How does PE ratio affect a company’s stock price?

One has a share price of $100 and a PE ratio of 15. The other has a share price of $50 and a PE ratio of 30. The first company’s share price may be higher, but a PE ratio of 15 means you’re only paying $15 for every $1 of the company’s earnings. Investors in the company with a PE ratio of 30 are paying $30 for $1 of earnings.

What is the difference between Peg and P/E ratio?

The price/earnings-to-growth (PEG) ratio is a company's stock price to earnings ratio divided by the growth rate of its earnings for a specified time period. Forward price-to-earnings (forward P/E) is a measure of the P/E ratio using forecasted earnings for the P/E calculation.

What is the difference between market price and P/E ratio?

Think of it this way: The market price of a stock tells you how much people are willing to pay to own the shares, but the P/E ratio tells you whether the price accurately reflects the company’s earnings potential, or it’s value over time.

Is it cheaper to buy a stock with a higher PE?

If the sector’s average P/E is 15, Stock A has a P/E = 15 and Stock B has a P/E = 30, stock A is cheaper despite having a higher absolute price than Stock B because you pay less for every $1 of current earnings. However, Stock B has a higher ratio than both its competitor and the sector.

How does PE ratio predict stock price?

Key TakeawaysYou can find a past P/E ratio by dividing the current price of a stock by last year's earnings. ... Find the predicted P/E ratio by dividing the current price of a stock by the company's projected earnings, though this projection may be inaccurate.The P/E 10 shows the value of the whole stock market.More items...

Is it good to buy a stock with high PE?

The popular opinion about stocks with high P/E ratios is that they are excellent investment options since investors are willing to pay more for a smaller share in the company's earnings. Hence, they presume this to be an indicator of an optimistic investor perception towards the stock.

Is PE a good indicator?

To many investors, the price-earnings ratio is the single most indispensable indicator for any stock purchase.

Is a low PE good for a stock?

P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors.

What is a healthy PE ratio?

So, what is a good PE ratio for a stock? A “good” P/E ratio isn't necessarily a high ratio or a low ratio on its own. The market average P/E ratio currently ranges from 20-25, so a higher PE above that could be considered bad, while a lower PE ratio could be considered better.

What PE ratio is too high?

A PEG greater than 1 might be considered overvalued because it might indicate the stock price is too high compared to the company's expected earnings growth.

What is Tesla's PE ratio?

The PE ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure. Tesla PE ratio as of July 22, 2022 is 98.21.

Is 30 a high PE ratio?

P/E 30 Ratio Explained A P/E of 30 is high by historical stock market standards. This type of valuation is usually placed on only the fastest-growing companies by investors in the company's early stages of growth.

How do you know if a stock is overvalued or undervalued?

This ratio is used to assess the current market price against the company's book value (total assets minus liabilities, divided by number of shares issued). To calculate it, divide the market price per share by the book value per share. A stock could be overvalued if the P/B ratio is higher than 1.

Is a PE ratio of 28 good?

Digging a Little Deeper Play Now's P/E ratio of 28 means that investors are willing to pay $28 for each $1 of earnings that the company generates. Taking this a step further, some investors interpret a “high P/E” as an overpriced stock.

Is a PE ratio of 14 good?

Higher P/E stocks, in general, are considered more expensive; while lower P/E stocks are, in general, considered cheap. Over history, the average P/E ratio of the stock market has been around 15-17.

What stock has the best PE ratio?

Top 10 Stocks With Low Price-to-Earnings RatioWalgreens Boots Alliance (Nasdaq: WBA) (See More)Meta Platforms (Nasdaq: FB) (See More)NortonLifeLock (Nasdaq: NLOK)Devon Energy (NYSE: DVN) (See More)Discover Financial Services (NYSE: DFS)JPMorgan (NYSE: JPM) (See More)American Express (NYSE: AXP) (See More)More items...•

What happens high PE stock?

High PE ratio “Typically, stocks selling at higher PE ratios have higher growth expectations than those selling at lower PE ratios,” Johnson says. “In essence, investors are willing to pay a higher premium for current earnings because they expect future earnings to grow substantially.”

