Stock dilution occurs when a company issues new stock, and the current shareholders experience a lessening of their ownership percentage in the enterprise. When a company issues more shares, stockholders own a diluted percentage of the company, and the value of each individual share decreases.

What causes dilution in the stock market?

Dilution can be caused due to a number of dilutive securities such as stock options, restricted and performance stock units, preferred stock, warrants, and convertible debt. Dilution may cause the share price to decline because it reduces the company’s earnings per share (EPS).

What is a dilutive stock?

When it happens, and the numbers of company shares increases, the newer shares are the "dilutive stock." If a company has a total of 1,000 shares of float on the market, for example, and its management issues another 1,000 shares in a secondary offering, there are now 2,000 shares outstanding.

What is the opposite of stock dilution?

The opposite of stock dilution by a company is stock buyback. When it buys its own shares back, basically taking them out of circulation, the overall number of shares are reduced. This generally means the price of the remaining shares increase.

Can shares be diluted?

Shares can also be diluted by employees who have been granted stock options. Investors should be particularly mindful of companies that grant employees a large number of optionable securities. If and when employees choose to exercise the options, then common shares may be significantly diluted.

What is dilutive effect of stock?

Dilution occurs when a corporate action, like a secondary offering, increases the number of shares outstanding. Exercising stock options is dilutive to shareholders when it results in an increase in the number of shares outstanding.

What is reverse treasury stock method?

The reverse treasury stock method is used to calculate the effect of a put option on the diluted earnings per share calculation of a publicly-held entity. A business may be party to a contract that requires it to buy back its own stock from a shareholder.

What is the if converted method for diluted EPS?

If-Converted Method and Earnings Diluted EPS is how much, per share, the company made if all the convertible securities were converted to common stock. Since there would be more common shares if all the convertible securities were converted, the diluted EPS is lower than EPS.

Why is treasury stock method used?

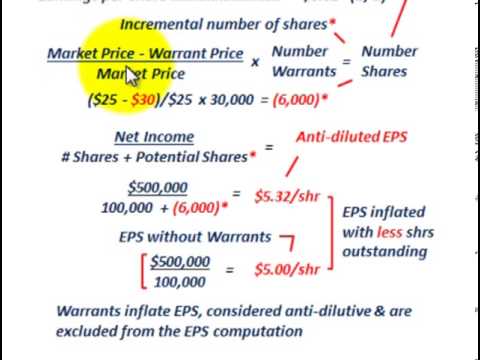

The treasury stock method is used to calculate the net increase in shares outstanding if in-the-money options and warrants were to be exercised. This information is included in the calculation of diluted earnings per share, expanding the number of shares and therefore reducing the amount of earnings per share.

What is fully diluted stock?

“Fully diluted” shares are the total common shares of a company counting not only shares that are currently issued or outstanding but also shares that could be claimed through the conversion of convertible preferred stock or through the exercise of outstanding options and warrants.

Why is diluted EPS disclosed?

Diluted EPS is important for shareholders simply because it lays down the earnings that a shareholder would get in the worst of the scenarios. If a public listed entity has more of different stock types in its capital framework, it should provide information pertaining to both diluted EPS and Basic EPS.

What is diluted EPS vs EPS?

EPS takes into account a company's common shares, whereas diluted EPS takes into account all convertible securities, such as convertible bonds or convertible preferred stock, which are changed into equity or common stock.

How do you calculate dilutive effect of stock options?

How to Calculate Share Dilution? Diluted Shareholding is calculated by dividing existing shares of an individual (Let it be X) by the sum of the total number of existing shares and a total number of new shares.

What is diluted EPS with example?

Diluted EPS Formula= Net Income(Before Preferred Dividends)+After Tax Cost of Interest / (Common Shares Outstanding +Additional Shares Against Exercise of Convertible Securities) Diluted EPS = (20,00,000 + 750) / (8,00,000 + 50,000 + 5,000 + 1,818) Diluted EPS = 20,00,750 / 8,56,818. Diluted EPS = 2.34.

What is stock method?

The treasury stock method computes the number of new shares that may potentially be created by unexercised in-the-money warrants and options. This method assumes that the proceeds a company receives from an in-the-money option exercise are used to repurchase common shares in the market.

