A drawdown is the negative half of the standard deviation in relation to a stock’s price. A drawdown from a share price’s high to its low is considered its drawdown amount. If a stock drops from $100 to $50 and then rallies back to $100.01 or above, then the drawdown was $50 or 50% from the peak.

What is a drawdown in trading?

- Fidelity Drawdown is the maximum loss a trader might experience in a given time horizon. See how analyzing drawdown can help you weigh the risks and rewards that might impact your trading strategy.

What is maximum drawdown in stocks?

Maximum drawdown is considered to be an indicator of downside risk, with large MDDs suggesting that down movements could be volatile. While MDD measures the largest loss, it does not account for the frequency of losses, not the size of any gains.

What does a 40% drawdown from a stock or fund mean?

If a 40% drawdown of a stock or the fund decreases to 20% drawdown, this reflects that the stock or the fund has started performing again and will soon reach the peak mark again thus reducing the downward risk in the stock or the portfolio.

What is a low drawdown in a portfolio?

A stock or the portfolio with a lower drawdown will give comfort to the traders or the investors to put their money and earn. It helps the trader or the investor to ascertain the volatility of the stock or the fund with the market and the industry in specific.

What is a good drawdown in trading?

Drawdowns FAQs However, it is always recommended for investors and traders that drawdown should be kept below the 20% level. By setting a 20% maximum drawdown level, investors can trade with peace of mind and always make meaningful decisions in the market that will, in the long run, protect their capital.

What is a good drawdown ratio?

In practice, investors want to see maximum drawdowns that are half the annual portfolio return or less. That means if the maximum drawdown is 10% over a given period, investors want a return of 20% (RoMaD = 2). So the larger a fund's drawdowns, the higher the expectation for returns.

What does it mean to draw down funds?

In banking, a drawdown refers to a gradual accessing of credit funds. In trading, a drawdown refers to a reduction in equity. Drawdown magnitude refers to the amount of money, or equity, that a trader loses during the drawdown period.

How do you calculate stock drawdown?

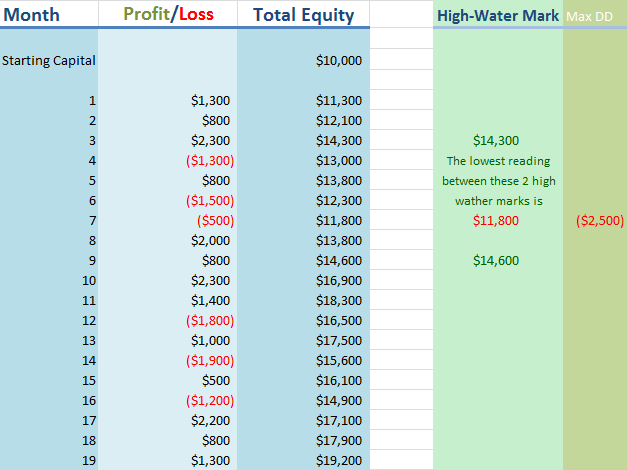

How do I calculate maximum drawdown?First, get the latest peak value (PV). Then, obtain the lowest price value (LP) after such a peak.Once you have both, divide LP by PV. Subtract 1, and multiply the result by 100%.The result indicates the maximum drawdown percentage.

Is a high Calmar ratio good?

Like many of the other risk statistics, the higher the Calmar ratio the better with anything over 0.50 is considered to be good. A Calmar ratio of 3.0 to 5.0 is really good.

What is drawdown risk?

In its simplest form, drawdown risk is the measure of how long it takes for a mutual fund or other investment to recoup its losses after it falls from a previous high.

How do you reduce a drawdown in trading?

The 4-Step Process to Control DrawdownsKeep risk as low as possible. What would happen if you lost 20 trades in a row? ... Reduce risk if losses continue. The second step in this process is to lower your risk per trade if losses continue. ... Set a drawdown cap. ... If all else fails, walk away.

What should be the maximum drawdown?

A maximum drawdown (MDD) is the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained. Maximum drawdown is an indicator of downside risk over a specified time period.