Is 200 a high PE ratio?

A P/E ratio of 200 is high. But it is basically saying that people expect the company to grow earnings to be 15 to 20 times as large as they are now (so the P/E ratio would be 10 to 15).

Price Earnings Ratio Formula

P/E = Stock Price Per Share / Earnings Per ShareorP/E = Market Capitalization / Total Net EarningsorJustified P/E = Dividend Payout Ratio / R – Gwh...

P/E Ratio Formula Explanation

The basic P/E formula takes current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divide...

Why Use The Price Earnings Ratio?

Investors want to buy financially sound companies that offer cheap shares. Among the many ratios, the P/E is part of the research process for selec...

Limitations of Price Earnings Ratio

Finding the true value of a stock cannot just be calculated using current year earnings. The value depends on all expected future cash flows and ea...

What is the P/E ratio in the stock market?

The stock market’s P/E ratio is the reciprocal of the capitalization (cap) rate – how buyers of real estate price their investments. The most recent P/E ratio of 28.2 is equivalent to a cap rate of 3.5% – not great, but an improvement over Q4 2020 when the cap rate equivalent was just 2.5%.

What is the P/E ratio?

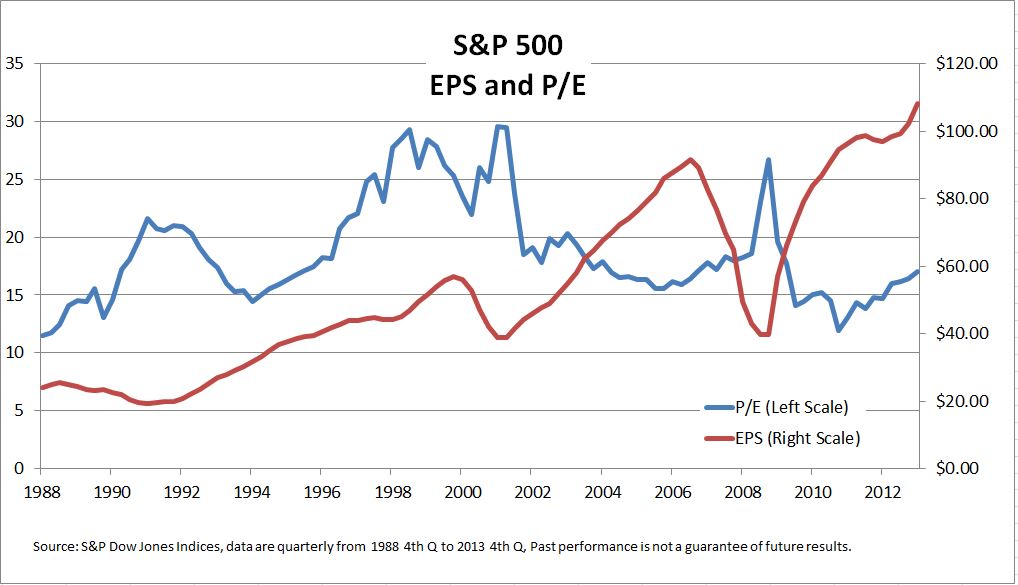

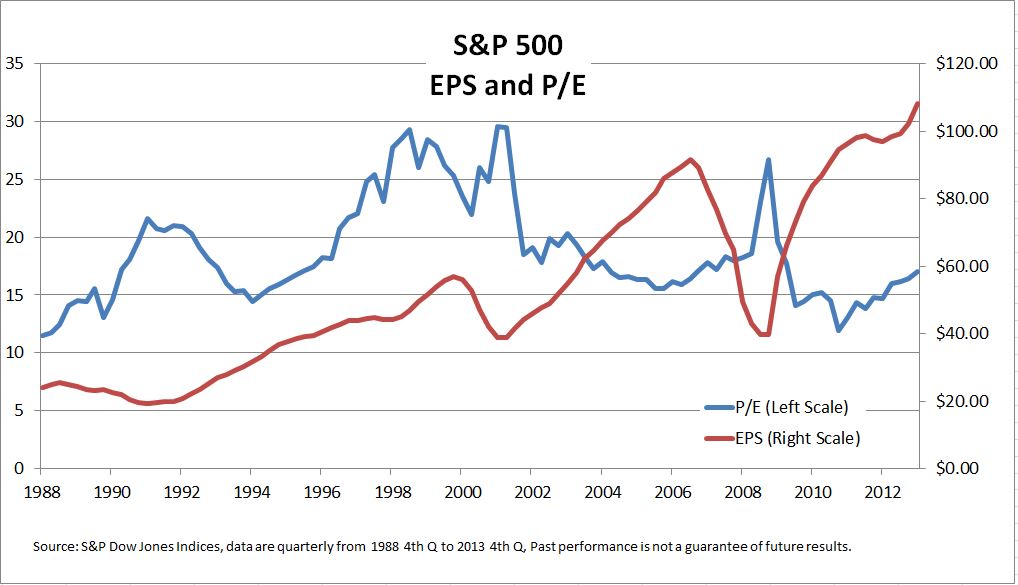

The price-to-earnings (P/E) ratio is a simple abstraction, a multiplier used to compare the price of a stock with the earnings of the company. In the market crash of 2008, stock prices dropped dramatically from their former heights, but as the P/E ratio demonstrates, the earnings reported by the companies that underlie those stocks dropped much further.

Why was the P/E ratio elevated in 1997?

Part of the accelerated rate was due to a surge of Boomer earnings and investments driving up the overall price of stocks (just as home prices were boosted by the surge of Boomers in the 1980s).

How do real estate investors determine their success?

Remember: real estate buyers evaluate the property’s return on their investment by use of the cap rate; stock market investors determine their success by the ratio of earnings to quoted price. More importantly, stocks represent stored wealth, especially the accumulated wealth of senior citizens.

Why did the stock market return to normal in 2009?

This return to market norms in 2009 and early 2010 came about due to a combination of gradually rising stock prices and dramatically rising earnings. Provided the market continues to gradually right itself, investors will soon become more tolerant of risk, and the economy as a whole will benefit.

