What's the difference between VXX and uvxy?

Both UVXY and VXX are ETFs. UVXY has a higher expense ratio than VXX (1.65% vs 0.89%). Below is the comparison between UVXY and VXX. The Fund seeks to provide investment results that correspond to one and one-half times (1.5x) the performance of the S&P 500 VIX Short-Term Futures Index ("Index") for a single day. UVXY expense ratio is 1.65%.

Is shorting uvxy or VXX the perfect trade?

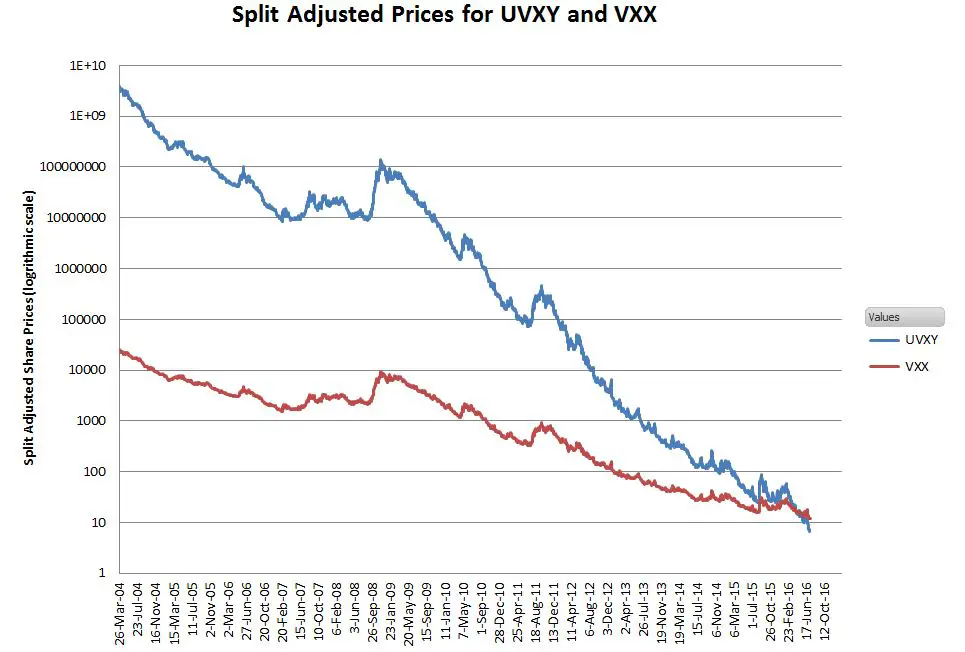

October 2, 2016. by Vance Harwood. Long term charts of VXX or UVXY suggest they are perfect candidates for shorting but there are risks you should be aware of and alternatives to consider. The charts for long volatility Exchange Traded Products (ETP) like Barclays’s VXX and ProShares’ 1.5X levered UVXY are astonishing.

How to trade uvxy options?

Step 5: Develop and Test Your Trading Plan

- Buy Premium Strategy. Buying premium means that you expect a move in the market that would make the options you own appreciate significantly in value.

- Sell Premium Strategy. Selling options premiums generally involves receiving premium income in return for accepting risk, which can be unlimited if you sell naked options.

- Premium Neutral Strategy. ...

How to trade tvix uvxy VXX Vix?

- These securities are always in the “hard to borrow” category, so it’s very likely at least a phone call to your broker will be required to create a short position. ...

- You’ll need to have margin capability setup in a taxable account. ...

- You’ll need extra cash / marginable securities in your account as margin. ...

Is UVXY a good stock to buy?

As mentioned in the beginning, UVXY is destined to be a loser. Stay invested in this ETF for too long, and the most likely outcome is capital loss. Therefore, before stepping into this fund, traders should already have a clear exit plan in mind.

What kind of stock is UVXY?

UVXY is an ETF which is tracking the S&P 500 Short-Term VIX Futures Index on a 1.5x leveraged basis. This index is provided by S&P Global and it relatively straightforward: it holds a basket of first and second month VIX futures such that the average holding is 30-days into the future.

Can UVXY go to zero?

UVXY has gone to zero multiple times due to contango loss in VIX futures. Because financial assets can't trade below zero, UVXY avoids trading below zero by reverse splitting at ratios as high as 5:1.

