Shares of Coinbase Global (NASDAQ: COIN) have been hammered because of ongoing volatility in the cryptocurrency market. However, today Coinbase is also getting smacked because of a lowered price target from a Wall Street analyst.

Full Answer

Why did Coinbase shares fall Tuesday?

Shares of Coinbase Global Inc. were set to extend their slide Tuesday after an analyst at J.P. Morgan abandoned his bullish call in the wake of an “extreme decline” in cryptocurrency prices.

Why are Coinbase shares set to extend their slide?

Shares of Coinbase Global Inc. were set to extend their slide Tuesday after an analyst at J.P. Morgan abandoned his bullish call in the wake of an "extreme...

Could Coinbase stock double from current levels to $100?

But the reality is that Coinbase stock could double from current levels to $100 and still be down 76.6% from the high, 60% year to date and 33.3% from the first-quarter low. That puts in perspective just how much pain this stock has endured.

Is Coinbase’s volume declining?

He estimates that Coinbase’s volumes have declined more than 30% in the current quarter on the heels of a 40% drop in the March quarter. “Ameritrade data from 1999-2006 suggests a recovery in activity levels could take many years,” he added.

Why is Coinbase stock dropping?

Shares of Coinbase closed down 26% on Wednesday after the company reported shrinking revenue and declining users. Coinbase said Tuesday that revenue fell 27% year-over-year to $1.17 billion, which was below Wall Street's projected $1.48 billion. It also said it lost $430 million in the first quarter.

Is Coinbase losing market share?

The firm's market value has shrunk by about $51 billion since the end of its first day of trading last April. Coinbase shares fell to an all-time low earlier in May, and even after recovering somewhat are still down about 80% from their debut. That's a steeper drop than Bitcoin's 53% slump in the same period.

Is Coinbase stock expected to go up?

Stock Price Forecast The 21 analysts offering 12-month price forecasts for Coinbase Global Inc have a median target of 100.00, with a high estimate of 380.00 and a low estimate of 45.00. The median estimate represents a +85.08% increase from the last price of 54.03.

Is Coinbase stock a good buy?

Coinbase is a leveraged bet on the crypto industry And Coinbase has an 11.2% share of the crypto market, a figure that has steadily increased over time. As the crypto market increases in value throughout the next decade, Coinbase will continue attracting a good chunk of those assets.

Is Coinbase in financial trouble?

According to the earnings report, Coinbase's first-quarter revenue slumped to $1.17 billion, below Wall Street's expectations of $1.48 billion. The exchange's total trading volume shrank from $547 billion in the fourth quarter of 2021 to $309 billion. Coinbase said its first-quarter net loss was $430 million.

Can Coinbase go bust?

Coinbase CEO Brian Armstrong clarified that the company faces “no risk of bankruptcy.” The company has also said customer assets are safe and each account is segregated.

What will Coinbase stock be worth in 2022?

(NASDAQ: COIN) Coinbase's current Earnings Per Share (EPS) is $11.60. On average, analysts forecast that COIN's EPS will be -$7.60 for 2022, with the lowest EPS forecast at -$9.50, and the highest EPS forecast at -$5.68.

Is Coinbase stock a good long term investment?

Coinbase stock trades 50% lower than its first day of trading. The stock trades at 10x trailing earnings, but earnings are likely to be highly volatile moving forward. The company is projecting to increase its headcount by nearly 200% in 2022.

Is Coinbase a good investment 2022?

Coinbase's revenue in 2021 was $7.4 billion, with an adjusted EBITDA of $4.1 billion, according to the company. Despite the fact that these measures have increased by multiples of ten, the stock's price has stayed low. Expectations of much weaker growth in 2022 are a major factor in this decline.

What's the best crypto to buy right now?

7 best cryptocurrencies to buy now:Bitcoin (BTC)Ether (ETH)Solana (SOL)Avalanche (AVAX)Polygon (MATIC)Binance Coin (BNB)KuCoin Token (KCS)

Should I invest in crypto right now?

Cryptocurrency may be a good investment if you are willing to accept it is a high risk gamble which could pay off – but also that there is a strong chance you could lose all of your money. Prices of cryptocurrencies including bitcoin have been falling in 2022 amid a worldwide crypto price crash.

Is cryptocurrency a good investment 2022?

For more information, see How We Make Money. Ethereum is the most well-known altcoin, and it's much more than just another cryptocurrency for many investors and enthusiasts alike. And experts say it could grow in value by as much as 400% in 2022.

Is Coinbase Global a buy right now?

22 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Coinbase Global in the last year. There are currently 1 sell rating, 4 ho...

Are investors shorting Coinbase Global?

Coinbase Global saw a increase in short interest during the month of May. As of May 15th, there was short interest totaling 23,630,000 shares, an i...

When is Coinbase Global's next earnings date?

Coinbase Global is scheduled to release its next quarterly earnings announcement on Tuesday, August 9th 2022. View our earnings forecast for Coinb...

How were Coinbase Global's earnings last quarter?

Coinbase Global, Inc. (NASDAQ:COIN) posted its earnings results on Tuesday, May, 10th. The cryptocurrency exchange reported ($1.98) earnings per sh...

What price target have analysts set for COIN?

22 Wall Street analysts have issued twelve-month price targets for Coinbase Global's shares. Their forecasts range from $60.00 to $455.00. On avera...

