Typically, a balanced portfolio has a 50/50 or 60/40 split between stocks and bonds. And because you have a mix of stocks and bonds, you are balancing your risk level — and your possible return on investments. Having a balanced portfolio means striking a balance between preserving your capital and achieving growth.

How important is a balanced portfolio?

- A balanced product portfolio has Cash Cows that can provide the investment funds to develop Question Marks and Stars.

- Once a balanced portfolio has been defined, there are four strategies that can be followed: Hold, Build, Harvest, or Divest.

- A balanced portfolio does NOT mean having equal numbers of products or services in each quadrant.

What does it mean to have a balanced investment portfolio?

- Balancing your portfolio ensures that you have a mix of investment assets -- usually stocks and bonds -- appropriate for your risk tolerance and investment goals.

- Rebalancing your portfolio allows you to maintain your desired level of risk over time.

- Portfolios naturally get out of balance as the prices of individual investments fluctuate over time.

How to build a balanced portfolio?

How to Build a Portfolio of Mutual Funds

- Use a Core and Satellite Portfolio Design. Before building begins, you will need a basic design—a blueprint—to follow. ...

- Use Different Types of Fund Categories for the Structure. ...

- Know Your Risk Tolerance. ...

- Determine Your Asset Allocation. ...

- Learn How to Choose the Best Funds. ...

- A Few More Tips and Cautions for Building a Portfolio of Mutual Funds. ...

How do you balance your portfolio?

- Enroll in your employer’s 401 (k).

- Open an IRA and invest in an index fund or exchange-traded fund (ETF).

- Even easier, open an automatically-managed investment account —these companies will handle almost everything for you.

How do I know if my portfolio is balanced?

Determining how a balanced portfolio looks for you Subtract your age from 110 to determine what percentage of your portfolio should be allocated to stocks, with the remainder mostly in bonds. For example, if you are 39, so this means that about 71% of your portfolio should be in stocks, with the other 29% in bonds.

How many stocks should be in a balanced portfolio?

Some experts say that somewhere between 20 and 30 stocks is the sweet spot for manageability and diversification for most portfolios of individual stocks. But if you look beyond that, other research has pegged the magic number at 60 stocks.

What is a good balance portfolio?

Typically, a balanced portfolio has a 50/50 or 60/40 split between stocks and bonds. And because you have a mix of stocks and bonds, you are balancing your risk level — and your possible return on investments. Having a balanced portfolio means striking a balance between preserving your capital and achieving growth.

How do you create a balanced stock portfolio?

Building a balanced portfolioStart with your needs and goals. The first step in investing is to understand your unique goals, timeframe, and capital requirements. ... Assess your risk tolerance. ... Determine your asset allocation. ... Diversify your portfolio. ... Rebalance your portfolio.

How many stocks should I own with $100 K?

A good range for how many stocks to own is 15 to 20. You can keep adding to your holdings and also invest in other types of assets such as bonds, REITs, and ETFs. The key is to conduct the necessary research on each investment to make sure you know what you are buying and why.

What is the average return on a balanced portfolio?

Balanced Retirement Portfolios A 50% weighting in stocks and a 50% weighing in bonds has provided an average annual return of 8.3%, with the worst year -22.3% and the best year +33.5%. For most retirees, allocating at most 60% of their funds in stocks is a good limit to consider.

What is the 7 year rule for investing?

The most basic example of the Rule of 72 is one we can do without a calculator: Given a 10% annual rate of return, how long will it take for your money to double? Take 72 and divide it by 10 and you get 7.2. This means, at a 10% fixed annual rate of return, your money doubles every 7 years.

What is the ideal portfolio mix?

The old rule of thumb used to be that you should subtract your age from 100 - and that's the percentage of your portfolio that you should keep in stocks. For example, if you're 30, you should keep 70% of your portfolio in stocks. If you're 70, you should keep 30% of your portfolio in stocks.

What is a good asset allocation for a 65 year old?

The general rule is that the younger you are, the more risk you're able to tolerate. The older you get, though, means you must cut back on the amount of risk in your portfolio. The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to 100 minus your age.

Is it too late to start investing at 35?

Key Takeaways. It's never too late to start saving money for your retirement. Starting at age 35 means you have 30 years to save for retirement, which will have a substantial compounding effect, particularly in tax-sheltered retirement vehicles.

What should investment portfolio look like?

Commonly cited rules of thumb suggest subtracting your age from 100 or 110 to determine what portion of your portfolio should be dedicated to stock investments. For example, if you're 30, these rules suggest 70% to 80% of your portfolio allocated to stocks, leaving 20% to 30% of your portfolio for bond investments.

How much cash should I have in my portfolio?

A common-sense strategy may be to allocate no less than 5% of your portfolio to cash, and many prudent professionals may prefer to keep between 10% and 20% on hand at a minimum. Evidence indicates that the maximum risk/return trade-off occurs somewhere around this level of cash allocation.

Is there a correlation between asset classes?

There is usually very little correlation, and in some cases a negative correlation, between different asset classes. This characteristic is integral to the field of investing. – Investopedia. The success (or failure) of one won’t affect the other.

Is an employer-sponsored retirement account a good investment?

It’s a 100% return on your investment. Regardless of any debt you may have, an employer-sponsored retirement account is an excellent, passive way to build wealth. There is no one way to design a balanced portfolio because everyone’s situation is different.

The Basics of Keeping a Balanced Investment Portfolio

Whether you’re brand new to investing or you have an established portfolio, balance is seen as one of the keys to making the most of your investments.

