Determining Percentage Gain or Loss

- Take the selling price and subtract the initial purchase price. The result is the gain or loss.

- Take the gain or loss from the investment and divide it by the original amount or purchase price of the investment.

- Finally, multiply the result by 100 to arrive at the percentage change in the investment.

- Take the selling price and subtract the initial purchase price. ...

- Take the gain or loss from the investment and divide it by the original amount or purchase price of the investment.

- Finally, multiply the result by 100 to arrive at the percentage change in the investment.

How do you calculate stock growth?

How do you calculate implied growth rate? Divide the annual dividends per share by the current stock price. As an example, if a company offers dividends of $3 per share and the stock is currently trading at $75, then you would get 0.04. Subtract this figure from the stock's rate of return to calculate the implied growth rate of the dividend.

How do you calculate capital gains?

You may qualify for the 0% long-term capital gains rate for 2021 with taxable income of $40,400 or less for single filers and $80,800 or less for married couples filing jointly. You calculate taxable income by subtracting the greater of the standard or ...

What if I had invested stock calculator?

S&P 500 Periodic Reinvestment Calculator (With Dividends)

- The S&P 500 Periodic Investment Calculator. Starting Month & Year - When to start the scenario. Ending Month & Year - When to end the scenario. ...

- Methodology for the S&P 500 Periodic Reinvestment Calculator. The tool uses data published by Robert Shiller, which you can find here. ...

- FAQ on the Periodic Reinvestment Tool. How often do you update the data? ...

How to calculate capital gains and losses?

- If you have no allowable capital losses, skip to step 7.

- If you have a net capital loss carried forward from previous years, subtract this first.

- You can choose which capital gains to subtract your losses from. ...

How do you calculate daily stock gain?

To calculate how much you gained or lost per day for a stock, subtract the opening price from the closing price. Then, multiply the result by the number of shares you own in the company. For example, say you own 100 shares of a stock that opened the day at $20 and ended the day at $21.

How do I calculate 30% gain?

Subtract the original value from the new value, then divide the result by the original value. Multiply the result by 100. The answer is the percent increase. Check your answer using the percentage increase calculator.

What is stock total gain?

This is the total gain on a portfolio position adding unrealised gains on current holdings, realised gains from sales and dividends received expressed in the chosen portfolio currency.

What is a 10% gain?

For example, if $10,000 is invested in a stock and it gains 10% in a year, it generates $1,000.

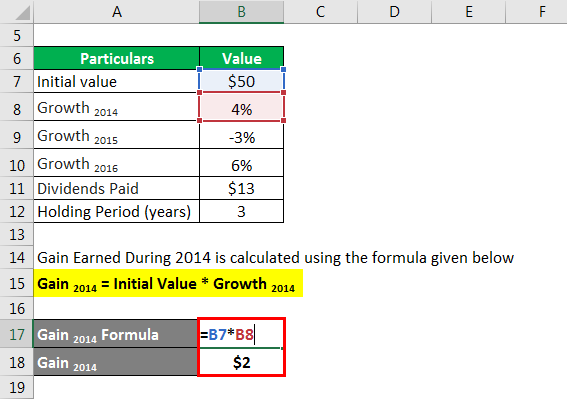

What is gain formula?

Gain Realized Formula = Selling Price – Buying Price. Here, Selling price > Buying price.

How do you calculate gain and sell price?

How to Calculate Selling Price Per UnitDetermine the total cost of all units purchased.Divide the total cost by the number of units purchased to get the cost price.Use the selling price formula to calculate the final price: Selling Price = Cost Price + Profit Margin.

How do I calculate profit per share?

To calculate your profit or loss, subtract the current price from the original price. The percentage change takes the result from above, divides it by the original purchase price, and multiplies that by 100.

What is gain percentage?

Percentage gain means to express the profit or the gain in the form of percentages. This way makes it easier and faster for a person to understand the variables or the vitals of a business transaction. Sometimes it is useful to find the increase or decrease of an amount.

How do you calculate realized gain or loss?

To calculate a realized gain or loss, take the difference of the total consideration given and subtract the cost basis. If the difference is positive, it is a realized gain. If the difference is negative, it is a realized loss.

What does 20X mean in stocks?

A stock trading at 20X earnings has a share price 20 times the current or previous year's net earnings per share. Video of the Day.

When should I take profit from stock?

How long should you hold? Here's a specific rule to help boost your prospects for long-term stock investing success: Once your stock has broken out, take most of your profits when they reach 20% to 25%. If market conditions are choppy and decent gains are hard to come by, then you could exit the entire position.

When should I sell stock?

Investors might sell a stock if it's determined that other opportunities can earn a greater return. If an investor holds onto an underperforming stock or is lagging the overall market, it may be time to sell that stock and put the money to work in another investment.

How to calculate percentage gain on an investment?

To calculate the percentage gain on an investment, investors need to first determine how much the investment originally cost or the purchase price. Next, the purchase price is subtracted from the selling price of the investment to arrive at the gain or loss on the investment.

Why is it important to calculate the percentage of gain or loss?

Calculating the gain or loss on an investment as a percentage is important because it shows how much was earned as compared to the amount needed to achieve the gain.

What is dividend in investment?

A dividend is a cash payment paid to shareholders and is configured on a per-share basis. Using the Intel example, let's say the company paid a dividend of $2 per share.

What is percentage gain or loss?

The percentage gain or loss calculation will produce the dollar amount equivalent of the gain or loss in the numerator.

What is Dow Jones Industrial Average?

The Dow is an index that tracks 30 stocks of the most established companies in the United States.

How to incorporate transaction costs?

To incorporate transaction costs, reduce the gain (selling price – purchase price) by the costs of investing.

Does investing come without costs?

