The stock portfolio refers to the compilation of individual stocks that you own. Complete investment portfolios include assets from various classes, such as stocks, bonds and cash reserves. You may also integrate alternative investments within your portfolio, which include real estate and hedge funds.

Full Answer

How do I create an investment portfolio?

A stock portfolio is a collection of stocks that you invest in with the hope of making a profit. By putting together a diverse portfolio that spans various sectors you’re able to become a more resilient investor. That’s because if one sector takes a hit, the investments you hold in other sectors aren’t necessarily affected.

How to create a free stock portfolio?

· What Is a Stock Portfolio? Stock Trading January 24, 2022 6 min A portfolio is a collection of a person’s investments across asset classes, such as stocks, bonds, cash, and real estate. Assets may be owned or subject to a vesting schedule.

How do you calculate portfolio return?

The stock portfolio refers to the compilation of individual stocks that you own. Complete investment portfolios include assets from various classes, such as stocks, bonds and cash reserves. You may also integrate alternative investments within your portfolio, which include real estate and hedge funds.

What is a portfolio of investments?

· All investors should strive to create a portfolio that matches their risk tolerance. But here’s one huge caveat: we would highly discourage you from investing the bulk of your money in a pure “stock portfolio” altogether, since the term refers to a collection of individual equities — and humans, especially untrained ones, tend be not-very-good individual stock pickers.

What does portfolio mean in stocks?

Portfolio definition A portfolio is a person's or an institution's entire collection of investments or financial assets, including stocks, bonds, real estate, mutual funds and other securities. A "portfolio" refers to all of your investments — which may not necessarily be housed in one single account.

What is a good portfolio of stocks?

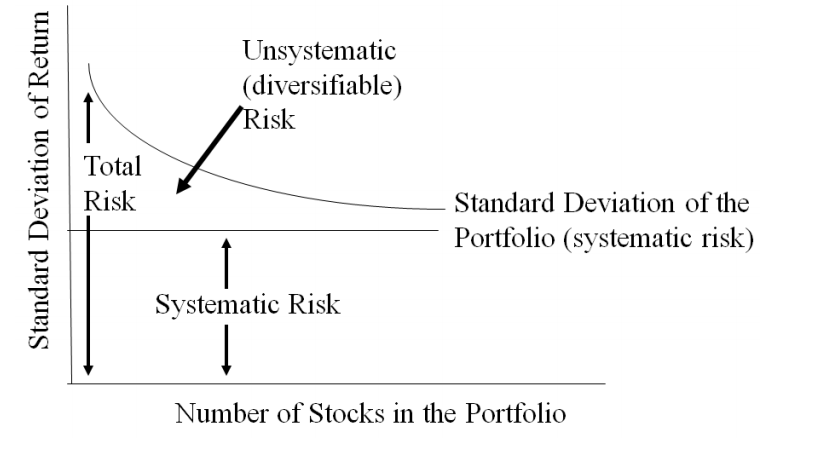

Some experts say that somewhere between 20 and 30 stocks is the sweet spot for manageability and diversification for most portfolios of individual stocks. But if you look beyond that, other research has pegged the magic number at 60 stocks.

Is having a stock portfolio good?

The more equities you hold in your portfolio, the lower your unsystematic risk exposure. A portfolio of 10 or more stocks, particularly those across various sectors or industries, is much less risky than a portfolio of only two stocks.

What does it mean to buy a portfolio?

Key Takeaways. A portfolio investment is an asset that is purchased in the expectation that it will earn a return or grow in value, or both. A portfolio investment is passive, unlike a direct investment, which implies hands-on management.

How do beginners invest in stocks?

One of the best ways for beginners to get started investing in the stock market is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

How do I build a stock portfolio?

How to build an investment portfolioDecide how much help you want.Choose an account that works toward your goals.Choose your investments based on your risk tolerance.Determine the best asset allocation for you.Rebalance your investment portfolio as needed.

Is it worth buying 1 share?

Is it worth buying one share of stock? Absolutely. In fact, with the emergence of commission-free stock trading, it's quite feasible to buy a single share. Several times in recent months I've bought a single share of stock to add to a position simply because I had a small amount of cash in my brokerage account.

How many stocks should I own with $100 K?

A good range for how many stocks to own is 15 to 20. You can keep adding to your holdings and also invest in other types of assets such as bonds, REITs, and ETFs. The key is to conduct the necessary research on each investment to make sure you know what you are buying and why.

How many stocks should I own as a beginner?

If you can keep your costs down, some experts recommend buying a portfolio of 12 to 18 stocks to properly diversify out the risk of owning individual stocks.

What is your Robinhood portfolio?

