The 15/50 rule says you should always invest 50% of your assets in bonds and 50% in stocks as long as you think you have more than 15 years left to live. Why 'Own Your Age' No Longer Works

What percentage of my investments should be in stocks and bonds?

Provided that you have some sort of emergency fund, we think that 100% of your investment accounts should be in stocks and bonds.

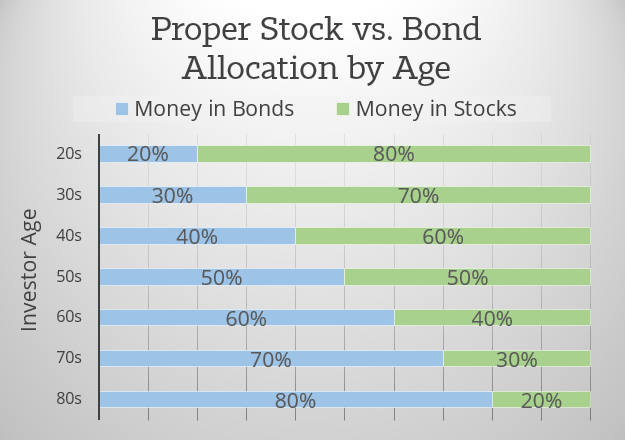

Should the percentage of bonds in your portfolio equal your age?

This financial axiom states that the percentage of bonds in your portfolio should equal your age, based on the notion that as we move nearer to retirement, we want to replace the growth potential and risk of stocks with the relative predictability of bonds. For example, if you are 25, 25% of the value of your portfolio should be in bonds.

Are stocks or bonds better for your portfolio?

For example, in the past, stocks have had a higher rate of return than bonds over the long term. But, stocks have had more volatility in the short term. 2 The four allocation samples below are based on a strategic approach.

What is the proper asset allocation of stocks and bonds?

The proper asset allocation of stocks and bonds depends on your overall net worth composition. The smaller your stocks and bonds portfolio as a percentage of your overall net worth, the more aggressive your portfolio can be in stocks. The Proper Asset Allocation Of Stocks And Bonds Analyzed

What percentage of my investments should be in stocks?

The old rule about the best portfolio balance by age is that you should hold the percentage of stocks in your portfolio that is equal to 100 minus your age. So a 30-year-old investor should hold 70% of their portfolio in stocks.

Is it better to have more stocks or bonds?

Stocks offer an opportunity for higher long-term returns compared with bonds but come with greater risk. Bonds are generally more stable than stocks but have provided lower long-term returns. By owning a mix of different investments, you're diversifying your portfolio.

What is the 90 10 rule in finance?

The 90/10 investing strategy for retirement savings involves allocating 90% of one's investment capital in low-cost S&P 500 index funds and the remaining 10% in short-term government bonds. The 90/10 investing rule is a suggested benchmark that investors can easily modify to reflect their tolerance to investment risk.

What percentage of my 401k should be in bonds?

With this rule you subtract your age from 100 to get your stock allocation, with the remainder going into bonds. For example, a 40-year-old should have a 60 percent exposure to stocks and 40 percent to bonds, while a 65-year-old should have 35 percent in stocks and 65 percent in bonds.

How much of my portfolio should be bonds?

The 15/50 rule says you should always invest 50% of your assets in bonds and 50% in stocks as long as you think you have more than 15 years left to live.

What is a 70/30 portfolio?

A 70/30 portfolio allocates 70% of your investment dollars to stocks and 30% to fixed income. So an investor who uses this strategy might have 70% of their money invested in individual stocks, equity-focused actively or passively managed mutual funds and equity-focused index or exchange-traded funds (ETFs).

What does Warren Buffett recommend for investing?

Buffett has long recommended that investors put their money in low-cost index funds, which hold every stock in an index, making them automatically diversified. The S&P 500, for example, includes big-name companies like Apple, Coca-Cola and Amazon.

What is a good asset allocation for a 65 year old?

If you're 65 or older, already collecting benefits from Social Security and seasoned enough to stay cool through market cycles, then go ahead and buy more stocks. If you're 25 and every market correction strikes fear into your heart, then aim for a 50/50 split between stocks and bonds.

When should you invest in stocks vs bonds?

With risk comes reward. Bonds are safer for a reason⎯ you can expect a lower return on your investment. Stocks, on the other hand, typically combine a certain amount of unpredictability in the short-term, with the potential for a better return on your investment.

Should I put my 401k in stocks or bonds?

Bonds are more stable, but offer potentially lower returns over time. Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

What is a good asset mix for retirement?