Can you make money on UVXY?

In fact, you can even profit from volatility and extreme fear in the markets by trading a single ETF. The ProShares Ultra VIX Short-Term Futures ETF ($UVXY) provides leveraged exposure to the S&P 500 VIX Short-Term Futures Index. It seeks results that are 1.5 times the daily performance of that index.

What is UVXY and how does it work?

UVXY offers daily leveraged exposure to short-term VIX futures, designed to capture the volatility of the S&P 500, in a commodity pool wrapper. As a geared product with daily resets, UVXY is designed as a short-term trading tool and not a long-term investment vehicle.

Is UVXY a fear index?

This ETF offers leveraged exposure to an index comprised of short-term VIX futures contracts, making it a very powerful tool for those looking to implement sophisticated strategies requiring exposure to the VIX. The VIX, also known as the “fear index,” is a widely followed indicator of equity market volatility.

What is difference between VIX and UVXY?

VXX (ETN) and UVXY (ETF) both track the daily percent return of a portfolio comprised of the two front-month VIX futures contracts. UVXY is slightly different than VXX because it is 2x leveraged. This means that UVXY will return twice the percentage of VXX on a given day.

What's the opposite of UVXY?

What Is The Opposite Of UVXY? The opposite of the UVXY is the Short VIX Short-Term Futures (SVXY). SVXY is also an ETF however it differs from UVXY by being an 'inverse ETF'. An inverse ETFs means that it is designed to return the opposite of the underlying security.

Can you buy UVXY after hours?

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET)....After-Hours Trades.After Hours Time (ET)After Hours PriceAfter Hours Share Volume18:29:07$12.86104 more rows

Does UVXY pay dividends?

UVXY does not currently pay a dividend.

Is UVXY hard to borrow?

These securities are always in the “hard to borrow” category, so it's very likely at least a phone call to your broker will be required to create a short position. It's also very likely you'll have to pay an ongoing fee to borrow the shares. Plan on the annualized fee being at 3% for the non-leveraged VXX.

How is UVXY taxed?

ProShares has three volatility ETFs: ULTRA VIX SHORT-TERM FUTURES ETF (UVXY), SHORT VIX SHORT-TERM FUTURES ETF (SVXY), and VIX SHORT-TERM FUTURES ETF (VIXY). These ProShares ETF's are taxed as securities: Unlike ETN's, ETF RICs make annual distributions of income and capital gains to shareholders.

How has ProShares Ultra VIX Short-Term Futures ETF's stock performed in 2022?

ProShares Ultra VIX Short-Term Futures ETF's stock was trading at $12.43 on January 1st, 2022. Since then, UVXY shares have increased by 19.0% and...

When did ProShares Ultra VIX Short-Term Futures ETF's stock split? How did ProShares Ultra VIX Short-Term Futures ETF's stock split work?

Shares of ProShares Ultra VIX Short-Term Futures ETF reverse split on Wednesday, May 26th 2021. The 1-10 reverse split was announced on Tuesday, Ma...

What other stocks do shareholders of ProShares Ultra VIX Short-Term Futures ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other ProShares Ultra VIX Short-Term Futures ETF investors own in...

What is ProShares Ultra VIX Short-Term Futures ETF's stock symbol?

ProShares Ultra VIX Short-Term Futures ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "UVXY."

Who are ProShares Ultra VIX Short-Term Futures ETF's major shareholders?

ProShares Ultra VIX Short-Term Futures ETF's stock is owned by a variety of retail and institutional investors. Top institutional investors include...

Which institutional investors are selling ProShares Ultra VIX Short-Term Futures ETF stock?

UVXY stock was sold by a variety of institutional investors in the last quarter, including Group One Trading L.P., Prelude Capital Management LLC,...

Which institutional investors are buying ProShares Ultra VIX Short-Term Futures ETF stock?

UVXY stock was purchased by a variety of institutional investors in the last quarter, including Jane Street Group LLC, Simplex Trading LLC, Tairen...

How do I buy shares of ProShares Ultra VIX Short-Term Futures ETF?

Shares of UVXY can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBul...

What is ProShares Ultra VIX Short-Term Futures ETF's stock price today?

One share of UVXY stock can currently be purchased for approximately $14.79.

How has ProShares Ultra VIX Short-Term Futures ETF's stock price been impacted by COVID-19 (Coronavirus)?

