- Obtain Charting Software. The number of shares bought and sold through an exchange over a given period is commonly called a stock's volume.

- Select a Stock to Analyze. Many brokers offer their clients charting software as part of their service package. ...

- Activate the Volume Indicator. Type the name or ticker of the stock you want to analyze into your charting software. ...

- Track Volume With a Moving Average. Almost all charting software offers the option to overlay indicators onto your charts. Locate the indicators list and select "Volume."

- A Manual Alternative. Most charting software will automatically insert a moving average into the volume indicator histogram.

What does volume have to do with stock trading?

· Consider a market that is composed of two traders. The first trader, X, purchases 100 shares of stock Alpha and sells 50 shares of stock Beta. The second trader, Y, buys 200 shares and sells 100 shares of the same stock, Gamma, to X. In such a situation, the total trading volume in the market would be 350.

What does volume mean in stocks trading?

· Broadly speaking, volume in investing means the total amount of a security that changes hands over a given period of time. This can refer to shares of an individual stock, the number of options ...

Does trading volume affect stock price?

Otherwise, the volume mainly used on TradingView is a simple tool. Called simply “volume” available in the TradingView Indicators. The layout to find the tool and the tool itself will look like the following: This volume histogram that will appear at the bottom of your chart will come in a color and with a moving average that you can readjust.

What does volume indicate in stock market?

· Momentum stocks can still trade at above-average volume without a catalyst. Another cause of a stock trading at above-average volume is a technical breakout on the daily chart. Look at the SQ daily chart when it broke out in March: You can see the volume that came into the stock after it broke out above that 48 level.

What is trading volume?

Trading volume is a measure of how much of a given financial asset has traded in a period of time. For stocks, volume is measured in the number of shares traded and, for futures and options, it is based on how many contracts have changed hands.

What is volume in stock?

Volume measures the number of shares traded in a stock or contracts traded in futures or options.

