shares of common stock are outstanding at year-end

| Transaction | General Journal | Debit | Credit |

| a. | Cash | 300,000 | |

| Common Stock, $25 Par Value | 225,000 | ||

| Paid-In Capital in Excess of Par Value, ... | 75,000 | ||

| b. | Organization Expenses | 170,000 |

Full Answer

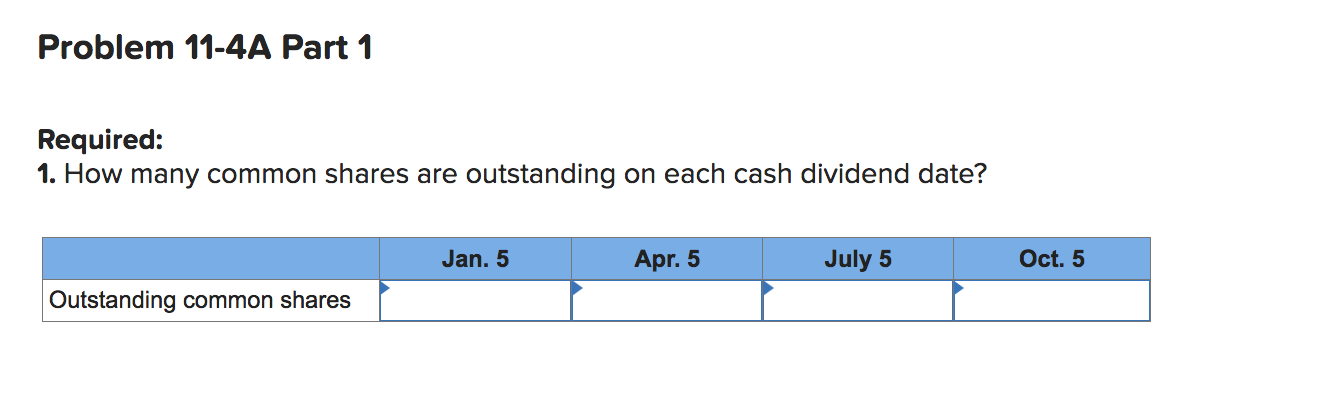

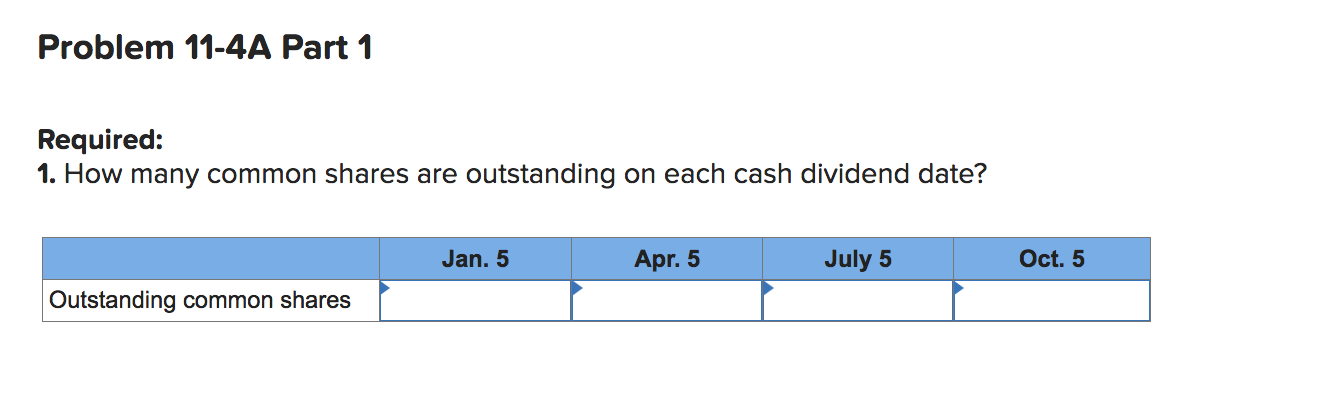

What is the number of shares of common stock outstanding?

The number of shares of common stock outstanding is a metric that tells us how many shares of a company are currently owned by investors. This can often be found in a company's financial statements, but is not always readily available -- rather, you may see terms like "issued shares" and "treasury shares" instead.

What does shares outstanding Mean?

Shares outstanding refers to the number of shares of common stock a company has issued to investors and company executives. The number is used to calculate many common financial metrics, such as earnings per share (EPS) and market capitalization.

How does the number of shares outstanding affect ownership?

The number of a company’s shares of common stock outstanding is the number of shares that investors currently own and has a direct effect on your ownership interest as a stockholder in the company. If the number of shares outstanding rises due to a company issuing additional shares, your percentage ownership will fall.

How do you calculate common stock outstanding with treasury stock?

Subtract the number of shares of treasury stock from the number of issued shares to calculate the number of common shares outstanding. In this example, subtract 1 million shares of treasury stock from 10 million shares issued to get 9 million shares of common stock outstanding at the end of the accounting period.

What does the number of shares of common stock mean?

The number of shares of common stock outstanding is a metric that tells us how many shares of a company are currently owned by investors. This can often be found in a company's financial statements, but is not always readily available -- rather, you may see terms like "issued shares" and "treasury shares" instead.

What is outstanding stock?

Outstanding shares: The total number of shares that are currently available to be bought and sold, as well as shares held by institutions and insiders.

How many shares of Johnson and Johnson were issued in 2014?

Next, 336,620,000 shares were held in the company's treasury at that time, so subtracting this from the number of issued shares means that Johnson & Johnson had 2,783,223,000 outstanding shares at the end of 2014.

