What causes stocks to rise?

What causes stock prices to rise & fall?

- Profit forecast & quarterly results may have a strong impact on the share price

- Socio-economic developments may contribute to price increases & decreases

- Inflation & interest can boost the stock price

- Dividend can affect the stock price in both the short and long term

- Takeover rumours may cause the stock price to suddenly rise sharply

What causes stock prices to change?

The key points to remember about this subject are the following:

- Stock prices, at the most fundamental level, is determined by supply and demand.

- The value of a company is not determined by just comparing the share price of two companies. ...

- It is not only by the way of earnings that a company’s stock prices are affected, but also through investor sentiments, attitudes and expectations.

What makes a stock go up?

| Is It Only Supply & Demand or Are There Other Factors?

- Supply and Demand. While there are many factors that affect the prices of stocks, ultimately, it boils down to supply and demand.

- Fundamental Factors. While investor demand is what drives stock prices up, most buyers must see value in a company to be willing to invest in them.

- Technical Factors. ...

- Market Sentiment. ...

- The Bottom Line. ...

How do stocks increase?

What Causes Stocks to Increase or Decrease?

- Fundamental Factors. Most experts believe that the expected future earnings of the company, often expressed as a ratio of stock price to earnings (“PE” ratio), is a fundamental driver of ...

- Economic Factors. ...

- Greed. ...

- Fear. ...

Why are stock prices rising?

Stock prices are constantly rising and falling: this is due to the constant game of supply and demand. When more investors want a share, the price rises. At the same time, you see that the price of a share falls when many people sell it.

What are the effects of the stock market?

If, for example, there is an uncertain political climate in a certain part of the world or a threat of war, the shares of companies in this region will fall . Natural disasters are also a cause of sudden changes in the price of stocks.

How does dividend affect stock price?

Dividend can affect the stock price in both the short and long term. Takeover rumours may cause the stock price to suddenly rise sharply. The stock market trend influences the general movement of share prices. A stock split immediately causes a sharp fall in the stock price. Shorters can cause the share price to rise rapidly.

What happens when a company changes its dividend policy?

A changed dividend policy can also cause the price of a stock to rise or fall sharply. When a company starts to pay out more dividend, you see that the stock price often rises. On the contrary, a decrease in the dividend can put pressure on the stock price.

What happens if a company pays out too much dividend?

When a company pays out too much dividend, this can put pressure on profitability and the share price in the future. It is also important to remember that the stock price drops temporarily after dividends have been paid out. If the company pays out $1 per stock, the share price will fall by $1.

What happens if a company has a positive profit expectation?

If there is a very positive profit expectation, then this gives a company share a good future perspective. As a result, more investors will want to buy a share. A negative profit forecast, on the other hand, obviously has the opposite effect.

How does globalization affect stock prices?

The exchange rates of currencies can also influence stock prices. As a result of globalization, companies are increasingly selling their products to other regions. When a European company sells products in America, they receive dollars for their products. If a European company sells products in America, they receive dollars for their products. When the value of the euro rises sharply, the competitive position of European companies is weakened because the products are relatively expensive for other countries. Fluctuations in exchange rates therefore affect the results of companies operating internationally.

Learn why the stock market and individual stocks tend to fluctuate and how you can use that information to become a better investor

Tim writes about technology and consumer goods stocks for The Motley Fool. He's a value investor at heart, doing his best to avoid hyped-up nonsense. Follow him on Twitter: Follow @TMFBargainBin

What affects stock price?

High demand for a stock drives the stock price higher, but what causes that high demand in the first place? It's all about how investors feel:

The big picture is what matters

Long-term investors, like those of us at The Motley Fool, don't much care about the short-term developments that push stock prices up and down each trading day. When you have years or even decades to let your money grow, analyst reports and earnings beats are often fleeting and irrelevant.

How do fundamental factors affect stock prices?

Company earnings can heavily influence a stock’s rise or fall, but earnings alone won’t tell you everything you need to know. Knowing the fundamentals will give you a better understanding of the value of a company.

How do technical factors affect stock prices?

It would be ideal if investors could evaluate a stock’s current – and future – value on fundamentals alone. But the fact is, there are many external criteria that could impact the supply and demand for a certain stock. These are known as technical factors.

What's the impact of news on the share price of a company?

