Is Pearson PLC (pson) a good stock to buy?

According to analysts' consensus price target of GBX 844.50, Pearson has a forecasted upside of 7.1% from its current price of GBX 788.40. Pearson has been the subject of 6 research reports in the past 90 days, demonstrating strong analyst interest in this stock. There is no current short interest data available for PSON.

What are analysts' 1 year price targets for Pearson's stock?

8 Wall Street research analysts have issued 1 year price objectives for Pearson's stock. Their PSON stock forecasts range from GBX 742 to GBX 1,000. On average, they predict Pearson's share price to reach GBX 844.50 in the next year. This suggests a possible upside of 7.1% from the stock's current price.

What is Pearson's stock symbol?

What is Pearson's stock symbol? Pearson trades on the New York Stock Exchange (NYSE) under the ticker symbol "PSO." Who are Pearson's major shareholders? Pearson's stock is owned by a variety of institutional and retail investors.

When will Pearson stock pay a dividend?

Pearson announced a semi-annual dividend on Thursday, March 3rd. Stockholders of record on Friday, March 25th will be paid a dividend of $0. 1894 per share on Wednesday, May 11th. This represents a yield of 3. 2%. The ex-dividend date is Thursday, March 24th. This is an increase from Pearson's previous semi-annual dividend of $0. 09.

See more

Is Pearson a good stock to buy?

Pearson is a leading dividend payer. It pays a dividend yield of 3.67%, putting its dividend yield in the top 25% of dividend-paying stocks.

Why are Pearson shares dropping?

Shares in Pearson and Imperial Brands dropped sharply in opening trade following downbeats updates from both companies. Pearson's share price dropped by 13.4% to 745p after the educational publisher said its full-year profits will be at the lower end of expectations because of weaker trading in the US.

How much is the company Pearson worth?

$7.03B.Pearson net worth as of July 22, 2022 is $7.03B. Pearson is a global media conglomerate. They publish books, periodicals, reports and screen-based services for professional communities worldwide, under brand names which include the Financial Times, Pitman Publishing andChurchill Livingstone.

Is Pearson a publicly traded company?

Pearson has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has a secondary listing on the New York Stock Exchange in the form of American depositary receipts.

Why is Pearson stock rising?

Pearson shares jump over 5% in response to raised earnings guidance. Shares in education group Pearson (PSON) jumped 5.7% to 668p after the firm upgraded its full year annual profits guidance.

How do I buy Darktrace stock?

How to trade Darktrace sharesCreate an account or log in.Search for 'Darktrace' on our trading platform.Select 'buy' to go long or 'sell' to go short in the deal ticket.Set your position size and take steps to manage your risk.Open and monitor your position.

Is Pearson a Fortune 500?

Pearson has been plagued of late by loss of mega contracts, dramatic drop in share value, shedding of major assets, virtual information overload, and a business model that even MBAs cannot understand.

What companies does Pearson own?

Pearson owns educational media brands including Addison–Wesley, Peachpit, Prentice Hall, eCollege, Longman, Scott Foresman, and others. Pearson is part of Pearson plc, which formerly owned the Financial Times.

Where is Pearson headquartered?

London, United KingdomPearson / Headquarters

What Pearson sells?

We are the world's leading learning company, serving customers in nearly 200 countries with digital content, assessments, qualifications, and data. For us, learning isn't just what we do. It's who we are.

Who is the CEO of Pearson?

Andy Bird (Oct 19, 2020–)Pearson / CEOThe Pearson Executive Team is rated a "C-" and led by CEO Andy Bird. Pearson employees rate their Executive Team in the Bottom 30% of similar size companies on Comparably with 10,000+ Employees.

Who is the owner of Pearson VUE?

In 1994, Clarke Porter, Steve Nordberg, and Kirk Lundeen launched Virtual University Enterprises (VUE), a world-class training services company, which was eventually acquired by NCS and then Pearson in 2000 to become the leading computer-based testing company in the world.

Is PSO stock a buy right now?

10 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Pearson in the last twelve months. There are currently 1 sell ra...

How has Pearson's stock price performed in 2022?

Pearson's stock was trading at $8.40 on January 1st, 2022. Since then, PSO stock has increased by 12.6% and is now trading at $9.46. View the best...

Are investors shorting Pearson?

Pearson saw a decline in short interest in May. As of May 15th, there was short interest totaling 1,200,000 shares, a decline of 14.9% from the Apr...

How often does Pearson pay dividends? What is the dividend yield for Pearson?

Pearson declared a semi-annual dividend on Thursday, March 3rd. Shareholders of record on Friday, March 25th will be paid a dividend of $0.1894 per...

Is Pearson a good dividend stock?

Pearson(NYSE:PSO) pays an annual dividend of $0.35 per share and currently has a dividend yield of 3.65%. View Pearson's dividend history .

Who are Pearson's key executives?

Pearson's management team includes the following people: Mr. Adam Bird CBE , CEO & Director (Age 58, Pay $8.87M) Ms. Sally Kate Miranda Johnson...

What is Andy Bird's approval rating as Pearson's CEO?