What is an issued share?

Issued shares: The total number of shares a company has ever issued. This includes shares that were made available to be bought and sold by the public, as well as shares bought by or issued to company insiders and institutional investors.

What is Treasury Shares?

Treasury shares: Shares that a company has bought back and are held in the company's treasury.

What is float stock?

Float: The shares that are currently available to be bought and sold by the public.

What is the number of shares outstanding in a company?

The number of shares outstanding for a company is equal to the number of shares issued minus the number of shares held in the company's treasury. If a company buys back its own stock, those repurchased shares are called treasury stock.

How does the number of shares outstanding change over time?

The number of shares outstanding increases if a company sells more shares to the public, splits its stock, or employees redeem stock options. The number of shares outstanding decreases if the company buys back shares or a reverse stock split is completed.

How many shares of Apple are outstanding in 2020?

Total shares outstanding decreased from more than 21 billion in 2016 to less than 17 billion in 2020. The tech company spent billions buying back its stock during these years.

What is the difference between number of shares issued and number of shares issued?

A company's number of shares outstanding is the number of shares investors and company executives currently own , while the number of issued shares is the number of shares that have ever been traded in the stock market. A company's number of issued shares includes any shares the company has bought back and now holds in its treasury.

What is the meaning of "shares outstanding"?

Shares outstanding refers to the number of shares of common stock a company has issued to investors and company executives. The number is used to calculate many common financial metrics, such as earnings per share (EPS) and market capitalization.

Where to find outstanding shares?

The number of outstanding shares can be found on a company's most recent quarterly or annual filing with the Securities and Exchange Commission (SEC), usually on its balance sheet in the shareholders' equity section . Image source: Getty Images.

Can a company's number of shares change?

Recognizing that a company's number of shares outstanding can change is also useful. For example, the difference between the number of shares currently outstanding and the number of shares fully diluted is comparatively likely to be significant for fast-growing technology companies.

Where to find common stock?

Find the “Stockholders’ Equity” section of a company’s balance sheet and identify the “Common Stock” line item.

What happens to the number of shares of a company?

The number of a company’s shares of common stock outstanding is the number of shares that investors currently own and has a direct effect on your ownership interest as a stockholder in the company . If the number of shares outstanding rises due to a company issuing additional shares, your percentage ownership will fall.

Why do companies buy back shares?

A company may buy back shares if it believes its shares are undervalued or to reduce its number of outstanding shares. In this example, assume the company has 1 million shares of treasury stock. Subtract the number of shares of treasury stock from the number of issued shares to calculate the number of common shares outstanding.

What happens to your percentage of stock ownership if the number decreases?

If the number decreases, your percentage ownership will increase. A company typically lists its number of shares of common stock outstanding directly on its balance sheet in its “Stockholders’ Equity” section. If it doesn’t, you can calculate the number based on other information provided on the balance sheet.

How to check if your ownership percentage is changing?

Check the number of shares of common stock outstanding each quarter to see if your ownership percentage is changing.

How many common stock does a company have in 2018?

According to the balance sheet for the year 2018, the company has 5.0 million authorized common stock and 1.0 million authorized preferred stock, out of which it has issued 3.5 million common stock and 0.7 million preferred stock. During 2018, the company repurchased 0.3 million common stocks and 0.1 million preferred stocks.

What is the share outstanding formula?

What is the Shares Outstanding Formula? The term “shares outstanding” of a business refers to the number of authorized shares that are being either held by the promoters of the company or sold to the public shareholders while excluding the number of treasury stocks that have been bought back by the company itself.

How many shares of common stock did Walmart have in 2016?

Let us take the example of Walmart Inc.’s financial for the year 2016. The opening number of issued common stock for the year was 3,228 million, while the company repurchased 66 million stock during the year. Based on the given information, Calculate the number of shares outstanding of Walmart Inc. at the end of the year 2016.

How many shares of Apple stock were issued in 2016?

Let us take the example of Apple Inc.’ to explain slightly different kinds of calculations. During 2016, the company repurchased 279.61 million common stock and issued fresh 37.02 million common stock. Calculate the number of shares outstanding of Apple Inc. at the end of the year 2016 if the opening number of issued common stock for the year was 5,578.75 million.

Does the number of shares outstanding increase with the issue of new shares and stock split?

The number of shares outstanding increases with the issue of new shares and stock split, while it decreases with share re-purchase and reverses split.

Is shares outstanding a subset of authorized stock?

Please don’t confuse shares outstanding with authorized stock and issued stock as they are completely different, and shares outstanding is a subset of both authorized stock and issued stock.

What happens if common stock is issued for an amount greater than par value?

If common stock is issued for an amount greater than par value, the excess should be credited to

When will Sheridan pay dividends?

The dividend is to be paid on August 15, 2020, to stockholders of record on July 31, 2020. The correct entry to be recorded on July 15, 2020, will include a

What is the loss of Wildhorse 2022?

An increase in accounts receivable. Wildhorse Co. reported a net loss of $16200 for the year ended December 31, 2022. During the year, accounts receivable decreased $8100, inventory increased $12960, accounts payable increased by $16200, and depreciation expense of $9720 was recorded.

When is Bramble's dividend?

declared a cash dividend of $1.30 per share on 36000 shares of common stock on July 15, 2020. The dividend is to be paid on August 15, 2020, to stockholders of record on July 31, 2020. The correct entry to be recorded on August 15, 2020, will include a. debit to Dividends Payable.