Five days and more than $3 trillion lost. This week has been one for the history books. The coronavirus wiped $3.18 trillion in market value from U.S. stocks this week, according to estimates from S&P Dow

Dow Jones Industrial Average

The Dow Jones Industrial Average, or simply the Dow, is a stock market index that indicates the value of 30 large, publicly owned companies based in the United States, and how they have traded in the stock market during various periods of time. These 30 companies are also included in the S&…

Full Answer

Why did the stock market fall yesterday?

· The VIX index is currently at 33, and 22% of the S&P 500 stocks trade above their 200 moving average, reflecting high uncertainty but not yet extreme panic 1. Source: FactSet, CBOE VIX, S&P 500 total returns, Edward Jones. Past performance does not guarantee future results. The graph shows that prior spikes in the volatility index (VIX) have ...

What is the biggest drop in the stock market?

Today ||| 52-Week Range. 4,819-15.57%. Year-to-Date ... Most stock quote data provided by BATS. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. All ...

What to expect in the markets this week?

For the week, the Dow and S&P 500 are down 3.55% and 4.69% so far, respectively, while the Nasdaq Composite has declined 6.37%. The stock market has been sliding for months, starting with unprofitable high-growth technology stocks late last year and spreading to companies with healthy cash flows in recent weeks.

Why is stock market falling?

Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq-100, Dow Jones Industrial & more.

How much did the stock market fall today?

The Dow Jones Industrial Average DJIA +1.34% fell 1,164.52 points, or 3.6%, while the S&P 500 SPX +2.02% declined 4%, and the Nasdaq Composite dropped 4.7%.

What percentage has the stock market dropped?

The S&P 500 fell 3.2 percent, adding to a downdraft that has knocked 16.3 percent off the index this year, including a five-week stretch of selling that is the market's longest such decline in more than a decade.

What happened in the stock market this week?

For the week, the Dow fell 2.5%, the S&P 500 shed 3.3%, while the Nasdaq declined 3.9%.

How many points did the stock market drop?

It was the worst showing for U.S. stocks since the start of the COVID-19 pandemic in March of 2020, when the Dow cratered 1,191 points in its largest drop since the financial crisis of 2007 and 2008.

What is the biggest percentage drop in the stock market?

On Monday, Oct. 19, 1987, the Dow Jones Industrial Average plunged by nearly 22%. Black Monday, as the day is now known, marks the biggest single-day decline in stock market history.

Will the market crash again?

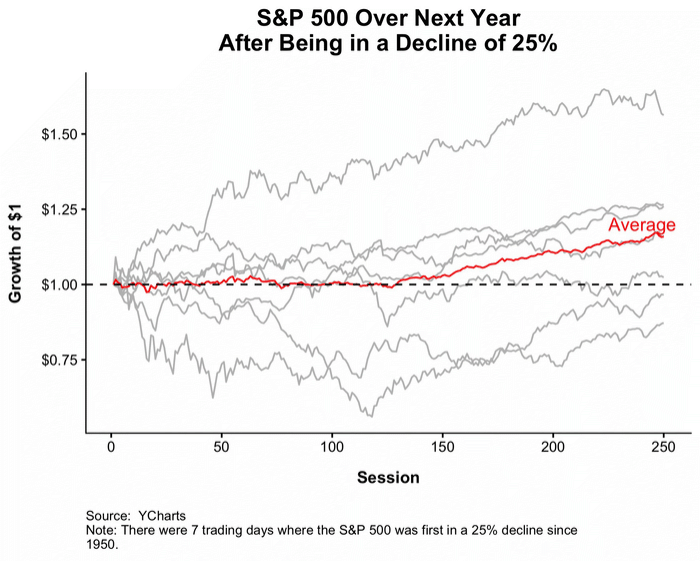

While there are no guarantees when investing, it's extremely likely the market will recover from any future crashes as well. No one can say for sure when the market will crash again, but it's likely there will be a downturn at some point.

How is the stock market doing right now?

Stock marketStock market

Is this a good time to invest?

So, if you're asking yourself if now is a good time to buy stocks, advisors say the answer is simple, no matter what's happening in the markets: Yes, as long as you're planning to invest for the long-term, are starting with small amounts invested through dollar-cost averaging and you're investing in highly diversified ...

Is the stock market in a correction right now?

"The current correction in stocks is overdue: we have not had a 10%+ S&P 500 correction since the quick bear market of March 2020.

How long does it take the market to recover?

2020: As COVID-19 spread globally in February 2020, the market fell by over 30% in a little over a month. But by August 2020, the market had already rebounded, taking six months to recover.

Did the stock market crash 2022?

The shrinking markets. Dow 30, S&P 500, Nasdaq, and Bitcoin all lost value in 2022.

How much has the market dropped in 2022?

The Dow is down nearly 15% in 2022, while the Nasdaq has dropped 29%.

What are the risks involved in investing?