Why is maximum drawdown important?

Max drawdown in trading is important in trading because it plays a major role in how you compound long-term. A drawdown can make you jump ship, or it can make a real dent in your performance.

What is a good Sharpe ratio?

Generally speaking, a Sharpe ratio between 1 and 2 is considered good. A ratio between 2 and 3 is very good, and any result higher than 3 is excellent.

What is drawdown in finance?

Drawdown in Finance refers to how much an investment declines from the historical peak in a particular period and then regains its original position. In other words, how much an investment in a stock or a fund is down from its peak mark before it reaches back the peak position. It is a measure of the downside volatility of an investment, whether in stocks or funds. It is also important for comparing the historical fund performance as compared to its peers or monitor the personal trading of individuals.

What is drawdown method?

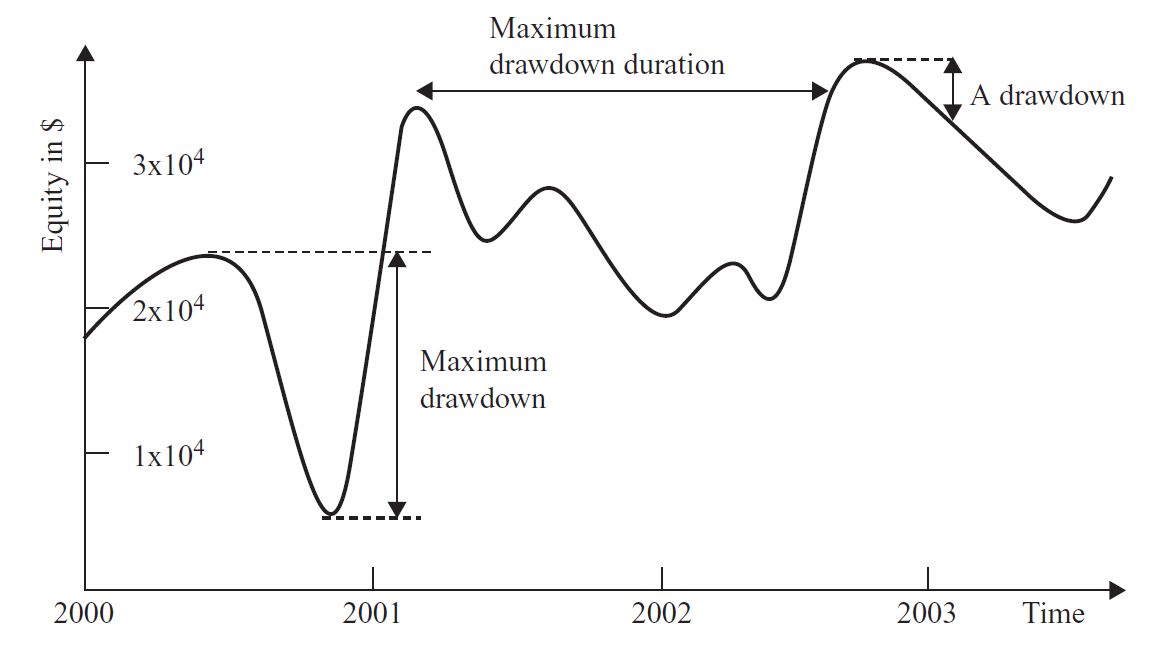

Drawdown method is used for measuring and managing the financial risks associated with the investments with respect to money and time and the two factors that are used for the purpose of defining this metric are its magnitude (i.e. how low will the price fall) and the duration (i.e. how long this phase of drawdown will last).

Why is drawdown important?

It is also important for comparing the historical fund performance as compared to its peers or monitor the personal trading of individuals. Drawdown is one of the most important and widely used mathematical technologies used by the analyst to analyze the performance of the stock or the fund or the fund based upon drawdown %.

What is the difference between a drawdown and a loss?

A drawdown and a loss are two separate things since a drawdown is only a temporary decline in the value of the stock or the fund, while loss refers to when the same stock or the fund has been sold at a price lower than the purchase price

What is negative standard deviation?

