Is Lululemon worth the high price tag?

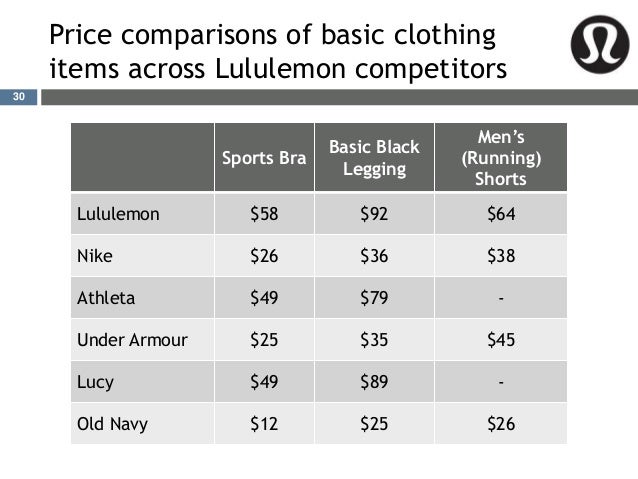

The round, reflective logo on Lululemon gear is like a beacon for all fitness lovers. It comes with a prestige that the Nike swoosh and Under Armour X-thingy simply don’t have—but it also comes with a higher price tag. That price is often what persuades most people to pass it up, or only purchase items sparingly.

Is Lululemon stock buy before earnings?

Make sure to utilize our Earnings ESP Filter to uncover the best stocks to buy or sell before they’ve reported. Lululemon stock appears a compelling earnings-beat candidate. However, LULU investors should pay attention to other factors too for betting on this stock or staying away from it ahead of its earnings release.

Is Lululemon publicly traded?

There are nearly 500 Lululemon stores throughout North America, Europe, Oceania, and Asia. The company is publicly traded on Nasdaq under its ticker symbol LULU and is included in the stock market index the NASDAQ-100 component. In 2019 the company had total revenues of $4 billion with an operating income of $889.1 million.

Is Lululemon a public company?

“Lululemon IS capitalism. It is literally a privately-owned corporation that raked in half a billion dollars in pure profits last year, merely by selling overpriced yoga pants to women willing and able to pay for this luxury. All this begs the question … WUT?” wrote Amy Swearer with the rightwing Heritage Foundation. Others followed.

Is Lululemon stock a good buy?

lululemon athletica inc. The company currently carries a Zacks Rank #3 (Hold), which is also a favorable signal. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here. So, if you are looking for a decent pick in a strong industry, consider Lululemon.

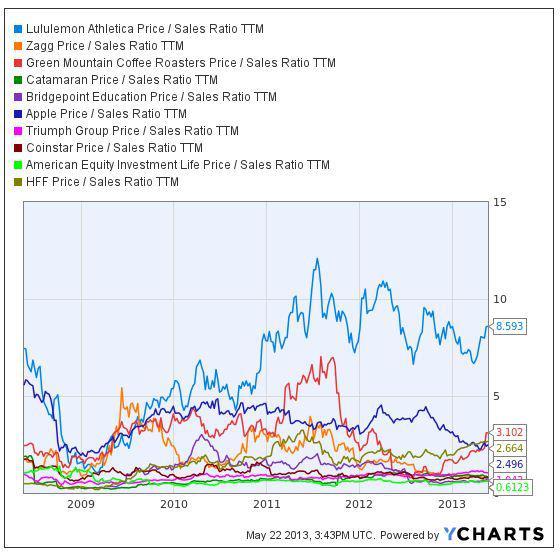

Is Lululemon stock overpriced?

lulu. Several outlets, including Forbes, noted the athleisure wear company to be overvalued in the first half of 2021. Yet, difficult to discourage, investors have continued to support the Company and further bumped up the stock's price.

Will Lululemon stock go up?

Stock Price Forecast The 26 analysts offering 12-month price forecasts for Lululemon Athletica Inc have a median target of 405.00, with a high estimate of 505.00 and a low estimate of 300.00. The median estimate represents a +49.81% increase from the last price of 270.34.

What price did Lululemon go public?

$18.00 per sharelululemon athletica inc.'s initial public offering of 18.2 million shares of common stock has been priced at $18.00 per share. The shares were trading on the Nasdaq Global Select Market under the symbol LULUV and on the Toronto Stock Exchange under the symbol LLL on Friday.

Why is Lulu stock dropping?

The sector has been sinking since Tuesday, when Walmart released disappointing earnings results. Over the last month, Lululemon's stock price has fallen 33%, underperforming the 20.3% decline in the SPDR S&P Retail ETF.

Does Lululemon pay dividend?

Dividend Overview. LULU does not currently pay a dividend.

How do I buy Lulu shares?

How to buy shares in Lululemon AthleticaCompare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. Complete an application with your details.Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

Who is Lululemon target market?

Lululemon's demographic profile is mainly fueled by women between the ages of 16–35. The current target market for Lululemon is men and women in the upper middle class between the ages of 18 and 35 with a fitness mindset. Approximately 41% of the world population is between the ages of 18 and 35.

Is wayfair stock a good buy?

IBISWorld estimated that Wayfair's online sales grew at a five year average rate of 36.8% through 2021, its growth rate peaked at 57.4% and in 2021 it eked out 8% growth. Its market share peaked in 2020 at 9.8% in 2020 and fell to 8.8% in 2021. Meanwhile industry growth is expected to slow down considerably.

