What is the latest stock price for bank of America?

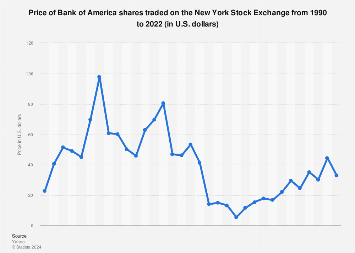

Historical daily share price chart and data for Bank Of America since 1986 adjusted for splits. The latest closing stock price for Bank Of America as of February 04, 2022 is 48.28.

What is the bank of America 52-week high and low price?

The Bank Of America 52-week high stock price is 50.08, which is 3.7% above the current share price. The Bank Of America 52-week low stock price is 32.40, which is 32.9% below the current share price. The average Bank Of America stock price for the last 52 weeks is 41.85.

How has bank of America performed in past financial crises?

How a bank has performed in past financial crises indicates how the same bank will perform in future crises. While this is just a theory, it's corroborated by the history of Bank of America ( NYSE:BAC). As I discuss below, the 111-year-old bank has come within a hair's breadth of failure in every banking crisis since the Panic of 1907.

What has been the result of bank of America's litigation?

The net result for Bank of America has been years of costly litigation, substantial loan losses, and a bloated expense base. By my estimate, it has incurred $91. 2 billion worth of legal fines and settlements since the beginning of 2008, most of which relate to mortgages. For example, in 2011, Bank of America paid $8.

See more

What was Bank of America stock 2008?

30.7568Compare BAC With Other StocksBank Of America Historical Annual Stock Price DataYearAverage Stock PriceAnnual % Change201014.6932-11.42%200912.35316.96%200830.7568-65.87%33 more rows

What happened to Bank of America stock 2009?

Bank of America Needs a Regime Change. 10 Dividend Stocks for the Next Decade and Beyond. One Heckuva Cheap Stock. The Worst Investment in 50 Years....Join Over 1 Million Premium Members Receiving…Closing DateTransactionSizeJanuary 2009Merrill Lynch$44.4 billionJuly 2008Countrywide Financial$4.2 billion3 more rows•Jan 28, 2009

When did Bank of America stock split?

The first split for BAC took place on November 21, 1986. This was a 2 for 1 split, meaning for each share of BAC owned pre-split, the shareholder now owned 2 shares. For example, a 1000 share position pre-split, became a 2000 share position following the split. BAC's second split took place on February 28, 1997.

What was AIG stock price in 2008?

AIG - American International Group, Inc.DateOpenClose*Aug 01, 2008530.40429.80Jul 01, 2008521.80521.00Jun 04, 20084 DividendJun 01, 2008720.00529.2012 more rows

Why did Bank of America stock drop 2008?

By the fall of 2008, borrowers were defaulting on subprime mortgages in high numbers, causing turmoil in the financial markets, the collapse of the stock market, and the ensuing global Great Recession.

Is it good to invest with Bank of America?

BAC is a good buy at the current level given its low valuation, decent dividend yield, tailwinds from the rising interest rate environment, and good loan book growth prospects as it catches up with the deposit growth.

What stock paid the highest dividend?

9 highest dividend-paying stocks in the S&P 500:AT&T Inc. (T)Williams Cos. Inc. (WMB)Devon Energy Corp. (DVN)Oneok Inc. (OKE)Simon Property Group Inc. (SPG)Kinder Morgan Inc. (KMI)Vornado Realty Trust (VNO)Altria Group Inc. (MO)More items...•

Do I lose money if a stock splits?

A stock split doesn't add any value to a stock. Instead, it takes one share of a stock and splits it into two shares, reducing its value by half. Current shareholders will hold twice the shares at half the value for each, but the total value doesn't change.

Did Bank of America raise its dividend?

Bank of America Corporation today announced the Board of Directors declared a regular quarterly cash dividend on Bank of America common stock of $0.22 per share, up $0.01 from the prior quarter. The dividend is payable on September 30, 2022 to shareholders of record as of September 2, 2022.

