Key Takeaways

- Stock markets are vital components of a free-market economy because they enable democratized access to trading and exchange of capital for investors of all kinds.

- They perform several functions in markets, including efficient price discovery and efficient dealing.

- In the US, the stock market is regulated by the SEC and local regulatory bodies.

Full Answer

What is the stock market and how does it work?

Jun 22, 2017 · The stock market lets buyers and sellers negotiate prices and make trades. The stock market works through a network of exchanges — you may have heard of the New York Stock Exchange or the Nasdaq....

What are some examples of stock market?

Apr 07, 2022 · A stock market refers to the process and facilitation of investors buying and selling stocks with one another. A stock exchange is the actual intermediary that connects buyers with sellers, such as...

What is the stock market telling us?

Dec 22, 2017 · A stock market is a place where people buy and sell stocks. Those happen on any one of many sites, both physical and virtual, that are known as exchanges. The two best known exchanges in the U.S....

What are the basics of the stock market?

Nov 03, 2021 · A stock index is a collection of stocks intended to be reflective of the stock market as a whole or, in some cases, a particular industry or segment of the market. In other words, a stock index can...

What is stock market and how it works?

The stock market lets buyers and sellers negotiate prices and make trades. The stock market works through a network of exchanges — you may have heard of the New York Stock Exchange or the Nasdaq. Companies list shares of their stock on an exchange through a process called an initial public offering, or IPO.

What is the stock market in simple terms?

Stock markets are venues where buyers and sellers meet to exchange equity shares of public corporations. Stock markets are vital components of a free-market economy because they enable democratized access to trading and exchange of capital for investors of all kinds.

What is a stock market example?

For example, if an investor buys shares of a company's stock at $10 a share and the price of the stock subsequently rises to $15 a share, the investor can then realize a 50% profit on their investment by selling their shares.

How do you make money from stocks?

Collecting dividends—Many stocks pay dividends, a distribution of the company's profits per share. Typically issued each quarter, they're an extra reward for shareholders, usually paid in cash but sometimes in additional shares of stock.

How do beginners buy stocks?

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker's website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

How can I learn stock market?

There are many options available through which you can learn stock market basics....Take a look at the many ways by which you can learn share market:Read books.Follow a mentor.Take online courses.Get expert advice.Analyse the market.Open a demat and trading account.

Why do people buy stocks?

People buy value stocks in the hope that the market has overreacted and that the stock's price will rebound. Blue-chip stocks are shares in large, well-known companies with a solid history of growth. They generally pay dividends.

What are the 4 types of stocks?

What Are The Different Types Of Stock?Common Stock. When investment professionals talk about stock, they almost always mean common stock. ... Preferred Stock. ... Class A Stock and Class B Stock. ... Large-Cap Stocks. ... Mid-Cap Stocks. ... Small-Cap Stocks. ... Growth Stocks. ... Value Stocks.More items...•Feb 10, 2022

Who controls the stock market?

How Is the Stock Market Highly Regulated? The securities industry is one of the most highly regulated industries in the United States. The U.S. Congress is at the top of the list of security industry regulators. It created most of the structure and passes legislation that affects how the industry operates.

Can stocks make you rich?

Can a Person Become Rich by Investing in the Stock Market? Yes, you can become rich by investing in the stock market. Investing in the stock market is one of the most reliable ways to grow your wealth over time.Mar 9, 2022

How much money do I need to invest to make $1000 a month?

To make $1000 a month in dividends you need to invest between $342,857 and $480,000, with an average portfolio of $400,000. The exact amount of money you will need to invest to create a $1000 per month dividend income depends on the dividend yield of the stocks.

Do you get paid for having stocks?

The stock pays dividends. Not all stocks pay dividends, but many do. Dividends are payments made to shareholders out of the company's revenue, and they're typically paid quarterly.

What is the stock market?

The stock market refers to public markets that exist for issuing, buying, and selling stocks that trade on a stock exchange or over-the-counter. Stocks.

Where are stocks traded?

How Stocks are Traded – Exchanges and OTC. Most stocks are traded on exchanges such as the New York Stock Exchange (NYSE) or the NASDAQ. Stock exchanges essentially provide the marketplace to facilitate the buying and selling of stocks among investors.

Where did stock trading start?

Although stock trading dates back as far as the mid-1500s in Antwerp, modern stock trading is generally recognized as starting with the trading of shares in the East India Company in London.