A portfolio is a 30,000-foot view of your investments. It's the big picture — the breakdown of all the stocks, bonds, and other financial assets you own. Ideally, your portfolio should help you achieve the best possible return given your risk tolerance.

How do portfolios work?

A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange traded funds (ETFs). People generally believe that stocks, bonds, and cash comprise the core of a portfolio.

Do I own my stocks on Robinhood?

Debunking misinformation: Yes, you own the shares you buy through Robinhood.

What is a portfolio?

A portfolio is a collection of a person’s investments across asset classes, such as stocks, bonds, cash, and real estate. Assets may be owned outright, or they may be subject to a vesting schedule. Assets may also be tucked into tax-deferred retirement accounts with withdrawal restrictions.

Types of portfolios

There are many ways to build a portfolio, and investors may even choose to have multiple portfolios that each reflect a different strategy for a different need.

The impact of time horizon on portfolio allocations

Time horizon refers to the amount of time an individual expects to hold an investment before selling it. To find their time horizon, investors ask themselves, “When do I need this money?” The answer is typically connected to the amount of time they have before reaching a financial goal.

The bottom line

Stock portfolios are typically categorized by the type of investment strategy they serve. When choosing their own, investors consider their risk tolerance, how much time they want to put toward monitoring the portfolio, and their time horizon.

What is a stock portfolio?

The stock portfolio refers to the compilation of individual stocks that you own. Complete investment portfolios include assets from various classes, such as stocks, bonds and cash reserves. You may also integrate alternative investments within your portfolio, which include real estate and hedge funds.

Is there a one size fits all portfolio?

No one-size-fits-all portfolio exists that is suitable for all investors. For example, younger savers will prefer small capitalization, or growth stocks for their profit potential. Retirees, however, typically gravitate towards less risk and mature companies.

What is financial statement?

Financial statements describe the makeup of your stock portfolio. Brokerage statements list your cash, stock positions and the total dollar amount of each investment. Information technology allows you to track the portfolio in real time through brokerage web portals.

What is a portfolio of stocks?

A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange traded funds (ETFs). People generally believe that stocks, bonds, and cash comprise the core of a portfolio.

What is a portfolio?

Key Takeaways. A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, as well as their fund counterparts. Stocks and bonds are generally considered a portfolio's core building blocks, though you may grow a portfolio with many different types of assets—including real estate, gold, paintings, ...

What is the wisdom of portfolio management?

One of the key concepts in portfolio management is the wisdom of diversification —which simply means not to put all your eggs in one basket. Diversification tries to reduce risk by allocating investments among various financial instruments, industries, and other categories.

What are the different types of assets in a portfolio?

Although stocks, bonds, and cash are generally viewed as a portfolio's core building blocks, you may grow a portfolio with many different types of assets—including real estate, gold stocks, various types of bonds, paintings, and other art collectibles. Investopedia / Carla Tardi.

What is hybrid portfolio?

Generally, a hybrid portfolio entails relatively fixed proportions of stocks, bonds, and alternative investments. This is beneficial, because historically, stocks, bonds, and alternatives have exhibited less than perfect correlations with one another.

What is aggressive portfolio?

The underlying assets in an aggressive portfolio generally would assume great risks in search of great returns. Aggressive investors seek out companies that are in the early stages of their growth and have a unique value proposition. Most of them are not yet common household names.

What is the wisdom of diversification?

One of the key concepts in portfolio management is the wisdom of diversification —which simply means not to put all your eggs in one basket. Diversification tries to reduce risk by allocating investments among various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event. There are many ways to diversify. How you choose to do it is up to you. Your goals for the future, your appetite for risk, and your personality are all factors in deciding how to build your portfolio.

What is a portfolio in finance?

A portfolio is a window into your financial life, providing a breakdown of how you’ve decided to allocate your money. For many people, a portfolio is a collection of stocks, bonds, and cash. But more broadly, it can include other assets, like foreign currencies, gold, art, real estate, or investments in private companies.

What is a portfolio?

For many people, a portfolio is a collection of stocks, bonds, and cash. But more broadly, it can include other assets, like foreign currencies, gold, art, real estate, or investments in private companies. Many factors can influence how you design your portfolio, including how much risk you’re willing to take and how long you plan to own each asset.

Why do we need a portfolio?

If you want, a portfolio can help you diversify your assets, spreading them across stocks, bonds, and other purposes .

What is intentional portfolio?

However, research suggests that building a more intentional portfolio (one that helps optimize your returns, while effectively managing your risk) means including a variety of assets. The mix that you choose is known as your asset allocation. Hire a financial advisor to choose investments for you.

How to build an asset portfolio?

There are three main ways to build an actual portfolio: Pick individual assets yourself; Invest in an actively managed mutual fund or exchange-traded fund; or. Hire a financial advisor to choose investments for you.

