Is General Electric a good stock to buy?

Per Group Comparative Performance

- The company's stock price performance year-to-date lags the peer average by -35.1%

- The company's stock price performance over the past 12 months beats the peer average by 162.8%

- The company's price-to-earnings ratio, which relates a company's share price to its earnings per share, is 285.7% higher than the average peer.

Is General Electric a good investment?

Overall, General Electric Company stock has a Value Grade of D, Growth Grade of C and Quality Grade of C. Whether this is a good investment depends on your goals and risk tolerance. AAII can help you figure out both and identify which investments align with what works best for you.

Is it time to buy General Electric Company stock?

The stock has spent two months testing new resistance, with last week’s selloff likely to continue in coming weeks. General Electric Co. (GE) reports Q4 2021 earnings in Tuesday’s pre-market, with analysts expecting the company to post a profit of $0 ...

Where will General Electric stock be in 10 years?

General Electric is scheduled to report its Q4 2021 results on Tuesday, January 25. We expect GE stock ... year 2022, we expect the adjusted EPS to be higher at $4.00, compared to $0.10 in 2020 ...

Who invested in GE?

Top Institutional HoldersHolderShares% OutVanguard Group, Inc. (The)82,214,6907.47%Blackrock Inc.68,258,0596.20%FMR, LLC63,470,8455.77%Capital Research Global Investors53,968,7284.90%6 more rows

Who owns the most stock in General Electric?

The top shareholders of GE are H. Lawrence Culp, Jr., Russell Stokes, Jeffrey S. Bornstein, T. Rowe Price Associates Inc., Vanguard Group Inc., and BlackRock Inc.

Who handles GE stock?

EQ Shareowner Services is GE's transfer agent and administers all matters related to stock that is directly registered with GE.

Is General Electric a good stock to buy?

Bottom line: GE stock is not a buy. Over the long term, buying an index fund, such as SPDR S&P 500 (SPY), would have delivered safer, higher returns than GE stock. If you want to invest in a large-cap stock, IBD offers several strong ideas here.

Does Berkshire Hathaway own any GE stock?

Fortunately for Buffett, he did not buy common shares of GE stock. Instead, he bought preferred shares, which paid an annual dividend yield of 10%. Those shares were also convertible, meaning Buffett could choose to convert them to common shares.

Who owns General Motors?

Today, the top three individual GM shareholders are Mary Barra, Mark Reuss and Dan Ammann. Since, being top shareholders, these individuals “own” significant chunks of the company, let's look at them each in-depth. It may seem like a weird question, but did you ever wonder: How big is General Motors?

How much does it cost to buy a stock GE?

During the day the price has varied from a low of $100.91 to a high of $103.27. The latest price was $103.16 (25 minute delay). General Electric Company is listed on the NYSE and employs 168,000 staff....General Electric Company shares at a glance.Open$101.66High$103.27Low$100.91Close$103.16Previous close$102.464 more rows

Does GE pay dividends 2021?

—December 10, 2021—The Board of Directors of GE (NYSE: GE) today declared a $0.08 per share dividend on the outstanding common stock of the Company. The dividend is payable January 25, 2022 to shareholders of record at the close of business on December 21, 2021. The ex-dividend date is December 20, 2021.

Who is wabtec transferring?

Broadridge Shareholder ServicesDirect shareholders can contact our transfer agent, Broadridge Shareholder Services, to have questions answered or to make account updates.

Is GE a good stock in 2022?

Is GE undervalued? On a brighter note, the sell-off in the stock means GE now trades at a market cap of just $82.5 billion. Even if it only hits the low end of the free-cash-flow (FCF) 2022 guidance range of $5.5 billion to $6.5 billion, the stock will trade at just 15 times FCF in 2022.

Is GE stock expected to rise?

General Electric Co (NYSE:GE) The 15 analysts offering 12-month price forecasts for General Electric Co have a median target of 107.00, with a high estimate of 120.00 and a low estimate of 80.00. The median estimate represents a +65.79% increase from the last price of 64.54.

Why did GE stock rise so much?

Culp has sold assets, reduced debt, and cut costs. As a result, GE's free cash flow from its industrials operations is rising again after years of declines.

Is General Electric stock a Buy, Sell or Hold?

General Electric stock has received a consensus rating of buy. The average rating score is and is based on 21 buy ratings, 5 hold ratings, and 0 se...