What is the P/E ratio for Q4 2020?

Stock prices reached record highs in the fourth quarter (Q4) of 2020. The price-to-earnings (P/E) ratio rose to 39.6 in Q4 2020, the highest since the 2009 financial crisis and well above the historically applicable benchmark of 15.5.

Can you buy real estate with 5% cap rate?

Property owners certainly do not buy real estate based on a 5% cap rate – a net income multiplier of 20 – the current P/E ratio buyers of stocks are settling for. Further, problems that plague stocks, like spurts of inflation and short-term interest rates, are far less likely to affect properly mortgaged real estate.

Why do investors use P/E?

Investors not only use the P/E ratio to determine a stock's market value but also in determining future earnings growth. For example, if earnings are expected to rise, investors might expect the company to increase its dividends as a result. Higher earnings and rising dividends typically lead to a higher stock price.

What is P/E in business?

Remember that the P/E is a measure of expected earnings. As economies mature, inflation tends to rise. As a result, the Federal Reserve increases interest rates to slow the economy and tame inflation to prevent a rapid rise in prices.

Why is the PEG ratio important?

Since the P/E ratio does not factor in future earnings growth, the PEG ratio provides more insight into a stock's valuation. By providing a forward-looking perspective, the PEG is a valuable tool for investors in calculating a stock's future prospects.

How to tell if a stock is overvalued or undervalued?

As stated earlier, to determine whether a stock is overvalued or undervalued, it should be compared to other stock in its sector or industry group. Sectors are made up of industry groups, and industry groups are made up of stocks with similar businesses such as banking or financial services.

What does a high P/E mean?

A high P/E could mean that a stock's price is high relative to earnings and possibly overvalued.

What is EPS in valuation?

EPS provides the “E” or earnings portion of the P/E valuation ratio as shown below.

When to use PEG ratio?

Since stock prices are typically based on investor expectations of future performance by a company, the PEG ratio can be helpful but is best used when comparing if a stock price is overvalued or undervalued based on the growth in the company's industry.

