:brightness(10):contrast(5):no_upscale()/HowtoTellWhenaStockIsOvervalued-5706fe715f9b581408d48751.jpg)

Generally, a stock is considered to be overvalued when its price isn’t justified by its earnings outlook. In other words, the stock trades at a price that’s above its fair market or intrinsic value. So if a stock’s intrinsic value is $10 per share but it trades at $20 per share, it would fit the definition of being overvalued.

What does it mean if a stock is overvalued?

Overvalued stocks are those stocks whose current price does not do justice to the earning potential and have an inflated PE Ratio as compared to its fundamental value (found using DCF valuation, Comparable Comps) and therefore, analysts expect its share price to fall sharply in a market with due course of time.

What happens when stocks are over valued?

When a stock is truly overvalued as determined by the whole of the market participants, it’s price will fall (by definition). That’s the only time you know something is truly overvalued versus your subjective view that it may be overvalued.

When is a stock considered illiquid?

What are illiquid stocks? A stock is considered illiquid when the investor cannot easily liquidate the investments held. In other words, with illiquid stocks, buyers or sellers are not readily available. It is important to know about illiquid stocks because they are traded on an exchange.

When to sell a good stock?

- High short interest is something that retail traders seek to find stocks that may hold potential for aggressively bullish swings.

- When penny stocks experience a short squeeze, that can compound momentum in the market.

- In this article, we look at 5 penny stocks with higher levels of short interest.

How do you know a stock is overvalued?

This ratio is used to assess the current market price against the company's book value (total assets minus liabilities, divided by number of shares issued). To calculate it, divide the market price per share by the book value per share. A stock could be overvalued if the P/B ratio is higher than 1.

What causes a stock to be overvalued?

Overvaluation may result from an uptick in emotional trading, or illogical, gut-driven decision making that artificially inflates the stock's market price. Overvaluation can also occur due to deterioration in a company's fundamentals and financial strength. Potential investors strive to avoid overpaying for stocks.

When should you buy overvalued stocks?

For example, an overvalued stock may still be a good investment if the company has a strong future outlook and is expected to grow earnings rapidly. An undervalued stock may not be a good investment if the company has a weak future outlook and is expected to decline in earnings.

Is it OK to buy overvalued stocks?

Buying overvalued stocks can be risky, as they might drop closer to their intrinsic value at any time, especially over the short term. Yes, over the long term, the intrinsic value of healthy and growing companies will grow. But it's still possible to simply pay too much for a stock.

What indicates a stock is undervalued?

An asset that is undervalued is one that has a market price less than its perceived intrinsic value. Buying undervalued stock in order to take advantage of the gap between intrinsic and market value is known as value investing.

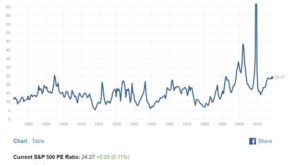

What is good PE ratio?

As far as Nifty is concerned, it has traded in a PE range of 10 to 30 historically. Average PE of Nifty in the last 20 years was around 20. * So PEs below 20 may provide good investment opportunities; lower the PE below 20, more attractive the investment potential.

What is the most undervalued stock?

Top undervalued stocks to buy today:Micron Technology Inc. (MU)CrowdStrike Holdings Inc. (CRWD)SentinelOne Inc. (S)Cloudflare Inc. (NET)Valero Energy Corp. (VLO)Williams-Sonoma Inc. (WSM)Crocs Inc. (CROX)

Is Apple overvalued?

As of this writing, we think Microsoft's stock is about 23% undervalued, while Apple's stock is 14% overvalued.

Where should I invest if market is overvalued?

Mutual fund typesELSS Mutual Funds.SIP Mutual Funds.Mutual Fund Types.Hedge Funds.Debt Funds.Index Funds.Arbitrage Funds.Equity Funds.More items...•

How do you judge if a stock is a good buy?

Here are nine things to consider.Price. The first and most obvious thing to look at with a stock is the price. ... Revenue Growth. Share prices generally only go up if a company is growing. ... Earnings Per Share. ... Dividend and Dividend Yield. ... Market Capitalization. ... Historical Prices. ... Analyst Reports. ... The Industry.More items...

What are the most overvalued stocks right now?

