How do you make money shorting a stock?

Jan 10, 2022 · Also known as shorting a stock, short selling is designed to give you a profit if the share price of the stock you choose to short goes down -- …

How to make money shorting a stock?

Mar 13, 2022 · Short selling is a way to profit from a stock whose price the investor expects to fall.

How does shorting a stock drive its price down?

Mar 30, 2020 · Shorting, also called short selling, is a way to bet against a stock. It involves borrowing and selling shares, then buying them back later at a lower price and returning them while pocketing the difference.

What does it mean to 'short' a stock?

Apr 29, 2019 · Shorting, also known as short selling or going short, is an act of selling an asset at a given price without owning it and buying it back later at a lower price. Simply put, if you have a reason to believe that some financial instrument is about to depreciate in value, you can make money by borrowing it to sell at the current market price and repurchase it when the price goes …

What is shorting a stock example?

What does it mean when you short a stock?

How can you tell if a stock is being shorted?

How does shorting a stock drive the price down?

Can you short stocks on Robinhood?

Is shorting a stock legal?

What is the most shorted stock right now?

| Symbol Symbol | Company Name | Float Shorted (%) |

|---|---|---|

| GOGO GOGO | Gogo Inc. | 40.89% |

| BYND BYND | Beyond Meat Inc. | 40.72% |

| CYN CYN | Cyngn Inc. | 39.65% |

| LMND LMND | Lemonade Inc. | 38.17% |

What is the most shorted stock?

- Nikola Corporation (NASDAQ:NKLA) Number of Hedge Fund Holders: 12. Float Shorted: 30.02% ...

- Bed Bath & Beyond Inc. (NASDAQ:BBBY) Number of Hedge Fund Holders: 17. ...

- SmileDirectClub, Inc. (NASDAQ:SDC) Number of Hedge Fund Holders: 18. ...

- Beyond Meat, Inc. (NASDAQ:BYND) ...

- Lemonade, Inc. (NYSE:LMND)

What is the penalty for short selling?

Is short selling unethical?

Can shorts manipulate a stock?

Is a pump and dump illegal?

What Is Short Selling?

Short selling is an investment or trading strategy that speculates on the decline in a stock or other security's price. It is an advanced strategy that should only be undertaken by experienced traders and investors.

Understanding Short Selling

Wimpy of the famous Popeye comic strip would have been a perfect short seller. The comic character was famous for saying he would "gladly pay next Tuesday for a hamburger today." In short selling, the seller opens a position by borrowing shares, usually from a broker-dealer.

Short Selling for a Profit

Imagine a trader who believes that XYZ stock—currently trading at $50—will decline in price in the next three months. They borrow 100 shares and sell them to another investor. The trader is now “short” 100 shares since they sold something that they did not own but had borrowed.

Short Selling for a Loss

Using the scenario above, let's now suppose the trader did not close out the short position at $40 but decided to leave it open to capitalize on a further price decline. However, a competitor swoops in to acquire the company with a takeover offer of $65 per share, and the stock soars.

Short Selling as a Hedge

Apart from speculation, short selling has another useful purpose— hedging —often perceived as the lower-risk and more respectable avatar of shorting. The primary objective of hedging is protection, as opposed to the pure profit motivation of speculation.

Pros and Cons of Short Selling

Selling short can be costly if the seller guesses wrong about the price movement. A trader who has bought stock can only lose 100% of their outlay if the stock moves to zero.

Additional Risks to Short Selling

Besides the previously-mentioned risk of losing money on a trade from a stock's price rising, short selling has additional risks that investors should consider.

What Does it Mean to Short a Stock?

When an investor goes long on a stock, she buys it with the belief that it is going to increase in value over time. Going short, on the other hand, is what some investors do when they believe the stock is about to decrease and think they can take advantage of that. In short selling a stock, the investor doesn't actually own it.

Why Do People Short-Sell Stocks?

Why do some investors decide to do this? It's clearly a high-risk situation for them, and even more out of their control than a usual investment. Is it worth it?

Risks of Short-Selling

There are rewards in short-selling if you get it right. But investors don't always get it right -- and enough of them trying to can have major consequences for an economy.