Who owns lululemon now?

Lululemon AthleticaTypePublic companyKey peopleCalvin McDonald (CEO) Glenn Murphy (chairman) Meghan Frank (CFO) Sun Choe (CPO) Celeste Burgoyne (EVP, Americas)ProductsAthletic apparelBrandsLabRevenueUS$6.26 billion (2021)17 more rows

When did lululemon stock split?

Split HistoryDateRatioJul. 12, 20112:1Jun 17, 2022

Does lululemon own any other companies?

The Company-Operated Stores segment comprises lululemon and ivivva brands; and specialize in athletic wear for female youth.

Should I buy or sell Lululemon Athletica stock right now?

24 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Lululemon Athletica in the last twelve months. There ar...

What is Lululemon Athletica's stock price forecast for 2022?

24 equities research analysts have issued 1-year price targets for Lululemon Athletica's shares. Their forecasts range from $300.00 to $530.00. On...

How has Lululemon Athletica's stock performed in 2022?

Lululemon Athletica's stock was trading at $391.45 on January 1st, 2022. Since then, LULU shares have decreased by 25.5% and is now trading at $291...

When is Lululemon Athletica's next earnings date?

Lululemon Athletica is scheduled to release its next quarterly earnings announcement on Wednesday, September 14th 2022. View our earnings forecast...

How were Lululemon Athletica's earnings last quarter?

Lululemon Athletica Inc. (NASDAQ:LULU) released its earnings results on Thursday, June, 2nd. The apparel retailer reported $1.48 earnings per share...

How will Lululemon Athletica's stock buyback program work?

Lululemon Athletica announced that its board has authorized a share repurchase plan on Tuesday, March 29th 2022, which permits the company to repur...

What guidance has Lululemon Athletica issued on next quarter's earnings?

Lululemon Athletica issued an update on its second quarter 2022 earnings guidance on Thursday, June, 9th. The company provided earnings per share g...

Who are Lululemon Athletica's key executives?

Lululemon Athletica's management team includes the following people: Mr. Calvin R. McDonald , CEO & Director (Age 50, Pay $4.59M) ( LinkedIn Pro...

What is Calvin McDonald's approval rating as Lululemon Athletica's CEO?

532 employees have rated Lululemon Athletica CEO Calvin McDonald on Glassdoor.com . Calvin McDonald has an approval rating of 96% among Lululemon...

3 Beaten-Down Stocks in 2022 to Buy Now

A Look At The Fair Value Of Lululemon Athletica Inc. (NASDAQ:LULU)

It can be uncomfortable to watch your investments lose value when the market is volatile, especially if you're new at this. Management is planning to reach 55,000 stores by 2030, which could make Starbucks the largest restaurant chain in the world.

3 Stocks That Could Help You Retire a Millionaire

Does the February share price for Lululemon Athletica Inc. ( NASDAQ:LULU ) reflect what it's really worth? Today, we...

Gap Stock Gets a Downgrade. 2 Big Issues Worry the Analyst

By purchasing companies with strong franchises and sustainable momentum, you can build a robust investment portfolio to serve you well during retirement.

Lululemon (LULU) Dips More Than Broader Markets: What You Should Know

BofA Securities' Lorraine Hutchinson lowered her rating on the retailer to Underperform from Neutral, and nearly halved her price target.

Return to the office drives higher well-being: Lululemon report

In the latest trading session, Lululemon (LULU) closed at $313.64, marking a -0.97% move from the previous day.

Lululemon (LULU) Gains But Lags Market: What You Should Know

A return to the office may actually be good for your health, according to Lululemon’s second annual Global Wellbeing Report.

About Lululemon Athletica

In the latest trading session, Lululemon (LULU) closed at $334.40, marking a +0.66% move from the previous day.

Lululemon Athletica (NASDAQ:LULU) Frequently Asked Questions

lululemon athletica, Inc. engages in the designing, distributing and retail of athletic apparel and accessories. It operates through the following business segments: Company-Operated Stores, Direct to Consumer. The Company-Operated Stores segment comprises lululemon and ivivva brands; and specialize in athletic wear for female youth.

Where is Lululemon located?

23 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Lululemon Athletica in the last year. There are currently 5 hold ratings and 18 buy ratings for the stock.

What is Lululemon Athletica?

The co. mpany was founded in 1998 and is based in Vancouver, Canada. Key Executives.

What time do you trade in the pre market?

Lululemon Athletica Inc. designs, distributes, and markets athletic apparel and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment.

The stock for this popular athleisure brand looks like an attractive investment candidate today

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment.

Don't worry about the supply chain

Neil Patel is a long-term investor focused on finding the next compounding machine. His investing philosophy is simple: find high-quality companies, don't overpay, and do nothing. He covers consumer goods, financials, and cryptocurrencies for The Motley Fool.

The brand is powerful

Lululemon shares actually started their slide downward in mid-November, when the stock hit an all-time intraday high of $485.82. In early December, the company crushed Wall Street's estimates when it reported fiscal 2021 third-quarter (ending Oct. 31) financial results, but surprisingly, that didn't help the stock bounce back.

Attractive valuation

Lululemon's greatest competitive advantage lies in its brand recognition. According to Piper Sandler's fall " Taking Stock With Teens" survey, Lululemon is the fifth-most-popular clothing brand among this young demographic. Lululemon's gross margin of 57.2% exemplifies inherent pricing power, a key attribute of powerful consumer brands.