ProShares Ultra VIX Short-Term Futures ETF's stock was trading at $482.20 on March 11th, 2020 when COVID-19 (Coronavirus) reached pandemic status according to the World Health Organization. Since then, UVXY shares have decreased by 96.5% and is now trading at $16.75. View which stocks have been most impacted by COVID-19.

When did ProShares Ultra VIX Short-Term Futures ETF's stock split? How did ProShares Ultra VIX Short-Term Futures ETF's stock split work?

Shares of ProShares Ultra VIX Short-Term Futures ETF reverse split before market open on Wednesday, May 26th 2021. The 1-10 reverse split was announced on Tuesday, May 11th 2021. The number of shares owned by shareholders was adjusted after the closing bell on Tuesday, May 25th 2021.

What other stocks do shareholders of ProShares Ultra VIX Short-Term Futures ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other ProShares Ultra VIX Short-Term Futures ETF investors own include NVIDIA (NVDA), Tesla (TSLA), Netflix (NFLX), SPDR S&P 500 ETF Trust (SPY), Advanced Micro Devices (AMD), Micron Technology (MU), Bank of America (BAC), Direxion Daily Gold Miners Index Bull 2x Shares (NUGT), VelocityShares Daily 2x VIX Short-Term ETN (TVIX) and Boeing (BA)..

What is ProShares Ultra VIX Short-Term Futures ETF's stock symbol?

ProShares Ultra VIX Short-Term Futures ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "UVXY."

Who are ProShares Ultra VIX Short-Term Futures ETF's major shareholders?

ProShares Ultra VIX Short-Term Futures ETF's stock is owned by a number of institutional and retail investors. Top institutional shareholders include Susquehanna International Group LLP (0.00%), Citadel Advisors LLC (0.00%), Wolverine Trading LLC (0.00%), Goldman Sachs Group Inc. (0.00%), Goldman Sachs Group Inc. (0.00%) and JPMorgan Chase & Co.

Which major investors are selling ProShares Ultra VIX Short-Term Futures ETF stock?

UVXY stock was sold by a variety of institutional investors in the last quarter, including IMC Chicago LLC, Cutler Group LP, Omnia Family Wealth LLC, Antonetti Capital Management LLC, and Larson Financial Group LLC.

Which major investors are buying ProShares Ultra VIX Short-Term Futures ETF stock?

UVXY stock was acquired by a variety of institutional investors in the last quarter, including Wolverine Trading LLC, Goldman Sachs Group Inc., Goldman Sachs Group Inc., RPO LLC, Raffles Associates LP, JPMorgan Chase & Co., BTG Pactual Global Asset Management Ltd, and Benchmark Financial Wealth Advisors LLC.

UVXY Chart

Welcome to the 4th Industrial Revolution Hyperspace Travelers. 2022 has arrived! Keep your hands in the spaceship at all times. It is sure to be a memorable one. 2022 UVXY Macro Time-Series Active. It is time to feast on their greed. The reset will usher in the cybernetic era of advancement. SPX 850. DXY 138.

Ideas

Welcome to the 4th Industrial Revolution Hyperspace Travelers. 2022 has arrived! Keep your hands in the spaceship at all times. It is sure to be a memorable one. 2022 UVXY Macro Time-Series Active. It is time to feast on their greed. The reset will usher in the cybernetic era of advancement. SPX 850. DXY 138.

Signals & Forecast

There are mixed signals in the stock today. A sell signal was issued from a pivot top point on Friday, February 18, 2022, and so far it has fallen -1.09%. Further fall is indicated until a new bottom pivot has been found. Furthermore, there is currently a sell signal from the 3 month Moving Average Convergence Divergence (MACD).

Support, Risk & Stop-loss

ProShares Ultra VIX Short-Term Futures finds support from accumulated volume at $16.66 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Is ProShares Ultra VIX Short-Term Futures stock A Buy?

ProShares Ultra VIX Short-Term Futures holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

About ProShares Ultra VIX Short-Term Futures

The index seeks to offer exposure to market volatility through publicly traded futures markets and is designed to measure the implied volatility of the S&P 500 over 30 days in the future.... Read more

Golden Star Signal

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Top Fintech Company

featured in The Global Fintech Index 2020 as the top Fintech company of the country.