- We'll add 1 share of free stock to your account when you link your bank account and fulfill the conditions in your promotion. ...

- The shares of free stock are chosen randomly from our inventory of settled shares. ...

- No, each person is only allowed one Robinhood brokerage account.

What free stock does Robinhood give?

A free share of stock (up to $225 value) when you open a commission-free brokerage account. And more free stock (up to a $225 value) every time one of your friends opens a Robinhood account from your promotional link. That's up to $1,000 in free stock every year.Dec 1, 2021

Can you sell Robinhood Free stock?

If you decide to sell the stock that you receive as part of our Referral Program, you're allowed to do so three trading days after you receive it. Once you've sold it, you are free to use the proceeds from the sale towards other stocks that you want to invest in.

Is Robinhood Free stock Safe?

YES–Robinhood is absolutely safe. Your funds on Robinhood are protected up to $500,000 for securities and $250,000 for cash claims because they are a member of the SIPC. Furthermore, Robinhood is a securities brokerage and as such, securities brokerages are regulated by the Securities and Exchange Commission (SEC).Dec 1, 2021

Can you cash out Robinhood?

Withdrawing money from Robinhood is possible. In fact, on every business day, you can make up to 5 withdrawals into your account, which is great. You can even withdraw as much as up to $50,000 per business day. The only thing you need to ensure is that you withdraw the money to the right account.Mar 16, 2022

Does Robinhood report to IRS?

Yes, Robinhood Report to the IRS. The dividends you receive from your Robinhood shares or any profits you earn through selling stocks via the app must be included on your tax return.Mar 5, 2022

What is the catch with Robinhood?

What is the catch with Robinhood? Unlike most online stock brokers, Robinhood does not offer trading of mutual funds; only stocks, ETFs, and crypto, are supported. And while Robinhood does offer commission-free trading, it earns money from your business in a number of ways.Jan 14, 2022

Is Robinhood good for beginners?

Robinhood is a pioneer in the no-commission brokerage model. It remains a solid choice for beginners, as they can invest in stocks, ETFs, and options with zero commissions.Apr 11, 2022

Is Robinhood safe for beginners?

Streamlined interface: Robinhood is extremely easy to use. So easy, in fact, some have argued that it's made complex trading strategies, such as options trading, too accessible to inexperienced users. However, if your only goal is to dabble in stocks, the trimmed-down interface is highly convenient.Apr 11, 2022

What is trading day?

A “trading day” is a day when the market is open. The market is typically open Monday - Friday, depending on the holiday schedule. Understand this if you are looking to sell your free share immediately. Your sell order will have to wait at least two of these days.

Can you invite friends to Robinhood?

No. Robinhood only allows one account to be opened per person to restrict abuse of their free stock promotion. However, you can invite friends and each of you will get a free stock when you do this. By referring friends, you can earn up to an additional $500 in free stock! Not to mention, that $500 limit resets every year.

What is Robinhood Gold?

With Robinhood Gold, those who upgrade can invest up to double their cash. They also get access to “after-hours” trading. In short, Robinhood Gold is similar to a margin account. A margin account allows you to borrow money to invest.

What is the best way to get your feet wet?

Starting to invest in the stock market is the best thing you can do to start building wealth. Robinhood is the best way for you to get your feet wet!

Is Robinhood free to trade?

Free stuff is great, but surely you want to hear more about Robinhood before you sign-up…. …Robinhood is a free-trading app that allows you to trade stocks without paying commissions. Instead of throwing $8 to your brokerage per transaction, you can trade 100% free of charge.

Does Robinhood charge commission?

Best of all, since Robinhood does NOT charge a commission, if you don't like the stocks you are getting for free, just sell them and buy what you want. You should definitely take advantage of this Robinhood Free Stock Giveaway!

How does Robinhood make money?

Robinhood is paid by the market maker for its customers’ orders — a common practice among retail brokers. That’s one way Robinhood makes money, according to its a page on its own site, which a Robinhood spokesperson pointed Money to when asked for comment.

How much does Robinhood Gold cost?

With Robinhood Gold, which starts at $5 per month, customers can participate in margin trading. This allows you to borrow money from Robinhood so that you’re trading more than just your own money — it gives you extra buying power and the potential for bigger returns.

What is bid ask spread?

The bid-ask spread. With no-fee investing, you — as the name entails — don’t pay fees on a trade. But you may be paying something called the bid-ask spread. When you place a market order on an app like Robinhood, you’re telling a broker to get the best price you can right this second.

Does Robinhood charge commission?

Robinhood doesn’t charge any commission fees for its customers to trade stocks, ETFs, crypto or options. You can open an account (and get a free stock), then trade without paying any fees — so yes, in a way, investing with Robinhood is “free.”. But even a company offering “free trading” needs to make money somehow. Here’s how Robinhood does it:

But for some investors, it might actually be worth it

John has found investing to be more interesting and profitable than collectible trading card games. He seeks growth and value stocks in the U.S., in Germany, and beyond!

Free is free

Robinhood is a pioneer of offering free stuff to investors. It was one of the first brokerages to offer commission-free trading in 2013. Now it's offering "free stock" (well, one free share of stock) to new account holders.

Random isn't random

Microsoft, Visa, and Johnson & Johnson are great companies. When I signed up for my Robinhood account, Johnson & Johnson's shares were trading just under $150/share, and Microsoft and Visa were at about $200/share.

Something isn't nothing

As you probably guessed, I didn't get a $200 share of Visa. Instead, I'm now the proud owner of a share of Helix Energy Solutions Group ( NYSE:HLX). I had to laugh, because Helix is an oilfield services company, an underperforming sector I've been saying investors should avoid. Lucky me!

