What was the worst stock market crash in US history?

Feb 28, 2022 · The stock market crash of Oct. 19, 1987, also known as Black Monday, marked the largest one-day stock market decline in history. 3 The most recent crash, the 2020 Coronavirus Stock Market Crash,...

What actually happens during a stock market crash?

Feb 29, 2020 · The "Great Recession" Stock Market Crash of 2008 Many Americans likely don't know just how close the U.S. financial sector came to collapsing during the stock market crash of 2008 and 2009, as Wall...

What past stock market declines can teach us?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket. The crash affected many more than the relatively few Americans who invested in the stock market.

What was the worst crash ever?

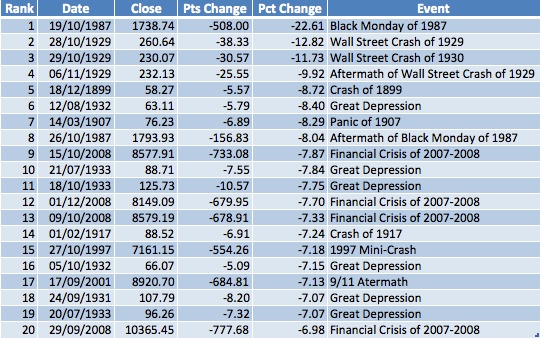

Jan 28, 2022 · The stock market crash of 2008 occurred on September 29, 2008. The Dow Jones Industrial Average fell by 777.68 points in intraday trading. Until the stock market crash of March 2020 at the start of the COVID-19 pandemic, it was the largest point drop in history.

How long did the 2008 market crash last?

The US bear market of 2007–2009 was a 17-month bear market that lasted from October 9, 2007 to March 9, 2009, during the financial crisis of 2007–2009.

When was the biggest stock market crash?

19291929 stock market crash The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.Feb 2, 2022

How much did the stock market drop in 2008?

The stock market crash of 2008 occurred on September 29, 2008. The Dow Jones Industrial Average fell by 777.68 points in intraday trading. Until the stock market crash of March 2020 at the start of the COVID-19 pandemic, it was the largest point drop in history.

Why did the stock market crash in 2008?

By the fall of 2008, borrowers were defaulting on subprime mortgages in high numbers, causing turmoil in the financial markets, the collapse of the stock market, and the ensuing global Great Recession.

How much has the stock market dropped in 2022?

For the first quarter of 2022, all major stock benchmarks saw their biggest quarterly losses in two years, ranging from a 4.6% decline for the S&P 500 to as much as 9% for the Nasdaq Composite.Apr 1, 2022

What caused the 1973 stock market crash?

The OPEC oil embargo of October 1973 and the Watergate scandal that led to President Nixon's resignation in August 1974 accelerated the declines. The long grind downward stoked investor pessimism about when stock prices might ever recover.

How long did it take for stocks to recover after 2008?

The S&P 500 dropped nearly 50% and took seven years to recover. 2008: In response to the housing bubble and subprime mortgage crisis, the S&P 500 lost nearly half its value and took two years to recover.

How long did it take to recover from 2008 recession?

The recession ended in June 2009, but economic weakness persisted. Economic growth was only moderate – averaging about 2 percent in the first four years of the recovery – and the unemployment rate, particularly the rate of long-term unemployment, remained at historically elevated levels.

Why did stocks fall 2000?

What caused the 2000 stock market crash? The 2000 stock market crash was a direct result of the bursting of the dotcom bubble. It popped when a majority of the technology startups that raised money and went public folded when capital went dry.

Who made money in 2008 crash?

1. Warren Buffett. In October 2008, Warren Buffett published an article in the New York TimesOp-Ed section declaring he was buying American stocks during the equity downfall brought on by the credit crisis.

What happened in 2008 in the world?

Great Recession The financial crisis of 2008, or Global Financial Crisis, was a severe worldwide economic crisis that occurred in the early 21st century. It was the most serious financial crisis since the Great Depression (1929).

How long did the Great Depression last?

43The Great Depression / Duration (months)

What happened to the stock market after the 1929 crash?

