Finding patterns in stock data with similarity matching - Stock Pattern Analyzer

- Search Engine. The approach would be quite simple if we would’t care about runtime. Just imagine a sliding window over...

- Measurement results.

- The tool. Now that we have the search models, we can build the whole tool. ... When we start the stock-API, a bunch of...

- References.

Full Answer

What are the most common stock patterns?

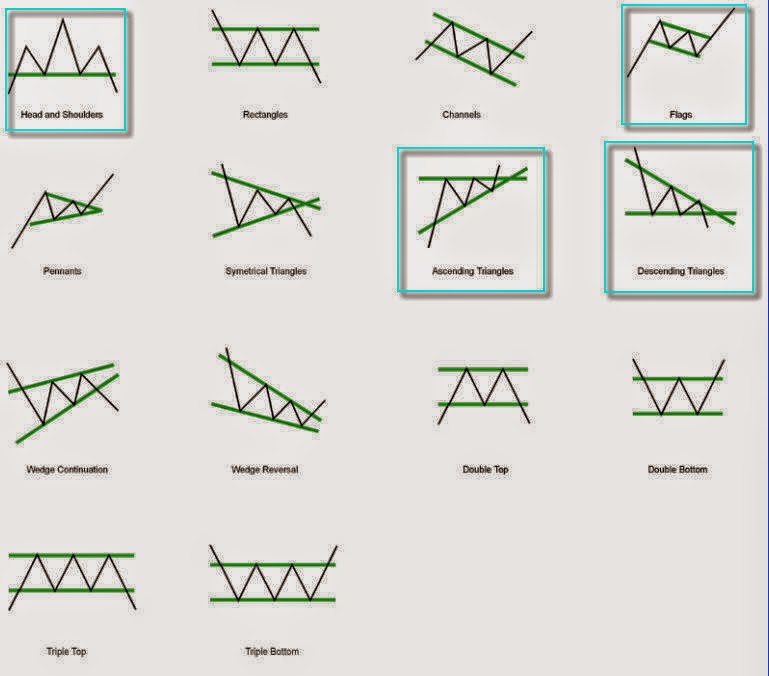

Triangle chart patterns come in three distinct types:

- The symmetrical triangle. The top and bottom trend lines are equal distances from the midpoint. ...

- The ascending triangle. The lower trend line is rising, but the top line is horizontal. ...

- The descending triangle. The upper trend line slopes down, but the bottom line is horizontal. ...

How to recognize stock patterns?

Traders looking to take a position in a stock trading in a downtrend can usually find the safest entry on the lower high. Bullish traders can enter the trade on the lower low and exit on the lower high. These traders can also enter when the downtrend breaks and the stock makes a higher high indicating a reversal into an uptrend may be in the cards.

How to read stock patterns?

What Is a Stock Chart?

- 52-Week High and Low. The 52-week high and low are key metrics when looking at the trajectory of a stock in a given period (in this case, one year).

- Ticker Symbol. ...

- Dividend per Share. ...

- Dividend Yield. ...

- P/E Ratio. ...

- Day High and Low. ...

- Open Price. ...

- Close Price. ...

- Prev. ...

- Net Change. ...

How to find patterns to trade stocks?

Top 20 Stock Chart Patterns for Traders and Investors

- Ascending Triangles. The ascending triangles a is favorite among those looking to take a bullish stance on an investment heading upward.

- Bearish and Bullish Symmetric Triangles. ...

- Bollinger Bands. ...

- Bump and Run. ...

- Cup and Handle. ...

- Descending Triangle. ...

- Double Bottom. ...

- Double Top. ...

- Bearish and Bullish Flag. ...

- Head and Shoulders. ...

How do you identify a stock pattern?

Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. A pattern is identified by a line that connects common price points, such as closing prices or highs or lows, during a specific period of time.

How do you learn stock chart patterns?

29:0558:10How to Read Stock Market Charts and Patterns for Beginners - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo what you want to do is find as many angular peaks and valleys. On a stock chart as possible peaksMoreSo what you want to do is find as many angular peaks and valleys. On a stock chart as possible peaks again known as well it's known as angular resistance or ceilings. And valleys are known as angular.

Are there stock patterns?

When day trading in the U.S. stock market, you may notice certain patterns, based on the time of day, that occur more often than not. These patterns, or tendencies, happen often enough for professional day traders to base their trading around them.

What is the best pattern in stocks?

Head and shoulders pattern is considered to be one of the most reliable reversal chart patterns. This pattern is formed when the prices of the stock rises to a peak and falls down to the same level from where it had started rising.

Do chart patterns actually work?