36 employees have rated Pearson CEO Andy Bird on Glassdoor.com . Andy Bird has an approval rating of 89% among Pearson's employees.

Who are some of Pearson's key competitors?

Some companies that are related to Pearson include John Wiley & Sons (WLYB) , John Wiley & Sons (WLY) , Scholastic (SCHL) , Lingo Media (LMDCF)...

What other stocks do shareholders of Pearson own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Pearson investors own include Pearson (PSON) , Energy Tra...

Is PSON stock a buy right now?

8 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Pearson in the last twelve months. There are currently 1 sell rat...

Will Pearson's stock price go up in 2022?

8 brokers have issued 1-year price objectives for Pearson's stock. Their forecasts range from GBX 625 to GBX 1,000. On average, they predict Pearso...

How has Pearson's stock price performed in 2022?

Pearson's stock was trading at GBX 613.20 at the beginning of the year. Since then, PSON shares have increased by 22.1% and is now trading at GBX 7...

When is Pearson's next earnings date?

Pearson is scheduled to release its next quarterly earnings announcement on Thursday, July 28th 2022. View our earnings forecast for Pearson .

How were Pearson's earnings last quarter?

Pearson plc (LON:PSON) issued its quarterly earnings data on Friday, July, 24th. The company reported ($5.10) earnings per share for the quarter, m...

How often does Pearson pay dividends? What is the dividend yield for Pearson?

Pearson announced a dividend on Friday, February 25th. Investors of record on Thursday, March 24th will be paid a dividend of GBX 14.20 per share o...

Is Pearson a good dividend stock?

Pearson(LON:PSON) pays an annual dividend of GBX 0.20 per share and currently has a dividend yield of 2.73%. The dividend payout ratio of Pearson i...

Who are Pearson's key executives?

Pearson's management team includes the following people: Mr. Adam Bird CBE , CEO & Director (Age 58, Pay $7.11M) Ms. Sally Kate Miranda Johnson...

Who are some of Pearson's key competitors?

Some companies that are related to Pearson include Transcontinental (TCL.A) , Transcontinental (TCL.B) , Euromoney Institutional Investor (ERM)...

What is the ticker symbol for Pearson?

What is Pearson's business?

Pearson trades on the New York Stock Exchange (NYSE) under the ticker symbol "PSO."

What is Pearson's P/B ratio?

Pearson plc provides educational materials and learning technologies. The company operates in four segments: Global Online Learning, Global Assessment, North America Courseware, and International. It provides test development, processing, and scoring services to governments, educational institutions, corporations, and professional bodies. The company also offers content across the curriculum and a range of education services, including teacher development, educational software, and system-wide solutions, as well as owns and operates colleges and schools comprising virtual schools. It provides content, assessment, and digital services to schools, colleges, and universities, as well as professional and vocational education to learners. Pearson plc was founded in 1844 and is headquartered in London, the United Kingdom.

Where is Pearson headquartered?

Pearson has a P/B Ratio of 1.21. P/B Ratios below 3 indicates that a company is reasonably valued with respect to its assets and liabilities.

Does Pearson have a long track record of dividend growth?

It provides content, assessment, and digital services to schools, colleges, and universities, as well as professional and vocational education to learners. Pearson plc was founded in 1844 and is headquartered in London, the United Kingdom. Read More.

Who took over Pearson airport?

Pearson does not have a long track record of dividend growth.

Is Pearson a hold?

Deborah Flint had lofty plans when she took over Pearson airport. Then the harsh reality of COVID-19 hit - The Globe and Mail

Who is the next chief executive of Pearson?

Wall Street analysts have given Pearson a "Hold" rating, but there may be better buying opportunities in the stock market. Some of MarketBeat's past winning trading ideas have resulted in 5-15% weekly gains. MarketBeat just released five new stock ideas, but Pearson wasn't one of them.

How much did Pearson make in 2020?

Education publisher Pearson has tapped Andy Bird as its next chief executive, turning to a media veteran who helped build Walt Disney's consumer online business to complete its tricky digital transforma...

What is Pearson plc?

In 2020, Pearson's revenue was 3.40 billion, a decrease of -12.20% compared to the previous year's 3.87 billion. Earnings were 310.00 million, an increase of 17.42%.

How much did Pearson pay to settle the cyber intrusion?

Pearson plc provides educational materials and learning technologies. The company operates in four segments: Global Online Learning, Global Assessment, North America Courseware, and International. It provides test development, processing, and scoring services to governments, educational institutions, corporations, and professional bodies. The company also offers content across the curriculum and a range of education services, including teacher development, educational software, and system-wide solutions, as well as owns and operates colleges an... [Read more...]

What is Pearson stock trading at?

London-based Pearson PLC will pay $1 million to settle charges it misled investors about a 2018 cyber intrusion involving the theft of millions of student records, the U.S. Securities and Exchange Commi...

What is the ticker symbol for Pearson?

Pearson's stock was trading at GBX 539.20 on March 11th, 2020 when Coronavirus (COVID-19) reached pandemic status according to the World Health Organization. Since then, PSON stock has increased by 51.2% and is now trading at GBX 815.20. View which stocks have been most impacted by COVID-19.