Why did AIG stock drop?

Too Big To Fail. Simply put, AIG was considered too big to fail. A huge number of mutual funds, pension funds, and hedge funds invested in AIG or were insured by it, or both. Money market funds, generally seen as safe investments for the individual investor, were also at risk since many had invested in AIG bonds.

How much was AIG bailed out for?

$85 billionOn Sept. 16, the Federal Reserve deemed AIG systemically important to the global financial system and provided the company with an $85 billion two-year loan in exchange for a 79.9% equity stake in the company.

When did AIG go public?

1984. AIG begins trading on the New York Stock Exchange.

Is BAC a good dividend stock?

Dividend growth analysis The dividend current stands at $0.84 annually and $0.21 per quarter with a current yield of 2.32%. The dividend growth metrics all have high scores according to Seeking Alpha's dividend growth scorecard over all timeframe for the past 10 years.

Which stock is splitting soon?

Upcoming stock splits in 2022CompanyStock Split RatioPayable DateAmazon (NASDAQ:AMZN)20-for-1June 3, 2022Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG)20-for-1July 15, 2022Shopify (NYSE:SHOP)10-for-1June 28, 2022DexCom (NASDAQ:DXCM)4-for-1June 10, 20221 more row•Jun 8, 2022

What was the last stock to split?

Recent Stock SplitsSymbolDescriptionSplit DateNASDAQ:ELREYINFU GOLD CORP2022-07-27NASDAQ:XELAExela Technologies, Inc.2022-07-26NASDAQ:SNDLSNDL Inc. - Common Shares2022-07-26NASDAQ:MOTSMotus GI Holdings, Inc.2022-07-2691 more rows•4 days ago

How many times has Wells Fargo stock split?

Wells Fargo and (WFC) has 6 splits in our Wells Fargo and stock split history database.

When did Bank of America stock trade?

How much is Bank of America stock worth in 2020?

Yahoo. "Price of Bank of America Shares Traded on The New York Stock Exchange from 1990 to 2020 (in U.S. Dollars)." Statista, Statista Inc., 4 Jan 2021, https://www.statista.com/statistics/378453/price-of-bank-of-america-shares/

How much did Bank of America stock price in 2021?

The price of the Bank of America share amounted to 30.31 U.S. dollars in 2020.

What is Bank of America?

Looking back at BAC historical stock prices for the last five trading days, on July 19, 2021, BAC opened at $36.75, traded as high as $37.25 and as low as $36.51, and closed at $36.93. Trading volume was a total of 83.25M shares.

How much is BAC in 2021?

Bank of America is a bank and financial holding company. Through its subsidiaries, Co. provides banking, investing, asset management and other financial and risk management products and services.

How much did the Bush bailout cost?

On July 23, 2021, BAC opened at $38.20, traded as high as $38.27 and as low as $37.56, and closed at $37.70. Trading volume was a total of 48.63M shares.

How many points did the Dow lose in the two days?

And on Friday, President Bush signed into law the $700 billion bank bailout, which involves the Treasury buying bad debt directly from banks in order to get them to start lending to each other again.

What is the Fed move?

NEW YORK� (CNNMoney.com) -- Wall Street's drubbing continued Tuesday, with a 500-point loss bringing the Dow's two-day slump to nearly 900 points, as the Federal Reserve's plan to loosen credit markets failed to temper investor pessimism.

Will the Fed buy commercial paper?

The Fed move is aimed at creating a market for this kind of debt, ultimately loosening up the frozen credit markets. ( Full story)

Did Bank of America cut its dividend?

Fed plan: The Federal Reserve said Tuesday it will buy commercial paper, short-term debt that companies use to finance daily operations, from individual companies. Panicky investors have been less willing to buy this kind of debt lately, making it hard for companies to get the money they need to operate.

What happened to Bank of America in 2008?