Nothing isn't something

Robinhood isn't alone in advertising a too-good-to-be-true perk for signing up. Brokers Merrill Lynch and TradeStation both advertise cash rewards for new accounts, of "up to $600" and "up to $5,000," respectively. That sounds much better than a lousy $3.60 share of stock!

The deal isn't bad

Earning 3.6% in two days is better than earning 0.5% in 90 days (Merrill) or 1% in 270 days (TradeStation). And it's certainly better than earning nothing because you don't have thousands of dollars to invest.

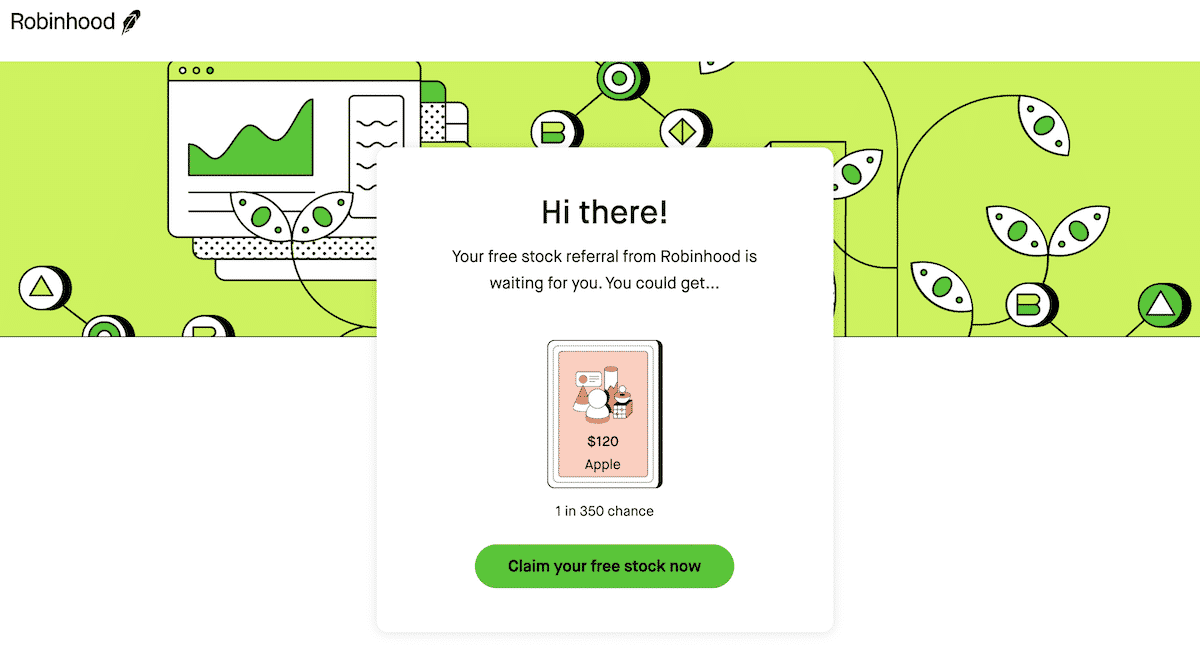

Our Referral Program

We think investing is better with friends, so for everyone you invite to join, you’ll both earn a reward stock. As soon as your friend signs up and links their bank account, we’ll credit each of your accounts with a reward stock. Keep in mind: You can receive up to $500 in reward stocks each calendar year, so feel free to spread the word.

How to Claim Your Reward Stock

Once your reward stock is ready, we’ll send you a notification prompting you to claim your reward. If you forget to tap on the notification, you can claim your reward stock by navigating to Messages to check if you have new claimable stocks under Robinhood Rewards.

How We Choose Your Reward Stock

Each stock is chosen randomly from our inventory of settled shares. The value of the share you receive could be anywhere between $3 and $225, and fluctuates based on market movements. Each stock is selected from our inventory based on the total value and price of each share.

Stock Reward Limit

You can receive up to $500 in stocks per year through this program, and the price of each stock you receive will be listed in your Statements & History.

Taxes

Make sure you consult with your tax advisor on how the receipt and sale of stock will impact your own tax situation. The cash value of the stock at the time you claim it may be reported as “Other Income” on a 1099-Misc form, if applicable. Any gains or losses on the sale of the stock are reported as capital gains or losses.

Is Robinhood 1 Free Share of Stock a Scam?

If you’ve signed up for a Robinhood Financial account, chances are you’ve heard of their unique referral bonus where they promise a free share of stock from a random company for both you and your referred friend. Many people have been asking if this is a legitimate offer or a scam.

How the Robinhood's Referral Program Works

In the bottom right corner of the app tap the Account icon and it will take you to the above screen, where you want to tap “Invite Friends”. For every friend that you invite that applies for a Robinhood account you will both receive one free share of random stock.

How Does Robinhood Choose the Free Stock?

The free stock shares you and your friend receive may not be for the same company as they are randomly chosen from Robinhood’s inventory of settled shares that are set aside for this program. The shares will be worth between $2.50 and $200 and are selected from among the most popular and largest companies that are traded by Robinhood accounts.

Is There a Limit?

Robinhood’s referral program limits the amount of free shares each account can receive to $500 worth of free stock. So if all your referred friends sign up and you get $500 worth of free stock you won’t receive any more free shares for future referrals, however your referrals will still get the free share.

Are There Any Tax Implications?

The cash value of the free shares you receive may be reported as “Other Income” on a 1099-Misc form and therefore subject to taxes. Any capital gains (or losses) that are realized when and if the free shares are sold would be considered capital gains (or losses) and taxed accordingly at year-end.

/cdn.vox-cdn.com/uploads/chorus_image/image/65546976/square_cash_01.0.jpeg)