September 29, 2008: Stock Market Crashes as Bailout Rejected

- Brazil's Bovespa was halted after dropping 10%

- The London Financial Times Stock Exchange dropped 15%

- Gold soared to over $900 an ounce

- Oil dropped to $95 a barrel

What is the worst stock market crash?

Sep 15, 2018 · A trader works on the floor of the New York Stock Exchange on September 15, 2008 in New York City. In afternoon trading the Dow Jones Industrial Average fell over 500 points as U.S. stocks suffered...

What actually happens during a stock market crash?

The 2008 crash took place on September 29, 2008, when the fall of Dow Jones Industrial Average to 777.68 per cent. The crash began in the US and later spread to Europe that tended to affect many US and Europe financial firms.

What was the exact date the stock market crashed?

Nov 03, 2008 · on sept. 6, 2008, with the financial markets down nearly 20% from the oct. 2007 peaks, the government announced its takeover of fannie mae and freddie mac as a result of losses from heavy exposure...

When was the last market crash?

Sep 21, 2021 · The 2008 stock market crash took place on Sept. 29, 2008, when the Dow Jones Industrial Average fell 777.68 points. This was the largest single-day loss in Dow Jones history up to this point. It came on the heels of Congress’ rejection of the bank bailout bill.

How long did the stock market crash of 2008 last?

three-week19, 2008 intraday high of 11,483 to the Oct. 10, 2008 intraday low of 7,882. 12 The following is a recap of the major U.S. events that unfolded during this historic three-week period.

How much did the stock market drop in 2008 and 2009?

From its local peak of 1,300.68 on August 28, 2008, the S&P 500 fell 48 percent in a little over six months to its low on March 9, 2009. This drop is similar to the decrease in much of the rest of the world (Bartram and Bodnar 2009).

What caused the stock market to fall in 2008?

The stock market crashed in 2008 because too many had people had taken on loans they couldn't afford. Lenders relaxed their strict lending standards to extend credit to people who were less than qualified. This drove up housing prices to levels that many could not otherwise afford.Jun 4, 2019

When did the stock market crash in 2007?

October 9, 2007The US bear market of 2007–2009 was a 17-month bear market that lasted from October 9, 2007 to March 9, 2009, during the financial crisis of 2007–2009.

How long did it take the stock market to recover after the 2008 crash?

The Dow didn't reach its lowest point, which was 54% below its peak, until March 6, 2009. It then took four years for the Dow to fully recover from the crash.Feb 2, 2022

Who made the most money from the 2008 crash?

1. Warren Buffett. In October 2008, Warren Buffett published an article in the New York TimesOp-Ed section declaring he was buying American stocks during the equity downfall brought on by the credit crisis.

What happened in 2008 in the world?

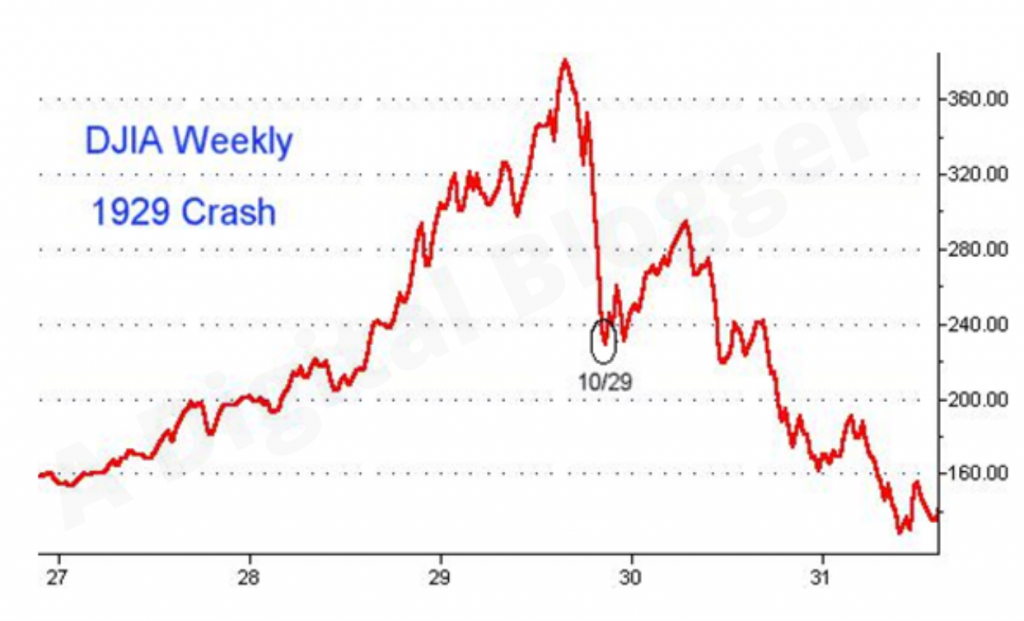

Great Recession The financial crisis of 2008, or Global Financial Crisis, was a severe worldwide economic crisis that occurred in the early 21st century. It was the most serious financial crisis since the Great Depression (1929).