There’s no doubt that good news or bad news can influence share prices. If there’s a new government economic report suggesting that Canada’s economy is growing at a good clip, it will likely boost demand for stocks, and increase prices.

What is market sentiment, and how does it impact share price?

Market sentiment, or investor sentiment, is a loose measurement of investor optimism in the economy, or confidence in the Canadian and U.S. stock markets. Are they feeling positive and hopeful? Or cautious and nervous?

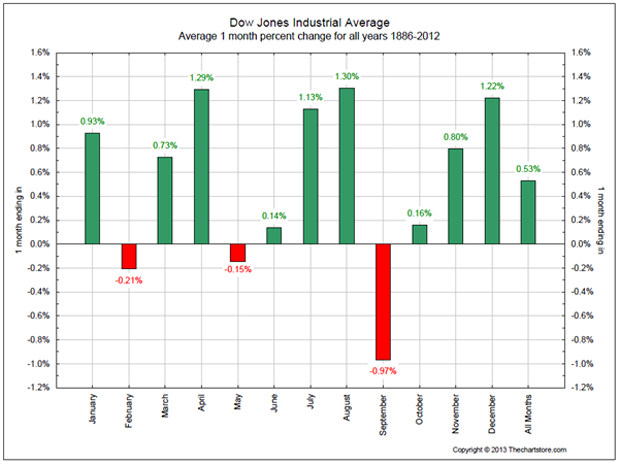

How do seasons and holidays affect the stock market?

The stock market tends to repeat certain seasonal trends year after year. The fabled “Santa Claus Rally” in December is just one example. During these time periods, share prices can be especially volatile.

Falling and rising stock prices in a nutshell

The bottom line is this: all investment vehicles, whether individual stocks, bonds, mutual funds and so on, fall or rise as a result of many different factors. Sharp investors will want to pay especially close attention to the short-term and long-term market movements.

More Frequently-Asked Questions

Stock market cycles are driven by large institutional investors, but fueled by economic factors such as economic growth rates, inflation or deflation, lower or higher interest rates set by the Bank of Canada or the U.S. Federal Reserve, and unemployment rates. This, in turn, can impact market/investor sentiment, both negatively or positively.

How do major industries affect the stock market?

Major industry sectors can impact the stock market not only because they can improve the economy of the nation, but also because they create new investment opportunities. By contrast, when major industries are in trouble, the economy can weaken, and enthusiasm for stocks in general can dry up, causing stock prices to fall.

Why is it important to be aware of major factors that impact the stock market?

It's important to be aware of major factors that impact the stock market and to pay attention to changes in those areas to get a handle on where the market may be heading.

What is the importance of corporate profits in investing?

If corporate profits are generally on the rise, this supports higher stock prices . If profits are in a general decline, the market is more likely to retreat.

What happens to the economy when the economy declines?

They will also spend more money, which will flow into publicly traded companies and improve their earnings. A declining economy, and especially a recession, results in a reversal of all of those positive dynamics. The net effect on the market is typically negative.

How many publicly traded companies are there in 2019?

However, the number of publicly traded companies has fallen to 3,473 as of Dec. 31, 2019. Fewer publicly traded companies means more competition for available stocks. That raises the price of the surviving stocks, causing the market to rise.

Why is international capital flow good?

Economic or geopolitical troubles in major foreign economies can be a positive driver in the US stock market. This is because as conditions in foreign countries deteriorate, capital leaves those countries.

Does war have a negative impact on the stock market?

Since the stock market hates uncertainty, war can have a very negative impact on the market. At the opposite end of the spectrum, if any of these events are resolved in a positive way, the stock market typically resumes an uptrend.

How do mergers and acquisitions affect stock prices?

Those mergers and acquisitions affect companies’ stock prices too because they permit companies to move into new markets or to maintain dominance in their current market . Market share translates to dollars, which in turn affects stock price and therefore a company’s bottom line.

What happens to a company's stock if it's a positive reaction?

If it’s a positive reaction, the companys stock price will rise. If it’s bad, the stock price goes down. Without question the most important factor that affects a company’s value, and therefore its stock price, is its earnings.

What happens when a company releases news?

When a company releases news about a new product line or management change, be it good or bad, Wall Street and investors are sure to react. If it’s a positive reaction, the companys stock price will rise.

Is it a good time to buy or sell stocks?

