The standard deviation of a particular stock can be quantified by examining the implied volatility of the stock’s options. The implied volatility of a stock is synonymous with a one standard deviation range in that stock. Remember, the higher the implied volatility is, the wider our standard deviation range of outcomes is.

- Calculate the average (mean) price for the number of periods or observations.

- Determine each period's deviation (close less average price).

- Square each period's deviation.

- Sum the squared deviations.

- Divide this sum by the number of observations.

What is the formula for finding standard deviation?

- x i = i th random variable

- X = Mean of the sample

- n = number of variables in the sample

What is the approximate standard deviation?

This relationship is sometimes referred to as the range rule for standard deviation. The range rule tells us that the standard deviation of a sample is approximately equal to one-fourth of the range of the data. In other words s = (Maximum – Minimum)/4.

How to compute SDI?

– State Disability Insurance

- California 0.900% $998.12/year $110,902

- Rhode Island 1.200% $817.20/year $ 68,100

- New Jersey* 0.765% $256.28/year $ 33,500

- Hawaii 0.500% $ 5.12/week –

- New York 0.500% $0.60/week –. *This is a total of the New Jersey employee SDI, unemployment, workforce development, and family leave insurances.

How to find the standard deviation formula?

Finding Standard Deviation. The basic formula for SD (population formula) is: Where, σ is the standard deviation; ∑ is the sum; X is each value in the data set; µ is the mean of all values in a data set; N is the number of values in the data set; Basically, standard deviation is σ = √Variance . What is Variance? It is the average of the squared differences from the mean.

How do you find the standard deviation of a daily stock return?

3:384:28Stock returns: average, variance, and standard deviation - YouTubeYouTubeStart of suggested clipEnd of suggested clipMore decimal points and the standard deviation standard deviation is basically the square root ofMoreMore decimal points and the standard deviation standard deviation is basically the square root of the variance. I. Will explain to you the difference between the two you know in a. Bit.

How do you find the variance and standard deviation of a stock?

Variance is derived by taking the mean of the data points, subtracting the mean from each data point individually, squaring each of these results, and then taking another mean of these squares. Standard deviation is the square root of the variance.

Where can I find the standard deviation?

To calculate the standard deviation of those numbers:Work out the Mean (the simple average of the numbers)Then for each number: subtract the Mean and square the result.Then work out the mean of those squared differences.Take the square root of that and we are done!

What is standard deviation on a stock chart?

Standard Deviation measures the volatility of securities. It is computed as the square root of variance with respect to the mean price. In simple language, it helps one identify the spread or deviation of a price from the mean by considering the historical price data.

How do you find the standard deviation of a stock in Excel?

Using the numbers listed in column A, the formula will look like this when applied: =STDEV. S(A2:A10). In return, Excel will provide the standard deviation of the applied data, as well as the average.

What is standard deviation in investing?

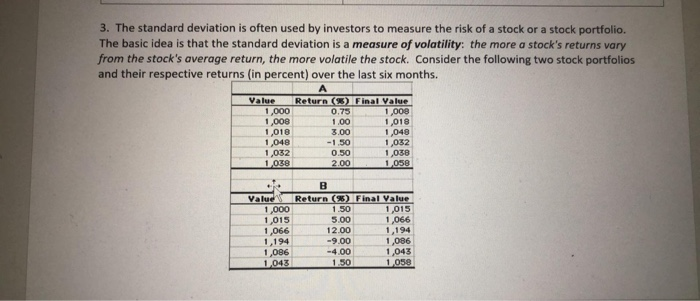

Standard deviation, also referred to as volatility, measures the variation from average performance. • If all else is equal, including returns, rational investors would select investments with lower volatility. •

How do you find standard deviation by hand?

Here's how you can find population standard deviation by hand:Calculate the mean (average) of each data set.Subtract the deviance of each piece of data by subtracting the mean from each number.Square each deviation.Add all the squared deviations.More items...•

How do you calculate sample standard deviation?

If you have four measurements that are 51.3, 55.6, 49.9 and 52.0 and you want to find the relative standard deviation, first find the standard deviation, which is 2.4. Then take 2.4 and multiply it by 100, which is 240. Next, you divide 240 by the average of the four numbers, which is 52.2, to get 4.6%.

How do you find sample standard deviation on a calculator?

0:462:18Calculator Steps to find The Standard Deviation (TI83 or TI84) - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe main things you're looking for are s and Sigma. So s is the sample standard deviation. And SigmaMoreThe main things you're looking for are s and Sigma. So s is the sample standard deviation. And Sigma represents the population standard deviation you have to know which data you put in the calculator.

What is the standard deviation of S&P 500 index?

An S&P 500 index fund has a standard deviation of about 15%; a standard deviation of zero would mean an investment has a return rate that never varies, like a bank account paying compound interest at a guaranteed rate.

What is the standard deviation of this portfolio?

Portfolio Standard Deviation refers to the volatility of the portfolio which is calculated based on three important factors that include the standard deviation of each of the assets present in the total Portfolio, the respective weight of that individual asset in total portfolio and correlation between each pair of ...