How the 2008 financial crisis happened?

Housing prices started falling in 2007 as supply outpaced demand. That trapped homeowners who couldn't afford the payments, but couldn't sell their house. When the values of the derivatives crumbled, banks stopped lending to each other. That created the financial crisis that led to the Great Recession.

How much did home prices drop in 2008?

The National Association of Realtors reports that home prices dropped a record 12.4% in the final quarter of 2008 - the biggest decline in 30 years.Feb 12, 2009

What banks failed in 2008?

2008BankAssets ($mil.)1Douglass National Bank58.52Hume Bank18.73ANB Financial NA2,1004First Integrity Bank, NA54.721 more rows

What was the financial crisis of 2008?

The 2008 financial crisis had its origins in the housing market, for generations the symbolic cornerstone of American prosperity. Federal policy conspicuously supported the American dream of homeownership since at least the 1930s, when the U.S. government began to back the mortgage market. It went further after WWII, offering veterans cheap home loans through the G.I. Bill. Policymakers reasoned they could avoid a return to prewar slump conditions so long as the undeveloped lands around cities could fill up with new houses, and the new houses with new appliances, and the new driveways with new cars. All this new buying meant new jobs, and security for generations to come.

What was the Commodity Futures Modernization Act of 2000?

Congress gave them one way to do so in 2000, with the Commodity Futures Modernization Act, deregulating over-the-counter derivatives—securities that were essentially bets that two parties could privately make on the future price of an asset. Like, for example, bundled mortgages.

Why did the mortgage salesmen make these deals without investigating a borrower's fitness or a property's

The salesmen could make these deals without investigating a borrower's fitness or a property's value because the lenders they represented had no intention of keeping the loans. Lenders would sell these mortgages onward; bankers would bundle them into securities and peddle them to institutional investors eager for the returns the American housing market had yielded so consistently since the 1930s. The ultimate mortgage owners would often be thousands of miles away and unaware of what they had bought. They knew only that the rating agencies said it was as safe as houses always had been, at least since the Depression.

What did Jim Bunning call the bailouts?

Senator Jim Bunning of Kentucky called the bailouts "a calamity for our free-market system" and, essentially, "socialism"—albeit the sort of socialism that favored Wall Street, rather than workers. Earlier in the year, Paulson had identified Lehman as a potential problem and spoke privately to its chief executive, Richard Fuld.

What did the Glass-Steagall Act do?

the Glass-Steagall Act ), they separated these newly secure institutions from the investment banks that engaged in riskier financial endeavors.

What was the financial environment like in the early 21st century?

The financial environment of the early 21st century looked more like the United States before the Depression than after: a country on the brink of a crash. pinterest-pin-it. An employee of Lehman Brothers Holdings Inc. carrying a box out of the company's headquarters after it filed for bankruptcy.

When did Paulson say the government would not rescue Lehman?

By the weekend of September 13-14, 2008, Lehman was clearly finished, with perhaps tens of billions of dollars in overvalued assets on its balance sheets.

Why did the stock market crash in 2008?

In all, the stock market crash 2008 as a result of a series of events that eventually led to the failure of some of the largest companies in the US.

What was the impact of the 2008 stock market crash?

There is no doubt behind the saying, that the crash pushed the banking system towards the edge of collapse.

What was the Dow value in September 2008?

The day was ended at the Dow value of 11,388.44. On September 20, 2008, the bank bailout bill was sent to Congress by Secretary Paulson and Federal Reserve Chair. The Dow fell to 777.68 points during the intraday trading that increased panic in the Global Market.

How many points did the Dow drop in 2008?

By September 17, 2008, the Dow fell by 446.92 points. By the end of the week on September 19, 2008, the Fed established the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility that committed to offer loans to banks to buy Commerical paper from the money market funds.

How much did the Fed lose from Lehman Brothers?

By making $85 billion loans for 79.9% equity the Fed took ownership of the AIG. With the collapse of Lehman Brothers, there was a loss of $196 billion that increased the panic among many businesses. Bank has driven up the rates as they were afraid to lend money. By September 17, 2008, the Dow fell by 446.92 points.

What was the fourth cause of the 2008 financial crisis?

