Well, to clear up terminology, stocks do not pay interest. Many pay dividends, which you can sometimes choose to either take as cash or to reinvest (meaning either take the dividend in stock or buy more stock with the dividend), which then works much like compounding interest.

Full Answer

How to make money in dividend stocks?

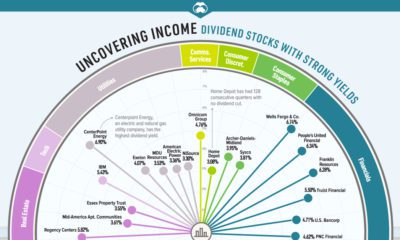

Making money from dividend stocks involves a handful of key factors:

- The dividend yield that a stock offers at the time you buy it

- The rate of growth in the company's profit, which can be used to project future dividend increases

- The health of the company's balance sheet

- Current dividend tax laws

What stocks pay dividends?

These high-yield, well-covered stocks are:

- China Petroleum & Chemical Corp (NYSE: SNP)

- Braskem (NYSE: BAK)

- Ternium (NYSE: TX)

- OneMain Holdings (NYSE: OMF)

- New York Community Bancorp (NYSE: NYCB)

- Sinopec Shanghai Petrochemical (NYSE: SHI)

- Vector Group (NYSE: VGR)

What are the best dividend paying stocks?

Stocks for Beginners: The 3 Best TSX Dividend Stocks to Buy Today

- Fortis. Canada’s top utility stock Fortis (TSX:FTS) (NYSE:FTS) pays stable dividends that yield 3.7%. ...

- Canadian Natural Resources. The country’s biggest oil and gas play Canadian Natural Resources (TSX:CNQ) (NYSE:CNQ) is a relatively safe bet in the sector.

- TC Energy. ...

- Bottom line. ...

How to tell if a stock pays a dividend?

3 top dividend stocks poised to give you a pay raise this month

- Walmart (WMT)

- Coca-Cola (KO)

- Genuine Parts Company (GPC)

- Trending on MoneyWise

Do stocks pay interest or dividends?

Stock funds include only investments in the stock market. If any of these stocks pay dividends, then the mutual fund also pays dividends. Similarly, bond funds include only investments in corporate and government bonds. Most bonds pay guaranteed amounts of interest each year, called coupon payments.

How do dividends work in the stock market?

How do stock dividends work? A dividend is paid per share of stock — if you own 30 shares in a company and that company pays $2 in annual cash dividends, you will receive $60 per year.

Do dividend stocks go up with interest rates?

There are some notable exceptions to the rule that interest rate changes have an effect on stocks with above-average dividend yields. For instance, banks generally pay sizeable dividends. However, they tend to do well when interest rates are rising, because rates usually trend higher when the economy is doing well.

How do you make money in the stock market with dividends?

7 top ways to make money with dividends include:Invest in stocks that pay dividends.Reinvest all dividends received.Invest for higher dividend yields.Invest for dividend growth.Swap portfolio holdings.Sell portfolio holdings for homemade dividends.Minimize income taxes.

How long do you have to hold a stock to get the dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

Do Tesla pay dividends?

Plus, Tesla does not pay a dividend to shareholders, which is also an important factor for income investors to consider. As a result, we believe income investors looking for lower volatility should consider high-quality dividend growth stocks, such as the Dividend Aristocrats.

Are dividends better than interest?

Interest and dividends are among the simplest and safest ways to earn steady investment income. Interest is money earned for lending your money and offers a guaranteed rate of return. Stock dividends are paid regularly by companies, but run the risk of being cut or suspended.

What happens to high dividend stocks when interest rates go up?

While their cash flows may not be as stable or reliable as bonds', dividend-paying stocks tend to exhibit a similar relationship with interest rates. Historically, the highest-yielding stocks have underperformed those that either don't pay dividends or have lower yields during periods of rising interest rates.

Which stock has the highest dividend?

Highest current dividend yieldsCompanyTickerCurrent dividend yieldLumen Technologies, Inc.LUMN, +2.92%8.42%Altria Group Inc.MO, +2.09%6.80%Simon Property Group Inc.SPG, +3.02%6.31%Vornado Realty TrustVNO, +4.62%6.25%12 more rows•May 25, 2022

How can I get $100 a month on dividends?

How To Make $100 A Month In Dividends: A 5 Step PlanChoose a desired dividend yield target.Determine the amount of investment required.Select dividend stocks to fill out your dividend income portfolio.Invest in your dividend income portfolio regularly.Reinvest all dividends received.

How much money do I need to invest to make 1000 a month?

Assuming a deduction rate of 5%, savings of $240,000 would be required to pull out $1,000 per month: $240,000 savings x 5% = $12,000 per year or $1,000 per month.

Can you live off dividends of 1 million dollars?

The average person would need to build a portfolio of at least $1 million to fully cover living expenses with dividend income. A portfolio of $2 million would produce an amount that provides a comfortable lifestyle for most people.

What is dividend per share?