What is the cost method for treasury stock?

Cost Method of Treasury Stock: Definition The cost method is based on the assumption that the acquisition of treasury stock is essentially a temporary reduction in stockholders' equity that will be reversed when the shares are reissued. It is widely used due to its simplicity.

What are diluted shares outstanding?

Fully diluted shares outstanding is the total number of shares a company would theoretically have if all dilutive securities were exercised and converted into shares. Dilutive securities include options, warrants, convertible debt, and anything else that can be converted into shares.

What is stock dilution?

Stock dilution occurs when a company's action increases the number of outstanding shares and therefore reduces the ownership percentage of existing shareholders. Although it is relatively common for distressed companies to dilute shares, the process has negative implications for a simple reason: A company's shareholders are its owners, ...

What is a dilutive stock?

When it happens, and the numbers of company shares increases, the newer shares are the "dilutive stock.".

Why is exercise of stock options dilutive?

Exercising stock options is dilutive to shareholders when it results in an increase in the number of shares outstanding. Dilution decreases each shareholder's stake in the company but is often necessary when a company requires new capital for operations. Convertible debt and equity can be dilutive when these securities are converted to shares.

How do employee stock options work?

When the option contracts are exercised, the options are converted to shares and the employee can then sell the shares in the market, thereby diluting the number of company shares outstanding. The employee stock option is the most common way to dilute shares via derivatives, but warrants, rights, and convertible debt and equity are sometimes ...

How does stock dilution affect shareholders?

After all, by adding more shareholders in the company, they are having their ownership cut down. This can lead to shareholders thinking that the value of the company is reduced.

What is diluted earnings per share?

These all would reduce the earning per share for the common shareholders. The value of earnings per share in case all the convertible securities, including convertible notes, equity warrants, and stock options, are converted to common shares is known as diluted earnings per share (EPS).

What is the if converted method?

The if-converted method is utilized to calculate the diluted EPS in case the company has potentially dilutive preferred stock. To utilize this method, subtract the preferred dividend payments from net income in the numerator and add the number of new common shares that would be issued if it is converted, to the weighted average number of shares outstanding in the denominator.

How does dilution affect stock price?

Depending on the number of shares held, dilution can greatly affect a portfolio’s value. Not only is the individual share price affected, but dilution may also affect the stock’s earnings per share. The EPS is the result of the company’s net income divided by the float.

How does share dilution affect shareholders?

Share dilution affects every shareholder’s ownership percentage in a company , but unless you own a substantial number of shares, ownership percentage isn’t the first thing on your mind when share dilution occurs. That isn’t the case with closely held corporations. When only a few people own shares, each person tends to think of the percentage of the corporation they own, not the number of shares. Majority shareholders, however, can use share dilution to force out minority shareholders or make them accept actions they would normally not condone.

Why do startups issue stock options?

That means when the employees exercise these stock options, existing shareholders experience stock dilution, lessening the amount they own in the startup.

What does "dilution" mean in a drink?

For many people, the word dilute often corresponds to liquids. For example, if you want to lessen the effects of an alcoholic beverage, you may pour some water into it. This dilution makes the drink less potent. Share dilution operates in a similar way.

What is the opposite of dilution?

The opposite of stock dilution by a company is stock buyback. When it buys its own shares back, basically taking them out of circulation, the overall number of shares are reduced. This generally means the price of the remaining shares increase.

What happens when a company offers stock options to employees?

If a company offers stock options to employees, those exercising their stock options will have them converted into the company’s shares, which increases the number of shares. A company may also issue convertible securities, either bonds or stock warrants. Warrants are usually issued to lenders.

Why do companies issue new shares?

Some companies may issue new shares because they seek new capital for further growth opportunities. Other companies may issue new stock out of the need to service debt. If a company purchases another business, they may issue new shares to that firm’s shareholders. A smaller company might issue shares to individual service providers.

What causes a stock to dilution?

Dilution can be caused due to a number of dilutive securities such as stock options. Stock Option A stock option is a contract between two parties which gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period.

Why does dilution cause a decline in stock price?