It is also referred to as the negative standard deviation in relation to the price of the stock. It is very common among hedge fund. Hedge Fund A hedge fund is an aggressively invested portfolio made through pooling of various investors and institutional investor’s fund.

Why are Drawdowns Important in Investment?

Risk management is very important in investing or trading activity. It is what keeps you in the game. When developing a strategy, traders look to have one that gives them an edge in the markets. A strategy that has, say 80% success rate, does not imply that 8 trades out of 10 will be profitable.

Drawdown Assessments

Every investor should know how to assess drawdowns to effectively mitigate the risks it poses. Depending on the asset class you are trading, drawdown risk is curbed by assessing the diversification of a portfolio as well as the effort required to overcome it.

What is drawdown in investment?

A drawdown is an investment term that refers to the decline in value of a single investment or an investment portfolio from a relative peak value to a relative trough. It is an important risk factor for investors to consider, becoming more important in asset management. Asset Management Asset management refers to the process of developing, ...

What are the elements of drawdown?

Two key elements must be looked at in relation to a drawdown. The first is money, and the second is time. The element of money refers to the monetary amount of the drawdown. The time element refers to how long the drawdown lasts – that is, what period of time elapses before the value of an investment recovers the drawdown amount, ...

What is drawdown risk?

A drawdown is an important risk factor for investors to consider. The two elements of a drawdown are the monetary amount of the drawdown and the period of time required for an investment to recover from the drawdown.

Why is potential drawdown important?

Potential drawdown is an important factor for investors to consider , either in relation to an individual investment or their total investment portfolio. The two examples above illustrate why both the amount and duration of drawdowns are key elements to take into account.

What is drawdown loss?

A drawdown is a temporary peak-to-trough metric, while the loss is calculated based on the purchase price relative to the instrument’s current or exit price.

How long does it take for a drawdown to occur?

After the initial peak (X), the price hits a trough (Y) and then goes on to surpass the first peak (Z). As you can see, the first drawdown takes two months to complete. Meanwhile, the second lasts three months and a half. When trading, drawdowns can take anywhere from a few minutes to several months or even years.

What is the maximum drawdown in 5th trade?

5th Trade – a profit of $55 with a maximum drawdown of $30. At the end of the day, Joe’s gain is $55, with a maximum drawdown of $60 (the one in Trade 3). The scenario above is an example of a suicidal strategy because the maximum drawdowns are very high. In the end, Joe gets lucky and ends up on the winning side.

How much drawdown does the S&P 500 have?

Drawdowns are an inevitable part of financial markets and more common than you might expect. According to some estimates, the S&P 500 has a 5% to 10% drawdown approximately 12.8% of the time.

Why is 20% drawdown good?

In that case, a drawdown of 20% might be viable because, for that time length, your portfolio will most probably be able to recover from potential negative impacts. On the other hand, individuals close to retirement should look at portfolios with as low drawdown as possible to ensure their capital is protected.

How long is a 20% drawdown?

A 20% drawdown lasting a few months is bearable. But when it lasts years, it can really put your nerves to the test. Use the maximum drawdown to better forecast the worst-case scenario for your trades. Keeping this in control will help you become a better performing trader.

When did the S&P 500 drawdown happen?

In the chart below you can see another example of an S&P 500 drawdown, taking place between June 2008 and March 2012. With a length of three years and nine months, the drawdown hit the lowest point of -52%.

What is maximum drawdown?

Maximum drawdown is a specific measure of drawdown that looks for the greatest movement from a high point to a low point, before a new peak is achieved. However, it's important to note that it only measures the size of the largest loss, without taking into consideration the frequency of large losses.

When did the S&P 500 plunge?

While this may seem like a huge loss, note that the S&P 500 had plunged more than 55% from its peak in October 2007 to its trough in March 2009. While other metrics would need to be considered to assess Gamma fund's overall performance, from the viewpoint of MDD, it has outperformed its benchmark by a huge margin.