To speculate, you have to follow three steps:

- Form a definite opinion on stocks;

- Wait until the stocks become active and confirm your opinion;

- Then back your opinion by buying or shorting.

- Form a definite opinion on stocks;

- Wait until the stocks become active and confirm your opinion;

- Then back your opinion by buying or shorting.

What is speculation in the stock market and why does it matter?

Each of these buyers and sellers have different reasons for their activity, but all, at least a little bit, are based in speculation. As it relates to the stock market, speculation is the anticipation of future price movement based on a belief the market has inaccurately priced the stock.

What are the different types of stock market speculation?

Stock market speculation covers a wide range of techniques, including pairs trading, swing trading, hedging and margin trading. There are various speculation techniques, including hedging and margin trading. However, speculation comes with great risks as well as the possibility of great rewards.

How do you speculates on a stock?

You can speculate on the stock by buying it on margin. Margin is a form of borrowing. You borrow money from an investments broker to purchase the stock using the stock in your account, which will include the stock you are purchasing, as collateral for the loan.

Should I invest in speculative stocks?

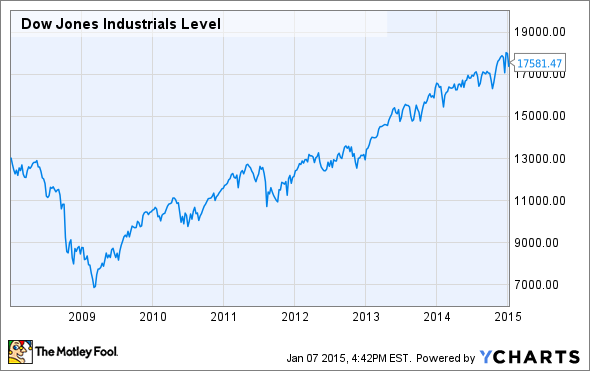

Investing in Speculative Stocks. Speculative stocks generally outperform in very strong bull markets when investors have abundant risk tolerance. They under-perform in bear markets, because investors’ risk aversion causes them to gravitate towards larger-cap stocks that are more stable.

Who wrote the theory of speculation?

Why are the risks of speculating so high?

How long do options last?

What is the first source of information for investing?

When you speculate, do you try to achieve a positive return in a short time?

Can you use futures for speculation?

Can you speculate in shares?

See more

How do you speculate stocks?

Definition: Speculation involves trading a financial instrument involving high risk, in expectation of significant returns. The motive is to take maximum advantage from fluctuations in the market. Description: Speculators are prevalent in the markets where price movements of securities are highly frequent and volatile.

How do you predict stocks to buy?

Topics#1. Influence of FPI/FII and DII.#2. Influence of company's fundamentals. #2.1 About fundamental analysis. #2.2 Correlation between reports, fundamentals & fair price. #2.3 Two methods to predict stock price. #2.4 Future PE-EPS method. #1 Step: Estimate future PE. #2 Step: Estimate future EPS.

Is the stock market based on speculation?

Speculative Stock Transactions The stock market and all its fluctuations are entirely based on the millions of transactions that occur between buyers and sellers each day. Each of these buyers and sellers have different reasons for their activity, but all, at least a little bit, are based in speculation.

What is a speculation strategy?

Speculation is a trading strategy that often involves very quick-paced buying and selling. It's based on hunches, educated guesses, or theories on price moves—as opposed to fundamentals—about the financial asset or investment.

How do you Analyse stocks?

How to do Fundamental Analysis of Stocks:Understand the company. It is very important that you understand the company in which you intend to invest. ... Study the financial reports of the company. ... Check the debt. ... Find the company's competitors. ... Analyse the future prospects. ... Review all the aspects time to time.

What is the best tool to predict stock market?

The MACD is the best way to predict the movement of a stock. Fibonacci retracement: Fibonacci retracement is based on the assumption that markets retrace by certain predictable percentages, the most common among them being 38.2 per cent, 50 per cent and 61.8 per cent.

How do speculators make profit?

Speculators earn a profit when they offset futures contracts to their benefit. To do this, a speculator buys contracts then sells them back at a higher (contract) price than that at which they purchased them. Conversely, they sell contracts and buy them back at a lower (contract) price than they sold them.

How do you become a successful speculator?

5 Tips for Starting Out as a SpeculatorYou Need Start-Up Capital—at least $10,000. Someone once asked me how to speculate with $1,000. ... Speculate Only with Money You Can Afford to Lose. Successful speculation requires discipline. ... Don't Be Lazy. ... Don't Be Greedy. ... Accept Help.

