Will Rockwell Collins Stock pay a dividend in November?

Rockwell Collins trades on the New York Stock Exchange (NYSE) under the ticker symbol "COL.". Rockwell Collins announced a quarterly dividend on Thursday, November 1st. Investors of record on Friday, November 16th will be given a dividend of $0.33 per share on Monday, December 10th.

How much of Rockwell Collins'stock is owned by institutions?

68.70% of the stock of Rockwell Collins is held by institutions. High institutional ownership can be a signal of strong market trust in this company. Earnings for Rockwell Collins are expected to grow by 11.67% in the coming year, from $7.11 to $7.94 per share.

Is Rockwell Collins'PE ratio overvalued or undervalued?

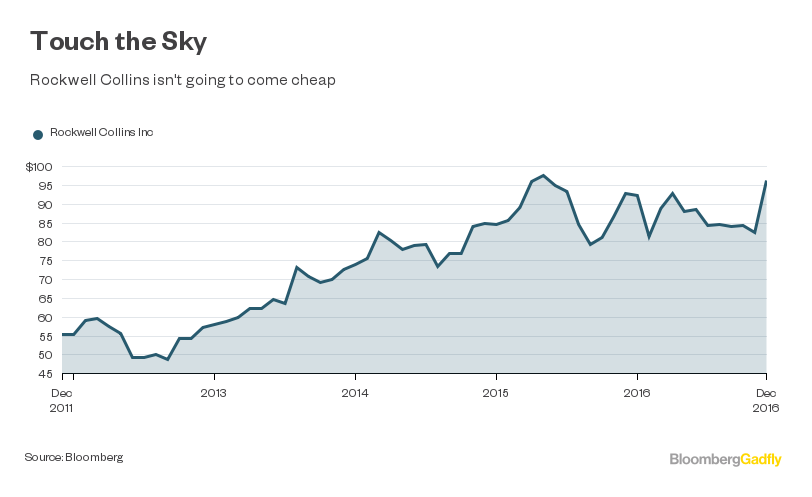

The P/E ratio of Rockwell Collins is 22.93, which means that it is trading at a more expensive P/E ratio than the Aerospace sector average P/E ratio of about 20.43. Rockwell Collins has a PEG Ratio of 1.73. PEG Ratios above 1 indicate that a company could be overvalued. How were Rockwell Collins' earnings last quarter?

How much does Rockwell Collins make a year?

The aerospace company earns $705 million in net income (profit) each year or $6.15 on an earnings per share basis. What is Rockwell Collins' official website? The official website for Rockwell Collins is www.rockwellcollins.com.

How do I find the price of a stock on a certain date?

Use the "Historical Stock Price Values" tool on the MarketWatch website to find stock prices for a specific date. Enter the symbol of the stock, or a keyword for the company if you don't know the stock symbol, into the first box in the tool.

Is Rockwell Collins publicly traded?

Rockwell Collins becomes a stand-alone publicly traded company.

What is the stock symbol for Rockwell Collins?

Stock Quote (U.S.: NYSE) | MarketWatch....$ 220.01.CloseChgChg %$220.504.642.15%

What happened to Rockwell Collins stock?

(“Rockwell Collins” and, such transaction, the “Merger”), all shares of Rockwell Collins common stock have been canceled and converted into the right to receive $93.33 per share in cash, without interest and 0.37525 shares of UTC common stock, plus cash in lieu of fractional shares (collectively, the “Merger ...

Did Raytheon buy Rockwell Collins?

United Technologies and Raytheon closed the merger on Friday and the company will have a new name, Raytheon Technologies Corporation. In late 2018, United Technologies completed its purchase of Rockwell Collins, then changing the Rockwell name to Collins Aerospace.

Is ROK a buy?

Out of 13 analysts, 3 (23.08%) are recommending ROK as a Strong Buy, 1 (7.69%) are recommending ROK as a Buy, 7 (53.85%) are recommending ROK as a Hold, 0 (0%) are recommending ROK as a Sell, and 2 (15.38%) are recommending ROK as a Strong Sell.

Who owns Collins Aerospace?

Raytheon Technolog...United Technolog... CorporationCollins Aerospace/Parent organizations

Is Collins Aerospace a public company?