Here are seven stocks to sell before their outlooks dim even further:Peloton Interactive (NASDAQ:PTON)Teladoc Health (NYSE:TDOC)Block (NYSE:SQ)Nvidia (NASDAQ:NVDA)MicroStrategy (NASDAQ:MSTR)Royal Caribbean (NYSE:RCL)Boston Beer (NYSE:SAM)

How to tell if a stock is overvalued?

Signals of Overvalue. A stock is thought to be overvalued when its current price doesn't line up with its P/E ratio or earnings forecast. If a stock's price is 50 times earnings, for instance, it's likely to be overvalued compared to one that's trading for 10 times earnings. Some people think the stock market is efficient.

How to know if a stock deserves a closer look?

Many types of useful signals may show that a stock deserves a closer look. It's helpful to start with a review of the annual report , 10-K filing , income statement, balance sheet, and other statements. These will give you a feel for the way the firm works, before you dig deeper into the numbers.

How to track dividend yield?

To track and check a dividend yield over time, first map out the dividend yields over several points in time. Then, divide the chart into five equal parts. Any time the yield falls below the bottom fifth, be wary.

Why is dividend yield important?

The dividend yield served as a signal. It was a way for people to look at the price as it relates to the profits. It was also a way to strip away the complex data that can arise when dealing with Generally Accepted Accounting Principles (GAAP) standards.

How often do Treasury bonds exceed earnings?

Treasury bond yields have only exceeded earnings yields by 3:1 a few times every couple of decades, but you should be aware that it is seldom a good thing. If it happens to enough stocks, the stock market as a whole will likely be very high in relation to Gross National Product (GNP).

What happens if you have a lot of knowledge of a certain industry?

For instance, if you have a lot of knowledge of a certain industry, you might spot a turning point in a firm that's closely tied to economic cycles. Then you might decide that the earnings might turn out to be stronger than they are being forecast.

What is the upper threshold?

The upper threshold that most people want to watch for is a ratio of two. In this case, the lower the number, the better. Anything at one or below could be a good deal.

How to Spot Overvalued Stocks?

The most common way to detect such stocks being traded in the free market is by doing an earning analysis by taking the help of P/E ratio analysis or price to earnings ratio analysis. This is a dimension that brings about a sort of comparison between by taking the most critical factor, which is the market value of stocks. The most important thing to watch about for is the P/E ratio, which indicates the earning of the company against the price of the stock. An overvalued stock may be one that is generally traded at a rate that is much higher than its peer group.

How much is 200/4 in stock?

Thus we see the P/E here is dividing the market value of the stock by earnings per share, which is 200/4 = 50. Therefore, the stock is being traded in the market at 50 times more than what its earning is actually.

What is the P/E ratio of a stock?

The most important thing about overvalued stocks is the P/E ratio#N#P/E Ratio The price to earnings (PE) ratio measures the relative value of the corporate stocks, i.e., whether it is undervalued or overvalued. It is calculated as the proportion of the current price per share to the earnings per share. read more#N#, which indicates the earning#N#Earning Earnings are usually defined as the net income of the company obtained after reducing the cost of sales, operating expenses, interest, and taxes from all the sales revenue for a specific time period. In the case of an individual, it comprises wages or salaries or other payments. read more#N#of the company against the price of the stock. It may be one that is generally traded at a rate that traded at a much higher PE ratio as compared to its peer group.

How to Determine Whether the Stock Market is Overvalued

There are dozens of possible metrics you can measure the market’s valuation with, some well known (like PE or CAPE) and some not (Tobin Q, Buffet’s market cap/GDP).

How to Use This Information to Make Smarter Long-Term Decisions With Your Savings

A reasonable and prudent approach to marginal (new money only) capital allocation depends on your investing style. If you want to be as hands-off as possible and like a broad index like the S&P 500 (through ETFs like VOO), then you can apply a sliding scale like this one.

What is an overvalued stock?

An overvalued stock is one that trades at a price significantly higher than its fundamental earnings and revenue outlook suggests it should. It may also trade at a price-to-earnings multiple higher than its peers when adjusted for future growth.

How do stocks become overvalued?

A stock can become overvalued when the market detaches the price of a security from its underlying fundamentals. In the short run, stocks can stray far away from their intrinsic value, but, in the long run, they will move back closer to the true value of the underlying company.

