Most Popular Dividend Stocks

| Company | MarketBeat Followers | Dividend Yield | Annual Payout | Earnings Per Share |

| VZ Verizon Communications | 4,714 | 5.31% | $2.56 | 5.15 |

| IBM International Business Machines | 4,628 | 4.94% | $6.60 | 6.10 |

| JPM JPMorgan Chase & Co. | 4,216 | 3.36% | $4.00 | 13.48 |

...

25 high-dividend stocks.

| Symbol | Company name | Dividend yield |

|---|---|---|

| OMC | Omnicom Group Inc | 3.67% |

| CVX | Chevron Corp | 3.62% |

| VLO | Valero Energy Corp | 3.51% |

| KMB | Kimberly-Clark Corp | 3.34% |

What are the best stocks for paying dividends?

22 rows · Weyco Group (NASDAQ: WEYS) caught our eye a few years ago while screening for small-cap dividend ...

Which shares pay the best dividends?

Apr 27, 2022 · Many real estate investment trusts (REITs) pay dividends monthly since they must distribute at least 90% of their taxable income to shareholders annually. Next, we will look at the five best stocks that pay dividends monthly. EPR Properties: 5.90% annual dividend yield …

How can I find out which stocks pay dividends?

Apr 25, 2022 · The common share dividend of $0.25 per common share is payable on April 29 to shareholders of record as of April 4, 2022. For cumulative redeemable preferred stock, dividends for Series A, Series ...

What company pays the highest dividends?

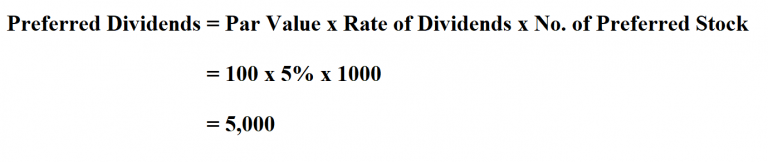

May 09, 2022 · Payout ratio: A stock's payout ratio is the amount of money it pays per share in dividends, divided by its earnings per share. In other words, this tells you what percentage of earnings a stock ...

Which type of stocks pays dividends?

How do you know if a stock pays a dividend?

What stocks pay dividends monthly?

- AGNC Investment Corp. (AGNC)

- Prospect Capital Corp. (PSEC)

- Main Street Capital Corp. (MAIN)

- LTC Properties Inc. (LTC)

- Broadmark Realty Capital Inc. (BRMK)

- Ellington Financial Inc. (EFC)

- Gladstone Commercial Corp. (GOOD)

Does Amazon pay a dividend?

Is Apple a dividend stock?

How do I make 500 a month in dividends?

- 1) Open a brokerage account for your dividend portfolio, if you don't have one already. ...

- 2) Determine how much you can save and invest each month. ...

- 3) Set up direct deposit to your dividend portfolio account. ...

- 4) Choose stocks that fit your dividend strategy.

How can I earn 1000 a month in dividends?

Does Coca-Cola pay monthly dividends?

What is dividend stock?

Dividend stocks are companies that pay out a portion of their earnings to a class of shareholders on a regular basis. These companies usually are well established, with stable earnings and a long track record of distributing some of those earnings back to shareholders. The distributions are known as dividends and may be paid out in the form ...

Who is Matthew Johnston?

Matthew Johnston has more than 5 years writing content for Investopedia. He is an expert on company news, market news, political news, trading news, investing, and the economy. He received his bachelor's degree in interdisciplinary studies from St. Stephen's University and his master's degree in economics at The New School for Social Research. He teaches macroeconomics at St. Stephen's University.

Why do utilities have dividends?

The reason why is that utility companies like electric and gas companies provide basic necessities so they can be relied on to generate a lot of revenue .

What is Prudent Financial?

Prudent Financial is an insurance company specializing in life insurance policies, annuities, and retirements replate products. The company manages in total over $1 trillion in assets and has offices on 4 continents.

Who is Tim Fries?

Sc. in Mechanical Engineering from the University of Michigan, and an MBA from the University of Chicago Booth School of Business. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital , an investment firms specializing in sensing, protection and control solutions.

What is Brookfield Infrastructure Partners?

Brookfield Infrastructure Partners is one of the single largest infrastructure assets companies in the world and work in transport, energy, communications, and utilities sectors.