Company news: After the close Monday, Bank of America ( BAC, Fortune 500) reported a steep drop in profit that was short of estimates and cut its dividend. The bank also said it will raise $10 billion through a stock sale and that the company will need to set aside money for bad loans through the coming year. Shares fell over 26% Tuesday. ( Full story)

How much did Bank of America write off in 2008?

In 2008, Bank of America compounded its problems by acquiring Countrywide Financial, the largest mortgage originator in America at the time. It was a blunder of unprecedented proportions. Countrywide had long-since abandoned any semblance of prudence and integrity when it came to underwriting and selling mortgages.

What caused the Federal Reserve to raise short term interest rates to nearly 20%?

But Bank of America's affinity for MBNA soon waned as losses from the combined company' credit card division mounted. It wrote off $20 billion in bad credit card loans in 2008, $29.6 billion in 2009, and $23.1 billion in 2010, split between provisions for loan losses and a goodwill impairment charge to the book value of the credit card franchises. In these three years alone, Bank of America charged off $60 billion more than its normal $4-billion-a-year run-rate for bad credit card loans.

How did Bank of America deplete its capital cushion?

This changed in the 1970s. Soaring oil prices from the oil embargos of 1973 and 1979 triggered rapid inflation, caused the Federal Reserve to raise short-term interest rates to nearly 20%, and resulted in the final breakdown of the international monetary system.

What was the net result of the 1980s?

To complicate things even further, from 2003 to 2007, Bank of America depleted its capital cushion by buying back $40 billion worth of common stock. It's average purchase price was $52 per share. Eighteen months later, the Federal Reserve ordered it to raise $33.9 billion in new capital to absorb losses and build capital. It did so by issuing 3.5 billion new shares at an average price of $13.47 per share. The grand total came out to $47.5 billion. Suffice it to say, the resulting dilution devastated shareholder value, which, to the present day, is off by 70% from its pre-crisis high.

How much did Continental Illinois lose in 1981?

The net result was a series of linked crises in the 1980s that culminated in the less-developed-country crisis. Throughout the period, banks recycled "petrodollars" from oil exporting countries to oil importing countries, principally throughout Central and South America.

How old was the Bank of America in 1907?

According to Hector: Loan write-offs [from 1981-1986] totaled $4.6 billion -- an amount then greater than the average annual income of the population of Sacramento, Louisville, or Tampa.

How much did Bank of America lose in 2009?

As I discuss below, the 111-year-old bank has come within a hair's breadth of failure in every banking crisis since the Panic of 1907. Aside from an agricultural downturn that ravaged banks throughout the 1920s, the next major crisis after the Panic of 1907 was the Great Depression.

When did Bank of America break $30?

However, the fact remains that this recovery for Bank of America has been much longer and more brutal, with its financial crisis era collapse from $55 a share in November 2006 to a mere $3.14 a share in March 2009, a brutal, almost 95%, price collapse. Even with the brutal environment at the time for all financial services companies, ...

Why is Bank of America not appreciated?

Yet after a long and drudging decade, on January 4th, Bank of America finally broke past the $30 mark into that rarefied air and symbolic price range once again. BAC data by YCharts. Let's compare how Bank ...

Is Bank of America a stable bank?

The biggest takeaway is that Bank of America is now just as or even more profitable than it was back then, yet the biggest reason for the share price not having appreciated is the massive dilution that has taken place due to new shares being issued in the wake of the financial crisis and since.

Is Bank of America back at housing boom?

Bank of America is now a much more stable and steady bank, with likely continued growth amid macroeconomic, monetary policy, and regulatory tailwinds as it reaches for its previous highs. Bank of America (NYSE: BAC) begins 2018 steadily climbing again, amid a continuing rich macroeconomic and regulatory environment providing continued tailwinds, ...

Was Bank of America a behemoth?

Bank of America recently began 2018 by rising past the symbolic $30 a share mark, a price not seen since October 2008 in the midst of the financial crisis. Compared to the bank's collapse in the wake of the dot-com boom, this recovery has taken far longer and, by some metrics, isn't over yet. While Bank of America is back at its housing-boom era ...