The moderately conservative allocation is 25% large-cap stocks, 5% small-cap stocks, 10% international stocks, 50% bonds and 10% cash investments. The moderate allocation is 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds and 5% cash investments.

Are bonds a good investment in 2022?

If you're eyeing ways to fight swelling prices, Series I bonds, an inflation-protected and nearly risk-free asset, may now be even more appealing. I bonds are paying a 9.62% annual rate through October 2022, the highest yield since being introduced in 1998, the U.S. Department of the Treasury announced Monday.

What is the difference between a stock and a bond?

Stocks give you partial ownership in a corporation, while bonds are a loan from you to a company or government. The biggest difference between them is how they generate profit: stocks must appreciate in value and be sold later on the stock market, while most bonds pay fixed interest over time.

Why are bonds more valuable?

For example, if you buy a bond with a 2% yield, it could become more valuable if interest rates drop, because newly issued bonds would have a lower yield than yours . On the other hand, higher interest rates could mean newly issued bonds have a higher yield than yours, lowering demand for your bond, and in turn, its value.

How much equity was issued in 2018?

In 2018, $221.2 billion worth of equity was issued in the country. Corporations often issue equity to raise cash to expand operations, and in return, investors are given the opportunity to benefit from the future growth and success of the company. Buying bonds means issuing a debt that must be repaid with interest.

Why do companies issue stock?

Companies may issue shares to the public for several reasons, but the most common is to raise cash that can be used to fuel future growth.

What does it mean to own stock?

Stocks represent partial ownership, or equity, in a company. When you buy stock, you’re actually purchasing a tiny slice of the company — one or more "shares." And the more shares you buy, the more of the company you own. Let’s say a company has a stock price of $50 per share, and you invest $2,500 (that's 50 shares for $50 each).

What is corporate bond?

A company’s ability to pay back debt is reflected in its credit rating, which is assigned by credit rating agencies like Moody’s and Standard & Poor’s. Corporate bonds can be grouped into two categories: investment-grade bonds and high-yield bonds. Investment grade. Higher credit rating, lower risk, lower returns.

How long does a bond last?

The durations of bonds depend on the type you buy, but commonly range from a few days to 30 years. Likewise, the interest rate — known as yield — will vary depending on the type and duration of the bond.

What percentage of your portfolio should be fixed income?

These fixed-income securities should make up approximately 15 percent of your portfolio.

Do stocks increase in value over time?

But even given periods of radical fluctuations, stocks have historically increased in value over time. The “buy and hold” strategy, where patience pays, works for holding equities long-term. You can create subsections of your stock strategy, with a percentage of small-cap, mid-sized companies and large-caps represented.

What kind of stocks should you own?

You can pick value stocks or growth stocks, large-, mid-, or small-cap stocks, international or domestic stocks, and stocks on all levels of the risk spectrum. Here are a few basic definitions you should know and then we'll discuss how you can figure out your stock allocation.

How to tell what your stock portfolio should look like?

In a nutshell, there's no way for us to tell you exactly what your stock portfolio should look like, but as long as you diversify and stick mainly to stocks (or funds) that have a proven record of success, you should be just fine.

How much of your assets should be in cash?

The short answer: not much. A more thorough answer is that you should have a good amount of cash in a readily accessible place such as a savings account. Experts generally recommend that you aim to have six months' worth of your living expenses in a cash account, in order to be able to cover unforeseen expenses without tapping into your investments, borrowing the money, or selling something.

What is value mutual fund?

A value mutual fund's objective is to identify and invest in a variety of undervalued stocks, with the goal of producing market-beating returns over time. Growth stocks -- Companies with faster-than-average growth as measured by revenue or earnings. A growth fund's objective is to identify and invest in the best growth stocks.

What is the most important thing to do when investing in mutual funds?

Also on the concept of diversification, if you plan to invest in mutual funds, it's important to spread your money around.

How to determine your target stock allocation?

As a general rule of thumb, subtract your age from the number 110 in order to determine your target stock allocation. For example, if you're 35, this rule says that approximately 75% of your assets should be in stocks.

Is there a one size fits all asset allocation strategy?

The bottom line on asset allocation. While there is no one-size-fits-all asset allocation strategy, by analyzing your personal situation you can determine the best asset allocation for you. Doing so can get you the right combination of growth and income, while still allowing you to sleep at night.

What is 10 percent return?

Over 30 years, investing the same amount every year, a 10 percent return results in your nest egg, your retirement income, being 48 percent larger than what you would have with an 8 percent return. 2) There is no mix of stocks and bonds that eliminates the possibility of loss. Investing means losing money. If you invest, your portfolio will decline ...