Chart patterns work by representing the market's supply and demand. This causes the trend to move in a certain way on a trading chart, forming a pattern. However, chart pattern movements are not guaranteed, and should be used alongside other methods of market analysis.

What patterns should I look for in Day Trading?

Best Day Trading Patterns For BeginnersBest Day Trading Patterns. ... Japanese Candlesticks: Why Day Traders Use Them. ... Japanese Candlestick Patterns. ... Bullish Hammer Pattern. ... Bullish Engulfing Candlestick. ... Chart Patterns. ... Trading the Bull Flag. ... Trading the Ascending Triangle.More items...

Why do stocks dip at noon?

There is typically a drop-off in trading (meaning the volume of the transactions) at noon as most of the major news events are out in the market. During this lull, stock prices can often lose some ground.

What is the most bullish pattern?

Ascending Triangle. An ascending triangle is a bullish continuation pattern and one of three triangle patterns used in technical analysis. The trading setup is usually found in an uptrend, formed when a stock makes higher lows, and meets resistance at the same price level.

Are stock patterns accurate?

The head and shoulders patterns are statistically the most accurate of the price action patterns, reaching their projected target almost 85% of the time. The regular head and shoulders pattern is defined by two swing highs (the shoulders) with a higher high (the head) between them.

Are chart patterns profitable?

Even, if the pattern works you'll not be able to profit from it! Specifically, by the time most chart patterns is confirmed, a good part of the profit has already been realized by those who cause the patterns in the first place, unintentionally or even intentionally, leaving the rest to fight volatility.

How can you tell a sell off?

Another commonly used indicator is the Relative Strength Index, which can determine whether a security is overbought or oversold. If overvalued, this could be a sure sign that a sell-off is imminent.

What is the pattern day trader rule?

According to FINRA rules, you are considered a pattern day trader if you execute four or more "day trades" within five business days—provided that the number of day trades represents more than six percent of your total trades in the margin account for that same five business day period.

What are stock chart patterns?

Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversa...

How many types of chart patterns are there?

There are three key chart patterns used by technical analysis experts. These are traditional chart patterns, harmonic patterns and candlestick pat...

What chart patterns are common in forex?

The head and shoulders chart pattern and the triangle chart pattern are two of the most common patterns for forex traders. They occur more regularl...

How do stock chart patterns work?

Chart patterns work by representing the market’s supply and demand. This causes the trend to move in a certain way on a trading chart, forming a pa...

What are reversal and continuation patterns?

When a price signal changes direction, it is a reversal pattern. However, when a price trend continues in the same direction it is a continuation p...

Do Chart Patterns Work?

Yes, but no pattern works 100% of the time. And no pattern will play out exactly the same every time. To learn them, you need practice. Lots of pra...

How Many Stock Chart Patterns Are There?

There are three types of patterns — breakouts, reversals, and continuations. Within those three types of patterns, there are many possibilities. Yo...

How Do You Predict if a Stock Will Go Up or Down?

Look for bullish patterns and bearish patterns. If a pattern;’s bullish, it’s likely to go up. The opposite holds true for bearish patterns. Rememb...

What Patterns Do Day Traders Look For?

I always check the daily chart first. Then I look for key levels and breakouts. My favorite patterns — and setups — are the dip and rip and the VWA...

What is a pattern in technical analysis?

Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis . A pattern is identified by a line that connects common price points, such as closing prices or highs or lows, during a specific period of time. Technical analysts and chartists seek to identify patterns as ...

When a price pattern signals a change in trend direction, it is known as a "reversal pattern

When a price pattern signals a change in trend direction, it is known as a reversal pattern ; a continuation pattern occurs when the trend continues in its existing direction following a brief pause. Technical analysts have long used price patterns to examine current movements and forecast future market movements.

What are pennants drawn with?

Pennants are drawn with two trendlines that eventually converge. A key characteristic of pennants is that the trendlines move in two directions—that is, one will be a down trendline and the other an up trendline. The figure below shows an example of a pennant. Often, volume will decrease during the formation of the pennant, followed by an increase when price eventually breaks out.

Why are trendlines important?

Trendlines are important in identifying these price patterns that can appear in formations such as flags, pennants and double tops. Volume plays a role in these patterns, often declining during the pattern's formation, and increasing as price breaks out of the pattern.

What is an up trendline?

A trendline that is angled up, or an up trendline, occurs where prices are experiencing higher highs and higher lows. The up trendline is drawn by connecting the ascending lows. Conversely, a trendline that is angled down, called a down trendline, occurs where prices are experiencing lower highs and lower lows.

What are continuation patterns?

If price continues on its trend, the price pattern is known as a continuation pattern. Common continuation patterns include: 1 Pennants, constructed using two converging trendlines 2 Flags, drawn with two parallel trendlines 3 Wedges, constructed with two converging trendlines, where both are angled either up or down

Where do uptrends occur?