The fourth cause of the crash of 2008 was found to be the depression era Glass Steagall Act (1933) that allowed banks, securities firms and other insurance companies to enter into each other’s markets resulting in the formation of the bank that was too big to fail.

What were the causes of the Federal Reserve's crash?

Some of the top reasons for the crash are: Mild Recession in the Federal Reserve. Federal Reserve the Central Bank was facing a mild recession since 2001. The recession period resulted in the reduction of the federal funds rate from 6.5 to 1.75 from May 2000 to December 2001.

What happened in 2008?

By the fall of 2008, borrowers were defaulting on subprime mortgages in high numbers, causing turmoil in the financial markets, the collapse of the stock market, and the ensuing global Great Recession.

How much did the Dow drop in 2008?

The Dow would plummet 3,600 points from its Sept. 19, 2008 intraday high of 11,483 to the Oct. 10, 2008 intraday low of 7,882. The following is a recap of the major U.S. events that unfolded during this historic three-week period.

What mortgages are lethal?

Among the most potentially lethal of the mortgages offered to subprime borrowers were the interest-only ARM and the payment option ARM, both adjustable-rate mortgages (ARMs). Both of these mortgage types have the borrower making much lower initial payments than would be due under a fixed-rate mortgage. After a period of time, often only two or three years, these ARMs reset. The payments then fluctuate as frequently as monthly, often becoming much larger than the initial payments.

What is subprime mortgage?

Subprime mortgages are mortgages targeted at borrowers with less-than-perfect credit and less-than-adequate savings. An increase in subprime borrowing began in 1999 as the Federal National Mortgage Association (widely referred to as Fannie Mae) began a concerted effort to make home loans more accessible to those with lower credit and savings than lenders typically required. 1

What is the role of Fannie and Freddie?

2 . The role of Fannie and Freddie is to repurchase mortgages from the lenders who originated them and make money when mortgage notes are paid. Thus, ever-increasing mortgage default rates led to a crippling decrease in revenue for these two companies.

What is MBS in mortgage?

An MBS is a pool of mortgages grouped into a single security. Investors benefit from the premiums and interest payments on the individual mortgages the security contains. This market is highly profitable as long as home prices continue to rise and homeowners continue to make their mortgage payments.

Why did Bear Stearns fail?

By March 2007, with the failure of Bear Stearns due to huge losses resulting from its underwriting many of the investment vehicles linked to the subprime mortgage market, it became evident that the entire subprime lending market was in trouble.

Why did the stock market crash in 2008?

The stock market crashed in 2008 because too many had people had taken on loans they couldn’t afford. Lenders relaxed their strict lending standards to extend credit to people who were less than qualified. This drove up housing prices to levels that many could not otherwise afford.

What was the impact of the 2008 stock market crash?

The stock market crash of 2008 was a result of a series of events that led to the failure of some of the largest companies in U.S. history. As the housing bubble burst, it affected banks and financial institutions who were betting on the continued increase in home prices.

Why did Fannie Mae offer unconventional mortgage terms?

Lenders who extended home loans to high-risk borrowers offered mortgages with unconventional terms to reflect the increased likelihood of default.

How did the bailout affect the Dow Jones?

Each bailout announcement affected the Dow Jones, sending it tumbling as markets responded to the financial instability. The Fed announced a bailout package, which temporarily bolstered investor confidence. The bank bailout bill made its way to Congress, where the Senate voted against it on September 29, 2008.

What was the largest drop in history?

The Dow plummeted 777.68, the largest single-day drop in history up to this point. Global markets were swept up in the panic, causing global instability. Congress eventually passed the bailout bill in October, but the damage was done.

What banks were involved in the bailout?

The build-up of bad debt resulted in a series of government bailouts starting with Bear Stearns, a failing investment bank. Fannie Mae and Freddie Mac (the nickname given the Federal Home Loan Mortgage Corporation) were next on the government-sponsored bailout train.

Why did Lehman Brothers collapse?

In September 2008, investment firm Lehman Brothers collapsed because of its overexposure to subprime mortgages. It was the largest bankruptcy filing in U.S. history up to that point. Later that month, the Federal Reserve announced yet another bailout.