Does Apple pay dividends?

Apple ( NASDAQ:AAPL): Tech giant Apple has been paying dividends for only a few years now, which is understandable given the rapid growth it experienced in the early years of the iPhone and iPad. Companies tend to choose to reinvest profits into the business while in "growth mode.".

Is dividend stock a long term investment?

Dividend stocks are long-term investments. Of course, even the most rock-solid dividend stocks can experience significant volatility over short periods. There are simply too many market forces that can move them up or down over days or weeks, many of which have nothing to do with the underlying business itself.

What is dividend policy?

A dividend happens when a company sends money (or, very rarely, stock) to its shareholders. When a company gets to the point that it consistently earns more than management can effectively reinvest in the business, establishing a dividend policy and sending those excess profits back to investors is a smart move.

What is a durable competitive advantage?

A durable competitive advantage can come in several forms, such as a proprietary technology, high barriers to entry, high customer switching costs, or a powerful brand name , just to name a few.

Is Coca Cola a dividend stock?

Coca-Cola ( NYSE:KO): The beverage giant has been a fantastic dividend stock for generations and has increased its dividend for 59 consecutive years. While sugary soft drinks may indeed be in the early stages of a slow, long-term decline, it's important to realize there's much more to Coca-Cola.

What does a low payout ratio mean?

A reasonably low payout ratio (say 60% or less) is a good sign that the dividend is sustainable. History of raises: It's a very good sign when a company raises its dividend year after year, especially when it can continue to do so during recessions and other tough economic times like the COVID-19 pandemic.

What is dividend aristocrats index?

This is a collection of several companies that have increased their dividends for at least 25 consecutive years. That means that every company in the index successfully gave investors raises not just during the good times in the market, but also during more volatile downturns, such as the dot-com crash of the early 2000s, the financial crisis of 2008-2009, and the COVID-19 pandemic so far. They may be a safer investment than the average dividend-paying stock.

What is dividend in stocks?

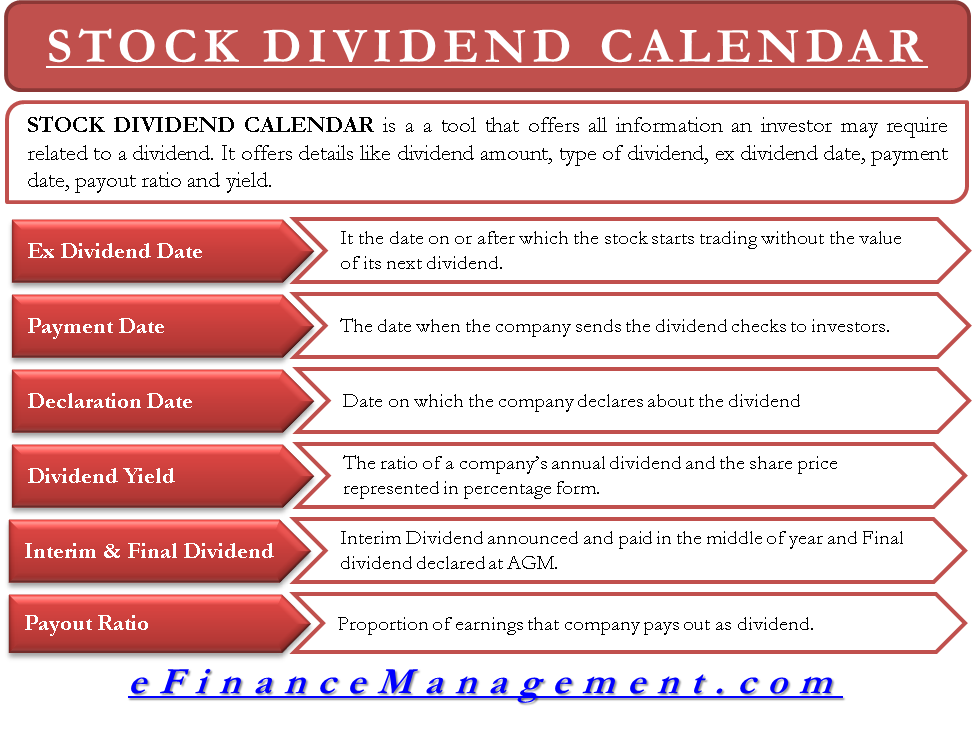

A dividend is a distribution of a portion of a company's earnings paid to its shareholders. Dividends can be issued as cash payments, as shares of stock, or other property. There are several accessible sources to help investors identify dividend-paying stocks. Below we've listed a number of resources that can help you determine which stocks pay ...