The company was acquired by United Technologies Corporation on November 27, 2018, and now operates as part of Collins Aerospace, a subsidiary of Raytheon Technologies....Rockwell Collins.TypeSubsidiaryTraded asNYSE: COLIndustryAerospace industry, DefenseFounded2001FounderArthur A. Collins11 more rows

Who owns Rockwell Collins?

Raytheon TechnologiesRockwell Collins / Parent organizationUnited Technologies (UTC) has received final regulatory approval to buy Rockwell Collins in one of the largest acquisitions in the history of the aerospace manufacturing industry. Under the new acquisition, Rockwell Collins will become Collins Aerospace in a combined re-structuring with UTC Aerospace Systems.

Who bought out Rockwell Collins?

Farmington, Connecticut-based United Technologies Corp. (UTC) has completed its acquisition of Rockwell Collins and intends to separate its other commercial businesses, Otis and Carrier (formerly Climate, Controls & Security (CCS), into three independent companies.

Why did UTC buy Rockwell Collins?

“Together, Rockwell Collins and UTC Aerospace Systems will enhance customer value in a rapidly evolving aerospace industry by making aircraft more intelligent and more connected.”

2 COL 10 Years Stock Chart

3 Rockwell Collins Inc (COL) Stock Chart 5 Years (Recent History)

Note: Long term investors give importance to long term charts (typically covering decades). The 10-year timeframe is a popular range of analysis used by value investors.

4 COL Stock 3-Year Chart

Note: Generally, an investing duration of around 5 years can be considered medium-term. Such investors would be naturally interested in knowing the performance data of a stock for the past 5 years. This data along with many other metrics will help them analyze the returns for the next 5 years.

5 COL Stock 1-Year Chart

Now let us see the 3-year historical chart of COL. This chart will help both short and medium-term investors in their analysis.

6 Rockwell Collins Inc (COL) Stock 6 Months Chart

Most recent performances get captured in short-term charts. Now let us see the 1-year price chart of Rockwell Collins Inc (COL). The duration of the plot is between 2017-11-26 and 2018-11-26.

Conclusion

Now we have entered the final section of this report. We are going to see a 6-month historical graph of COL.

Want to become a smart investor?

Pictures speak better than words. Hopefully, the bunch of Rockwell Collins Inc (COL) historical charts you just witnessed will help you analyze deep before and during investing.

How much does Rockwell Collins make?

Netcials reports section helps you with deep insights into the performance of various assets over the years. We are constantly upgrading and updating our reports section. Feel free to access them. Do not forget to leave your feedback.

What is the official website of Rockwell Collins?

Rockwell Collins has a market capitalization of $23.18 billion and generates $6.82 billion in revenue each year. The aerospace company earns $705 million in net income (profit) each year or $6.15 on an earnings per share basis.

What is the P/E ratio of Rockwell Collins?

The official website for Rockwell Collins is www.rockwellcollins.com.

Does Rockwell Collins have a long track record of dividend growth?

The P/E ratio of Rockwell Collins is 22.93, which means that it is trading at a more expensive P/E ratio than the Aerospace sector average P/E ratio of about 22.06.

Who bought Rockwell Collins?

Rockwell Collins does not have a long track record of dividend growth.

When did United Technologies buy Rockwell Collins?

United Technologies Corporation UTX has completed the acquisition of Rockwell Collins, Inc. COL , after having received China's regulatory body's approval a day before. Further, this conglomerate took the market by surprise as it communicated about its intention to separate into three independent companies.

How much did Zacks earnings increase in 2018?

The September 2017 buyout deal was finally completed on Nov 26, 2018.

What is Zacks research?

In the past 60 days, the Zacks Consensus Estimate for earnings on the stock has increased 0.7% to $7.27 for 2018 and decreased 1.4% to $7.76 for 2019. Further, these estimates represent year-over-year growth of 9.3% for 2018 and 6.8% for 2019.

What is United Technologies' 2018 revenue?

Zacks is the leading investment research firm focusing on stock research, analysis and recommendations. In 1978, our founder discovered the power of earnings estimate revisions to enable profitable investment decisions. Today, that discovery is still the heart of the Zacks Rank. A wealth of resources for individual investors is available at www.zacks.com.

Is Rockwell Collins a part of United Technologies?

Likewise, free cash flow projection was revised down from $4.5-$5 billion to $4.25-$4.5 billion. On the other hand, revenues are now predicted to be $64.5-$65 billion, reflecting growth from the earlier $64-$64.5 billion. Organic sales are still anticipated to be roughly 6%.