Is now a good time to buy Under Armour stock?

Under Armour, Inc. (UAA) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, UAA's 50-day simple moving average crossed above its 200-day simple moving average, known as a "golden cross."

How much is Under Armour stock?

Under Armour stock, a sports equipment company that manufactures footwear, sports, and casual apparel, experienced a marginal growth over the last week (five trading days) to levels of around $19 ...

How to buy Under Armour stock?

Under Armour Inc. (NYSE:UA) traded at $16.65 at last check on Wednesday, February 02, made an upward move of 2.81% on its previous day’s price. Looking at the stock we see that its previous close was $16.19 and the beta (5Y monthly) reads 1.25 with the day’s price range being $15.835 – $16.49. The company has a trailing 12-month PE ratio of 17.13.

Is Under Armour worth the money?

Under Armour Is Still Not Worth The Price. Apr. 26, ... but I'd prefer a growing business to go where the money is. Under Armour continues to be on my follow list but it's a no-go at these price ...

See more

Is Under Armor a publicly traded company?

Stock Information Under Armour has two classes of publicly traded common stock listed on the New York Stock Exchange: UAA (Class A) and UA (Class C).

Is Armour a good investment?

Analysts estimate that it will earn 79 cents a share in calendar 2022 after last year's 77 cents, on a 6% increase in sales, to $6 billion. The consensus calls for 2022 sales to rise about 9% and 22% at Nike and Lululemon, respectively.

When did Under Armour stock split?

The first split for UA took place on July 10, 2012. This was a 2 for 1 split, meaning for each share of UA owned pre-split, the shareholder now owned 2 shares. For example, a 1000 share position pre-split, became a 2000 share position following the split. UA's second split took place on April 15, 2014.

Is UAA stock a buy?

Out of 23 analysts, 5 (21.74%) are recommending UAA as a Strong Buy, 5 (21.74%) are recommending UAA as a Buy, 13 (56.52%) are recommending UAA as a Hold, 0 (0%) are recommending UAA as a Sell, and 0 (0%) are recommending UAA as a Strong Sell. What is UAA's earnings growth forecast for 2022-2023?

Why is Under Armour stock so cheap?

Under Armour reported an unexpected loss and sales below estimates as the company grappled with global supply chain challenges and Covid lockdowns in China. The athletic apparel retailer's stock fell as it also issued profit guidance that came in below Wall Street estimates.

Is Under Armour overvalued?

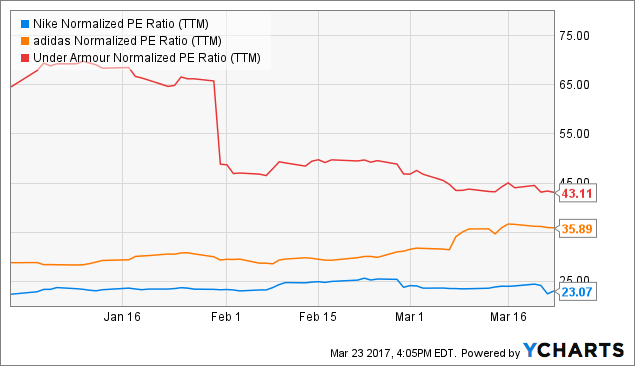

Under Armour is currently undervalued according to the same model. However, from my point of view, the risk of investing in Under Armour is much higher than investing in its competitors Nike or Adidas. For this reason, I would recommend to underweight the Under Armour position in an investment portfolio.

Why does under Armour have two stocks?

The ticker "UA" represents Class C shares, while "UAA" represents Class A voting shares. When there are two classes of stock, this is known as having a dual-class share structure. The structure has one purpose, and it's to dilute the voting rights of public shareholders.

Will under Armour ever pay a dividend?

Does Under Armour pay a dividend? At the present time we do not pay a dividend on our common stock.

Why are there two different under Armour stocks?

Under Armor split its stock in the form of a spinoff of a new non-voting class of shares. One share of new class C shares was distributed for each Under Armor share. The two classes trade separately so this should be treated as a spinoff rather than a stock split in the accounting software.

Does UAA stock pay dividends?

Under Armour (NYSE: UAA) does not pay a dividend.

Is Nike a buy or sell?

NIKE has received a consensus rating of Buy. The company's average rating score is 2.78, and is based on 21 buy ratings, 6 hold ratings, and no sell ratings.

Who bought under Armour?

Francisco PartnersGlobal fitness giant Under Armour announced this morning that it will be selling MyFitnessPal to investment firm Francisco Partners for $345 million, five and a half years after acquiring it for $475 million.