What is the P/E ratio?

A price-to-earnings ratio, or P/E ratio, is the measure of a company's stock price in relation to its earnings. When trying to decide whether to invest in a certain stock, using the P/E can help you explore the stock's future direction.

How Does the P/E Ratio Work?

Before you can use it, you have to learn what the P/E ratio is. It's easy to calculate as long as you know a given company's stock price and earnings per share (EPS). The equation looks like this:

Why do investors prefer PEG?

Some investors may prefer the price-to-earnings growth ( PEG) ratio instead, because it factors in the earnings growth rate. 7 Other investors may prefer the dividend-adjusted PEG ratio because it uses the basic P/E ratio. It also adjusts for both the growth rate and the dividend yield of the stock. 8.

What is the average P/E ratio for a healthcare company?

For instance, Fidelity research in early 2021 pegged the average health care company's P/E ratio at nearly 70. On the other hand, in the banking sector, companies tended to have a P/E ratio of just under 11.5. 3 4

What does negative P/E mean?

A negative P/E means that a company is not profitable. In these cases, the P/E ratio tells you how much money the company lost with every dollar you invested.

Why do you look at your portfolio through the P/E lens?

But looking at your portfolio through the P/E lens can help you avoid getting swept away in bubbles or panics. It can also help you know whether a stock is getting overvalued and no longer earning enough to warrant its price. Warning. You should never rely on P/E ratios alone when you choose investments.

Why are there differences between sectors?

That's partly because different businesses have different expectations. In the software sector, for example, companies often have higher growth rates and higher returns on equity. That means they can sell at larger P/E ratios.

What does low P/E mean in stocks?

Companies with a low Price Earnings Ratio are often considered to be value stocks. It means they are undervalued because their stock price trade lower relative to its fundamentals. This mispricing will be a great bargain and will prompt investors to buy the stock before the market corrects it. And when it does, investors make a profit as a result of a higher stock price. Examples of low P/E stocks can be found in mature industries that pay a steady rate of dividends#N#Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.#N#.

How to find current P/E?

The basic P/E formula takes the current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divided by the weighted average shares outstanding#N#Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements#N#. Earnings can be normalized#N#Normalization Financial statements normalization involves adjusting non-recurring expenses or revenues in financial statements or metrics so that they only reflect the usual transactions of a company. Financial statements often contain expenses that do not constitute a company's normal business operations#N#for unusual or one-off items that can impact earnings#N#Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through#N#abnormally. Learn more about normalized EPS#N#Normalized EPS Normalized EPS refers to adjustments made to the income statement to reflect the up and down cycles of the economy.#N#.

What is a peg ratio?

PEG Ratio PEG Ratio is the P/E ratio of a company divided by the forecasted Growth in earnings (hence "PEG"). It is useful for adjusting high growth companies. The ratio adjusts the traditional P/E ratio by taking into account the growth rate in earnings per share that are expected in the future. Examples, and guide to PEG

What is justified P/E ratio?

The justified P/E ratio#N#Justified Price to Earnings Ratio The justified price to earnings ratio is the price to earnings ratio that is "justified" by using the Gordon Growth Model. This version of the popular P/E ratio uses a variety of underlying fundamental factors such as cost of equity and growth rate.#N#above is calculated independently of the standard P/E. In other words, the two ratios should produce two different results. If the P/E is lower than the justified P/E ratio, the company is undervalued, and purchasing the stock will result in profits if the alpha#N#Alpha Alpha is a measure of the performance of an investment relative to a suitable benchmark index such as the S&P 500. An alpha of one (the baseline value is zero) shows that the return on the investment during a specified time frame outperformed the overall market average by 1%.#N#is closed.

What is a growth stock?