Notable Examples of Short-Selling

Some economists put part of the blame for the 2008 stock market crash and Great Recession on all the investors short-selling companies like Fannie Mae and Freddie Mac after the housing market collapsed.

If you've ever wanted to make money from a company's misfortune, selling stocks short can be a profitable -- though risky -- way to invest

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Follow him on Twitter to keep up with his latest work! Follow @TMFMathGuy

Why would you short a stock?

Typically, you might decide to short a stock because you feel it is overvalued or will decline for some reason. Since shorting involves borrowing shares of stock you don't own and selling them, a decline in the share price will let you buy back the shares with less money than you originally received when you sold them.

How do you short a stock?

In order to use a short-selling strategy, you have to go through a step-by-step process:

A simple example of a short-selling transaction

Here's how short selling can work in practice: Say you've identified a stock that currently trades at $100 per share. You think that stock is overvalued, and you believe that its price is likely to fall in the near future. Accordingly, you decide that you want to sell 100 shares of the stock short.

What are the risks of shorting a stock?

Keep in mind that the example in the previous section is what happens if the stock does what you think it will -- declines.

Be careful with short selling

Short selling can be a lucrative way to profit if a stock drops in value, but it comes with big risk and should be attempted only by experienced investors. And even then, it should be used sparingly and only after a careful assessment of the risks involved.

Example of a Short Sale

For example, if an investor thinks that Tesla (TSLA) stock is overvalued at $625 per share, and is going to drop in price, the investor may "borrow" 10 shares of TSLA from their broker, who then sells it for the current market price of $625.

What Are the Risks?

Short selling involves amplified risk. When an investor buys a stock (or goes long), they stand to lose only the money that they have invested. Thus, if the investor bought one TSLA share at $625, the maximum they could lose is $625 because the stock cannot drop to less than $0. In other words, the maximum value that any stock can fall to is $0.

Why Do Investors Go Short?

Short selling can be used for speculation or hedging. Speculators use short selling to capitalize on a potential decline in a specific security or across the market as a whole. Hedgers use the strategy to protect gains or mitigate losses in a security or portfolio.

When Does Short Selling Make Sense?

Short selling is not a strategy used by many investors largely because the expectation is that stocks will rise in value. The stock market, in the long run, tends to go up although it certainly has its periods where stocks go down.

How to short a stock: 6 steps

These instructions assume that you have a brokerage account that you can use to buy and sell stocks. If not, here is a guide on how to get one.

What short selling is and how it works

Buying a stock is also known as taking a long position. A long position becomes profitable as the stock price goes up over time, or when the stock pays a dividend.

A simple analogy for understanding short selling

It may be easier to understand short selling by considering the following analogy.

Short selling has several major risks

Short selling is incredibly risky, which is why it isn't recommended for most investors. Even professionals often lose a lot of money when shorting.

Shorting alternatives: other ways to profit from declining prices

There are several other ways to profit from falling prices that are also risky, but not quite as risky as short selling.

Only go short if you truly know what you are doing

At the end of the day, short selling is a very risky trading method that should only be done by sophisticated investors.

What is shorting?

Shorting, also known as short selling or going short, is an act of selling an asset at a given price without owning it and buying it back later at a lower price.

How does shorting work?