Dilution may cause the share price to decline because it reduces the company’s earnings per share (EPS). The extent of the decline depends on the percentage of dilution. Given basic shares outstanding, share price, and information about dilutive securities, we can calculate dilution using the treasury stock method, ...

Why is the new share price of a company lower than its share price before dilution?

The reason for this is that the market capitalization of the company is divided by a greater number of shares. Dilutive securities cause the EPS of a company to decline.

What happens if you convert a stock into additional shares?

Since the securities are converted into additional shares at a price less than the market price of the company’s shares, fewer shares can be repurchased from the proceeds of the conversion. As a result, there is a dilutive effect. If the securities are not in the money, there will be no dilution.

What is the Treasury Stock Method?

The treasury stock method assumes that all of the money securities are converted into additional shares and proceeds from these additional shares are used to repurchase the company’s shares. A security is considered in the money if its exercise price is below the market price.

What is the seller of a stock option called?

A seller of the stock option is called an option writer , where the seller is paid a premium from the contract purchased by the stock option buyer. Cost of Preferred Stock The cost of preferred stock to a company is effectively the price it pays in return for the income it gets from issuing and selling the stock.

What is anti dilutive securities?

Anti-dilutive Securities Anti dilutive securities refer to the financial instruments initially available as convertible securities and not ordinary shares. However, converting such shares into ordinary stocks results in the higher earnings per share or an increase in shareholders' voting power. read more.

What are the components of a stock option?

It typically consists of four components: the strike price, the expiry date, the lot size, and the share premium. read more.

What is dilution in financial markets?

In most cases dilution happens when the company has desperate needs for infusing capital into its operations. Since modern financial ecosystem provides multiples routes and opportunities to achieve this aim, the most common strategies used by companies are to raise capital through debt offerings or through the issuance of new shares in the secondary public markets.

Does market value change after dilution?

Due to the rise in the total number of shares outstanding after the dilution, Market Value may change significantly after dilution, depending on the extent of the dilutive effect of the newly issued shares.

What is diluted EPS?

Therefore, the GAAP method is utilized to compute this figure for financial reporting. EPS is diluted due to outstanding in-the-money options. Stock Option A stock option is a contract between two parties which gives the buyer ...

Why is EPS diluted?

EPS is diluted due to outstanding in-the-money options. Stock Option A stock option is a contract between two parties which gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period.

What is a stock option writer?

A seller of the stock option is called an option writer, where the seller is paid a premium from the contract purchased by the stock option buyer. and warrants. These allow investors who own them to buy a number of common shares at a price below lower than the current market price.

When repurchased common shares, what is the exercise date assumed?

When exercising warrants and options, the exercise date assumed is the start of the reporting period.

What is the Treasury Stock Method?

The Treasury Stock Method (TSM) is used to compute the net new number of shares from potentially dilutive securities (i.e. stocks). The main idea behind the treasury stock method is that all securities that can be exercised should be accounted for in the share count calculation.

Treasury Stock Method (TSM) Assumptions

Under the TSM approach, the total diluted share count takes into account the new shares issued by the exercising of options and other dilutive securities that are “in-the-money” (i.e., the current share price is greater than the exercise price of the option/warrant/grant/etc.).

Treasury Stock Method (TSM) Formula

The formula for the total diluted share count consists of all basic shares, as well as the new shares from the hypothetical exercise of all in-the-money options and conversion of convertible securities.

Treasury Stock Method (TSM) Calculation Example

For instance, let’s say that a company has 100,000 common shares outstanding and $200,000 in net income in the last twelve months ( LTM ). If we were calculating the basic EPS, which excludes the impact of dilutive securities, the EPS would be $2.00 (200,000 net income ÷ 100,000 shares).

Excel Template Download

Now, we are ready to move onto an example calculation of fully diluted shares outstanding using the TSM. To get started, use the form below to download the template to follow along.

Treasury Stock Method (TSM) Example Calculation

To begin, we are given two assumptions that the current share price (i.e., equity value per share) is $20.00 and the basic shares outstanding is 10mm. If we were to ignore the dilutive impact of non-basic shares in the calculation of equity value, we would arrive at $200mm ($20.00 per share x 10mm basic shares outstanding).