Did an investor sell 116 million shares of Deutsche Bank stock?

Media reports claim that an unnamed investor has sold 116 million shares of DB stock, a massive trade that has sent Deutsche Bank’s share price sharply lower. Prior to today’s decline, the German lender’s stock had been down 6% year to date at right around $12 per share.

What is the downside in Deutsche Bank's stock price?

On average, they expect Deutsche Bank's stock price to reach $6.89 in the next year. This suggests that the stock has a possible downside of 13.8%. View Analyst Price Targets for Deutsche Bank.

Did an unknown investor sell 116 million shares of DB stock?

Deutsche Bank (NYSE: DB) stock is down 1% today on news that an unknown investor has sold a massive stake in the European bank. Media reports claim that an unnamed investor has sold 116 million shares of DB stock, a massive trade that has sent Deutsche Bank’s share price sharply lower.

What is Deutsche Bank's price targets for the next year?

Their forecasts range from $5.00 to $8.00. On average, they expect Deutsche Bank's stock price to reach $6.89 in the next year. This suggests that the stock has a possible downside of 13.8%. View Analyst Price Targets for Deutsche Bank.

See more

Is Deutsche Bank stock a good buy?

The 16 analysts offering 12-month price forecasts for Deutsche Bank AG have a median target of 13.43, with a high estimate of 20.15 and a low estimate of 8.83. The median estimate represents a +53.71% increase from the last price of 8.74.

Is Deutsche Bank a buy or sell?

Deutsche Bank Aktiengesellschaft has received a consensus rating of Hold. The company's average rating score is 2.29, and is based on 5 buy ratings, 8 hold ratings, and 1 sell rating.

Who is the owner of Deutsche Bank?

Christian SewingAlma materFrankfurt School of Finance & ManagementOccupationBanker, business executiveEmployerDeutsche BankTitleCEO of Deutsche Bank5 more rows

What countries does Deutsche Bank operate in?

EuropeAustria.Belgium.Bulgaria.Croatia.Czech Republic.France.Germany.Greece.More items...

How safe is Deutsche Bank?

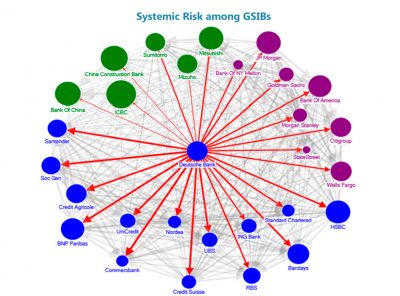

Last week, the IMF said that, of the banks big enough to bring the financial system crashing down, Deutsche Bank was the riskiest. Not only that, Deutsche Bank's US unit was one of only two of 33 big banks to fail tests of financial strength set by the US central bank earlier this year.

Is Deutsche Bank in the US?

Deutsche Bank launched its US intermediate holding company, DB USA Corporation, on July 1, 2016, under which most of its US-based operations were consolidated as required by the Dodd-Frank Act.

Is Deutsche Bank a bulge bracket?

As a catchall term for this class of large global investment bank, "bulge bracket" commonly refers to Bank of America Merrill Lynch, Goldman Sachs, Barclays Capital, Credit Suisse, Deutsche Bank, JPMorgan Chase, Citigroup, Morgan Stanley, and UBS.

What is the biggest bank in the world?

the Industrial and Commercial Bank Of China LtdThe largest bank in the world in terms of total assets under management (AUM) is the Industrial and Commercial Bank Of China Ltd.

What is the largest German bank?

Deutsche BankFounded in 1870, Deutsche Bank is the largest of the banks in Germany and one of the top banking and financial services companies in the world, with an extensive presence in Europe, the Americas, the Asia-Pacific region, and many emerging markets. The bank's core business is investment banking.

What is good about Deutsche Bank?

Deutsche Bank is the leading German bank with strong European roots and a global network. The bank focuses on its strengths in a Corporate Bank newly created in 2019, a leading Private Bank, a focused investment bank and in asset management.

Should I buy or sell Deutsche Bank Aktiengesellschaft stock right now?

14 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Deutsche Bank Aktiengesellschaft in the last year. Ther...

What is Deutsche Bank Aktiengesellschaft's stock price forecast for 2022?

14 Wall Street analysts have issued 12-month target prices for Deutsche Bank Aktiengesellschaft's stock. Their forecasts range from $12.20 to $16.3...

How has Deutsche Bank Aktiengesellschaft's stock price performed in 2022?

Deutsche Bank Aktiengesellschaft's stock was trading at $12.50 at the beginning of 2022. Since then, DB shares have decreased by 20.2% and is now t...

When is Deutsche Bank Aktiengesellschaft's next earnings date?

Deutsche Bank Aktiengesellschaft is scheduled to release its next quarterly earnings announcement on Wednesday, July 27th 2022. View our earnings...

How were Deutsche Bank Aktiengesellschaft's earnings last quarter?

Deutsche Bank Aktiengesellschaft (NYSE:DB) announced its earnings results on Wednesday, April, 27th. The bank reported $0.62 earnings per share for...

How often does Deutsche Bank Aktiengesellschaft pay dividends? What is the dividend yield for Deutsche Bank Aktiengesellschaft?

Deutsche Bank Aktiengesellschaft declared a -- dividend on Wednesday, May 18th. Stockholders of record on Monday, May 23rd will be given a dividend...

Who are Deutsche Bank Aktiengesellschaft's key executives?

Deutsche Bank Aktiengesellschaft's management team includes the following people: Mr. Christian Sewing , CEO & Chairman of Management Board (Age...

What is Christian Sewing's approval rating as Deutsche Bank Aktiengesellschaft's CEO?

847 employees have rated Deutsche Bank Aktiengesellschaft CEO Christian Sewing on Glassdoor.com . Christian Sewing has an approval rating of 88% a...

Who are some of Deutsche Bank Aktiengesellschaft's key competitors?

Some companies that are related to Deutsche Bank Aktiengesellschaft include Albina Community Bancorp (ACBCQ) , Berkshire Bancorp (BERK) , Beverl...

How much did Deutsche Bank lose in 2019?

How much did DB stock drop in 2009?

Deutsche Bank revenues fell 30% from $37.2 billion in 2015 to $25.9 billion in 2019. However, the company’s net loss improved from -$7.8 billion to -$6.4 billion over the same period. The revenues suffered as the bank exited businesses like equities sales & trading and scaled back its operations in the investment banking segment. Overall, its commissions & fee income declined by 25% over 2015-2019 coupled with a 95% drop in Net gains (losses) on financial assets/liabilities at fair value. The company’s Q3 2020 revenues were 13% above the year-ago period, and its EPS figure increased from -$0.46 to $0.16.

The long-troubled German lender got a powerful endorsement from a large U.S. money management firm

DB stock declined from levels of around $102 in October 2007 (the pre-crisis peak) to roughly $20 in March 2009 (as the markets bottomed out), implying that the stock lost around 81% of its value from its approximate pre-crisis peak. This marked a sharper drop than the broader S&P, which fell by about 51%.

What happened

Lou has followed the markets for more than two decades, developing extensive contacts including industry leaders, consultants, regulators, and labor representatives. He spends a lot of time these days focused on the industrials and financials.

So what

Shares of Deutsche Bank AG ( NYSE:DB) traded up more than 13% on Thursday after U.S. money management firm Capital Group disclosed a 3.1% stake in the large German lender.

Now what

Capital Group, a Los Angeles-based money manager with more than $2 trillion dollars under management, unveiled a stake that would make it Deutsche Bank's third largest shareholder behind the Qatari royal family and BlackRock.