Should I buy or sell Under Armour stock right now?

4 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Under Armour in the last year. There are currently 1 hold rating...

What is Under Armour's stock price forecast for 2022?

4 brokerages have issued 12 month price objectives for Under Armour's stock. Their forecasts range from $21.00 to $33.00. On average, they anticipa...

How has Under Armour's stock price performed in 2022?

Under Armour's stock was trading at $18.04 at the beginning of the year. Since then, UA shares have decreased by 48.2% and is now trading at $9.34....

When is Under Armour's next earnings date?

Under Armour is scheduled to release its next quarterly earnings announcement on Tuesday, August 2nd 2022. View our earnings forecast for Under Ar...

How were Under Armour's earnings last quarter?

Under Armour, Inc. (NYSE:UA) announced its quarterly earnings data on Tuesday, November, 2nd. The company reported $0.31 earnings per share for the...

What guidance has Under Armour issued on next quarter's earnings?

Under Armour issued an update on its FY 2023 earnings guidance on Monday, June, 6th. The company provided earnings per share (EPS) guidance of $0.6...

Who are Under Armour's key executives?

Under Armour's management team includes the following people: Mr. Kevin A. Plank , Founder, Exec. Chairman & Brand Chief (Age 49, Pay $2.27M) (...

What is Patrik Frisk's approval rating as Under Armour's CEO?

85 employees have rated Under Armour CEO Patrik Frisk on Glassdoor.com . Patrik Frisk has an approval rating of 84% among Under Armour's employees.

Who are some of Under Armour's key competitors?

Some companies that are related to Under Armour include FOX (FOX) , Sands China (SCHYY) , Pool (POOL) , Swedish Match AB (publ) (SWMAY) , Robl...

Two big investors sell large chunks of stakes in Under Armour

4 Top Stock Trades for Monday: XOM, Oil, F, UAA

Credit Suisse AG and Adage Capital Partners were two of Under Armour's four biggest institutional shareholders.

About Under Armour

Thursday was tough and Friday was worse for the bulls as the markets rolled over on worries of higher inflation, more rate hikes and geopolitical tension surrounding Ukraine and Russia. Let’s look at our top stock trades for next week. Top Stock Trades for Monday No.

Headlines

Under Armour, Inc. engages in the development, marketing, and distribution of branded performance apparel, footwear, and accessories for men, women, and youth. It operates through the following segments: North America, EMEA, Asia-Pacific, Latin America, and Connected Fitness. The North America segment comprises of U.S. and Canada.

How much is Under Armour stock worth in 2020?

Under Armour’s Supply-Chain Issues Worried Investors. This Analyst Says It’s Not That Bad.

How much does Under Armour make?

How has Under Armour's stock price been impacted by COVID-19? Under Armour's stock was trading at $11.38 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organization (WHO). Since then, UAA stock has increased by 78.7% and is now trading at $20.34.

When did Under Armour split?

Under Armour has a market capitalization of $9.30 billion and generates $4.47 billion in revenue each year. The company earns $-549,180,000.00 in net income (profit) each year or ($0.26) on an earnings per share basis.

What is under armour valuation?

Shares of Under Armour split on Tuesday, April 15th 2014. The 2-1 split was announced on Monday, March 17th 2014. The newly created shares were issued to shareholders after the closing bell on Monday, April 14th 2014. An investor that had 100 shares of Under Armour stock prior to the split would have 200 shares after the split.

What is stock ownership?

A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. Under Armour, Inc. is an American sports equipment company that manufactures footwear, sports and casual apparel.

What is Under Armour?

Stock. Ownership of a fraction of a corporation and the right to claim a share of the corporation's assets and profits equal to the amount of stock owned. US listed security. Listed on NYSE. US headquartered. Headquartered in Baltimore, Maryland, United States. Follow.

What time do you trade in the pre market?

Under Armour develops, markets, and distributes athletic apparel, footwear, and accessories in North America and other territories. Consumers of its apparel include professional and amateur athletes, sponsored college and professional teams, and people with active lifestyles.

Does market cap include convertible securities?

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment.

New York Stock Exchange

It does not include securities convertible into the common equity securities. "Market Cap" is derived from the last sale price for the displayed class of listed securities and the total number of shares outstanding for both listed and unlisted securities (as applicable).

Environmental, Social, and Governance Rating

The Companys principal business activity is the design, development, marketing and distribution of technologically advanced, branded performance products for men, women and youth.

Business Summary

"A" score indicates excellent relative ESG performance and a high degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.