Why is it important to have a diversified portfolio?

Typically, diversification helps reduce volatility and smooth returns. Putting all your money into a single asset class can put your portfolio at unacceptable levels of risk.

What is included in a conservative portfolio?

However, typical investments for a conservative investor might include a larger portion of cash and bonds, and smaller percentage of large, established companies.

A Portfolio Holds Your Investments

Your portfolio represents all of the investments you own. The term itself comes from the Italian word for a case designed to carry loose papers ( portafoglio ), but don’t think of a portfolio as a physical container. Rather, it’s an abstract way to refer to groups of investment assets.

How To Manage an Investment Portfolio

Building and managing a portfolio is one of the basic tasks of investing —the goal of an investment portfolio is always to build your wealth over time.

4 Common Types of Portfolio

Your portfolio construction is as unique as you are, and you’ll tailor it over time to reflect your preferences and goals. If you’re just getting started, here are some of the most popular portfolio types. (Keep in mind that you’ll probably want to meet with an investment professional before you start building your investment portfolio.)

What is an investment portfolio?

An investment portfolio is a basket of assets that can hold stocks, bonds, cash and more. Investors aim for a return by mixing these securitiesin a way that reflects their risk tolerance and financial goals. There are many different types of investment portfolios, as some are built into 401(k)s, IRAs and annuities, ...

What is an ETF fund?

An ETF is a fund that includes a number of similar stocks. That could mean stocks from a certain sector of the economy or even stocks from different countries. An ETF could invest only in large, established companies or only in small companies with high growth potential.

What is asset class?

An asset class is a category of different securities. For example, equities are stocks, shares of which you own as a slice of a company that do not offer fixed returns. Meanwhile, fixed-income can include bonds and certificates of deposit (CDs). Below, we provide some more examples of different securities you can build an investment portfolio with:

What does FDIC mean in investing?

The FDIC insures both of these. That means you won’t lose all your money the way you might with a stock. Your risk toleranceis the amount of variability that you can handle with your investments. In other words, it reflects how well you can stomach the ups and downs that come with any investment.

What does risk tolerance mean in investing?

That means you won’t lose all your money the way you might with a stock. Your risk toleranceis the amount of variability that you can handle with your investments. In other words, it reflects how well you can stomach the ups and downs that come with any investment. This is what investors call market volatility.

What is a portfolio?

A portfolio may contain the following: 1. Stocks. Stocks are the most common component of an investment portfolio. They refer to a portion or share of a company. It means that the owner of the stocks is a part owner of the company. The size of the ownership stake depends on the number of shares he owns. Stocks are a source of income ...

What is investment portfolio?

What is an Investment Portfolio? An investment portfolio is a set of financial assets owned by an investor that may include bonds. Bonds Bonds are fixed-income securities that are issued by corporations and governments to raise capital.

What is a bond?

Bonds Bonds are fixed-income securities that are issued by corporations and governments to raise capital. The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed (or variable) interest rate for a specified period. , stocks, currencies, cash and cash equivalents. Cash Equivalents Cash and cash equivalents are ...

What are the components of a portfolio?

Components of a Portfolio. The assets that are included in a portfolio are called asset classes. The investor or financial advisor. Financial Advisor A Financial Advisor is a finance professional who provides consulting and advice about an individual’s or entity’s finances.

What is financial advisor?

Financial Advisor A Financial Advisor is a finance professional who provides consulting and advice about an individual’s or entity’s finances. Financial advisors can help individuals and companies reach their financial goals sooner by providing their clients with strategies and ways to create more wealth.

What is the most common component of an investment portfolio?

1. Stocks. Stocks are the most common component of an investment portfolio. They refer to a portion or share of a company. It means that the owner of the stocks is a part owner of the company. The size of the ownership stake depends on the number of shares he owns. Dividend A dividend is a share of profits and retained earnings ...

What is the meaning of stock?

They refer to a portion or share of a company. It means that the owner of the stocks is a part owner of the company. The size of the ownership stake depends on the number of shares he owns. Stocks are a source of income because as a company makes profits, it shares a portion of the profits through dividends.

Do portfolio weights apply to specific securities?

Portfolio weights are not necessarily applied only to specific securities.

Why are portfolio weights related to market values fluid?

Portfolio weights related to market values are fluid because market values change constantly. Equal-weighted portfolios must be rebalanced frequently to maintain a relative equal weighting of the securities in question.

How to determine the weight of an asset?

The most basic way to determine the weight of an asset is by dividing the dollar value of a security by the total dollar value of the portfolio. Of course, if the portfolio contains stocks or stock funds, the numbers change constantly as the price of the assets and the value of the entire portfolio change with the movement of the markets.