Investing does not come without costs, and this should be reflected in the calculation of percentage gain or loss. The examples above did not consider broker fees and commissions or taxes. To incorporate transaction costs, reduce the gain (selling price – purchase price) by the costs of investing.

Capital Gains

If you are reading about capital gains, it probably means your investments have performed well. Or you're preparing for when they do in the future.

Capital Gains: The Basics

Let's say you buy some stock for a low price and after a certain period of time the value of that stock has risen substantially. You decide you want to sell your stock and capitalize on the increase in value.

Earned vs. Unearned Income

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Tax-Loss Harvesting

No one likes to face a giant tax bill come April. Of the many (legal) ways to lower your tax liability, tax-loss harvesting is among the more common - and the more complicated.

State Taxes on Capital Gains

Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you're lucky enough to live somewhere with no state income tax, you won't have to worry about capital gains taxes at the state level.

Capital Gains Taxes on Property

If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller's basis.

Net Investment Income Tax (NIIT)

Under certain circumstances, the net investment income tax, or NIIT, can affect income you receive from your investments. While it mostly applies to individuals, this tax can also be levied on the income of estates and trusts.

Why do you calculate net gain?

You should calculate a business' net gain on a regular basis for several reasons, including to determine if the business making a profit on the goods or services sold. If the company is making a profit on its sales activity, then you may choose to continue operating as is. However, if the company is losing money rather than making it, you may decide to adjust production procedures or sales prices to make a gain.

What is net gain or loss?

Net gains or losses, which also may be referred to as capital gains or losses, are the gains or losses that a person or business experiences as a result of selling an asset, writing off an asset or making an investment. Net gains and losses are also used to determine how much of a profit a business is making and how much money the company has left after subtracting expenses. The net gain or loss of a company includes income received from the sale of goods subtracted by how much money was spent on their acquisition and/or production.

How much money do you make if you sell 50 shares?

Determine how much money you have received as a result of the investment, sale of a product or being in business over a period of time. For example, if you sold the 50 shares you purchased for $10 per share at $15 per share, you would make $250 in profit. If you spent $10 on the manufacturing of a product and sold it for $20, you would make $10 in profit per product sold.

What to do if a company is losing money?

However, if the company is losing money rather than making it, you may decide to adjust production procedures or sales prices to make a gain.

What does it mean when your percentage gain is greater than the initial share price cost?

If your calculated gain is greater than the initial share price cost, your percentage gain will be greater than 100 percent, meaning the stock has more than doubled in value since you bought it.

How to see how much a stock has gone up over time?

If you want to see how much a stock has gone up over time, you can often just compare the two share prices to find the dollar change over time. Often, though, you'll want to compare what your rate of return would have been if you invested a certain amount of money in one stock rather than another, in which case you'll want to use ...

How to find the percentage of change in stock price?

To compute percentage change in stock price if you don't have a digital percent gain calculator app handy, simply subtract the old price from the new price and divide the difference by the old price. Then, multiply by 100 to get the percent change. If the sign is negative, that means that the price decreased. If it's positive, the price increased over time.

How to adjust stock price after split?

When you're comparing prices before and after a split, it's often useful to adjust the new price by multiplying by the split factor . For example, if a company's stock was worth $10 a year ago and $6 today, but it underwent a two-for-one stock split in the meantime, you would multiply that $6 price by 2 to help understand the value of the same stake in the company has actually gone up.

Why is it important to look at percentage change in stock price?

That's because you often want to know how much a particular investment in a stock would do compared to alternatives, making the relative change more useful to think about than ...

How to write a formula for a price change?

If you call the old price p1 and the new price p2, you can write the formula as 100 * (p2 - p1) / p1. This formula works for all kinds of values that change over time, not just for stock prices.

What is a stock split?

Stocks sometimes undergo stock splits, where they replace each share of the stock with a greater number of new shares in the compan y. They can also undergo reverse splits, where l arger numbers of shares are replaced by smaller numbers. These maneuvers are often done to position the stock price in a range where it's more attractive to investors.

What does it mean when you read about capital gains?

If you are reading about capital gains, it probably means your investments have performed well. Or you're preparing for when they do in the future.

What is the profit you make when you sell stock?

The profit you make when you sell your stock (and other similar assets, like real estate) is equal to your capital gain on the sale . The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level.

How long do you have to hold assets to pay taxes on capital gains?

The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling. There are short-term capital gains and long-term capital gains and each is taxed at different rates. Short-term capital gains are gains you make from selling assets that you hold for one year or less.

Why do people use tax harvesting?

Others say that it costs you more in the long run because you're selling assets that could appreciate in the future for a short-term tax break. You're basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut. And if you re-purchase the stock, you're essentially deferring your capital gains taxation to a later year. Critics of tax-loss harvesting also say that, since there's no way of knowing what changes Congress will make to the tax code, you run the risk of paying high taxes when you sell your assets later.

How to avoid paying taxes on capital gains?

Tax-loss harvesting is a way to avoid paying capital gains taxes. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. By selling unprofitable investments, you can offset the capital gains that you realized from selling the profitable ones. You can write off those losses when you sell the depreciated asset, canceling out some or all of your capital gains on appreciated assets. You can even wait and re-purchase the assets you sold at a loss if you want them back, but you'll still get a tax write-off if you time it right. Some robo-advisor firms have found ways to automate this process by frequently selling investments at a loss and then immediately buying a very similar asset. This allows you to stay invested in the market while still taking advantage of the tax deductions from your losses.

What is tax harvesting?

Tax-loss harvesting is a way to avoid paying capital gains taxes. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. By selling unprofitable investments, you can offset the capital gains that you realized from selling the profitable ones.

What is the tax rate for long term capital gains?

Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%.