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

What is the wage growth rate in 2007?

At 4.2%, wage growth is now the highest it's been since Thanksgiving of 2007, providing additional fuel for consumers 2. Looking back over the last 25 years, when wage growth was above 4% and accelerating, GDP growth averaged 3.2%, compared with an average of 2.5% over the entire period.

Can indexes be invested?

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Is the stock market going up after Thanksgiving?

The stock market has historically done well after Thanksgiving. Since 1950, the S&P 500 has risen by an average of 1.5% in December, logging a post-holiday gain more than 80% of the time. And when the market rose between Thanksgiving and year-end, three-quarters of the time it went on to deliver a gain in the following year. 1 In other words, a positive finish to the year has often set the table for a continued move higher.

Retail Trading Activity Tracker

What is Retail Trading Activity Tracker? This dataset tracks the daily buying and selling activity of retail investors at the ticker level.

ETFs

Powering trading and investment strategies for a full range of exchange-listed equities in the US, Nordics and Canada.

Investing During Volatility

What to do when the markets are volatile? Here are two primers to get you through the market's roller coaster.

S&P 500, Nasdaq test 2022 lows, market continues slide

Yahoo Finance's Jared Blikre looks at the market approaching a year-to-date low while industries across sectors take hits.

Slack, Peloton resolve widespread outages

Yahoo Finance Live's Brian Cheung and Akiko Fujita examine the resolved outages affecting the Slack and Peloton apps, in addition to commenting on the outlook for companies seeking to return to the office.

3 Important Takeaways From Fiverr's Latest Earnings

Freelance marketplace Fiverr International (NYSE: FVRR) announced its earnings results last week. The pandemic was a boost to Fiverr.

How much capital did the stock market crash wipe out?

The police probing the stock market crash that wiped about $ 3.2 trillion of capital out of the market today claimed to have found clues.

How much did investors lose on Dalal Street?

As the bears took control of Dalal Street on Monday, investors lost some Rs 3,00,000 crore worth of equity wealth. Certainly, not a great start to the week! ETMarkets.com captures the buzz on Dalal Street on what spooked the market and how long will this pain last. Take a look.Rs 3,00,000 crore equity wealth gone: What triggered this collapse

How many points did the BSE Sensex lose?

As the stock market resumed trade after a 45 minute halt, indices trimmed losses and the BSE Sensex was trading lower by around 700 points.Market trims losses as trade resumes, Sensex down 700 points

Why do analysts advise a wait and watch approach?

Some analysts advise a wait-and-watch approach owing to the exchange rate uncertainty.

What did Rogers say when things start shaking for a while?

Rogers said when things start shaking for a while, central bankers panic and they would do anything they can to save the bubble, the bull market and prosperity.

Why many first time investors may turn away from equities forever?

Coronavirus and market crash : Why many first-time investors may turn away from equities forever. Covid-19 has eroded the wealth painstakingly built over the past 4-5 years. The bigger danger is that many first-time investors may turn away from equities forever even as a pauperised populace cuts back on consumption.

Is the domestic market seeing sharp foreign outflows?

The domestic market was already seeing sharp foreign outflows amid rising inflation globally and a hawkish US Federal Reserve stance. The fresh Covid fears could result in a flight to safe havens and selling in riskier assets, which could only increase equity outflows from emerging markets like India.

What happens when asset prices go down?

Lower asset prices may result in substantially higher savings ratios – especially in the US – damping activity severely and feeding back into asset prices. “Like the last two recessions, an asset price bust may be the trigger for the next downturn.

How many points did the Dow close down?

On Tuesday, the Dow opened down 560 points before closing up 560 points. This unsettled trading action was a clear sign that markets were not giving an all-clear sign, no matter the assurances from the Wall Street intelligentsia. Boring markets were officially gone.

What was the VIX low in 2017?

In 2017, the VIX hit a record low of 8.64. By Monday afternoon the index was at 50. This surge in volatility — both realized and expected — led to the implosion of an exchange-traded fund designed to help investors bet against volatility. One of the trendiest trades of 2017 was reversed almost overnight.

Who wrote today's large increase of market volatility will clearly contribute to further outflows from systematic strategies in the days

JP Morgan’s Marko Kolanovic wrote late Monday that, “Today’s large increase of market volatility will clearly contribute to further outflows from systematic strategies in the days ahead.” For the rest of the week, “the computers” being in charge would be an often-heard — if perhaps misguided — theme about what besides higher rates was driving markets.

Who is the floor governor of the New York Stock Exchange?

On Thursday afternoon, Rich Barry , floor governor at the New York Stock Exchange, said the sell-off “has reached a point where traders are asking the following questions: Is this just another healthy correction in a long-running secular bull market? Have we seen the bottom yet?”

Was Monday's decline a bear market?

Wall Street strategists, however, were adamant that Monday’s decline was not the beginning of a bear market or a sign that something in the economic or earnings picture had changed.