method Media Intelligence, to conduct an independent review, and he came to the same conclusion as Kochava.

UPDATE

The story was updated to include a statement from Cheetah Mobile that it voluntarily removed CM Locker and Battery Doctor from the Play store.