If you are a beginning investor, you might wonder when it is a good time to buy or sell stocks. When attempting to understand why stock prices rise and fall it helps to understand the law of supply and demand. The only thing that is certain is that stocks are volatile and can rapidly change in price. If an item or service is in short supply, people ...

The Economist Answer

The most foundational aspect of the stock market (like any market) is supply and demand.

What You Need to Know About Stock Prices

There is one very important thing to understanding about buying stocks…

Why are stocks going down?

Political issues, economic concerns, earnings disappointments and countless other reasons can send stocks lower or higher. But over the long term, stock prices will be driven by just a handful of fundamental factors such as earnings growth and changes in valuation.

Why are stocks volatile?

Stocks were volatile around the 2016 and 2020 U.S. presidential elections as investors waited to see which administration would be in charge for the next four years. But often, the reaction of markets isn’t obvious and traders can quickly shift their attention to a new topic of concern or excitement.

What is the effect of higher discount rates on valuation?

Higher discount rates lower the valuation investors are willing to pay. An investor who demands a 12 percent return is willing to pay less for the same asset as an investor who requires only an 8 percent return. The change in valuation can have a big impact on investors’ returns over time.

Why do companies share their earnings with shareholders?

Mature companies tend to share more of their earnings with shareholders in the form of dividends or share repurchases because they aren’t able to deploy it themselves at attractive rates of return.

What is technical analysis in stock trading?

This analysis uses recent price movements and chart patterns in an effort to predict a stock’s future direction. Technical analysis can influence a stock’s price over the short term, but ultimately its value will come from the long-term earnings power of the business.

What is the key contributor to a company's return?

A key contributor to your return is the company’s growth in profits. This will be driven by the growth rate of the overall economy as well as the circumstances of the specific business.

Is a growing economy good for stocks?

A growing economy can lead to higher inflation and ultimately higher interest rates, both of which are healthy for stocks in moderation. But overly strong growth can lead to too much inflation and too-high rates, spooking investors who are worried about how rates may affect financial assets.

What happens when investors perceive a stock?

When investor perception of a stock diminishes, so does the demand for the stock, and, in turn, the price. So faith and expectations can translate into cold hard cash, but only because of something very real: the capacity of a company to create something, whether it is a product people can use or a service people need.

What happens if you buy a stock for $10 and sell it for $5?

If you purchase a stock for $10 and sell it for only $5, you will lose $5 per share. It may feel like that money must go to someone else, but that isn't exactly true. It doesn't go to the person who buys the stock from you.

How is value created or dissolved?

On the one hand, value can be created or dissolved with the change in a stock's implicit value, which is determined by the personal perceptions and research of investors and analysts.

What happens when a stock tumbles?

When a stock tumbles and an investor loses money, the money doesn't get redistributed to someone else. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock. That's because stock prices are determined by supply and demand and investor perception of value and viability.

What is implicit value in stocks?

Depending on investors' perceptions and expectations for the stock, implicit value is based on revenues and earnings forecasts. If the implicit value undergoes a change—which, really, is generated by abstract things like faith and emotion—the stock price follows.

How is implicit value determined?

A stock's implicit value is determined by the perceptions of analysts and investors, while the explicit value is determined by its actual worth, the company's assets minus its liabilities.

What is short selling?

Short Selling. There are investors who place trades with a broker to sell a stock at a perceived high price with the expectation that it'll decline. These are called short-selling trades. If the stock price falls, the short seller profits by buying the stock at the lower price–closing out the trade.

Interest Rates

Corporate Profits

The State of The Economy

International Events

International Capital Flows

Public Sentiment

- Ultimately, investing in the stock marketis all about cashing in on the profits of the companies issuing the stocks. If corporate profits are generally on the rise, this supports higher stock prices. If profits are in a general decline, the market is more likely to retreat.

Supply and Demand

- This factor may not be worth mentioning as a specific market driver because it is mostly a big-picture summary of all the other factors that drive the market. But more generally, when the state of the economy is good — as indicated by a healthy growth rate in the gross domestic product (GDP) — businesses feel more confident in expanding, and investors are more likely to invest. A…

Growth/Decline in Major Industry Sectors

- This goes beyond economic conditions in foreign countries. It's more about severe events such as a radical change in government in a friendly or formally stable country. It can also be the result of a contrived event such as the oil embargo or the recent coronavirus pandemic. Perhaps the most serious impact happens in the case of war. This will be especially true early in the conflict when …