The dividend per share (DPS) calculation shows the amount of dividends distributed by the company for each share of stock during a certain time period. Keeping tabs on a company’s DPS allows an investor to see which companies are able to grow their dividends over time.

How often do companies pay dividends?

In the United States, companies usually pay dividends quarterly, though some pay monthly or semiannually. A company's board of directors must approve each dividend. The company will then announce when the dividend will be paid, the amount of the dividend, and the ex-dividend date.

How to know if a dividend is safe?

Advisors say one of the quickest ways to measure a dividend’s safety is to check its payout ratio, or the portion of its net income that goes toward dividend payments. If a company pays out 100% or more of its income, the dividend could be in trouble. During tougher times, earnings might dip too low to cover dividends. Generally speaking, investors look for payout ratios that are 80% or below. Like a stock's dividend yield, the company's payout ratio will be listed on financial or online broker websites.

What is dividend reinvestment?

Instead of paying cash, companies can also pay investors with additional shares of stock. Dividend reinvestment programs (DRIPs). Investors in DRIPs are able to reinvest any dividends received back into the company's stock, often at a discount. Special dividends.

Why do investors devalue stocks?

However, once a company establishes or raises a dividend, investors expect it to be maintained, even in tough times. Because dividends are considered an indication of a company's financial well-being, investors often will devalue a stock if they think the dividend will be reduced, which lowers the share price.

What is special dividend?

Special dividends. These dividends payout on all shares of a company’s common stock, but don’t recur like regular dividends. A company often issues a special dividend to distribute profits that have accumulated over several years and for which it has no immediate need. Preferred dividends.

What is preferred dividend?

Preferred dividends. Payouts issued to owners of preferred stock. Preferred stock is a type of stock that functions less like a stock and more like a bond. Dividends are usually paid quarterly, but unlike dividends on common stock, dividends on preferred stock are generally fixed.

How do higher interest rates affect stock prices?

Higher interest rates tend to negatively affect earnings and stock prices (with the exception of the financial sector). Understanding the relationship between interest rates and the stock market can help investors understand how changes may impact their investments.

What is the interest rate that impacts the stock market?

The interest rate that impacts the stock market is the federal funds rate. Also known as the discount rate, the federal funds rate is the rate at which depository institutions borrow from and lend to each other overnight.

What happens to the market as interest rates fall?

Conversely, as interest rates fall, it becomes easier for entities to borrow money, resulting in lower-yielding debt issuances.

How does the business cycle affect the market?

At the onset of a weakening economy, a modest boost provided by lower interest rates is not enough to offset the loss of economic activity; stocks may continue to decline.

What is the measure of the sensitivity of a bond's price to a change in interest rates called?

The measure of the sensitivity of a bond's price to a change in interest rates is called the duration . One way governments and businesses raise money is through the sale of bonds. As interest rates rise, the cost of borrowing becomes more expensive for them, resulting in higher-yielding debt issuances.

Why did the Dow drop?

The number of points the Dow dropped on Oct. 10, 2018, due to the fear of higher interest rates. That said, the Dow also dropped even more significantly in March 2020 as the Fed cut rates to near zero amidst the global coronavirus pandemic.

What is interest rate?

Interest rates refer to the cost someone pays for the use of someone else's money. When the Federal Open Market Committee (FOMC), which consists of seven governors of the Federal Reserve Board and five Federal Reserve Bank presidents, sets the target for the federal funds rate —the rate at which banks borrow from and lend to each other overnight—it ...

How do dividends affect stock prices?

Dividends can affect the price of their underlying stock in a variety of ways. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices .

Why do companies pay dividends?

Companies pay dividends to distribute profits to shareholders, which also signals corporate health and earnings growth to investors. Because share prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. ...

What is dividend yield?

The dividend yield and dividend payout ratio (DPR) are two valuation ratios investors and analysts use to evaluate companies as investments for dividend income. The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested. It is expressed as a percentage and calculated as:

Why do dividends go unnoticed?

However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common share, and the stock price is reduced accordingly. As with cash dividends, smaller stock dividends can easily go unnoticed.

What happens to stock after ex dividend?

After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Dividends paid out as stock instead of cash can dilute earnings, which can also have a negative impact on share prices in the short term.

How to calculate dividends per share?

DPS can be calculated by subtracting the special dividends from the sum of all dividends over one year and dividing this figure by the outstanding shares.

How much does a dividend drop at $200?

As with cash dividends, smaller stock dividends can easily go unnoticed. A 2% stock dividend paid on shares trading at $200 only drops the price to $196.10, a reduction that could easily be the result of normal trading. However, a 35% stock dividend drops the price down to $148.15 per share, which is pretty hard to miss.

What is interest on a CD?

Interest is what you earn on your money by lending it: to a company through a bond, for example, or to a bank when you buy a CD. It’s income that’s promised to you by contract, which assures that as long as you park your money for a certain amount of time, you’ll be paid a percentage. You can count on the income.

Do dividends count as income?

You can count on the income. Dividends, on the other hand, are a share of profits that you get as a part owner of a company when you purchase its stock. They are your portion of the company’s earnings—if, in fact, it’s making money.