What is standard deviation in finance?

Standard deviation is a statistical measurement in finance that , when applied to the annual rate of return of an investment, sheds light on that investment's historical volatility . The greater the standard deviation of securities, the greater the variance between each price and the mean, which shows a larger price range.

What are the drawbacks of standard deviation?

The biggest drawback of using standard deviation is that it can be impacted by outliers and extreme values. Standard deviation assumes a normal distribution and calculates all uncertainty as risk, even when it’s in the investor's favor—such as above-average returns.

Why is variance smaller than standard deviation?

However, this is more difficult to grasp than the standard deviation because variances represent a squared result that may not be meaningfully expressed on the same graph as the original dataset.

How to find variance?

Variance is derived by taking the mean of the data points, subtracting the mean from each data point individually, squaring each of these results, and then taking another mean of these squares. Standard deviation is the square root of the variance. The variance helps determine the data's spread size when compared to the mean value.

Why is an index fund likely to have a low standard deviation versus its benchmark index?

As it relates to investing, for example, an index fund is likely to have a low standard deviation versus its benchmark index, as the fund's goal is to replicate the index.

Is standard deviation the same as variance?

Standard deviations are usually easier to picture and apply. The standard deviation is expressed in the same unit of measurement as the data, which isn't necessarily the case with the variance. Using the standard deviation, statisticians may determine if the data has a normal curve or other mathematical relationship.

Is standard deviation a risk measure?

Standard deviation is one of the key fundamental risk measures that analysts , portfolio managers, advisors use.

Description

Standard deviation is the statistical measure of market volatility, measuring how widely prices are dispersed from the average price. If prices trade in a narrow trading range, the standard deviation will return a low value that indicates low volatility.

How this indicator works

Standard deviation rises as prices become more volatile. As price action calms, standard deviation heads lower.

What is standard deviation in stock market?

Standard deviation is an important concept that is used to measure the volatility of different stock prices. Generally speaking, the higher the volatility, the higher is the risk associated with a particular stock. This is captured by the measure of standard deviation.

What is standard deviation?

In simple words, the standard deviation is “Mean of Mean”. The word Standard Deviation is usually used with a very professional audience .

What to do if stock splits?

If a stock splits, adjust your previous prices to reflect the split. Yahoo does this pretty well, so you can use their data series as a guide. If you’re using futures contracts, use a continuous front month future - this way you don’t have to deal with the roll dates to the front month.

Why is standard deviation important?

From a financial standpoint, the standard deviation can help investors quantify how risky an investment is and determine their minimum required return. Risk and Return In investing, risk and return are highly correlated. Increased potential returns on investment usually go hand-in-hand with increased risk.

What is normal distribution theory?

The normal distribution theory states that in the long run, the returns of an investment will fall somewhere on an inverted bell-shaped curve. Normal distributions also indicate how much of the observed data will fall within a certain range:

Why use standard deviation?

You can use the standard deviation formula to find the annual rate of return of an investment or study an investment's historical volatility. Investment firms can use standard deviation to report on their mutual funds and other products as it shows whether the return on funds is deviating from normal expectation.

What is standard deviation in 2021?

Standard deviation is a common mathematical formula used to measure how far numbers are spread out in a data set compared to the average of those numbers. While students use this formula in statistics and probability theory, the field of finance uses the standard deviation formula regularly to assess risk, ...

What does it mean when your data is not closely related to the average?

When your data is not closely related to the average, it has a high standard deviation, meaning your data is not as reliable. Another way to think of standard deviation is as a measure of disbursement, or how much your data is spread out. It's a way to measure how far each data point is spread from the average value.

How to find the mean of a data set?

You can find the mean, also known as the average, by adding up all the numbers in a data set and then dividing by how many numbers are in the whole set. The data set for this example problem is 6, 8, 12, 14. Add all the numbers in the data set, then divide by 4 for an average of 10.

What is the RSD in statistics?

Relative standard deviation, or RSD, is a special form of standard deviation that, in certain circumstances, is more convenient. You frequently use it in statistics, probability theory, chemistry and mathematics. It is useful to businesses when comparing data such as in financial settings like the stock market.

What is standard deviation in statistics?

Standard Deviation (SD) is a popular statistical tool that is represented by the Greek letter ‘σ’ and is used to measure the amount of variation or dispersion of a set of data values relative to its mean (average), thus interpret the reliability of the data. If it is smaller then the data points lies close to the mean value, thus shows reliability.

Why is standard deviation important?

Standard deviation is helpful is analyzing the overall risk and return a matrix of the portfolio and being historically helpful . It is widely used and practiced in the industry. The standard deviation of the portfolio can be impacted by the correlation and the weights of the stocks of the portfolio.

Does the deviation of the first fund matter?

If the first fund is a much higher performer than the second one, the deviation will not matter much. and is widely taught by professors among various top universities in the world however, the formula for standard deviation is changed when it is used to calculate the deviation of the sample.