2007

- The Dow opened the year at 12,474.52.2 It rose despite growing concerns about the subprime mortgage crisis. On December 19, 2006, the U.S. Department of Commerce warned that October's new home permits were 28% fewer than the year before.4 But economists didn't think the housin…

2008

- At the end of January, the BEA revised its fourth-quarter 2007 GDP growth estimate down.9 It said growth was only 0.6%. The economy lost 17,000 jobs, the first time since 2004.10 The Dow shrugged off the news and hovered between 12,000 and 13,000 until March.2 On March 17, the Federal Reserve intervened to save the failing investment bank, Bear Stearns. The Dow dropped …

October 2008

- Congress finally passed the bailout bill in early October, but the damage had already been done.24 The Labor Department reported that the economy had lost a whopping 159,000 jobs in the prior month.25 On Monday, October 6, 2008, the Dow dropped by 800 points, closing below 10,000 for the first time since 2004.26 The Fed tried to prop up banks by lending $540 billion to money mar…

November 2008

- The month began with more bad news. The Labor Department reported that the economy had lost a staggering 240,000 jobs in October.34 The AIG bailout grew to $150 billion.35 The Bush administration announced it was using part of the $700 billion bailouts to buy preferred stocks in the nations' banks.36 The Big Three automakers asked for a federal bailout. By November 20, 20…

December 2008

- The Fed dropped the fed funds rate to 0%, its lowest level in history.29 The Dow ended the year at a sickening 8,776.39, down almost 34% for the year.2

2009

- On January 2, 2009, the Dow climbed to 9,034.69.2 Investors believed the new Obama administration could tackle the recession with its team of economic advisers. But the bad economic news continued. On March 5, 2009, the Dow plummeted to its bottom of 6,594.44.37 Soon afterward, President Barack Obama's economic stimulus plan instilled the confidence nee…

Aftermath

- Investors bore the emotional scars from the crash for the next four years. On June 1, 2012, they panicked over a poor May jobs report and the eurozone debt crisis. The Dow dropped 275 points.39 The 10-year benchmark Treasury yield dropped to 1.47.40 This yield was the lowest rate in more than 200 years.41It signaled that the confidence that evaporated during 2008 had not q…

The Bottom Line

- The stock market crash of 2008 was a result of defaults on consolidated mortgage-backed securities. Subprime housing loans comprised most MBS. Banks offered these loans to almost everyone, even those who weren’t creditworthy. When the housing market fell, many homeowners defaulted on their loans. These defaults resounded all over the financial industry, which heavily i…

Overview

The financial crisis of 2008, or Global Financial Crisis (GFC), was a severe worldwide economic crisis that occurred in the late 2000s. It was the most serious financial crisis since the Great Depression (1929). Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubbleculminated in …

Background

The crisis sparked the Great Recession, which, at the time, was the most severe global recession since the Great Depression. It was also followed by the European debt crisis, which began with a deficit in Greece in late 2009, and the 2008–2011 Icelandic financial crisis, which involved the bank failure of all three of the major banks in Icelandand, relative to the size of its economy, was the la…

History

Following is a timeline of major events during the financial crisis, including government responses, and the subsequent economic recovery:

• May 19, 2005: Fund manager Michael Burry closed a credit default swap against subprime mortgage bonds with Deutsche Bankvalued at $60 million – the first such CDS. He projected they would become volatile within two years of the lo…

Causes

While the causes of the bubble are disputed, the precipitating factor for the Financial Crisis of 2007–2008 was the bursting of the United States housing bubble and the subsequent subprime mortgage crisis, which occurred due to a high default rate and resulting foreclosures of mortgage loans, particularly adjustable-rate mortgages. Some or all of the following factors contributed to …

Economists who predicted the crisis

Economists, particularly followers of mainstream economics, mostly failed to predict the crisis. The Wharton School of the University of Pennsylvania's online business journal examined why economists failed to predict a major global financial crisis and concluded that economists used mathematical models that failed to account for the critical roles that banks and other financial institutions, as opposed to producers and consumers of goods and services, play in the economy.

IndyMac

The first visible institution to run into trouble in the United States was the Southern California–based IndyMac, a spin-off of Countrywide Financial. Before its failure, IndyMac Bank was the largest savings and loan association in the Los Angeles market and the seventh largest mortgage loan originator in the United States. The failure of IndyMac Bank on July 11, 2008, was the fourth largest bank failure in United Stateshistory up until the crisis precipitated even larger fa…

Notable books and movies

• In 2006, Peter Schiff authored a book titled Crash Proof: How to Profit From the Coming Economic Collapse, which was published in February 2007 by Wiley. The book describes various features of the economy and housing market that led to the United States housing bubble, and warns of the impending decline. After many of the predictions came to pass, a second edition titled Crash Proof 2.0 was published in 2009, which included a "2009 update" addendum at the end of each c…

See also

• Banking (Special Provisions) Act 2008 (United Kingdom)

• List of bank failures in the United States (2008–present)

• 2008–2009 Keynesian resurgence

• 2010 United States foreclosure crisis