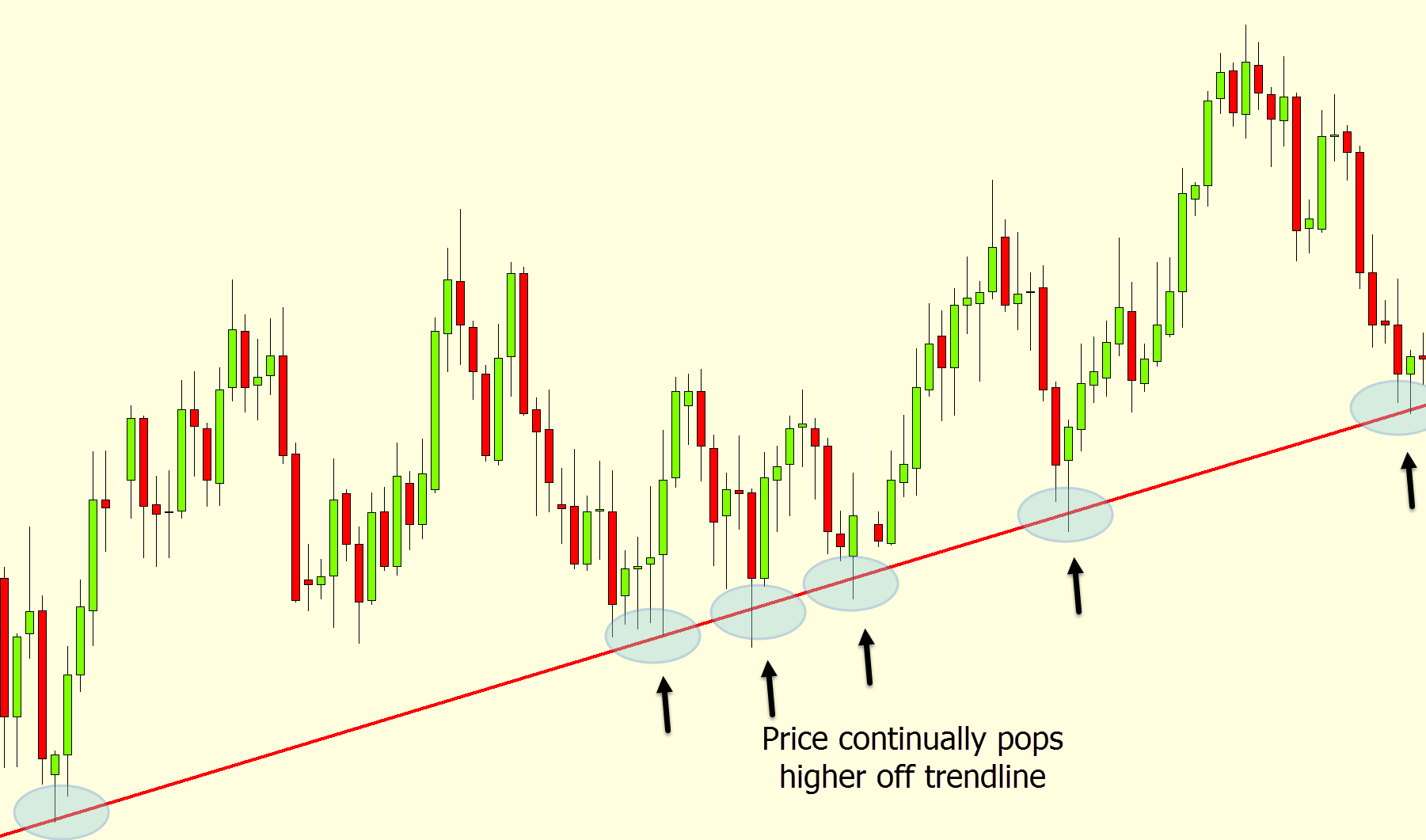

What does it mean when volume rises on a breakout chart?

On the initial breakoutfrom a rangeor other chart pattern, a rise in volume indicates strength in the move. Little change in volume or declining volume on a breakout indicates a lack of interest and a higher probability for a false breakout.

How to tell if a volume is bullish?

If the price on the move back lower doesn't fall below the previous low, and volume is diminished on the second decline, then this is usually interpreted as a bullish sign.

What happens to the market at the bottom of the market?

At a market bottom, falling prices eventually force out large numbers of traders, resulting in volatilityand increased volume. We will see a decrease in volume after the spike in these situations, but how volume continues to play out over the next days, weeks, and months can be analyzed using the other volume guidelines.

What does it mean when a stock price drops on volume?

Increasing price and decreasing volume might suggest a lack of interest, and this is a warning of a potential reversal. This can be hard to wrap your mind around, but the simple fact is that a price drop (or rise) on little volume is not a strong signal. A price drop (or rise) on large volume is a stronger signal that something in the stock has fundamentally changed .

What are some examples of charting tools that are based on volume?

On Balance Volume and Klinger Indicator are examples of charting tools that are based on volume.

Where are stock transactions recorded?

In a public stock exchange such as the New York, London or Frankfurt, transactions are recorded and publicly displayed. At any point during the day, you can access a list of all transactions, including the various prices at which a stock changed hands, how many shares were traded every time, and exactly when the stock changed hands.

What is the difference between illiquid and liquid stock market?

The greater the trading volume in a particular stock or market, the more liquid that stock or the market as a whole is considered . A liquid market offers plenty of buyers and sellers and makes it easy to trade. In an illiquid market, on the other hand, buyers and sellers are hard to come by. In this market, you might have to wait a while before you could sell the stocks you owned or buy new shares. Established stock markets such as the NYSE have far greater trading volume and are more liquid than their newer, smaller counterparts in developing economies.

What are the two most important figures in the stock market?

The two most fundamental figures in the stock market are price and volume. The financial press reports trading volume for individual stocks and for the market as a whole. Many keywords you will come across in the financial news media, such as liquidity and shallow or deep trading, will start to make sense once you understand how volume is ...

What does volume mean in stock trading?

A stock’s daily trading volume shows the number of shares that are traded per day. Traders have to calculate if the volume is high or low. The average daily trading volume represents an average number of stocks or other assets and securities traded in one single day. Also, it is an average number of stocks traded over a particular time frame.

How much volume do you need to trade stocks?

To decrease the risks, it is better to trade stocks with a minimum dollar volume in the range from $20 million to $25 million. Look at the institutional traders, they prefer a stock with daily dollar volume in the millions.

How to calculate ADTV?