Uptrends occur where prices are making higher highs and higher lows. Up trendlines connect at least two of the lows and show support levels below price. Downtrends occur where prices are making lower highs and lower lows. Down trendlines connect at least two of the highs and indicate resistance levels above the price.

What is stock chart pattern?

Stock chart patterns, when identified correctly, can be used to identify a consolidation in the market, often leading to a likely continuation or reversal trend. Traders may use these trendlines to forecast price patterns that can be traded for profit.

What is technical analysis?

Technical analysis is one of the best tools traders can use to spot shifts within the market, allowing them to predict support and resistance levels within a predictable timeframe. There are many different continuation and reversal patterns to look out for when reading the stock charts.

1. Flag Chart Pattern

The Flag stock chart pattern starts with an uptrend in price and is then met by buyers’ resistance to this new price high.

2. Pennant Pattern

The Pennant stock chart pattern shows that the stock price meets resistance during an uptrend, and the uptrend temporarily halts. Here you see lower highs but also a horizontal support line.

3. Ascending Triangle Pattern

The Ascending Triangle looks like the opposite of a Pennant, but the outcome is the same.

4. Descending Triangle Pattern

The Descending Triangle shows a very different picture. As the price moves down, the sellers believe the price is undervalued and refuse to sell at this new low price.

5. Rectangle Pattern

Continuation Patterns Diagram – Image courtesy of Liberated Stock Trader PRO Training.

6. Falling Wedge Chart Pattern

Falling Wedges have a very different character from triangles because they point in the same direction to the breakout. When the pattern of the Wedge points down, it means the stock price should theoretically continue moving upwards.

7. Head & Shoulders Pattern

The king of the reversal patterns is the most predictive of all stock chart patterns is the Head and Shoulders . The problem is most people do not know how a head and shoulder pattern actually works. Read on to find out more.

How many stock chart patterns are there?

There are hundreds of stock chart patterns. But not all chart patterns are equal. There’s a handful of stock chart patterns that traders always look for. These are the classics. Get to know these 12 key patterns. Look for examples of them and save them somewhere you can easily access them.

What do chart patterns tell you?

Position traders do the same, but with a longer view in mind. Patterns tell us what moves might happen. If you’re looking to take a trade, you want to know where the support and resistance are. You’re looking for key levels where other traders might buy or sell. Chart patterns can help you with that.

Why do traders use patterns?

Traders use them to gain insight when making a trade. Patterns give traders an idea of what the market might do next. They also show us key levels. Chart patterns can help you find good places to enter or exit a trade. Learning how to understand stock chart patterns can help you make a trading plan.

What is breakout pattern?

Charts fall into one of three pattern types — breakout, reversal, and continuation. Breakout patterns occur when a stock has been trading in a range. The top of the range is resistance, and the bottom is support. If the stock breaks through either end of this range, it’s a breakout.

Why are chart patterns important?

That’s why chart patterns are key. They can give you insight into the underlying psychology of the market. Understanding traders’ actions and reactions can provide insight into what might happen next. That can help you decide whether you should be long, short, or flat.

What is a triangle in stock?

Triangles are a common stock chart pattern. The price makes swings that get smaller each time. If you connect lines along the tops and bottoms, they form a triangle. Triangles are a versatile pattern. Sometimes they precede reversals and continuations, but there are triangle breakout patterns.

What do markets do?

Markets do one of three things — trend upward, trend downward, or consolidate. When a market trends upward, prices rise higher through a sequence of swings. The price makes higher highs and higher lows. When a market’s in a downward trend, prices swing lower. They make lower highs and lower lows.

Trendlines in Technical Analysis

Continuation Patterns

- A price pattern that denotes a temporary interruption of an existing trend is known as a continuation pattern. A continuation pattern can be thought of as a pause during a prevailing trend—a time during which the bulls catch their breath during an uptrend, or when the bears relax for a moment during a downtrend. While a price pattern is forming, there is no way to tell if the tr…

Reversal Patterns

- A price pattern that signals a change in the prevailing trend is known as a reversal pattern. These patterns signify periods where either the bulls or the bears have run out of steam. The established trend will pause and then head in a new direction as new energy emerges from the other side (bull or bear). For example, an uptrend supported by enthusiasm from the bulls can pause, signifying …

The Bottom Line

- Price patterns are often found when price "takes a break," signifying areas of consolidation that can result in a continuation or reversal of the prevailing trend. Trendlines are important in identifying these price patterns that can appear in formations such as flags, pennants and double tops. Volume plays a role in these patterns, often declining...