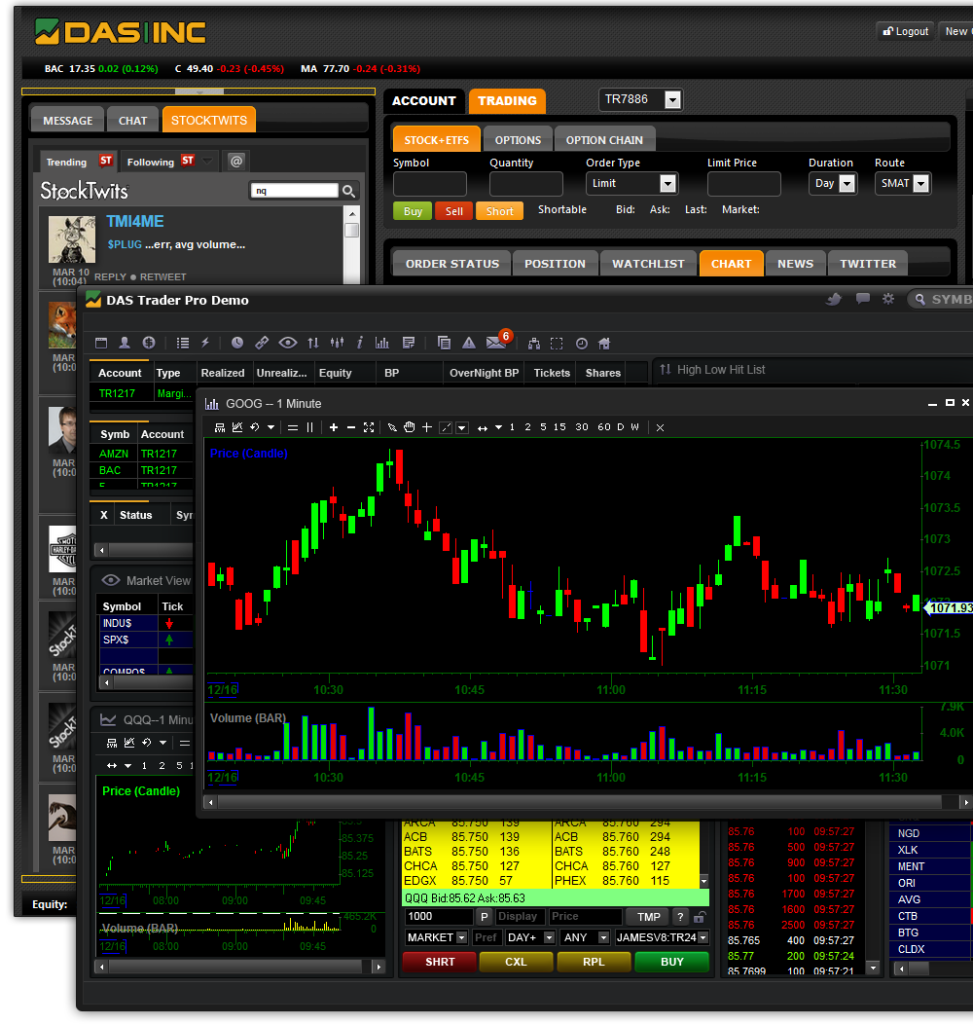

Now, you may wonder, how can you sell something if you don’t actually own it? It’s not as difficult as it seems. In order to perform short selling, you have to borrow an asset first (for the sake of explanation, let’s talk about a stock). Typically, it is done through a broker.

