Unlike par value, a stock’s market price is generally subject to frequent fluctuations and is largely determined by investors’ perception towards the future of stock and the operations of issuing company. The market price of the stocks of successful and well established companies are usually found to be much higher than their par value.

Why is the par value for a stock so low?

Of course, the drawback to setting a par value is that when shares are initially issued at formation, founders must pay the corporation at least the par value per share, but this is a small price to pay to avoid a potentially large franchise tax bill in the future.

What is the difference par value and market value?

Market Value: What's the Difference?

- Book Value vs. Market Value: An Overview. ...

- Book Value. The book value literally means the value of a business according to its books or accounts, as reflected on its financial statements.

- Market Value. The market value represents the value of a company according to the stock market. ...

- Key Differences. ...

- Special Considerations. ...

- Book Value FAQs. ...

- The Bottom Line. ...

What is par stock and what are the benefits?

- You can receive the payouts as and when they are made by the insurer.

- You can make use of these payouts to pay the premium due on your policy.

- You can deposit the bonuses or dividends with the insurer and allow those funds to earn interest.

What's the par value of a stock good for?

Par stock is important for the following reasons:

- Avoid problems like damaging materials because of overstocking.

- Make sure that supplies are properly delivered continuously.

- Par stock is important for the efficiency of budgeting.

- Makes inventory taking more simple.

- Allows business to properly manage and take good control of inventory.

Does par value affect stock price?

The company must indicate the share's no-par value on the stock certificate or within its articles of incorporation. This value does not impact the market value of a stock.

Is par value the same as price per share?

Par value for a share refers to the stock value stated in the corporate charter. Shares usually have no par value or very low par value, such as one cent per share. 2 In the case of equity, the par value has very little relation to the shares' market price.

Is par value the same as issue price?

Face value is also known as par value, it is a stated value of share on which issuer or company want to sell it and market value or issue price is the price that a investor actually pay. When a company issue share or security it has par value means that is minimum amount that an investor must have to pay to the issuer.

What is the difference between par value and purchase price?

Par value vs purchase price A bond with a par value of $10,000 simply means that if you purchase the bond and hold it until the maturity date specified in the contract, you receive $10,000. The purchase price, however, is exactly that: it's what you paid for the bond. Bonds may sell below, at, or above par.

What does $10 par value mean?

In other words, when incorporation papers are made, a par value is assigned saying the company stock is worth at least this much per share. Some companies set their par value at $1 while other set their stocks' par value at $10.

What is par value in stock market?

Par value is the value of a single common share as set by a corporation's charter. It is not typically related to the actual value of the shares. In fact it is often lower. Any stock certificate issued for shares purchased shows the par value.

What does $1 par value mean?

For example, if you set the par value for your corporation's shares at $1, all purchasers of the stock must pay at least this amount for every share they purchase. If you purchase 10,000 shares, you'll have to pay at least $10,000 for them. If you pay only $5,000, you'll owe your corporation another $5,000.

How is stock price calculated?

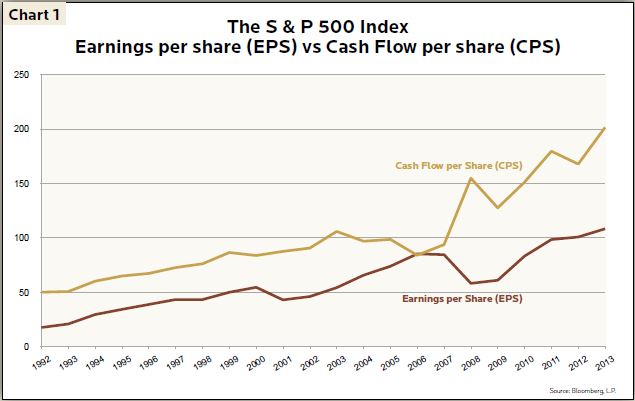

The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.

Why is it called par value?

The entity that issues a financial instrument like a bond or stock assigns a par value to it. Par value refers to the "face value" of a security, and the terms are interchangeable. Par value and face value are most important with bonds, as they represent how much a bond will be worth at the time of the bond's maturity.

How do you calculate par value per share?

The par value of a stock can be determined by dividing the total number of common / preferred stock at par value by the remaining number of outstanding shares.

What is another name for the par value of a preferred stock?

Most preferred stock has a par value or its equivalent under some other name, such as liquidation value or liquidation preference.

What does $1 par value mean?

For example, if you set the par value for your corporation's shares at $1, all purchasers of the stock must pay at least this amount for every share they purchase. If you purchase 10,000 shares, you'll have to pay at least $10,000 for them. If you pay only $5,000, you'll owe your corporation another $5,000.

What is the difference between face value and share price?

The face value can be any value like INR 2, INR 10, or INR 1000. The issue price, also called price band, is the stock's face value plus the premium that a company demands to charge from its investors. In simpler words, The issue price of the share = Face Value of the share + Premium asked by the company on the share.

What is the Par value?

The term par value refers to the price set for security by its issuer. Another term used for this value is face value. However, face value refers to the price imprinted on the security or asset, usually the same as its par value. The term par value can differ based on whether it applies to stocks or bonds.

What is the Market value?

Market value is a term used to determine an asset’s price in a marketplace. Another term used to describe this value is the open market valuation or OMV. In most cases, it refers to the amount a willing market participant will pay to receive an asset on a specific date.

Par value vs Market value: What are the differences?

There are several differences between par value and market value. As mentioned, investors must understand these differences to know how their returns and benefits will differ. The above definitions of both terms helped clarify what each of these was. However, it is crucial to look at the differences between them as well.

Conclusion

The par value and market value are terms that are crucial for investors when investing in the market. The par value of security refers to the amount set by the issuer for that security. On the other hand, the market value is the price for a stock or bond in the market.

What is par value in stock?

Corporations arbitrarily attach a dollar value, or par value, to each class of stock it issues. The corporation uses par value to record the shares issued in the financial records. The actual price received for the stock usually includes an amount greater than par value. The company records the amount received above par value as additional paid in capital. Par value never changes.

How do buyers and sellers determine the market value of each share of stock?

Buyers and sellers determine the market value of each share of stock through the prices they're willing to sell for or to pay for each share. When the demand for a particular stock is greater than the supply of shares available, the price increases. Buyers choose to pay more to receive a share of stock. If the demand for that stock is less than the supply of shares, the price decreases — buyers aren't willing to pay as much for each share.

What is the difference between a stock and a bond?

Stocks carry a higher risk than bonds for most investors. Bond ownership includes receiving regular interest payments and repayment of the principal balance when the bond matures. Bondholders become creditors to the corporation and hold a legal right to receive their money. Certain corporations pay dividends to stockholders, while other corporations keep their profits to fund future growth. Stockholders own a portion of the business indefinitely and receive no future payment for their investment. If a corporation liquidates, the bondholders hold a valid claim to receive their principal. Stockholders receive a distribution of the company’s assets if there's anything left after paying the company’s debts.

What happens to the market value of a bond?

If the interest paid on a bond is less than the current interest paid on similar bonds, the market value declines. If the interest paid is more than the interest paid on similar bonds, the market value increases.