Do: Aim to have a mix of assets

At its most basic level, balancing your portfolio means investing in a diverse mix of assets. But this mix might look different for every person depending on their specific financial situation, risk tolerance, age, and investment goals.

Do: Rebalance yearly

There are a few different ways to rebalance your portfolio. One way is to sell and rebuy assets according to your balance needs. The potential downside to taking this approach is that you could be selling your best-performing assets in favor of lesser-performing assets.

1. Berkshire Hathaway Stock Portfolio

One way to think of Berkshire Hathaway (NYSE: BRK.B) is as a giant stock portfolio.

2. LST Beat the Market Growth Portfolio

The Liberated Stock Trader Beat the Market Screener seeks to select stocks with a significant chance of beating the S&P500 returns. The screener uses growth in free cash flow and explosive EPS growth.

3. ESG Ethical Investment Portfolio Sample

If you care about the environment and the state of the planet, you are probably already taking steps to try and reduce your impact on the world. Perhaps like me, you have an electric or hybrid car, and you are reducing your use of plastics, you recycle, and are eating more vegetarian or even vegan dishes.

4. The CAN SLIM Growth Stock Portfolio

CANSLIM is a stock investing strategy designed by William J. O’Neil to produce market-beating profit performance. Using the CAN SLIM criteria in your investing should mean profitable returns. Current Earnings, Annual Earnings, New Products, Supply, Leaders, Institutional Sponsorship & Market Direction are vital criteria.

6. The FAANG Stocks Portfolio

FAANG is attractive portfolio example, because the FAANGs have a high margin of safety because of their huge market capitalizations. Three FAANGS, Apple, Alphabet, and Amazon, had market capitalizations exceeding $1 trillion in 2022.

7. The Bill Gates Portfolio

I am certainly not saying Bill Gates is an investing genius, but he is a genius nonetheless. I have a huge amount of respect for Mr. Gates; not only is he one of the world’s richest men, but he has given so much back to the world not just in monetary measure but in his time and effort.

8. The NAMPOF Stock Portfolio

A FAANG alternative is a basket of tech stocks composed of NVIDIA (NASDAQ: NVDA), Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), PayPal (NASDAQ: PYPL), Oracle (NYSE: ORCL), and Facebook (NASDAQ: FB). I call this portfolio the NAMPOF.

What is a balanced fund?

Balanced Funds. A balanced fund is a mutual fund that contains both a stock and bond component, as well as a small money market component in a single portfolio. Generally, these funds stick to a relatively fixed mix of stocks and bonds, such as 60/40 stocks to bonds. Balanced mutual funds have holdings that are balanced between equity and debt, ...

What is balanced investment strategy?

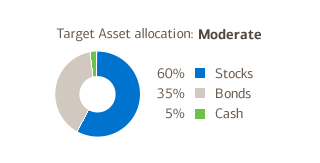

What Is a Balanced Investment Strategy? A balanced investment strategy combines asset classes in a portfolio in an attempt to balance risk and return. Typically, balanced portfolios are divided between stocks and bonds, either equally or with a slight tilt, such as 60% in stocks and 40% in bonds.

Why do retirees invest in equities?

The equities component helps to prevent erosion of purchasing power and ensure the long-term preservation of retirement nest eggs.

Why is portfolio allocation important?

When determining what strategy to select, it is important for investors to consider not only their objective capacity to bear risk, such as their net worth and income, but also their subjective risk tolerance.

Do balanced investors seek modest returns?

Although the exact parameters can be fine-tuned, most balanced investors will be seeking modest returns on their capital, along with a high likelihood of capital preservation. In the past, investors would need to assemble their portfolios manually by purchasing individual investments.

What is Browne's portfolio?

Browne's portfolio is designed to hold up well in any economic environment and be a simple portfolio to implement. Each asset class has a role to play: the long-term bonds will perform well during deflation; stocks will do well during times of economic growth; Treasury Bills will hold up during recessions and gold is helpful during times of inflation. By holding all four together you can, in theory, deal with anything that the economy throws at you and still have at least one part of your portfolio do relatively well.

Can you have a portfolio without bonds?

Basically, a portfolio without bonds can get too risky in the short-term for most to stomach, but if your bond exposure is too high, you may miss out on longer run returns.

A Balancing Act

Fortune Favors The Bold

- If you recently graduated college—and are able to do so without incurring significant debt – congratulations. The prudence that got you this far should propel you even further. (If you did incur debt, then depending on the interest rateyou're being charged, your priority should be to pay it off as quickly as possible, regardless of any short-term pain.) But if you're ever going to invest …

Risk Tolerance Decreases

- For most investors, their tolerance for risk decreases as they enter their 30s and 40s. These investors are less willing to bet substantial portions of their worth on single investments. Rather, they are looking to build out a liquid fund for emergencies and luxury purchases while also continuing to make automated investments for the long term. Seasoned investors may also be …

Fortune Doesn’T Favor The Reckless

- Fortune doesn't favor the reckless, however, and at some point in your life, you will want to seriously begin saving for retirement. In the case of retirement, it can be best to start with the three traditional classes of securities—in decreasing order of risk (and of potential return), that's stocks, bonds, and cash. (If you're thinking about investing in esoteric investments like cre…

The Bottom Line

- Investing isn't a hard science like chemistry, where the same experiment under the same conditions leads to the same result every time. However, there are some basic axioms, mainly centered around age with risk, for which investors can rely. Understanding and creating a portfolio allocation using stocks, bonds, and cash that aligns with your risk tolerances and short-term ver…