After the crash, the stock market mounted a slow comeback. By the summer of 1930, the market was up 30% from the crash low. But by July 1932, the stock market hit a low that made the 1929 crash. By the summer of 1932, the Dow had lost almost 89% of its value and traded more than 50% below the low it had reached on October 29, 1929.

What is a stock crash?

Stock Market Crash is a strong price decline across majority of stocks on the market which results in the strong decline over short period on the major market indexes (NYSE Composite, Nasdaq Composite DJIA and S&P 500).

How much wealth was lost in the 1929 stock market crash?

The Crash of 1929. In total, 14 billion dollars of wealth were lost during the market crash. On September 4, 1929, the stock market hit an all-time high. Banks were heavily invested in stocks, and individual investors borrowed on margin to invest in stocks.

When did banks go out of business?

When these banks started to invest heavily in the stock market, the results proved to be devastating, once the market started to crash. By 1932, 40% of all banks in the U.S. had gone out of business.

How much did the Dow drop in 1987?

On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day. This was a drop of 36.7% from its high on August 25, 1987.

What happened in 1987?

The Crash of 1987. During this crash, 1/2 trillion dollars of wealth were erased. The markets hit a new high on August 25, 1987 when the Dow hit a record 2722.44 points. Then, the Dow started to head down. On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day.

How much did the NASDAQ drop in 2000?

On September 1, 2000, the NASDAQ traded at 4234.33. From September 2000 to January 2, 2001, the NASDAQ dropped 45.9%.

What happened on August 24th 2015?

On Monday, August 24, world stock markets were down substantially, wiping out all gains made in 2015, with interlinked drops in commodities such as oil, which hit a six-year price low, copper, and most of Asian currencies, but the Japanese yen, losing value against the United States dollar.

How long did the Japanese asset bubble last?

1991. Lasting approximately twenty years, through at least the end of 2011, share and property price bubble bursts and turns into a long deflationary recession. Some of the key economic events during the collapse of the Japanese asset price bubble include the 1997 Asian financial crisis and the Dot-com bubble.

How long did the oil boom last?

Lasting 23 months, dramatic rise in oil prices, the miners' strike and the downfall of the Heath government.

What was the worst stock market crash in history?

The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.

What was the cause of the 1929 stock market crash?

The primary cause of the 1929 stock market crash was excessive leverage. Many individual investors and investment trusts had begun buying stocks on margin, meaning that they paid only 10% of the value of a stock to acquire it under the terms of a margin loan.

Why did the Dow drop in 1929?

The Dow didn't regain its pre-crash value until 1954. The primary cause of the 1929 stock market crash was excessive leverage. Many individual investors and investment trusts had begun buying stocks on margin, meaning that they paid only 10% of the value of a stock to acquire it under the terms of a margin loan.

When did the Dow Jones Industrial Average rise?

The Dow Jones Industrial Average ( DJINDICES:^DJI) rose from 63 points in August, 1921, to 381 points by September of 1929 -- a six-fold increase. It started to descend from its peak on Sept. 3, before accelerating during a two-day crash on Monday, Oct. 28, and Tuesday, Oct. 29.

What happened on Black Monday 1987?

Black Monday crash of 1987. On Monday, Oct. 19, 1987, the Dow Jones Industrial Average plunged by nearly 22%. Black Monday, as the day is now known, marks the biggest single-day decline in stock market history. The remainder of the month wasn't much better; by the start of November, 1987, most of the major stock market indexes had lost more ...

What is FNMA mortgage?

In 1999, the Federal National Mortgage Association (FNMA or Fannie Mae) wanted to make home loans more accessible to those with low credit ratings and less money to spend on down payments than lenders typically required . These subprime borrowers, as they were called, were offered mortgages with payment terms, such as high interest rates and variable payment schedules, that reflected their elevated risk profiles.

What was the first major stock market crash?

1. The Stock Market Crash of 1929. The first major U.S. stock market crash was in October 1929, when the decade-long "Roaring 20s" economy ran out of steam. With commodities like homes and autos selling like hotcakes, speculators ran wild in the stock markets.

What is a stock market crash?

