- Determine your trader personality.

- Consciously define trade parameters that could match your personality.

- Evaluate the performance of each individual parameter and how you deal with them.

- Make adjustments if you experience problems.

How can I find out what stocks to buy?

Here are three alternative approaches you could follow: Use my powerful new Value Scout tool, which analyzes all stocks on the US stock market each day based on several time-tested value investing criteria, and then sorts them from highest potential to lowest potential. With Value Scout you always know what stocks to buy. Learn more...

How to analyze a stock?

Take a look at the number of ways to analyze a stock and familiarize yourself with these terms. A P/E ratio is short for a price-to-earnings ratio. This is a commonly used method to analyze stocks. You can determine the P/E ratio of a stock by using a simple math division.

What is a stock trading strategy?

Stock Trading Strategies Definition: Stock trading strategies is a discipline of finance. According to Wikipedia, “a trading strategyis a fixed plan that is designed to achieve a profitable return by going long- term or short term trading markets”. A stock market beginner constantly searches for answers to basic questions.

Where to learn trading strategies for the Indian stock market?

Where To Learn Trading Strategies for the Indian Stock Market? An effective approach to master share trading is through learning an easy way out. IFMC institute offers unique stock trade courses for beginners to advanced traders. Uni-Directional Trade Strategies is a systematic approach for traders.

How do you choose a stock strategy?

How to Pick StocksUnderstand your level of risk and decide what is appropriate.No matter your personality type, develop a strategy for choosing stocks to invest in.Start by picking one stock and then analyze the results.Use trading charts to understand movement of stocks and the overall market.More items...•

Which trading strategy is best for beginners?

One of the simplest strategies, which is available even to market beginners, is the trend trading strategy. Its essence is that the price of any asset, such as currency or stock, has only three movement patterns – growth, decline, and sideways movement (as professionals say – flat).

Is day trading like gambling?

Some financial experts posture that day trading is more akin to gambling than it is to investing. While investing looks at putting money into the stock market with a long-term strategy, day trading looks at intraday profits that can be made from rapid price changes, both large and small.

What is safest option strategy?

Covered calls are the safest options strategy. These allow you to sell a call and buy the underlying stock to reduce risks.

How to choose a trading strategy?

That said, check out a few of the major benefits of choosing the right strategy: 1 Finding your stride. Different strategies work better in different environments. Trading breakouts can be advantageous when a lot of stocks are making breakouts … But when the market’s quiet, you may be better off trading for quick scalps and swing trades. Your trading success depends a lot on picking the right strategy for the right market environment. 2 Peace of mind. As traders, we all have different psychological makeup and risk tolerances. Some of us can’t sleep at night if we have an open position, so we might focus on day trading. Others might hate the frenzied pace of day trading. You might feel perfectly calm holding positions for weeks. Trading shouldn’t mean dying of stress. You should enjoy your life — pick a strategy that fits your mindset. 3 Lifestyle. Different lifestyles mean different strategies. Day trading can mean sitting in front of the screen all day … not great for a 9-to-5er. Longer-term trading often means you won’t be in front of the screens as much. It’s generally much more accessible if you work a full-time job. When you’re picking your strategy, keep your preferred lifestyle in mind.

How to start trading for beginners?

Most Common Trading Strategies for Beginners #3: Start Small. If you want to succeed at trading, first make sure you don’t fail. Small trades are the best way to live test your trading. And small profits and losses can be a good way to help enforce trading habits that will serve you well for your entire career.

How many hours a day does the forex market trade?

You can make a trade based on that idea. This can be more appealing than the sheer insanity of the stock market. The forex market trades 24 hours a day, five and a half days a week. Trading follows the sun around the earth, from Asia to Europe to the U.S.

What is scalping in trading?

In the most basic terms, scalping is ultra-short-term day trading. You’re looking to quickly make a penny to 10 cents or so per share. Scalping moves at a rapid pace — you need to be fully focused and use short-term charts and Level 2 quotes. With scalping, the goal is to make many small profits over a trading session.

What is day trading?

Day trading is opening a trade before closing it later in the day, looking to make a profit. Day traders aim to take advantage of intraday price movements, like reactions to news or company announcements. You can often find more trades than if using longer-term strategies.

What is the currency market?

The currency market is also known as the foreign exchange (forex) market. Due to the 24-hour nature of forex, swing trading is common for currencies. Traders may hold currency positions for days, profiting from global macro price waves.

What is investment in investing?