What is an OTC stock?

Although the vast majority of stocks are traded on exchanges, some stocks are traded over-the-counter (OTC), where buyers and sellers of stocks commonly trade through a dealer, or “market maker”, who specifically deals with the stock.

When was the New York Stock Exchange established?

The Beginnings of the New York Stock Exchange. Enter the New York Stock Exchange (NYSE), established in 1792. Though not the first on U.S. soil – that honor goes to the Philadelphia Stock Exchange (PSE) – the NYSE rapidly grew to become the dominant stock exchange in the United States, and eventually in the world.

What is secondary market?

Once a stock has been issued in the primary market, all trading in the stock thereafter occurs through the stock exchanges in what is known as the secondary market. The term “secondary market” is a bit misleading, since this is the market where the overwhelming majority of stock trading occurs day to day.

When did the NYSE merge with Euronext?

The NYSE eventually merged with Euronext, which was formed in 2000 through the merger of the Brussels, Amsterdam, and Paris exchanges.

What is the stock market?

The term "stock market" often refers to one of the major stock market indexes, such as the Dow Jones Industrial Average or the Standard & Poor's 500. When you purchase a public company's stock, you're purchasing a small piece of that company.

How does the stock market work?

The stock market lets buyers and sellers negotiate prices and make trades. The stock market works through a network of exchanges — you may have heard of the New York Stock Exchange or the Nasdaq. Companies list shares of their stock on an exchange through a process called an initial public offering, or IPO.

Who regulates the stock market?

The stock market is regulated by the U.S. Securities and Exchange Commission, and the SEC’s mission is to “protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.".

Is day trading risky?

Day trading, which requires rapidly buying and selling stocks based on price swings, is extremely risky. Conversely, investing in the stock market for the long-term has proven to be an excellent way to build wealth over time.

What does it mean when the stock market is down?

Most often, this means stock market indexes have moved up or down, meaning the stocks within the index have either gained or lost value as a whole. Investors who buy and sell stocks hope to turn a profit ...

What is the difference between bid and ask?

This difference is called the bid-ask spread. For a trade to occur, a buyer needs to increase his price or a seller needs to decrease hers.

Is NerdWallet an investment advisor?

NerdWallet, In c. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice.

What is the stock market?

A stock market refers to the process and facilitation of investors buying and selling stocks with one another.

How are stock prices governed?

Stock prices on exchanges are governed by supply and demand, plain and simple. At any given time, there's a maximum price someone is willing to pay for a certain stock and a minimum price someone else is willing to sell shares of the stock for. Think of stock market trading like an auction, with some investors bidding for the stocks ...

What is market maker?

Market makers ensure there are always buyers and sellers. To make sure there's always a marketplace for stocks on an exchange and investors can choose to buy and sell shares immediately whenever they want to during market hours, individuals known as market makers act as intermediaries between buyers and sellers.

What is a broker?

A broker may be an actual person whom you tell what to buy and sell, or, more commonly, this can be an online broker -- say, TD Ameritrade or Fidelity -- that processes the entire transaction electronically. When you buy a stock, here's the simplified version of how it works: You tell your broker (or input electronically) what stock you want ...

Can a company go public?

In other words, instead of being owned by an individual or a private group, some companies choose to "go public," meaning that anyone can become a part owner by purchasing shares of the company's stock.

What is the stock market?

A stock market is a place where people buy and sell stocks. Those happen on any one of many sites, both physical and virtual, that are known as exchanges. The two best known exchanges in the U.S. are the New York Stock Exchange (NYSE) and the Nasdaq, but there are also fourteen others that handle stocks. When people say things like, "the stock ...

What is an index in stocks?

In each case, the index comprises of a basket of stocks that are averaged to give a sense of the overall performance of the market. Obviously, if you hold stock in only one or two companies, the performance of an index tells you nothing about how your stocks did, but it does give a sense of the general mood among traders and investors. Indexes.

Where did Martin Tillier work?

Martin Tillier spent years working in the Foreign Exchange market, which required an in-depth understanding of both the world’s markets and psychology and techniques of traders. In 2002, Martin left the markets, moved to the U.S., and opened a successful wine store, but the lure of the financial world proved too strong, leading Martin to join a major firm as financial advisor.

What is an offer price?

