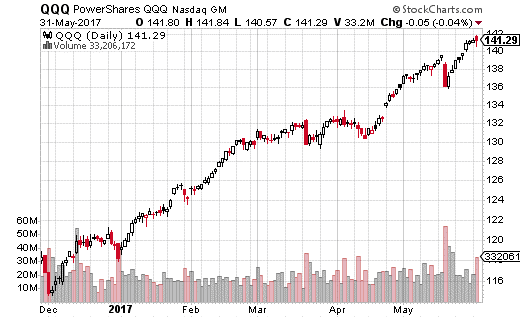

Predictions QQQ Stock Trend Given the current short-term trend, the ETF

Exchange-traded fund

An exchange-traded fund is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs track an index, such as a stock index or bond index. ETFs may be attractive as inve…

...

Predicted Opening Price for PowerShares QQQ Trust of Monday, July 25, 2022.

| Fair opening price July 25, 2022 | Current price |

|---|---|

| $303.55 | $301.99 (Undervalued) |

Is QQQ a good stock?

Ethereum, Ripple and altcoins could see a similar bearish fate. It's fair to say 2022 has not been a good one for investors in semi conductor stocks. After a surging year in 2021 investors would have been hoping the strong momentum was set to continue into ...

Is QQQ a good investment?

Yes, the QQQ is a good investment. You can possibly make more by getting the variants on QQQ. Let's suppose you had set up this investment portfolio 5 years ago: 1/3 QYLD, 1/3 QQQ and 1/3 QLD. The total return would have been 334%. (That beats QQQ by over 100%). I provide more details in my post below. https://www.patreon.com/posts/55629262

Should you buy QQQ stock?

Throughout much of the pandemic, it seemed the stock market was on fire. The Invesco QQQ ... buy back up to an additional $1.5 billion of stock during the next year. 3. Paycom: The rise of self-service means solid growth for years to come. It's a trend you ...

Is QQQ a good buy?

The Invesco QQQ ETF ( NASDAQ: QQQ) is one of the most important tech ETFs investors can put into their portfolios. Its strong capital appreciation in recent years has made the ETF a good investment, but with interest rates continuing to climb, "growthy", expensive names will likely not outperform in the coming years.

What is a good price for QQQ?

QQQ Price/Volume Stats - 7 Best ETFs for the NEXT Bull MarketCurrent price$307.3852-week highDay low$300.78VolumeDay high$307.43Avg. volume50-day MA$292.70Dividend yield200-day MA$346.701 more row

Will QQQ go up tomorrow?

There's a good chance that this upwards movement will continue tomorrow as well....Munafa value: 75 as on 20 Wed Jul 2022.Upside target308.04Upside target303.25Downside target301.73Downside target300.78Downside target299.235 more rows

Is QQQ a buy or a sell?

According to Seeking Alpha's Quant Rating system, QQQ is a buy at current levels with healthy asset flows, stable dividends, and a low expense ratio. However, the rating for momentum and risk is worsening, and this is something investors need to watch closely over the coming months.

What is the average return on QQQ?

Quarter-End Average Annual Total Returns As of 06/30/2022AverageNAV ReturnMarket Return1 Year-20.52-20.66%3 Year+15.19+14.93%5 Year+16.14+15.79%10 Year+17.02+16.61%2 more rows

Which is better QQQ or VOO?

If you want a single diversified investment that may not earn as much but carries less risk, VOO may be your best. On the other hand, if you're willing to take on more risk for the chance at earning higher returns, QQQ could be a solid addition to your investments.

Which is better SPY or QQQ?

QQQ is purely large cap growth stocks, which are looking extremely expensive relative to history, and fundamentals do not explain their expensiveness. SPY is basically the same thing as VOO from Vanguard; they track the same index. QQQ has a fee of 0.20%. SPY is cheaper at 0.09%.

Is QQQ good long term?

The most profitable companies in the world increased in value the most. That's how it should work, and I expect QQQ to continue being an excellent long-term investment. Assuming your time horizon is shorter, and you're more active in your trading, the three-year total return chart below may be of better value.

Is Tesla in the QQQ?

The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index....QQQ ETF Top Holdings.Invesco QQQ ETF Top HoldingsStockShare of QQQAmazon (AMZN)7.83%Tesla Inc. (TSLA)4.53%Alphabet C Shares (GOOG)4.02%7 more rows

Does QQQ have a dividend?

Invesco QQQ Trust (QQQ) QQQ has a dividend yield of 0.66% and paid $1.87 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Jun 21, 2022.

Is QQQ ETF a good investment?

