- Obtain Important Information. Find an online or print resource that offers historical price tables for your stock. ...

- Set Up the Data. Most sources will give you a variety of data regarding the stock for each closing date. ...

- Find the Return. To calculate a monthly stock return, you'll need to compare the closing price to the month in question to the closing price from the previous month.

- Perform the Necessary Analysis. Once you've calculated monthly returns, you can continue to analyze and play around with the stock return data.

How to choose the best stock valuation method?

Popular Stock Valuation Methods

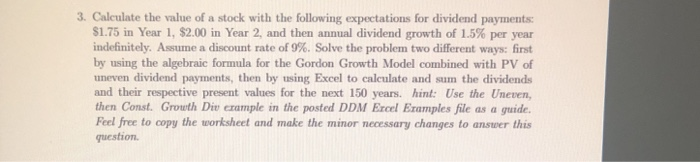

- Dividend Discount Model (DDM) The dividend discount model is one of the basic techniques of absolute stock valuation. ...

- Discounted Cash Flow Model (DCF) The discounted cash flow model is another popular method of absolute stock valuation. ...

- Comparable Companies Analysis

How do I calculate stock return on investment?

What is a Rate of Return?

- Video Explanation of Rate of Return. ...

- Formula for Rate of Return. ...

- Example Rate of Return Calculation. ...

- Annualized Rate of Return. ...

- Formula for Annualized ROR. ...

- Example of Annualized Rate of Return. ...

- Alternative Measures of Return. ...

- More Resources. ...

What is the formula for stock price?

- What will be the future price? Expected future price (after 3 years) of our example stock is Rs.1,982.2 We have arrived this by using the P/E formula (PE x EPS ...

- What is the current price? The current price of the stock is Rs.1,737.8 (see snapshots used in PE calculation above).

- At what rate the price will grow? Current price of stock is Rs.1,737.8. ...

How do you calculate current share price?

There are just a few simple steps to figure out this price:

- In the spreadsheet program of your choice, or by hand if that suits your fancy, make columns for the purchase date, amount invested, shares bought, and average purchase price.

- Fill in the data for the first three columns from your brokerage statements.

- Sum the amount invested and shares bought columns.

Profits vs. Return

Imagine that you buy stock in Facebook for $160 and sell it for $192.73.

Generalized return of a stock

Let’s just look at calculating stock returns again. But this time, we’ll work with notations instead of numbers.

Generalized return of a stock with dividends

Let’s just quickly look at how this equation works (using only notations this time).

How to Calculate Stock Returns on Python

Calculating stock returns on Python is actually incredibly straightforward.

Wrapping Up

You now know how to calculate stock returns. Actually, you know more than that including:

What Is Return on Investment?

Return on investment or ROI in short is a performance measure used to evaluate the returns of an investment.

Total Returns

Total returns measure the overall profit earned from all sources including dividends, interests and other capital gains over a set period of time. Generally, total returns are expressed in a form of percentages.

Simple Returns

Simple returns are super similar to total returns however, they are generally used to calculate returns on investments after they have been sold. Generally, simple returns are expressed in a form of percentages.

Compound Annual Growth Rate

The Compound Annual Growth Rate (CAGR) measures the value of money in your investment over a long period of time (more than 1 year).

Total Stock Return Cash Amount

The formula shown at the top of the page is used to calculate the percentage return. The actual cash amount for the total stock return can be calculated using only the numerator of the percentage return formula.

Example of the Total Stock Return Formula

Using the prior example, the original price is $1000 and the ending price is $1020. The appreciation of the stock is then $20. The $20 in price appreciation can then be added to dividends of $20 which would equal a total return of $40. This can then be divided by the original price of $1000 which would equal a percentage return of 4%.

Alternative Total Stock Return Formula

The total stock return can also be calculated by adding the dividend yield to the capital gains yield. The capital gains yield may sometimes be shown as the percentage change in stock price.

How Stock Return Calculator Works?

In order to use below moneycontain stock return calculator , you need to enter the price at which you bought the shares of a stock, second enter the quantity and expected returns and at last enter the time period i.e. tenure of the investment made in months.

Stock Return Calculator

Open Best Trading/Demat/Mutual Fund account online within minutes and start investing and trading in stocks, FNO, Commodity, Currency, ETF, SGB, IPO, Gold and many more Products..

How To Find Out Historical Returns Of Stocks?

If you are friend asks you do you know how much return MRF, which by the way is the most expensive stock listed on Indian exchange as of now, have generated in last 20 years, Or for that matter any other stock.

Conclusion

Investing in stocks in share market is one of the best way to groww your capital, there is no other financials instrument which generates such profits. However, one should always do proper technical and fundamental analysis before investing.

Why is ROI expressed as a percentage?

First, ROI is typically expressed as a percentage because it is intuitively easier to understand (as opposed to when expressed as a ratio). Second, the ROI calculation includes the net return in the numerator because returns from an investment can be either positive or negative.

What is ROI in investing?

Return on investment (ROI) is an approximate measure of an investment's profitability. ROI has a wide range of applications; it can be used to measure the profitability of a stock investment, when deciding whether or not to invest in the purchase of a business, or evaluate the results of a real estate transaction.

What is ROI in business?

Return on investment (ROI) is a simple and intuitive metric of the profitability of an investment. There are some limitations to this metric, including that it does not consider the holding period of an investment and is not adjusted for risk. However, despite these limitations, ROI is still a key metric used by business analysts to evaluate ...

Why is ROI important?

The biggest benefit of ROI is that it is a relatively uncomplicated metric; it is easy to calculate and intuitively easy to understand . ROI's simplicity means that it is often used as a standard, universal measure of profitability. As a measurement, it is not likely to be misunderstood or misinterpreted because it has the same connotations in every context.

Does leverage magnify ROI?

Combining Leverage with Return on Investment (ROI) Leverage can magnify ROI if the investment generates gains. However, by the same token, leverage can also amplify losses if the investment proves to be a losing investment.

What is average return?

What is an Average Return? Average return is the mathematical average of a sequence of returns that have accrued over time. In its simplest terms, average return is the total return over a time period divided by the number of periods.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. or security.

Why is annualized return used?

An average annual return is commonly used to measure returns of equity investments. However, because it compounds, the annual average return is typically not considered an ideal analysis metric; hence, it is infrequently used to evaluate changing returns. Also, the annualized return is computed using a regular mean.

What is the average growth rate?

The average growth rate is used to assess an increase or decrease in the value of an investment over a period of time. The growth rate is computed using the growth rate formula:

Does the average return account for different projects?

Despite its preferences as an easy and effective measure for internal returns, the average return has several pitfalls. It does not account for different projects that might require different capital outlays.

How to Calculate Share Price?

To calculate a stock’s market cap, you must first calculate the stock’s market price. Take the most recent updated value of the firm stock and multiply it by the number of outstanding shares to determine the value of the stocks for traders.

Share Price Formula in IPO

Via the primary market, firm stocks are first issued to the general public in an Initial Public Offering (IPO) to collect money to meet financial needs.

Conclusion

Stock prices are also depending on market sentiments. A stock at higher value looks cheaper in a bull market and a stock with lower value looks expensive in a bear market.

Frequently Asked Questions

Let's suppose Heromoto's P/E ratio has been 18.53 in the past. 2465 divided by 148.39 = 16.6 times the current P/E ratio. The present stock price should be 18 times its historical P/E ratio if it were trading at its historical P/E ratio of 18. 2754 is equal to 148.39. On this criteria, Heromoto's present stock price is undervalued.