What is the P/E ratio of Pearson?

Pearson trades on the London Stock Exchange (LON) under the ticker symbol "PSON."

What is Pearson's business?

The P/E ratio of Pearson is 16.54, which means that it is trading at a more expensive P/E ratio than the Consumer Cyclical sector average P/E ratio of about 15.74.

Is Pearson a hold?

Pearson plc provides educational materials and learning technologies. The company operates in four segments: Global Online Learning, Global Assessment, North America Courseware, and International. It provides test development, processing, and scoring services to governments, educational institutions, corporations, and professional bodies. The company also offers content across the curriculum and a range of education services, including teacher development, educational software, and system-wide solutions, as well as owns and operates colleges and schools comprising virtual schools. It provides content, assessment, and digital services to schools, colleges, and universities, as well as professional and vocational education to learners. Pearson plc was founded in 1844 and is headquartered in London, the United Kingdom.

Does Pearson have a long track record of dividend growth?

Wall Street analysts have given Pearson a "Hold" rating, but there may be better buying opportunities in the stock market. Some of MarketBeat's past winning trading ideas have resulted in 5-15% weekly gains. MarketBeat just released five new stock ideas, but Pearson wasn't one of them.

What is Pearson's business?

Pearson does not have a long track record of dividend growth.

Is Pearson plc listed on the NYSE?

Pearson plc provides educational materials and learning technologies. The company operates in four segments: Global Online Learning, Global Assessment, North America Courseware, and International. It provides test development, processing, and scoring services to governments, educational institutions, corporations, and professional bodies. The company also offers content across the curriculum and a range of education services, including teacher development, educational software, and system-wide solutions, as well as owns and operates colleges and schools comprising virtual schools. It provides content, assessment, and digital services to schools, colleges, and universities, as well as professional and vocational education to learners. Pearson plc was founded in 1844 and is headquartered in London, the United Kingdom.

Business Performance Continues to be Underwhelming

Pearson plc is listed on the NYSE as (NYSE:PSO).

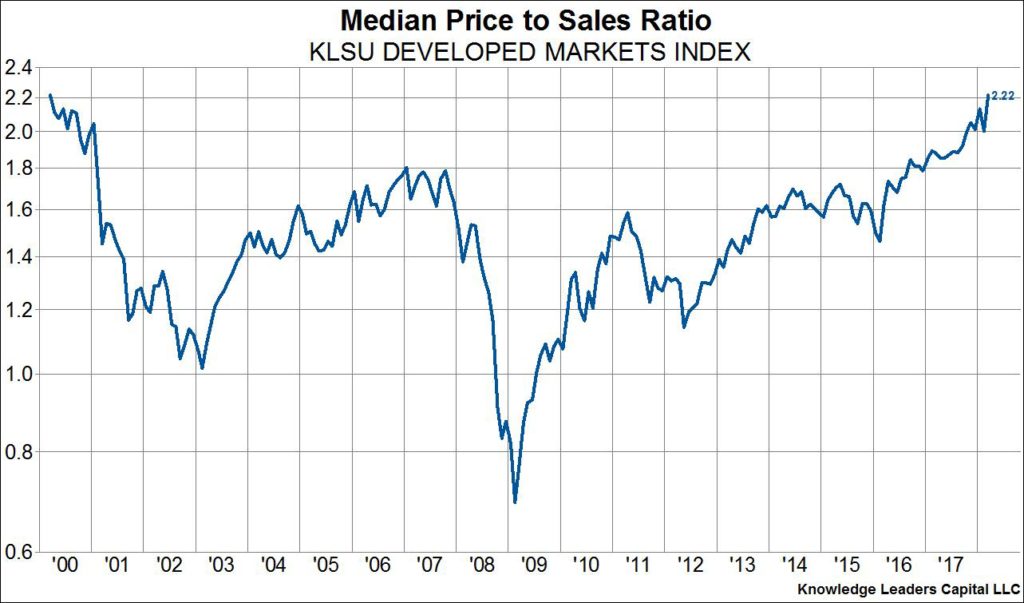

Valuation

The company’s results last year were predictably weak in some areas. That said, basic earnings per share did grow and the company held its dividend flat which while unexciting is better than a cut.

Sales fall by double digits

That brings us to valuation. Since my neutral July not e Pearson: Virtual Learning Powers Likely Growth, But Only Modestly, the shares have fallen 28%. Given its long-term history of value destruction (a share bought at the end of 2011 has halved in value a decade later), one hesitates to take a positive view on Pearson.

A bright future for Pearson?

Pearson said group sales dropped 10% during 2020, slightly better than what the market had been expecting. As a consequence, it said that full-year adjusted operating profit would range between £310m and £315m. This was bang in line with City consensus.

Our 6 'Best Buys Now' Shares

Andy Bird, chief executive of Pearson, commented that “ despite facing significant uncertainty, our teams have been laser-focused on closing out 2020, enabling us to report sales and profit for 2020 in line with expectations .”