What determines the long term return of a mutual fund?

The mix of assets determines both your long-term return as well as the volatility of the portfolio. Now, upward volatility rarely bothers investors—it’s the pesky downward volatility that represents losing the money you invested for retirement instead of spending it on a kitchen remodel. Let’s just focus on that. Vanguard, the only mutual fund company owned by its investors, put together a nice study of asset allocation models using data from 1926 to 2015 that gives an idea of the return and worst annual period (but not necessarily worst peak to trough) you could expect in the past with a given stock-to-bond ratio. I summarize its data in Table 1.

Is there a mix of stocks and bonds that eliminates the possibility of loss?

2) There is no mix of stocks and bonds that eliminates the possibility of loss. Investing means losing money. If you invest, your portfolio will decline in value from time to time. This should be expected, but do your best to increase your ability to tolerate that volatility.

How much of your portfolio should be in bonds?

For example, if you are age 25, then 25% of the value of your portfolio should be in bonds. If you are age 60, then 60% of your assets should be in bonds. But today, this rule might not have the same effect it once did. There are many reasons for this, but one is because the bond market, while not as risky as the stock market, can change, and is changing.

What is 15/50 stock rule?

A 15/50 Stock Rule portfolio requires more risk tolerance than one based on your age, especially if you are in your 70s. Higher risk is assumed if you build your portfolio to a 50/50 split and then leave it to grow; however, this split comes with a risk-mitigation tactic—proportional adjustment at 5% in either direction, which maintains the symmetrical value of each of the investment types.

How to ensure your portfolio is balanced?

To ensure that your portfolio is balanced, you should keep a close watch on the value of your stocks and bonds to make sure you don't go past your trigger percent.

Does the balance provide tax?

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Do bonds go up or down?

As interest rates fall, bond yields go up. It follows also that as interest rates rise, bond yields go down. After three decades of trending downward since the early 1980's, interest rates shot up to an extreme spike during the Covid-19 pandemic in 2020, and they have since seemed to be falling back to pre-2020 lows. 1

Why is it important to allocate stocks and bonds by age?

The Proper Asset Allocation Of Stocks And Bonds By Age. The proper asset allocation of stocks and bonds by age is important to achieve financial freedom. If you allocate too much to stocks the year before you want to retire and the stock market collapses, then you’re screwed.

Which asset allocation model is used for stocks and bonds?

The proper asset allocation of stocks and bonds generally follows the conventional model.

What happens if you allocate too much to stocks?

If you allocate too much to stocks the year before you want to retire and the stock market collapses, then you’re screwed. If you allocate too much to bonds over your career, you might not be able to build enough capital to retire at all. Just know the proper asset allocation is different for everyone. There is no “correct” asset allocation ...

How to determine asset allocation?

To determine the proper asset allocation, take a look at the historical returns for stocks. Stocks generally return around 10% since 1926. Below is a chart that shows the historical returns per year for the S&P 500.

Can bonds rise?

Bonds can also rise when stocks rise as you’ve seen in the historical chart above. During the 2008 Global Financial Crisis, a bond index fund only fell by about 1.5%, while stocks declined by 38%. The worst year ever for bonds was in 1994 when bonds fell 2.9%.

Is real estate a bond or a bond?

You can think about real estate as a bonds plus asset class. Real estate acts very much like bonds with its income generating ability and defensive characteristics. However, real estate can often do much better than bonds in a bull market.

Is real estate a good investment?

In addition to investing in stocks and bonds, I’m a big proponent of real estate investing. Real estate is a core asset class that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties.

What is Morningstar's world bond?

For example, Morningstar's world-bond category encompasses funds that are fully exposed to foreign-currency fluctuations, as well as those that hedge their currency exposures; funds also vary in their exposures to developed/developing markets and government- and corporate-issued bonds. Because types of foreign-debt exposure vary so widely, ...

How to stay on top of the market?

Staying on top of the markets is easier than ever: 1 Market movements at a glance 2 Real-time index performance 3 The pulse of the investing world

How to address volatility issue?

The volatility issue can be addressed--at least in large part--by hedging out the currency risk of the foreign bonds; that helps ensure that investors partake of foreign bonds' yields and any price changes, but not the currency-related impact when those returns are translated into dollars. However, hedging strategies entail costs, and in a low-returning asset class like bonds, those costs can take a big bite out of returns. That's a key reason that Morningstar's Lifetime Allocation Indexes, as well as target-date investment providers, have generally not mirrored the foreign/U.S. bond weightings of the global market capitalization.