Is day trading a speculation?

Day trading is a form of speculation. Day traders don't necessarily have any specific qualifications, rather, they are labeled as such because they trade often. They generally hold their positions for a day, closing once the trading session is complete.

How do we speculate?

To speculate, you have to follow three steps:Form a definite opinion on stocks;Wait until the stocks become active and confirm your opinion;Then back your opinion by buying or shorting.

What is speculation with example?

Speculation is the act of formulating an opinion or theory without fully researching or investigating. An example of speculation is the musings and gossip about why a person got fired when there is no evidence as to the truth.

How do you do speculative trading?

Speculative trading, or speculation, is the act of buying or selling stock simply because you have heard or believe that it will rise in value. If your prediction proves correct, you make money; if not, you lose it (or at least some of it). The results can be very rewarding but risky.

How to speculate on the stock market?

Do you want to start speculating yourself? Then you can use various financial instruments.

What is speculating?

Speculating is a form of investing where you try to take advantage of small price fluctuations in the short term. Speculation can take place on dif...

How to successfully speculate?

Unfortunately, there is no ‘perfect method’ that guarantees success with speculation. Nevertheless, I would like to give you some tips that will ce...

What are speculative stocks?

Speculative stocks are shares of companies that are often traded at a low price and where you can make a good profit in the long run due to a high...

Is speculation the same as gambling?

The stock market is difficult to predict in the short term: People sometimes mistakenly believe that speculation is the same as gambling. However,...

What does speculation mean?

When you look in the dictionary, you see that speculation means opportunity consideration. An alternative definition of speculation is a transactio...

Where & how can you speculate best?

Speculating is something you can do best with an online broker through contracts on the underlying asset. This way of investing is best suited for...

Hedging vs. Speculation: What's the Difference? - Investopedia

Hedging and speculation are two types of investment strategies. Hedging attempts to eliminate the volatility associated with the price of an asset by taking offsetting positions—that is ...

What is Speculation in the Stock Market? | Study.com

In every financial market, speculation plays a key role. On some exchanges with cheap stocks, speculative trades are the primary trades happening....

Speculation Definition & Explanation - Investopedia

Speculation is the act of trading in an asset or conducting a financial transaction that has a significant risk of losing most or all of the initial outlay with the expectation of a substantial ...

What is Speculation? Definition of Speculation ... - The Economic Times

Speculation involves trading a financial instrument involving high risk, in expectation of significant returns. The motive is to take maximum advantage from fluctuations in the market. Description: Speculators are prevalent in the markets where price movements of securities are highly frequent and volatile. They play very important roles in ...

Speculation Definition & Meaning | Dictionary.com

Speculation definition, the contemplation or consideration of some subject: to engage in speculation on humanity's ultimate destiny. See more.

What is speculation in finance?

Speculation refers to the act of conducting a financial transaction that has a substantial risk of losing value but also holds the expectation of a significant gain. Without the prospect of substantial gains, there would be little motivation to engage in speculation.

Why is speculation so popular?

Speculation is rapidly growing in popularity because of the easy access to world investment markets through online brokerage portals. Because speculation is difficult to master, spend time trading in a virtual account.

What do the proponents of the efficient market hypothesis believe?

Proponents of the efficient market hypothesis believe the market is always fairly priced, making speculation an unreliable and unwise road to profits. Speculators believe that the market overreacts to a host of variables. These variables present an opportunity for capital growth . Some market pros view speculators as gamblers, ...

What are the opponents of speculating?

Opponents of speculating believe that investing money solely based on an event that may happen in the near future is gambling. Speculators argue that they use a large amount of data sources to evaluate the market where most gamblers bet purely on chance or other less statistically significant indicators.

What is profitable speculating?

Profitable speculators often work for trading firms that provide training and resources designed to increase their odds of success. For those who speculate independently, a large amount of time is necessary to research the market, follow breaking news events and learn and understand complicated trading strategies .

How would a Middle East conflict affect the price of oil?

A Middle East conflict could affect the price of oil, a key eurozone figure could cause a violent move in the broad market indexes, and a material change in the unemployment rate could send markets soaring or plunging.

Why would Investor B sell 300 shares of Boeing?

Investor B, the speculator, might sell 300 shares because this person believed that Boeing was poised for a short- or medium-term price increase. Investor B may have evaluated the health and other fundamentals of Boeing but the primary metric was the anticipated short-term price movement.

What is speculation in stock market?

As it relates to the stock market, speculation is the anticipation of future price movement based on a belief the market has inaccurately priced the stock. While all stock trading has some degree of speculation, speculative trades have an especially high impact within financial markets. Speculative trades are trades that involve companies that, ...