What is dividend in accounting?

A dividend is a distribution of a portion of a company's earnings paid to its shareholders. Dividends can be issued as cash payments, as shares of stock, or other property.

Why are dividend stocks so attractive?

Dividend-paying stocks are attractive to investors because they distribute a portion of their earnings to shareholders in the form of cash payments or shares of stock. Investors can determine which stocks pay dividends by researching financial news sites, such as Investopedia's Markets Today page. Many stock brokerages offer their customers ...

What is a stock brokerage account?

Brokerage Accounts. Many individual stock brokerage accounts provide online research and pricing information to their customers. Similar to the news sites, investors can easily find information on dividend amounts and payout dates, as well as other types of peer comparisons and screeners.

Is AT&T a dividend paying company?

AT&T has long been one of the highest-dividend-paying stocks in the S&P 500, with shares of the regulated telecom and media giant rewarding investors with regular dividend income rather than plowing its cash back into growth. Generally speaking, that means stability for the wireless giant and leading player in the 5G revolution.

What is the S&P 500?

The S&P 500 is the most holistic of the three mainstream U.S. stock market indices and is supposed to represent a broad, inclusive array of the largest domestic companies.

Is Kinder Morgan a midstream company?

Kinder Morgan ( KMI ) As the second-largest publicly traded "midstream" oil and gas company in the U.S., the Houston-based Kinder Morgan is an established energy gathering, storage and transportation company. It owns and operates about 83,000 miles of pipelines crisscrossing the country.

What is the current yield of Kinder Morgan?

The company also trades at around 13 times 2020 AFFO, an entirely reasonable multiple. Current yield: 6.22%. Kinder Morgan ( KMI) As the second-largest publicly traded "midstream" oil and gas company in the U.S., the Houston-based Kinder Morgan is an established energy gathering, storage and transportation company.

What is Iron Mountain?

Technically considered a real estate investment trust, or REIT, Iron Mountain is a longtime purveyor of corporate data and information management services. The go-to company for physical document storage – think sensitive records and document destruction – the company has increasingly pivoted to offer digitization services, data center and cloud storage solutions in the digital age. As a REIT, the business is required to pay out at least 90% of taxable income to unit-holders in exchange for the ability to legally forego corporate taxes. The company expects adjusted funds from operations, or AFFO, a key profitability metric for REITs, to grow between 6% and 11% on a per-share basis in 2021. The company also trades at around 13 times 2020 AFFO, an entirely reasonable multiple.

What is AT&T's acquisition of Time Warner?

The acquisition of Time Warner also gives AT&T a compelling degree of vertical integration, combining its status as a cable provider with the ownership of a number of popular channels, including CNN, TNT, Comedy Central and MTV, among many others. Williams Cos. is a large-cap pipeline company based in Tulsa, Oklahoma.

The 4% Rule

- Was this helpful?Thanks! Give more feedback

How to Pick The Best Dividend Stock

| COMPANY | MARKETBEAT FOLL… | DIVIDEND YIELD | ANNUAL PAYOUT |

|---|---|---|---|

| T AT&T | 8,021 | 7.39% | $2.08 |

| PFE Pfizer | 5,679 | 3.74% | $1.56 |

| GILD Gilead Sciences | 5,409 | 4.11% | $2.84 |

| ABBV AbbVie | 5,073 | 4.40% | $5.20 |

| XOM Exxon Mobil | 4,824 | 6.10% | $3.48 |

| ET Energy Transfer | 4,377 | 6.10% | $0.61 |

| IBM International Business Mach… | 3,969 | 4.64% | $6.56 |

| VZ Verizon Communications | 3,943 | 4.49% | $2.51 |

10 Stocks That Pay Dividends

Conclusion

- Dividend investing is based around finding long-term sustainable growth. Several well-known investors such as Warren Buffett orient their entire investing strategy around top-notch dividend-paying companies. The ideal is to find a stock with a high dividend yield and then reinvest a portion of those dividends to buy more stock. Over time this compounding process will raise you…