Can an investor steer a larger share of her fixed income portfolio to a hedged international bond fund?

An investor could reasonably steer a larger share of her fixed-income portfolio to a hedged international-bond fund that emphasizes sovereign bonds rather than an unhedged product that emphasizes corporate and/or local-currency-denominated debt.

Is it right to allocate foreign stocks?

Unfortunately, the "right" allocations to foreign stocks and bonds will be evident only in hindsight. But let's take a closer look at various ways to approach these questions. For the purpose of this article, I'll assume that investors are pursuing a strategic approach to asset allocation (that is, buy, hold, and rebalance) versus a tactical strategy driven by valuations or other factors.

Is there consensus on globalized portfolios?

It's one of the central questions confronting investors putting together their portfolios, yet there's surely no consensus. Some experts argue for highly globalized portfolios, with allocations to foreign and U.S. stocks and bonds mirroring their market values.

Does asset allocation reduce foreign stock exposure?

Some asset-allocation frameworks directly reduce the percentage of foreign stock and bond exposure in a portfolio as the investor gets closer to retirement, while others do so only indirectly--that is, the portfolio's ratio of foreign to U.S. stocks remains static, but the total equity allocation declines over time.

Why Are Stocks And Bonds Both Near Record Highs?

The S&P 500 is at or close to a record high because of high earnings rebound expectations.

How much of your net worth should be public equity?

Your goal is to diversify your net worth by making public equity investments equal to no more than 50% of your net worth because you realize the value of various asset classes. You also long to be more independent after working diligently for the past 15 – 20 years. Therefore, the only way is to really create multiple income streams.

How to calculate stock allocation percentage?

The formula simply takes 120 minus an investor’s age to calculate the stock allocation percentage e.g. 120 – 40 year old = 80% in stocks. I use 120 because we live longer. The “New Life Model” is the base case asset allocation for the general public.

How does the stock market perform?

The stock market performs based off corporate earnings growth, which inflation helps. The more corporate earnings grow, the higher the stock market if valuation multiples stay the same. The stronger the expectations for earnings growth, the higher the stock market tends to climb as well as valuations expand.

Can I use Personal Capital to manage my net worth?

If you aren’t really interested in following the markets and find that you can spend your time making money elsewhere more efficiently, I recommend this route. You can always just use Personal Capital’s free tools to manage your investments and net worth as well.

Is time in the market better than timing the market?

2) Time in the market is better than timing the market. The longer we can invest, the higher the probability we will make money. Employ a disciplined dollar cost average strategy.

Is the S&P 500 higher than the Barclays bond?

The dividend yield of the S&P 500 at ~1.5% is higher than the dividend yield of the Barclays aggregate bond fund at ~1.3%. When this occurs, there’s a tendency for money to flow towards equities given the opportunity cost to invest in bonds is so low.

How much of your savings should you spend on bonds?

In general, the bigger share of your savings you hope to spend each year, the more you need to count on the market to boost your portfolio. If you aimed to spend just 3% of your savings a year, your chances of success with an all-bond portfolio jump to more than 70%. If you need to spend down 5% each year, they drop below 10%. “When you are behind on saving, you need to be more aggressive” in terms of stocks, says Dennis Nolte, a financial planner in Winter Park, Fla.

How much of your portfolio should be invested in stocks?

The authors suggested retiring with 20% to 40% of your portfolio invested in stocks, then gradually upping those levels to between 40% and 80%.

How much has the Standard and Poor's 500 returned in the past decade?

Chances are you’ve felt pretty good about stocks these days. Over the past decade the Standard & Poor’s 500 has returned over 14% a year on average.

How long did the stock market downturn last?

While stocks lost about 40% of their value on average each time, the duration of the downturn—measured from the month the market hit its last high until the month it bottomed out—was relatively short: about 1.4 years, on average.

How much money did the stock market lose in 2008?

History suggests that’s often exactly what happens. In the five years from the 2008 financial crisis, investors yanked more than $500 billion from U.S. stock funds, according to the trade group Investment Company Institute, while pouring roughly $1 trillion into bond funds. In fact, the stock market hit bottom in March 2009, before embarking on what would ultimately become a nearly decade-long bull market.

Is it hard to get into 401(k)?

The solution: Invest just a little to get started. While setting aside money may be hard, it’s easier than ever to get in the market. Over the past decade, more and more 401 (k)s have begun auto-enrolling participants. Unless you opt out, your employer may have already taken the leap for you.