A stock market crash occurs when a high-profile market index, like the Standard & Poor's 500 or the Dow Jones Industrial Index, bottoms out, as investors turn from buyers into sellers in an instant. Any market day where stocks fall by 10% or more is considered a market crash, and they happen on a fairly frequent basis, historically.

When did Lehman go bankrupt?

With few suitors to bail the company out, Lehman declared bankruptcy on September 15, 2008. Only 18 months earlier, the company's stock price was trading at $86 per share, and the company had reported net income of $4.2 billion in 2007.

Has there been a shortage of stock market crashes?

There has been no shortage of major U.S. stock market crashes -- all of which were followed by recoveries (although some took much longer to recover than others). Here's a snapshot.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

When did the stock market drop?

The stock market, which had been growing for years, began to decline in the summer and early fall of 1929, precipitating a panic that led to a massive stock sell-off in late October. In one month, the market lost close to 40 percent of its value.

Why did banks fail?

Many banks failed due to their dwindling cash reserves. This was in part due to the Federal Reserve lowering the limits of cash reserves that banks were traditionally required to hold in their vaults, as well as the fact that many banks invested in the stock market themselves.

What was Hoover's agenda?

Upon his inauguration, President Hoover set forth an agenda that he hoped would continue the “Coolidge prosperity ” of the previous administration. While accepting the Republican Party’s presidential nomination in 1928, Hoover commented, “Given the chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation forever.” In the spirit of normalcy that defined the Republican ascendancy of the 1920s, Hoover planned to immediately overhaul federal regulations with the intention of allowing the nation’s economy to grow unfettered by any controls. The role of the government, he contended, should be to create a partnership with the American people, in which the latter would rise (or fall) on their own merits and abilities. He felt the less government intervention in their lives, the better.

How many shares were traded on Black Tuesday?

On Black Tuesday, October 29, stock holders traded over sixteen million shares and lost over $14 billion in wealth in a single day. To put this in context, a trading day of three million shares was considered a busy day on the stock market. People unloaded their stock as quickly as they could, never minding the loss.

When did the Dow Jones Industrial Average peak?

As September began to unfold, the Dow Jones Industrial Average peaked at a value of 381 points, or roughly ten times the stock market’s value, at the start of the 1920s.

What happened on October 29, 1929?

October 29, 1929, or Black Tuesday, witnessed thousands of people racing to Wall Street discount brokerages and markets to sell their stocks. Prices plummeted throughout the day, eventually leading to a complete stock market crash. The financial outcome of the crash was devastating.

What was the cause of the 2008 stock market crash?

The stock market crash of 2008 was as a result of defaults on consolidated mortgage-backed securities. Subprime housing loans comprised most MBS. Banks offered these loans to almost everyone, even those who weren’t creditworthy.

Why did the Dow Jones Industrial Average fall?

1 Until the stock market crash of 2020, it was the largest point drop in history. The market crashed because Congress rejected the bank bailout bill. 2 But the stresses that led to the crash had been building for a long time.

When did the bailout bill pass?

20 The Labor Department reported that the economy had lost a whopping 159,000 jobs in the prior month. 21 On Monday, Oct. 6, 2008, the Dow dropped 800 points, closing below 10,000 for the first time since 2004. 22

Who is Kimberly Amadeo?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

1. Crashes and corrections happen frequently

The first thing to note is simply how often stock market crashes and corrections occur in the S&P 500. According to data provided by market analytics firm Yardeni Research, the benchmark index has undergone 38 declines of at least 10% since the beginning of 1950. This works out to a crash or correction, on average, every 1.87 years.

2. Bouncing back from a bear-market bottom is never smooth

The next data point of concern examines how the S&P 500 responds after it finds a bear-market bottom.

3. The S&P 500's valuation spells trouble

One of the bigger telltale warnings for the stock market has been the S&P 500's Shiller price-to-earnings ratio. This is a measure that examines inflation-adjusted earnings over the previous 10 years.

4. Inflation could be an ominous sign

A fourth cause for concern is rapidly rising inflation: i.e., the rising price for goods and services.

5. Investors are borrowing, and that's usually bad news

The final data point that should be a cause for concern is margin debt. Margin describes the amount of money investors are borrowing (and paying interest on) to buy or bet against securities.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.