What is speculative trade?

Most speculative trades involve new companies that may not have a history of profitability or positive cash flow, but that have a business plan or some other strategic advantage that entices market participants to buy shares of their stock.

What is pink slip trading?

While all stock transactions are somewhat speculative, smaller companies that are traded on the pink slips - an unregulated stock market exchange where most stocks trade for less than a dollar, and many for fractions of a penny.

Why aren't penny stocks listed on the NYSE?

Because they aren't established, they wouldn't be listed on the New York Stock Exchange (NYSE) or NASDAQ. Instead, they would be published on what is referred to as 'pink slips'. The pink slips are an unregulated stock market, where many stocks trade for less than $1. The pink slips, or 'penny stocks,' are very speculative.

Is it possible to turn $1,000 into millions?

Have you ever seen an advertisement for someone that claims to have turned $1,000 into millions of dollars? While the stock market makes that possible, it is extremely - extremely - unlikely. But, if someone picks the right trades and speculates accurately, there's no telling what might happen !

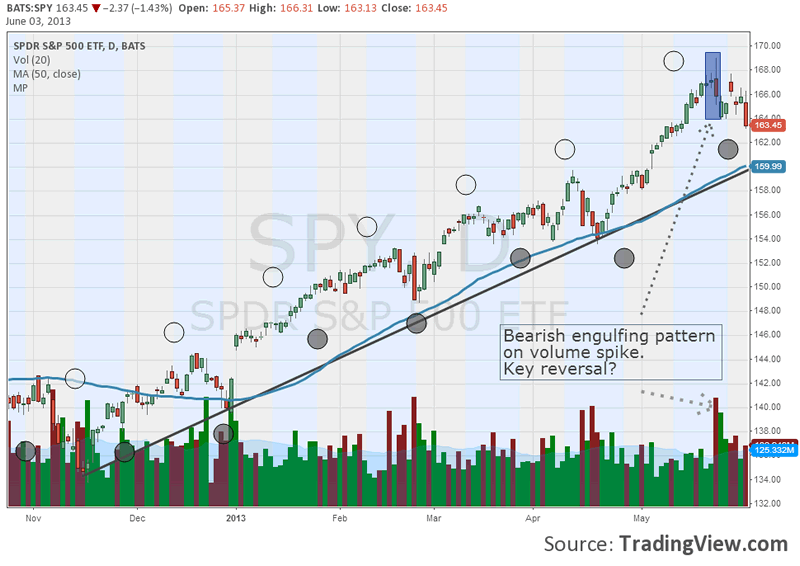

How does speculation affect stock price?

Understanding the Effects of Speculation. Increased activity by speculators can have a significant effect on a stock's price. The collective response to earnings, price patterns and breaking news creates momentum. If speculators believe the stock will increase in value, their purchases might drive the price up.

What is the best strategy for investing?

The best strategy for you depends on your age, risk tolerance, tax situation, family size, income and the amount you can invest. An investor who speculates on a stock can consult a broker for help developing a trading strategy, or can save money on commissions by conducting independent research with an online trading account.

What happens if a broker allows margin trading?

If your broker allows margin trading, you can borrow against the securities in your account to purchase more stock than you could otherwise afford. This speculation strategy is helpful when you think a stock is about to skyrocket and you would like to purchase as many shares as possible.

Is speculation a risk?

However, speculation comes with great risks as well as the possibility of great rewards.

Is stock investing risky?

All stock investing brings some risk, but the level varies based on your strategy. Higher returns often require a riskier strategy. An investor who speculates on a stock can lose everything in a very short time. However, that same investor can also make extreme gains, which is why stock market speculation is a popular strategy.

What to do if stock price is high?

If the stock price seems high, do not sell without thinking carefully about it. Instead, you must decide whether the price could go higher. If you have no basis justifying an upward trend, it may be wise to sell.