What are the two metrics used to assess the value of a stock?

You can use a variety of metrics to assess the value of a stock. Two of the most common are the price-to-earnings ratio (P/E) and the enterprise value to EBITDA ratio (EV/EBITDA). Both are measurements of the current stock price versus the underlying company's earnings or earnings potential.

How to tell if a stock is overvalued?

The best way to determine if a stock is overvalued is to dig into the company yourself. Make your own estimates for its future revenue growth, margin expansion (or compression), and how it all impacts the bottom line. Sometimes you might find something the rest of the market is missing.

Can a company be overpriced?

Even a great company can have an overpriced stock. Doing some analysis of the business and what it's truly worth can save you from making an investment that underperforms the market even if the company continues to perform as expected.

Is the stock market a weighing machine?

As famous value stock investor Benjamin Graham said, in the long run, the stock market is a weighing machine. Eventually, prices move toward their intrinsic values.

Can you buy overvalued stocks?

If you buy an overvalued stock, it will likely end up underperforming the market as the price eventually falls back to its real value.

How much correction is needed to bring the stock market back to the mean?

At current valuation levels, the stock market correction needed to bring prices back to the mean range from 51.8% to 76.7% utilizing the seven approaches shown above. The average of these calculations indicates a market correction of 62.2% is needed to bring the level back to the long-term average. And this would merely bring valuations to the mean. As the market is long overdue for a drop below the mean, a larger correction would be required.

Is past performance indicative of future performance?

This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied.

Is the stock market at extreme levels?

It is apparent to most investors today that the stock market is at extreme levels. In order to illustrate the overvaluation of the stock market, I have prepared a summary of seven different valuation methodologies. To counter the potential argument that the conclusion is due to using similar data points in the calculations, I have included methodologies utilizing disparate inputs. These include: earnings, sales, fixed-asset values, gross domestic product, and regression analysis. In the chart below, I summarize the seven different valuation methodologies.

Is the stock market overvalued?

No matter how one slices it, the stock market is tremendously overvalued. It is important to note that valuation methodologies are great indicators of long-term price movements; however, they are terrible short-term indicators. In other words, while the outcomes forecast by the valuation outcomes above will likely prove true, ...

Is valuation a short term indicator?

It is important to note that valuation methodologies are great indicators of long-term price movements; however, they are terrible short-term indicators. What they demonstrate is the embedded risk in the stock market. The average of seven separate valuation approaches, using different data points, indicate the stock market would have to fall ...

Explanation

How to Spot Overvalued Stocks?

- The most common way to detect such stocks being traded in the free market is by doing an earning analysis taking the help of P/E ratio analysis or price to earnings ratio analysis. This dimension brings about a sort of comparison by taking the most critical factor, which is the market value of stocks. The most important thing to watch is the P/E ratio, which indicates the c…

Examples

- Example #1

Let’s understand about a stock traded at $200 and has earnings per share or EPS of $4. Thus we see the P/E here is dividing the stock’s market value by earnings per share, which is 200/4 = 50. Therefore, the stock is being traded in the market at 50 times more than what its earning is actu… - Example #2

Another example of overvalued stock can be the OTT digital platform company called Netflix, a very common online application used in every nook and corner of the world. This company had an initial share price of $120 when it started and eventually peaked too close to $200. The rise shift…

Overvalued Stocks vs. Undervalued Stocks

- Overvalued stocks are those whose current market price doesn’t justify their earning potential. Therefore, it has an overrated price-to-earnings ratio, and analysts expect its price to fall sharply in the market. They are the ones which are a result of emotional trading, or logic-less decision making involved with the trade, which may inflate the p...

Conclusion

- Overvalued or undervalued stocks can be found by the prime dimension, which is called the P/E ratio, but there is no fixed value. For example, a share with á high P/E of 40 may still be undervalued as it all is dependent on the earnings. It is thus solely based on the analyst to decide whether the stock is over or undervalued and trade accordingly.

Recommended Articles

- This article has been a guide to Overvalued Stocks and their Meaning. Here we discuss how to spot overvalued stocks along with an example and its differences from Undervalued Stocks. You can learn more from the following articles – 1. Careers in Valuation 2. Post Money Valuation 3. Business Valuation Training 4. Valuation Methods