| Previous Close | 61.66 |

|---|---|

| Bid | 61.60 x 800 |

| Ask | 62.07 x 1100 |

| Day's Range | 61.60 - 62.17 |

| 52 Week Range | 58.16 - 69.82 |

What is the price of PSLV stock now?

Since then, PSLV stock has increased by 47.1% and is now trading at $8.56. View which stocks have been most impacted by COVID-19. Who are Sprott Physical Silver Trust's key executives? Who are some of Sprott Physical Silver Trust's key competitors?

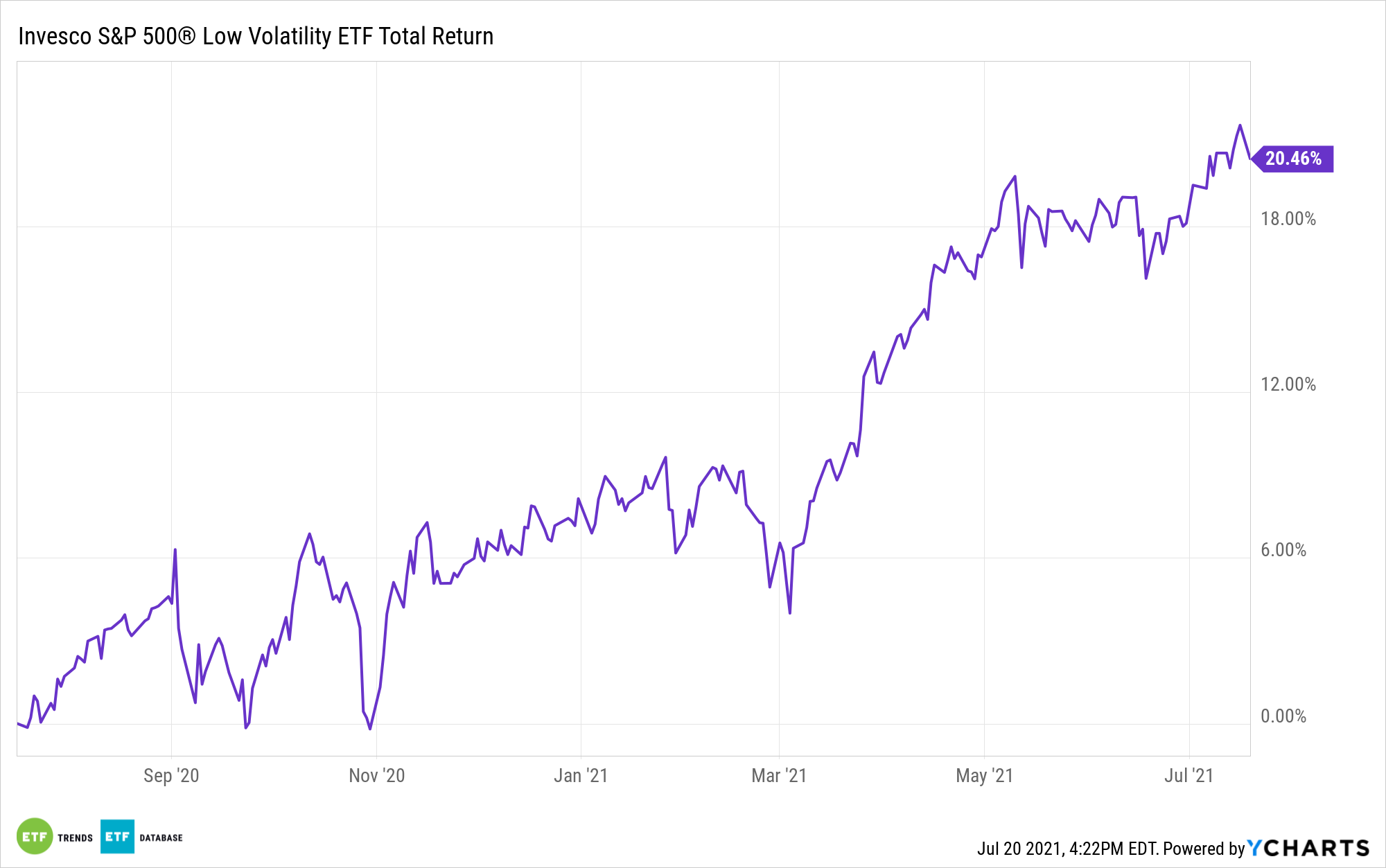

What is the S&P 500 low volatility fund?

The Fund seeks investment results that correspond to the S&P 500 Low Volatility Index. This Index consists of the 100 stocks from the S&P 500 Index with the lowest realized volatility over the past 12 months.

Should you invest in Invesco S&P 500 low volatility ETF?

Invesco S&P 500 Low Volatility ETF offers unbridled exposure to the S&P 500’s least-volatile stocks. Its unconstrained construction breeds pronounced sector tilts that threaten to compromise its low-risk objective. These risks warrant a downgrade to a Morningstar Analyst Rating of Neutral from Silver.

Where can I buy shares of PVL?

Shares of PVL can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

Is Splv a good ETF?

SPLV is rated a 5 out of 5.

Does Vanguard have a low volatility ETF?