Pros and cons of the shorting strategy

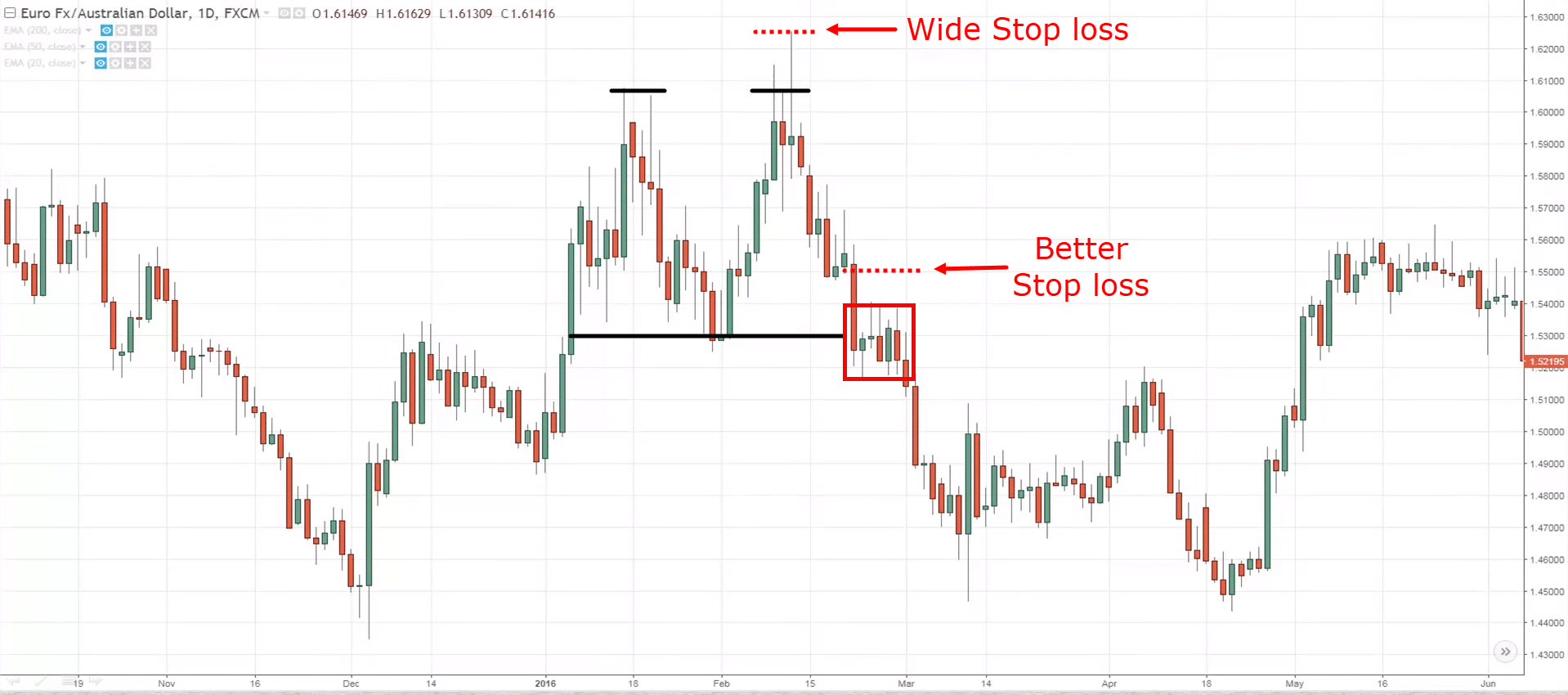

The main disadvantage of the shorting strategy is that the risk is theoretically infinite. If the market goes against you, there’s no limit to how high the price can go and how severe your losses will be.

Shorting CFDs

A contract for difference (CFD) is a favoured derivative product for short selling. With CFDs, you trade the price of an asset rather than the asset itself, so you don’t have to deal with the complexity of the actual shares.

:max_bytes(150000):strip_icc()/ShortStock-565c00683df78c6ddf5ea3f7.jpg)

When Short-Selling Makes Sense

The Risks of Short-Selling

- Short-selling can be profitable when you make the right call, but it carries greater risks than what ordinary stock investors experience. Specifically, when you short a stock, you have unlimited downside risk but limited profit potential. This is the exact opposite of when you buy a stock, which comes with limited risk of loss but unlimited profit ...

Alternative to Shorting

- As a final thought, an alternative to shorting that limits your downside exposure is to buy a put option on a stock. Essentially, a put optiongives you the right, but not the obligation, to sell a stock at a predetermined price (known as the strike price) at any time before the option contract expires. For example, if you buy a put option in a stock with a strike price of $100 and the stock …

Expert Q&A

- The Motley Fool had a chance to connect with an expert on shorting: Sofia Johan, an associate professor in the finance department of FAU's College of Business. The Motley Fool: What are some common misconceptions about short selling that investors should know? Johan: I think most investors believe the risks to be the same as that of taking long positions. Definitely not th…

What Does It Mean to Short A Stock?

Why Do People Short-Sell Stocks?

- Why do some investors decide to do this? It's clearly a high-risk situation for them, and even more out of their control than a usual investment. Is it worth it? If they play their cards right, certainly. And what could be more tempting for an experienced investor than the ability to make money off of a company's decline instead of losing money from it? It's not something that would necessaril…

Risks of Short-Selling

- There are rewards in short-selling if you get it right. But investors don't always get it right -- and enough of them trying to can have major consequences for an economy. The pros of shorting a stock are all based on the idea that a short-seller's instinct that a stock is about to tank is a sound, logical one that will come true. Despite your best efforts, however, that isn't something that can …

Notable Examples of Short-Selling

- Some economists put part of the blame for the 2008 stock market crash and Great Recessionon all the investors short-selling companies like Fannie Mae and Freddie Mac after the housing market collapsed. At its worst, too much short-selling may have contributed to major economic problems. In other instances, it can tell you how investors view a company. One recent example …