Similarly, those that own stock that they are looking to sell place an order stating how many shares they are looking to sell and at what price, which is known as an “offer” or “ask” price. When buyers and sellers agree on a price, the exchange matches them and that is posted as the price of the stock.

What are the factors that influence the stock market?

The most important are the profitability of the company, and/or its prospects for profits in the future.

What is the market fluctuation?

Fluctuations in “the market” in a more general sense are simply the sum of all those individual stock decisions, but there are things that dictate the direction of the market in general. To understand them you must understand one thing: the market is a forward-discounting mechanism.

What factors affect the price of a stock?

Many of those things, such as economic strength and political stability affect all stocks, so changes in things like economic conditions, political stability, and geopolitical stability can cause widespread buying ...

What is a stockholder?

What is a Stock? When a person owns stock in a company, the individual is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever have to dissolve). A shareholder may also be referred to as a stockholder. The terms “stock”, “shares”, and “equity” are used interchangeably in modern ...

What are the risks of owning a stock?

Risks of Owning Stock. Along with the benefits of stock ownership, there are also risks that investors have to consider, including: #1 Loss of capital. There is no guarantee that a stock’s price will move up.

When will a company liquidate?

In most cases, a company will only liquidate when it has very little assets left to operate. In most cases, that means that there will be no assets left for equity holders once creditors are paid off. #3 Irrelevant power to vote.

What is a shareholder in finance?

A shareholder may also be referred to as a stockholder. The terms “stock”, “shares”, and “equity” are used interchangeably in modern financial language. The stock market. Stock Market The stock market refers to public markets that exist for issuing, buying and selling stocks that trade on a stock exchange or over-the-counter.

What are the factors that affect the price of a stock?

There are many factors that affect share prices. These may include the global economy, sector performance, government policies, natural disasters, and other factors. Investor sentiment – how investors feel about the company’s future prospects – often plays a large part in dictating the price.

What is a finance career?

Most finance career paths will be directly involved with stocks in one way or another, either as an advisor. Banking (Sell-Side) Careers The banks, also known as Dealers or collectively as the Sell-Side, offer a wide range of roles like investment banking, equity research, sales & trading. , an issuer,

What is stock investment?

A stock is an investment. When you purchase a company's stock, you're purchasing a small piece of that company, called a share. Investors purchase stocks in companies they think will go up in value. If that happens, the company's stock increases in value as well. The stock can then be sold for a profit.

Why are stocks called shareholders?

For investors, stocks are a way to grow their money and outpace inflation over time. When you own stock in a company, you are called a shareholder because you share in the company's profits.

Do common stocks pay dividends?

Most investors own common stock in a public company. Common stock may pay dividends, but dividends are not guaranteed and the amount of the dividend is not fixed. Preferred stocks typically pay fixed dividends, so owners can count on a set amount of income from the stock each year.

What happens when a stock goes up?

If the price of a stock goes up during the time they own it, and they sell it for more than they paid for it. Through dividends. Dividends are regular payments to shareholders. Not all stocks pay dividends, but those that do typically do so on a quarterly basis.

Is NerdWallet an investment advisor?

NerdWallet, In c. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice.

Who is Arielle O'Shea?

He has covered financial issues for 20 years, including for The Wall Street Journal and CNN.com. Read more. Arielle O'Shea is a NerdWallet authority on retirement and investing, with appearances on the "Today" Show, "NBC Nightly News" and other national media. Read more.

Purposes of The Stock Market – Capital and Investment Income

- The stock market serves two very important purposes. The first is to provide capitalNet Working CapitalNet Working Capital (NWC) is the difference between a company's current assets (net of cash) and current liabilities (net of debt) on its balance sheet.to companies that they can use to fund and expand their businesses. If a company issues one mil...

History of Stock Trading

- Although stock trading dates back as far as the mid-1500s in Antwerp, modern stock trading is generally recognized as starting with the trading of shares in the East India Companyin London.