The QQQ mirrors the Nasdaq-100, which means it's technology-weighted, giving insight into how the technology sector is performing as a whole. In the 10 years from Dec. 31, 2011, to Dec. 31, 2021, the Invesco QQQ ETF has outperformed the S&P 500 with an average annual return of 20.27% versus 14.26%.

What is the highest QQQ has ever been?

Invesco QQQ - 23 Year Stock Price History | QQQThe all-time high Invesco QQQ stock closing price was 403.99 on November 19, 2021.The Invesco QQQ 52-week high stock price is 408.71, which is 33% above the current share price.More items...

Is QQQ good for Roth IRA?

The Invesco QQQ (NASDAQ: QQQ ) is ideal for younger Roth IRA investors with the benefits of time and higher risk tolerance. One of the most venerable broad market ETFs in the U.S., QQQ tracks the Nasdaq-100 Index and is known for being a reliable proxy on the technology sector without being a dedicated technology ETF.

Is QQQ a buy Zacks?

Zacks proprietary quantitative models divide each set of ETFs following a similar investment strategy (style box/industry/asset class) into three risk categories- High, Medium, and Low....Zacks Premium Research for QQQ.Zacks RankDefinition1Strong Buy2Buy3Hold4Sell1 more row

Is Invesco QQQ Trust a good investment?

The Invesco QQQ ETF (NASDAQ:QQQ) is one of the most important tech ETFs investors can put into their portfolios. Its strong capital appreciation in recent years has made the ETF a good investment, but with interest rates continuing to climb, "growthy", expensive names will likely not outperform in the coming years.

Should I buy spy stock?

If you're a long-term investor, any time is a good time to buy SPY stock. Given how diversified it is, SPY is the ultimate "set it and forget it" stock. Over the long term, the S&P 500 has returned 9.9% a year on average since 1928 including dividends, says IFA.com.

What stock should I buy now?

10 Stocks to Buy Now According to David Einhorn's Greenlight...Gulfport Energy Corporation (NASDAQ:GPOR) Greenlight Capital's Stake Value: $10,162,000. ... PLBY Group, Inc. (NASDAQ:PLBY) ... Civitas Resources Inc (NYSE:CIVI) ... TD SYNNEX Corporation (NYSE:SNX) ... International Seaways, Inc.

How has Invesco QQQ Trust's stock price performed in 2022?

Invesco QQQ Trust's stock was trading at $397.85 on January 1st, 2022. Since then, QQQ stock has decreased by 27.4% and is now trading at $288.84....

How often does Invesco QQQ Trust pay dividends? What is the dividend yield for Invesco QQQ Trust?

Invesco QQQ Trust declared a quarterly dividend on Friday, March 18th. Shareholders of record on Tuesday, March 22nd will be paid a dividend of $0....

Is Invesco QQQ Trust a good dividend stock?

Invesco QQQ Trust(NASDAQ:QQQ) pays an annual dividend of $1.74 per share and currently has a dividend yield of 0.60%. View Invesco QQQ Trust's div...

Who are some of Invesco QQQ Trust's key competitors?

Some companies that are related to Invesco QQQ Trust include SPDR S&P 500 ETF Trust (SPY) , JPMorgan Chase & Co. (JPM) , Bank of America (BAC) ,...

What other stocks do shareholders of Invesco QQQ Trust own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Invesco QQQ Trust investors own include NVIDIA (NVDA) , S...

What is Invesco QQQ Trust's stock symbol?

Invesco QQQ Trust trades on the NASDAQ under the ticker symbol "QQQ."

Who are Invesco QQQ Trust's major shareholders?

Invesco QQQ Trust's stock is owned by many different institutional and retail investors. Top institutional investors include Bank of America Corp D...

Which major investors are selling Invesco QQQ Trust stock?

QQQ stock was sold by a variety of institutional investors in the last quarter, including Bank of America Corp DE, Select Equity Group L.P., TD Ass...

Which major investors are buying Invesco QQQ Trust stock?

QQQ stock was acquired by a variety of institutional investors in the last quarter, including Deer Park Road Corp, Simplex Trading LLC, Jane Street...

How accurate is Invesco QQQ?

Invesco QQQ Trust has risen higher in 18 of those 22 years over the subsequent 52 week period, corresponding to a historical accuracy of 81.82 %

Will Invesco QQQ Trust Stock Go Up Next Year?

Over the next 52 weeks, Invesco QQQ Trust has on average historically risen by 9.8% based on the past 21 years of stock performance.

How much is PowerShares QQQ stock worth in 2021?