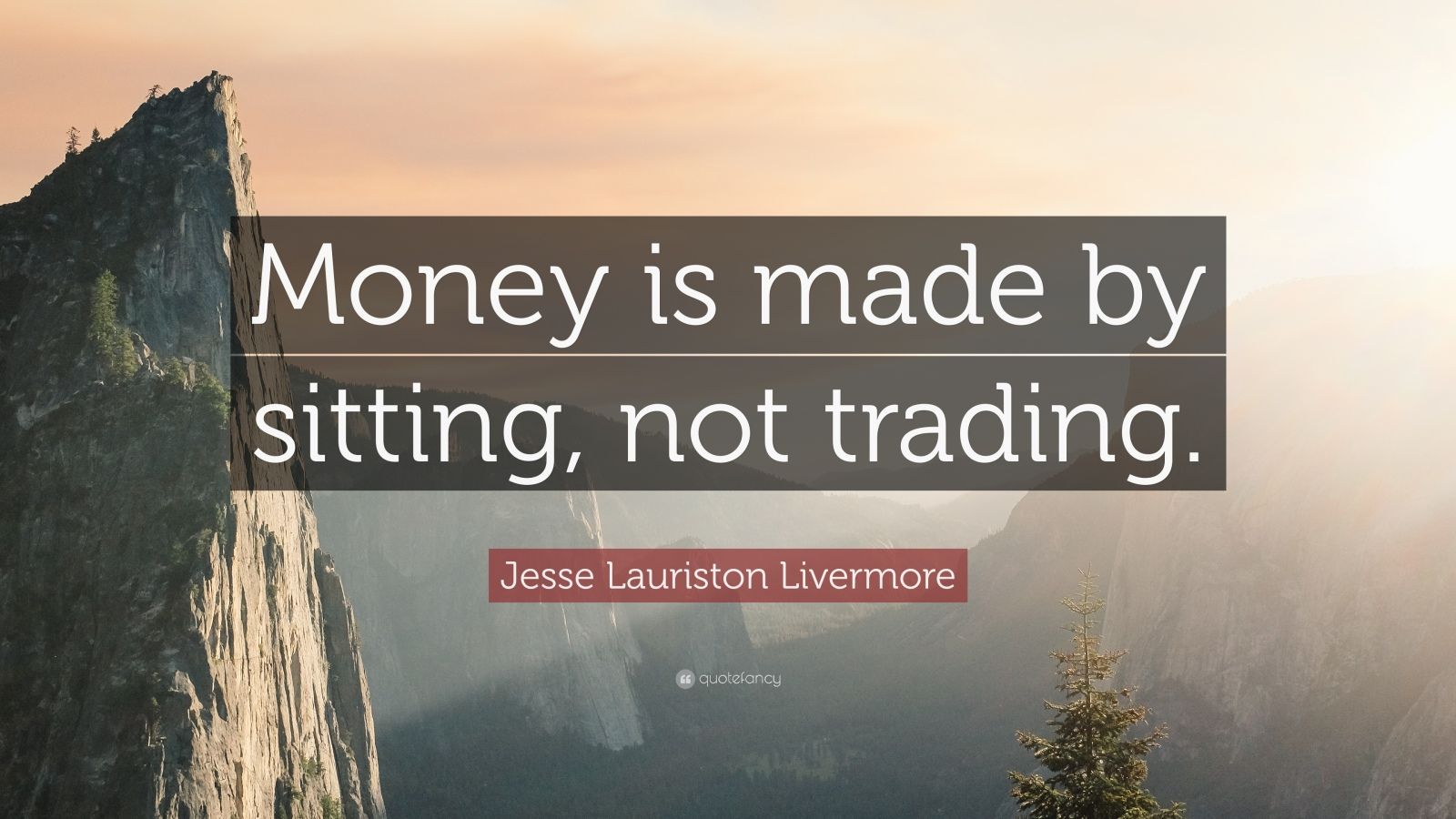

Is it always time to speculate?

It’s not always time to speculate. Sometimes, the market does not present the significant opportunities that you can seize. If you constantly speculate, you will sometimes take a lot of risk for small rewards. Risk is part of the game. Yet, you should only take some risk when the reward is likely to be significant.

Is speculation limited to stocks?

So speculation is not limited to speculative stocks—stocks with a high degree of risk. Speculators look for opportunities everywhere. They are “arbitrage seekers”. Speculation includes commodities, real estate, and all kind of securities.

Is a speculator a gambler?

Pick up the book and you’ll learn that intelligent speculators are not basic gamblers. They are meticulous. They know the extent of the risks they take and follow strict methods and rules. Choosing to speculate is a strategic choice. It requires a real commitment of time and energy.

Speculation

You can apply a number of speculation techniques when trading stocks. Speculation is a form of investing that involves taking significantly larger risks in exchange for anticipated higher gains. Speculation does not depend on the roll of a dice, the flip of a coin or the luck of the draw.

Margin

Perhaps you believe the price of a particular stock is about to have a sharp price increase, and you want to acquire more shares than you can afford to purchase outright. You can speculate on the stock by buying it on margin. Margin is a form of borrowing.

Options

You can speculate on the stock market by trading options. Options give your the right to buy or sell a particular stock at a set price for a specific amount of time, without giving you stock ownership. You participate in any gains produced by the movement of stock price, at a fraction of the cost of buying the actual stock.