The Early Days of Investment Trading

- Throughout the 1600s, British, French, and Dutch governments provided charters to a number of companies that included East India in the name. All goods brought back from the East were transported by sea, involving risky trips often threatened by severe storms and pirates. To mitigate these risks, ship owners regularly sought out investors to proffer financing collateral fo…

The East India Company

- The formation of the East India Company in London eventually led to a new investment model, with importing companies offering stocks that essentially represented a fractional ownership interest in the company, and that therefore offered investors investment returns on proceeds from all the voyages a company funded, instead of just on a single trip. The new business model mad…

The First Shares and The First Exchange

- Company shares were issued on paper, enabling investors to trade shares back and forth with other investors, but regulated exchanges did not exist until the formation of the London Stock Exchange (LSE) in 1773. Although a significant amount of financial turmoil followed the immediate establishment of the LSE, exchange trading overall managed to survive and grow thr…

The Beginnings of The New York Stock Exchange

- Enter the New York Stock Exchange (NYSE), established in 1792. Though not the first on U.S. soil – that honor goes to the Philadelphia Stock Exchange (PSE) – the NYSE rapidly grew to become the dominant stock exchange in the United States, and eventually in the world. The NYSE occupied a physically strategic position, located among some of the country’s largest banks an…

Modern Stock Trading – The Changing Face of Global Exchanges

- Domestically, the NYSE saw meager competition for more than two centuries, and its growth was primarily fueled by an ever-growing American economy. The LSE continued to dominate the European market for stock trading, but the NYSE became home to a continually expanding number of large companies. Other major countries, such as France and Germany, eventually dev…

How Stocks Are Traded – Exchanges and Otc

- Most stocks are traded on exchanges such as the New York Stock Exchange (NYSE) or the NASDAQ. Stock exchanges essentially provide the marketplace to facilitate the buying and selling of stocks among investors. Stock exchanges are regulated by government agencies, such as the Securities and Exchange Commission (SEC) in the United States, that oversee the market in orde…

Stock Market Players – Investment Banks, Stockbrokers, and Investors

- There are a number of regular participants in stock market trading. Investment banks handle the initial public offering (IPO)Initial Public Offering (IPO)An Initial Public Offering (IPO) is the first sale of stocks issued by a company to the public. Prior to an IPO, a company is considered a private company, usually with a small number of investors (founders, friends, family, and business inves…

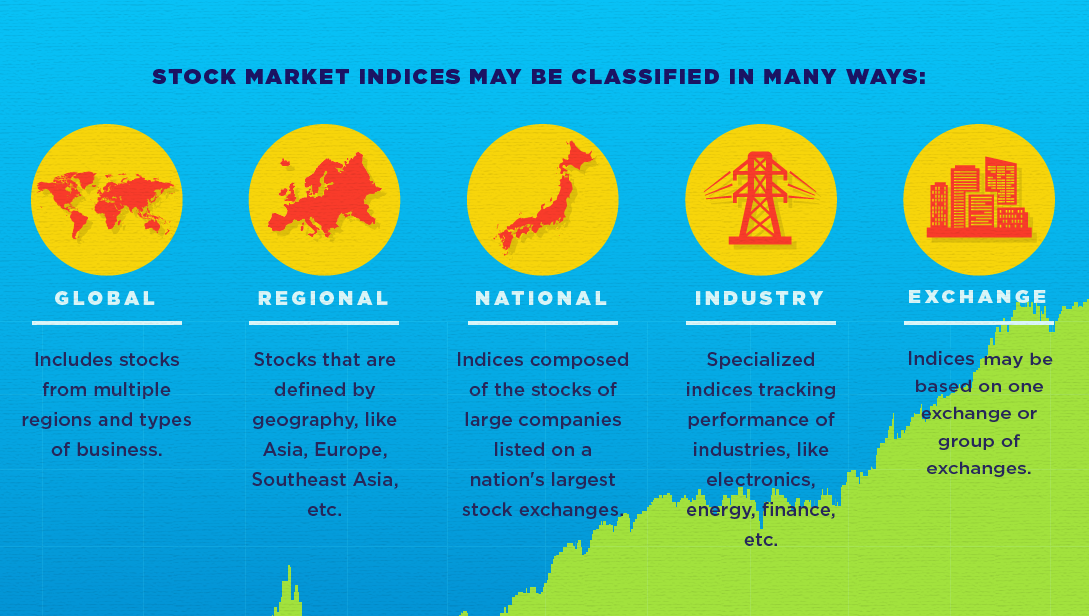

Stock Market Indexes

- The overall performance of the stock market is usually tracked and reflected in the performance of various stock market indexes. Stock indexes are composed of a selection of stocks that is designed to reflect how stocks are performing overall. Stock market indexes themselves are traded in the form of options and futures contracts, which are also traded on regulated exchang…