The PowerShares QQQ Trust stock price gained 0.62% on the last trading day (Friday, 9th Jul 2021), rising from $358.77 to $361.01. During the day the stock fluctuated 1.10% from a day low at $357.57 to a day high of $361.50. The price has risen in 7 of the last 10 days and is up by 3.18% over the past 2 weeks. Volume fell on the last day by -16 million shares and in total, 34 million shares were bought and sold for approximately $12.33 billion. You should take into consideration that falling volume on higher prices causes divergence and may be an early warning about possible changes over the next couple of days.

Is PowerShares QQQ stock a buy or sell signal?

The PowerShares QQQ Trust stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. On corrections down, there will be some support from the lines at $397.24 and $380.48. A breakdown below any of these levels will issue sell signals. A buy signal was issued from a pivot bottom point on Monday, October 04, 2021, and so far it has risen 14.57%. Further rise is indicated until a new top pivot has been found. Volume fell during the last trading day despite gaining prices. This causes a divergence between volume and price and it may be an early warning. The stock should be watched closely. Some negative signals were issued as well, and these may have some influence on the near short-term development. Furthermore, there is currently a sell signal from the 3 month Moving Average Convergence Divergence (MACD).

Is PowerShares QQQ a buy candidate?

PowerShares QQQ Trust holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

Is PowerShares QQQ Trust ETF A Buy?

PowerShares QQQ Trust holds several negative signals and is within a wide and falling trend, so we believe it will still perform weakly in the next couple of days or weeks. We therefore hold a negative evaluation of this ETF.

What does prediction tell AI Pickup?

This prediction tells AI Pickup's opinion about price Direction (Up or Down) with a specific closing date.

Is Invesco QQQ a good investment?

From Invesco QQQ etf forecast 2031, Invesco QQQ (QQQ) etf can be a good investment choice. According to AI Pickup, the Invesco QQQ etf price forecast for Nov. 2031 is $426.846831446276

About PowerShares QQQ Trust

The investment seeks investment results that generally correspond to the price and yield performance of the index.

Golden Star Signal

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Stock Podcast

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

Invesco QQQ Trust, Series 1 (QQQ) stock price prediction for the next 5 days on 22 Feb 2022

5-Day prediction shows that the price will grow by 19.6% probability and have a downward trend by 0% probability. Moreover, the probability that Invesco QQQ Trust, Series 1 (QQQ) price has no a definite trend is 80.4% (The price fluctuation will be experienced).

Invesco QQQ Trust, Series 1 (QQQ) stock price prediction for the next 10 days on 22 Feb 2022

10-Day prediction shows that the price will grow by 0% probability and have a downward trend by 13.47% probability. Moreover, the probability that Invesco QQQ Trust, Series 1 (QQQ) price has no a definite trend is 86.53% (The price fluctuation will be experienced).

Invesco QQQ Trust, Series 1 (QQQ) stock price prediction for the next 30 days on 22 Feb 2022

30-Day prediction shows that the price will grow by 0% probability and have a downward trend by 4.4% probability. Moreover, the probability that Invesco QQQ Trust, Series 1 (QQQ) price has no a definite trend is 95.6% (The price fluctuation will be experienced).

Users forecasts for Invesco QQQ Trust, Series 1 (QQQ)

In this section, you can easily predict without user registration. See also other users predictions.

What is ProShares UltraPro QQQ's stock symbol?

ProShares UltraPro QQQ trades on the NASDAQ under the ticker symbol "TQQQ."

When did ProShares UltraPro QQQ's stock split? How did ProShares UltraPro QQQ's stock split work?

Shares of ProShares UltraPro QQQ split on the morning of Thursday, January 13th 2022. The 2-1 split was announced on Thursday, January 13th 2022. The newly minted shares were issued to shareholders after the closing bell on Thursday, January 13th 2022. An investor that had 100 shares of ProShares UltraPro QQQ stock prior to the split would have 200 shares after the split.

What other stocks do shareholders of ProShares UltraPro QQQ own?

Based on aggregate information from My MarketBeat watchlists, some companies that other ProShares UltraPro QQQ investors own include NVIDIA (NVDA), Tesla (TSLA), Alibaba Group (BABA), Invesco QQQ Trust (QQQ), Micron Technology (MU), Square (SQ), Walt Disney (DIS), Netflix (NFLX), Boeing (BA) and PayPal (PYPL).

Where are ProShares UltraPro QQQ's headquarters?

ProShares UltraPro QQQ is headquartered at 7501 Wisconsin Avenue Suite 1000, Bethesda, 20814, United States .