What was the 52-week low for General Electric stock?

The low in the last 52 weeks of General Electric stock was 70.75. According to the current price, General Electric is 100.68% away from the 52-week...

What was the 52-week high for General Electric stock?

The high in the last 52 weeks of General Electric stock was 116.12. According to the current price, General Electric is 61.34% away from the 52-wee...

What are analysts forecasts for General Electric stock?

The 26 analysts offering price forecasts for General Electric have a median target of 113.50, with a high estimate of 131.00 and a low estimate of...

Who invested in GE in 2008?

Warren Buffett famously stepped in and invested $3 billion in 2008 to stabilize GE’s operations. And GE’s troubles didn’t end with the financial crisis. Its $9.5 billion purchase of French transportation company Alstom’s power business in 2015 was widely considered a flop.

When did General Electric end its run on the Dow?

The Coronavirus Impact. The Bottom Line. On June 19, 2018, General Electric's ( GE) more than 100-year run on the Dow Jones Industrial Average (DJIA) came to an end and the last remaining original component of the Dow was dropped from the index.

Why is Neutron Jack called Neutron Jack?

He earned the nickname of “Neutron Jack” because of his strategy of eliminating GE’s employees but leaving its physical assets intact. By the time Welch stepped down in 2001, he had transformed GE from a $25 billion manufacturing company into a $130 billion conglomerate of “boundary-less” segments.

What is the aviation unit of GE?

GE's aviation unit is specifically impacted; a unit that is crucial to the company's profitability. GE's aviation unit makes airplane engines for Boeing and Airbus, and is GE's most profitable division, generating $32.9 billion in revenue for the company in 2019. That's 34% of total revenues.

Why did GE Capital lose its balance during the Great Recession?

The GE Capital financial segment nearly toppled the company during the Great Recession because it did not have a competitive advantage over other financial services companies. To this day, the segment is still the subject of complaints that its balance sheet is too opaque and unwieldy.

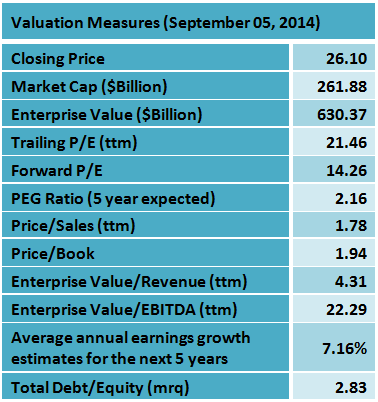

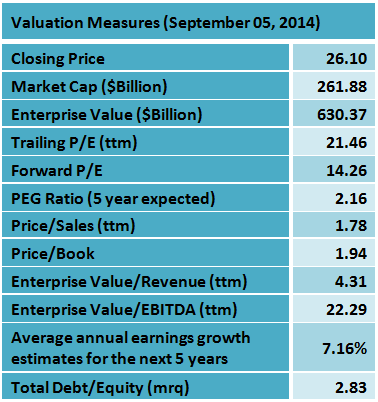

How much did GE cut in 2020?

As of February 2020, shares have fallen a whopping 59% since January 2017, when the company announced it would cut 12,000 jobs. The company’s market cap, which stood at $262 billion at the time, has fallen significantly to $107 billion.

What was the most popular jet engine in history?

It supplied the military with equipment and executives during World War II, and in 1949, introduced the J-47, the most popular jet engine in history.

When will GE reverse stock split?

GE ANNOUNCES EFFECTIVE DATE FOR REVERSE STOCK SPLIT. BOSTON — June 18, 2021 — GE (NYSE:GE) announced today that it will proceed with the 1-for-8 reverse stock split previously approved by GE shareholders at the annual meeting of shareholders on May 4, 2021.

What is GE in business?

GE (NYSE:GE) rises to the challenge of building a world that works. For more than 125 years, GE has invented the future of industry , and today the company’s dedicated team, leading technology, and global reach and capabilities help the world work more efficiently, reliably, and safely. GE’s people are diverse and dedicated, operating with the highest level of integrity and focus to fulfill GE’s mission and deliver for its customers. www.ge.com

Can you get fractional shares in reverse stock split?

No fractional shares will be issued in connection with the reverse stock split. Shareholders of record otherwise entitled to receive a fractional share as a result of the reverse stock split will receive a cash payment in lieu of such fractional shares.