It is usual to calculate ADTV (Average Daily Trading Volume) for 20 or 30 days but you can calculate it for any period if you like. For example, sum the average daily trading volumes for the last 30 days and divide it by 30. The number you will get is a 30-day average daily trading volume.

Why is it cheaper to buy a stock if the volume is low?

For example, if trading volume is low, the stock is cheaper because there are not too many traders or investors ready to buy it. Some traders and investors favor higher average daily trading volume because the higher volume provides them to easily enter the position. When the stock has a low average trading volume it is more difficult to enter ...

What is daily volume?

Daily volume is the total number of shares traded in one day. Trading activity is connected to a stock’s liquidity. When we say the average daily trading volume of a stock is high, that means the stock is easy to trade and has very high liquidity. Hence, the average daily trading volume has a great impact on the stock price.

How to calculate daily volume?

Daily volume is the total number of shares traded in one day .

What does it mean when volume goes over average?

If the volume goes a lot over average, that can unveil the maximum of the price progress. That usually means there will be no further rise in price. All interested in that stock already made as many trades as they wanted and there is no one more willing to push the stock price to go up further.

What is volume in stock?

Volume refers to the number of shares traded in a given time period. A stock's volume refers to the number of shares that are sold, or traded, over a certain period of time (usually daily).

What is volume in investing?

Broadly speaking, volume in investing means the total amount of a security that changes hands over a given period of time. This can refer to shares of an individual stock, the number of options contracts traded, or the total number of shares exchanged within an index or an entire stock market.

Why do technical analysts use volume?

In addition, technical analysts use a stock's volume in order to determine the best entry and exit points for a trade.

Why does volume increase when the stock price changes?

Certain events, such as the company's earnings report or a major news release, can cause volume to spike and can lead to a large move in either the positive or negative direction.

What is a high daily volume?

A high daily volume is common when stock-specific news items are released or when the market moves significantly, while a low daily volume can occur on light-news days and calm days for the stock market.

What does high volume mean in stocks?

High volume usually implies something interesting is going on in a stock. We may not know the why behind the move for some time. The example I show below is a stock that first alerted on a high volume scan, and then alerted again four hours later, on a ‘social media’ screener. The stock was already up over 6% by then.

What happens if you set min volume yesterday to 250%?

E.G. If you set the Min Volume Yesterday to 250%, you will only see symbols which traded on at least two and a half times their normal volume yesterday.

Who gets better price, day trader or market maker?

The market maker gets a better price than the high frequency trader, who in turn gets a better price than the day-trader. And this goes on, from day-trader to swing trader, to end-of-day investor, to the weekend investor. By using high intraday volume scans and alerts, gives the active trader an edge.

What happens if you set the min relative volume to 3?

E.G if you set the ‘Min Relative Volume’ to 3, you will only see stocks which are trading on at least 3 times greater than their normal volume.

Do stock screeners work all day?

The ‘end-of-day’ investor, who makes the effort to perform stock scans daily, would have got in before the weekend investor. Stock screeners take away the need to stare at a screen all day, so even long term investors can benefit from the alerts generated.

Can short term traders monitor intraday volume?

Short term traders often receive real time trading data also to this broker platform so there is possible to monitor intraday values. The only issue is if there is available also average trading volume in this platform.

Is average level of trading volume calculated value?

Average level of trading volume is calculated value and I noticed that it is not easily accessible even in trading platform of best online brokers. So please check it with your broker.

How to know when a stock is trading at above average volume?

A stock that is gapping up or down more than 4% with a catalyst will usually be trading with higher than average volume that day.

What is momentum stock?

The best momentum stocks have high relative volume. This means they are trading well above the typical number of shares they trade per day. Stocks will usually trade at above-average levels of volume when they are gapping up or down due to some type of catalyst, like earnings reports, FDA approval, or analyst upgrades or downgrades. Check out the daily of TWLO:

Down on Unusual Volume

Seeing today's up volume and down volume on a stock is like seeing people standing in line overnight to buy the latest and greatest gadget or must-have item. Unusual volume tells you something important is going on with a stock, and you should pay attention.

More About Unusual Volume

Seeing today's up volume and down volume on a stock is like seeing people standing in line overnight to buy the latest and greatest gadget or must-have item. Unusual volume tells you something important is going on with a stock, and you should pay attention.