Investing means holding an asset for anywhere between a year and a lifetime. Here, you’re looking for the asset to rise in price, as well as potential dividends. For these positions, think research: fundamentals, business viability, balance sheets, earnings reports.

Why is it important to choose a strategy?

The reason it is important to choose is that the sooner you start, the greater the effects of compounding .

What do I need to do before I make my first investment?

First, figure out how much money you need to cover your investments. That includes how much you can deposit at first as well as how much you can continue to invest going forward.

What is value investing?

Value investors are bargain shoppers. They seek stocks they believe are undervalued. They look for stocks with prices they believe don’t fully reflect the intrinsic value of the security. Value investing is predicated, in part, on the idea that some degree of irrationality exists in the market.

What is the best thing about investing?

The best thing about investing strategies is that they’re flexible. If you choose one and it doesn’t suit your risk tolerance or schedule, you can certainly make changes. But be forewarned: doing so can be expensive. Every purchase carries a fee.

Should I invest if I can't afford it?

Even though you don't need a lot of money to get started, you shouldn't get start if you can't afford to do so. If you have a lot of debts or other obligations, consider the impact investing will have on your situation before you start putting money aside.

Who is the ultimate value investor?

Warren Buffet : The Ultimate Value Investor. But if you are a true value investor, you don't need anyone to convince you need to stay in it for the long run because this strategy is designed around the idea that one should buy businesses—not stocks.

Is growth strategy more successful during periods of decreasing GDP?

Therefore, it stands to reason that a growth strategy may be more successful during periods of decreasing GDP. Some growth investing style detractors warn that “growth at any price” is a dangerous approach.

What is the range of a R squared value?

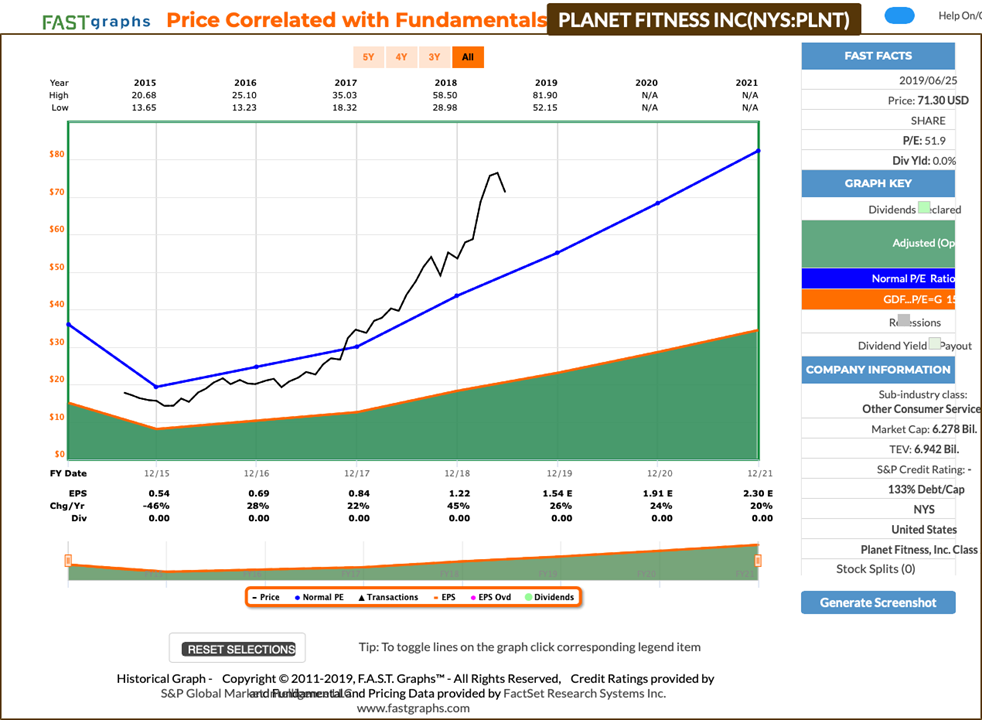

The range for an R-Squared value is between 0 and 1. (Or, if you express it as a percentage, between 0% and 100%.) The higher the value, the closer the data points conform to the regression line. The lower the value, the worse it conforms to the regression line. (In this example, the ‘data points’ are EPS growth numbers.)

Is value investing boring?

Some may think value investing is boring. Or that you have to sacrifice returns . Neither could be further from the truth. In fact, value investing has proven to be one of the most successful forms of investing over time.