Vanguard U.S. Minimum Volatility ETF seeks to provide long-term capital appreciation. The fund invests primarily in U.S. common stocks that when they are combined in a portfolio minimize volatility relative to the broad market, as determined by the advisor.

What is the S&P 500 Low Volatility Index?

The S&P 500 Low Volatility Index measures the performance of the 100 least volatile stocks in the S&P 500® based on their historical volatility. The index is designed to serve as a benchmark for low volatility investing in the US stock market.

What Vanguard fund has the least risk?

Vanguard Short-Term Corporate Bond ETF (VCSH, $77.74) is a low-risk index bond exchange-traded fund that offers investors a healthy yield of 3.6%.

Which ETF has the highest dividend?

Top 100 Highest Dividend Yield ETFsSymbolNameDividend YieldGTOInvesco Total Return Bond ETF7.96%JEPIJPMorgan Equity Premium Income ETF7.95%IAUFiShares Gold Strategy ETF7.85%SDIVGlobal X SuperDividend ETF7.76%92 more rows

Is the S&P 500 low risk?

To answer this, it is important to understand the risks associated with a particular investment. Placing all of one's assets in an index such as the S&P 500, which is concentrated in large-cap US companies, is a high-risk and volatile strategy.

What are the least volatile stocks?

Here are seven potential low volatility stocks to buy for steady returns in 2022:Coca-Cola (NYSE:KO)Regeneron Pharmaceuticals (NASDAQ:REGN)Texas Instruments (NASDAQ:TXN)Infosys (NYSE:INFY)Garmin (NYSE:GRMN)Northrop Grumman (NYSE:NOC)Berkshire Hathaway (NYSE:BRK-A, NYSE:BRK-B)

What type of market is the stock market?

primary marketAs a primary market, the stock market allows companies to issue and sell their shares to the public for the first time through the process of an initial public offering (IPO). This activity helps companies raise necessary capital from investors.

Which ETF has least volatility?

Low Volatility ETF ListSymbolETF Name5 YearJPSTJPMorgan Ultra-Short Income ETF8.51%SPLVInvesco S&P 500® Low Volatility ETF51.58%EEMViShares MSCI Emerging Markets Min Vol Factor ETF8.79%EFAViShares MSCI EAFE Min Vol Factor ETF4.51%4 more rows

Which ETF has lowest risk?

Nine ETFs for low-risk Investors: iShares MSCI USA Min Vol Factor ETF (USMV) Invesco S&P 500 Low Volatility ETF (SPLV) Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

What type of investment has low volatility?

Cash and GICs are low-volatility because there is no risk of losing the amount originally invested (known as the principal). Bond agreements, also known as covenants, also promise that the principal will be paid back when the bond matures.

What is the least volatile investment?

Money Market Mutual Funds Unlike Treasury products and corporate bonds, however, money market funds do offer investors absolute liquidity: They experience virtually no volatility, and you can pull your money out at any time. It's also worth noting that many banks also offer money market mutual funds.

Search halted for woman who jumped off Carnival cruise ship in the Gulf of Mexico

The U.S. Coast Guard had been searching in the area where a woman jumped from her balcony into the sea, but called off its search after canvassing 2,514 square nautical miles.

How sneaker seller GOAT thrived amid global supply chain issues

GOAT Group Co-Founder & CEO Eddy Lu joins Yahoo Finance Live to discuss how the sneaker market is recovering after a pandemic slump, supply chain disruptions, the top sneaker per market, and the possibility of entering the NFT space.

Headlines

Permianville Royalty Trust's (NYSE:PVL) Has Been On A Rise But Financial Prospects Look Weak: Is The Stock Overpriced?

Permianville Royalty Trust (NYSE:PVL) Frequently Asked Questions

Permianville Royalty Trust's stock was trading at $1.28 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organization (WHO). Since then, PVL shares have increased by 77.3% and is now trading at $2.27. View which stocks have been most impacted by COVID-19.

About Sprott Physical Silver Trust

Sprott Physical Silver Trust is a closed-end investment trust company, which engages in the provision of a secure, convenient, and exchange-traded investment alternative for investors interested in holding physical silver bullion without the inconvenience that is typical of a direct investment in physical silver bullion.

Sprott Physical Silver Trust (NYSEARCA:PSLV) Frequently Asked Questions

Sprott Physical Silver Trust's stock was trading at $5.82 on March 11th, 2020 when Coronavirus (COVID-19) reached pandemic status according to the World Health Organization. Since then, PSLV shares have increased by 44.2% and is now trading at $8.39. View which stocks have been most impacted by COVID-19.

How long are futures trading delayed?

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle.

How to calculate restricted stock?

To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded. A company's dividend expressed as a percentage of its current stock price.

How to calculate P/E?

The Price to Earnings (P/E) ratio, a key valuation measure, is calculated by dividing the stock's most recent closing price by the sum of the diluted earnings per share from continuing operations for the trailing 12 month period.

What is market capitalization for companies?

For companies with multiple common share classes, market capitalization includes both classes. Shares Outstanding. Number of shares that are currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. Public Float.

Is Permianville a statutory trust?

Permianville Royalty Trust operates as a statutory trust. It engages in the acquisition and holding of net profits from the sale of oil and natural gas production from certain properties in the states of Texas, Louisiana, and New Mexico held by Enduro Resource Partners...