Hedging

Hedging is a common practice for stock speculators. It is a technique designed to reduce the risk of an inherently risky investment by making an equal investment in the opposite direction. Perhaps XYZ stock is getting ready to announce a new wonder drug. You think XYZ stock is going to skyrocket, so you buy 100 shares.

What is speculative stock?

Speculative stocks are high-risk, high-reward, and tend to appeal to short-term traders. Speculative stocks tend to be clustered into sectors or types: penny stocks, emerging market stocks, rare materials stocks, pharmaceutical stocks, etc. 1:39.

What is the difference between investing and speculating?

The primary difference between investing and speculating is the amount of risk undertaken. High-risk speculation is typically akin to gambling, whereas lower-risk investing uses a basis of fundamentals and analysis.

Why do speculative stocks underperform in bear markets?

They underperform in bear markets because investors’ risk aversion causes them to gravitate toward larger-cap stocks that are more stable.

Why are penny stocks considered speculative?

Many traders are drawn to speculative stocks due to their higher volatility relative to blue-chip stocks, which creates an opportunity to generate greater returns —albeit at greater risk.

Why are speculative stocks important?

Speculative stocks often account for a small portion of portfolios held by experienced investors because such stocks may improve the return prospects for the overall portfolio without adding too much risk, thanks to the beneficial effects of diversification.

Why do investors and traders take calculated risk?

Investors and traders necessarily take on calculated risk as they attempt to profit from transactions they make in the markets. The level of risk undertaken in the transactions is the main difference between investing and speculating.

Should I trade speculative stocks?

Meanwhile, traders who choose to trade speculative stocks should be sure to use risk management techniques to avoid sharp declines.

Who wrote the theory of speculation?

Some people doubt whether it is possible to make a profit from speculation. In the year 1900, the mathematics Louis Bachelier published a thesis under the name theory of speculation. According to him, the formation of the share price is entirely arbitrary. This subsequently led to the development of the efficient market hypothesis.

Why are the risks of speculating so high?

The risks of speculating are much higher: because speculators try to achieve a high return, they also must accept higher risks. Indeed, there is a clear link between risk and return where the likelihood of both a high and a low return increases when you take a higher risk.

How long do options last?

This right expires after a certain period: Some options have a one-day duration while others are valid for weeks or even months.

What is the first source of information for investing?

The first source of information you can use when making investment decisions is the daily news. There are dozens of information websites where you can find large amounts of information. Think of websites such as CNBC, Marketwatch and Yahoo Finance. On these websites economic news is posted quickly.

When you speculate, do you try to achieve a positive return in a short time?

When you speculate, you try to achieve a positive return in a short time. You open positions to close them quickly. Investments have a longer time horizon: some investors hold shares for many years to even decades.

Can you use futures for speculation?

A final option is to use futures for speculation. This possibility is not suitable for the novice investor: For investment in futures you need a substantial amount of capital. Moreover, the smallest price fluctuations can result in a large loss. Be careful with investing in futures!

Can you speculate in shares?

It is also possible to speculate in shares directly. If you do, you buy and sell shares in the short term. You often need a little more capital for this: You cannot apply a lever, so you must invest the full amount needed for your investment. It is also important to pay attention to the transaction costs: If you do not, you lose a large part of your return. You pay your transaction fees with each transaction, over and over again.

Stock Market Speculation Strategies

- Most speculative trades involve new companies that may not have a history of profitability or positive cash flow, but that have a business plan or some other strategic advantage that entices market participants to buy shares of their stock. For example, a newly established technology company may be seeking funding and turn to the equity financial m...

Understanding The Effects of Speculation

Understanding Risk

Exploring Margin Trading

- The best strategy for you depends on your age, risk tolerance, tax situation, family size, income and the amount you can invest. An investor who speculates on a stock can consult a broker for help developing a trading strategy, or can save money on commissions by conducting independent research with an online trading account.

Researching Options Purchases

- Increased activity by speculators can have a significant effect on a stock's price. The collective response to earnings, price patterns and breaking news creates momentum. If speculators believe the stock will increase in value, their purchases might drive the price up. On the other hand, speculators' loss of confidence can send the price into a freefall. Conflicting opinions lead to sid…

Understanding The Role of Hedges

- All stock investing brings some risk, but the level varies based on your strategy. Higher returns often require a riskier strategy. An investor who speculates on a stock can lose everything in a very short time. However, that same investor can also make extreme gains, which is why stock market speculation is a popular strategy.