Is AVGO stock a good investment?

The financial health and growth prospects of AVGO, demonstrate its potential to perform inline with the market. It currently has a Growth Score of A. Recent price changes and earnings estimate revisions indicate this would be a good stock for momentum investors with a Momentum Score of A.

Will AVGO stock go up?

Broadcom Inc (NASDAQ:AVGO) The 21 analysts offering 12-month price forecasts for Broadcom Inc have a median target of 690.00, with a high estimate of 780.00 and a low estimate of 600.00. The median estimate represents a +42.03% increase from the last price of 485.82.

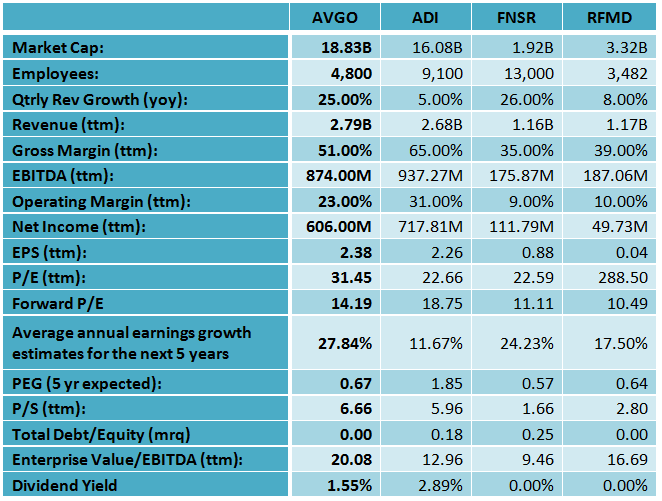

Is AVGO overvalued?

Valuation Metrics AVGO stock looks overvalued here as it trades above its three-year average valuation multiple averages on a forward EV/EBITDA ratio and a forward price-to-normalized-earnings basis.

Is Broadcom Inc a good buy?

Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also take a look at the company's future expectations. Broadcom's earnings over the next few years are expected to increase by 76%, indicating a highly optimistic future ahead.

What is Nio price target?

The 31 analysts offering 12-month price forecasts for NIO Inc have a median target of 30.14, with a high estimate of 66.85 and a low estimate of 21.94. The median estimate represents a +41.06% increase from the last price of 21.37.

Where will Nvidia stock be in 5 years?

Based on our forecasts, a long-term increase is expected, the "NVDA" stock price prognosis for 2027-06-25 is 580.695 USD. With a 5-year investment, the revenue is expected to be around +299.85%. Your current $100 investment may be up to $399.85 in 2027.

Is Broadcom a buy sell or hold?

Broadcom has received a consensus rating of Moderate Buy. The company's average rating score is 2.85, and is based on 22 buy ratings, 4 hold ratings, and no sell ratings.

Should I buy AVGO stock Zacks?

The financial health and growth prospects of EVGO, demonstrate its potential to underperform the market. It currently has a Growth Score of D. Recent price changes and earnings estimate revisions indicate this would be a good stock for momentum investors with a Momentum Score of A.

What does Broadcom do?

Broadcom is a worldwide leading provider of solutions for wireless LAN infrastructure, developing SoC solutions for 802.11 Wi-Fi routers, service provider gateways and enterprise access points.

Why did Broadcom stock drop?

Broadcom's poor stock performance comes as the company faces slowing earnings growth in fiscal 2019. Analysts are looking for revenue growth in 2019 to slow to just 3%, down from over 17.6% this year.

How many times has Broadcom split?

According to our Broadcom stock split history records, Broadcom has had 0 splits. To make the "Dividend Channel S.A.F.E.

Is HTA a good stock to buy?

Healthcare Trust Of America Inc (NYSE:HTA) The 6 analysts offering 12-month price forecasts for Healthcare Trust Of America Inc have a median target of 32.50, with a high estimate of 36.50 and a low estimate of 29.00. The median estimate represents a +17.41% increase from the last price of 27.68.