Companies with a high Price Earnings Ratio are often considered to be growth stocks. This indicates a positive future performance, and investors have higher expectations for future earnings growth and are willing to pay more for them. The downside to this is that growth stocks are often higher in volatility, and this puts a lot of pressure on companies to do more to justify their higher valuation. For this reason, investing in growth stocks will more likely be seen as a risky#N#Risk Aversion Risk aversion refers to the tendency of an economic agent to strictly prefer certainty to uncertainty. An economic agent exhibiting risk aversion is said to be risk averse. Formally, a risk averse agent strictly prefers the expected value of a gamble to the gamble itself.#N#investment. Stocks with high P/E ratios can also be considered overvalued.

What is the difference between EPS and fair value?

It is a popular ratio that gives investors a better sense of the value. Fair Value Fair value refers to the actual value of an asset - a product, stock, or security - that is agreed upon by both the seller and the buyer.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. of different prices and earnings levels.

Why do stocks have higher PE?

A stock’s PE ratio can rise if investors believe future earnings will be higher than current levels, which is typically how “grow th stocks” are defined. According to Robert Johnson, a chartered financial analyst and CEO of Economic Index Associates in New York, higher PE ratios often go hand-in-hand with such growth stocks.

What is a PE ratio?

A company’s price-to-earnings ratio, or PE ratio, is a single number that packs a lot of punch, and one of the most common ways to value a company’s stock shares.

Why is PE ratio low?

For businesses that are highly cyclical, a low PE ratio may signal an undervalued stock, when in reality, it’s been operating in a period of high earnings that’s about to end.

Why is PE ratio important?

The PE ratio helps investors understand the true value of a stock and how it compares to similar securities. But it’s really not as technical as it sounds — nor is it a surefire way to pick investments.

What happens to PE ratio when earnings fall?

To understand this from a technical view, remember the formula. If earnings fall but the stock price remains the same, the PE ratio will rise, suggesting the company may not be as valuable as the stock price reflects.

What does a low PE ratio mean?

A low PE ratio may signal that the stock price doesn’t accurately reflect the true value of the company based on its earnings. In this instance, the stock price may stay the same while the company’s earnings increase, which would send the PE ratio lower. Investors may see this as an opportunity to buy the stock with the expectation ...

What happens if a company's stock price jumps?

If its stock price jumps but its earnings stay the same (and no earnings increases are expected), the company’s intrinsic value didn’t change; the market’s perception of the company did.

Why use P/E ratio?

The most common use of the P/E ratio is to gauge the valuation of a stock or index. The higher the ratio, the more expensive a stock is relative to its earnings. The lower the ratio, the less expensive the stock. In this way, stocks and equity mutual funds can be classified as “growth” or “value” investments.

How is P/E ratio calculated?

The P/E ratio is closely related to earnings yield. Where the P/E ratio is calculated by dividing the price of a stock by its earnings, the earnings yield is calculated by dividing the earnings of a stock by a stock’s current price. It expresses earnings as a percentage of a stock’s price.

What Is the PEG Ratio?

The PEG Ratio is also related to the P/E ratio in important ways. Calculated by dividing the P/E ratio by the anticipated growth rate of a stock, the PEG Ratio evaluates a company’s value based on both its current earnings and its future growth prospects.

What is the Shiller P/E ratio?

A third approach is to use average earnings over a period of time. The most well known example of this approach is the Shiller P/E ratio, also known as the CAP/E ratio (cyclically adjusted price earnings ratio).

How long does it take to get a P/E ratio of 25?

If a company’s stock is trading at $100 per share, for example, and the company generates $4 per share in annual earnings, the P/E ratio of the company’s stock would be 25 (100 / 4). To put it another way, given the company’s current earnings, it would take 25 years of accumulated earnings to equal the cost of the investment.

What is earnings yield?

The earnings yield is often compared to current bond interest rates. Referred to by the acronym BEER (bond equity earnings yield ratio), this ratio shows the relationship between bond yields and earnings yields. Some studies suggest that it is a reliable indicator of stock price movements over the short-term.

What websites use trailing P/E?

Many financial websites, such as Google Finance and Yahoo! Finance, use the trailing P/E ratio. Popular investment apps M1 Finance and Robinhood use TTM earnings as well. For example, each of these sites recently reported the P/E ratio of Apple at about 33 (as of early August 2020).