Who are Coinbase Global's key executives?

Coinbase Global's management team includes the following people: Mr. Brian Armstrong , Co-Founder, Chairman & CEO (Age 39, Pay $2.99M) ( LinkedI...

Who are some of Coinbase Global's key competitors?

Some companies that are related to Coinbase Global include Synchrony Financial (SYF) , Lufax (LU) , SoFi Technologies (SOFI) , Hargreaves Lansd...

When did Coinbase Global IPO?

(COIN) raised $0 in an initial public offering on Wednesday, April 14th 2021. The company issued 114,900,000 shares at a price of $0.00 per share....

What is Coinbase Global's stock symbol?

Coinbase Global trades on the NASDAQ under the ticker symbol "COIN."

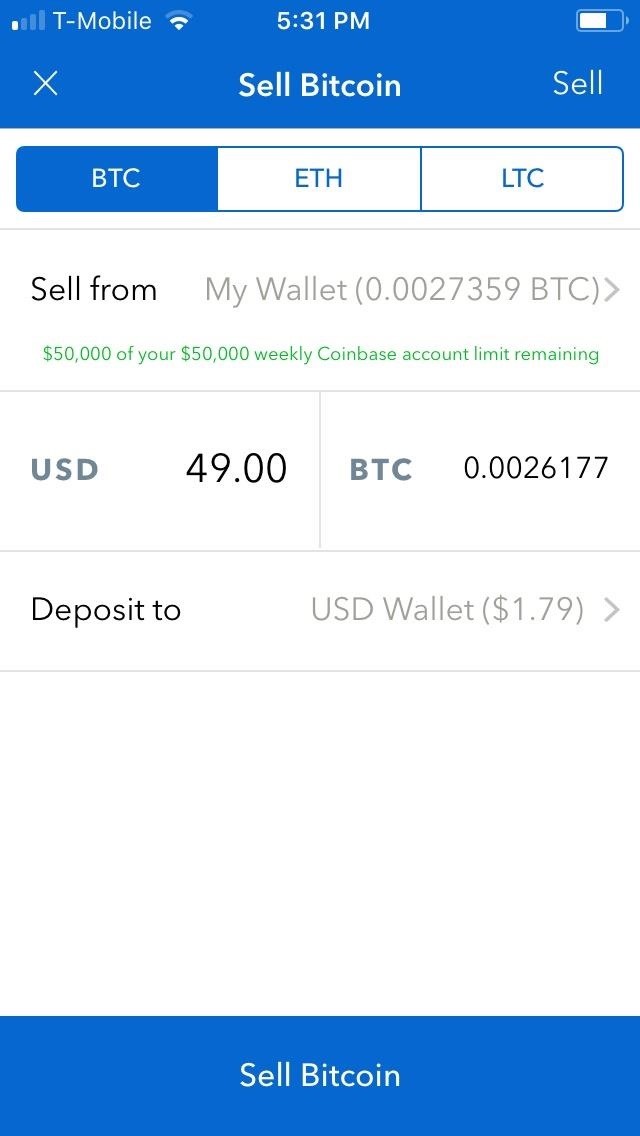

How does Coinbase work?

Coinbase’s platform enables retail and institutional customers to buy, sell, and store cryptocurrencies such as Bitcoin and Ethereum. The company primarily reaches customers via its Coinbase, Coinbase Pro, and Coinbase Wallet apps and its websites. Coinbase had a total of about 56 million retail users as of Q1 2021. Roughly 90% of the company’s revenues (as of 2020) came from the transaction fees from trading and via services such as storage and analytics. Coinbase charges its customers transaction fees (estimated at about 0.5%) based on the volumes that they trade, with larger trades seeing lower fees. The company’s commissions are higher than traditional exchanges, given the higher transaction costs for Bitcoin and other cryptos. About 10% of the company’s revenues come from sales of its own crypto assets to customers.

When will Coinbase go public?

Coinbase, the largest U.S. cryptocurrency exchange, is expected to go public on April 14, via a direct listing on the Nasdaq exchange with the ticker COIN. Although the proposed listing price isn’t known yet, investors expect that valuations could top $100 billion, given the strong interest in cryptocurrencies and the company’s stellar earnings for Q1 2021. In our interactive dashboard Coinbase Revenues: How Does COIN Make Money? we provide an overview of Coinbase’s business model and key revenue streams. Parts of the analysis are summarized below.

How is Bitcoin price affected?

Firstly, with Covid-19 vaccinations picking up in the U.S. and the economy opening up further, investors could be moving funds away from somewhat speculative cryptos to real economy assets.

How much does Coinbase charge for transactions?

Coinbase charges retail users a spread of about 0.50% for transactions, besides another fee of between 1.5% and 4% depending on how they fund their trades.

How much is Bitcoin trading volume in 2021?

The company had a stellar Q1 2021, with estimated Revenues growing to $1.8 billion, with trading volume for the quarter rising to $335 billion as the price of Bitcoin almost doubled year-to-date, causing the number of active monthly traders to surge from 2.8 million at the end of last year to 6.1 million in Q1.

Is Coinbase a sensitive company?

Coinbase’s revenues are quite sensitive to cryptocurrency pricing, as prices influence the number of monthly transacting users on the platform and the total value of transactions. If prices continue to trend lower, this could impact Coinbase’s revenue and profitability for this year.