When there is a high short interest in a stock (meaning a large percentage of the trading volume is people selling the stock short) this disrupts the balance between buyers and sellers. A stock’s price is determined by supply (selling) and demand (buying).

What happens when the stock price goes up with low volume?

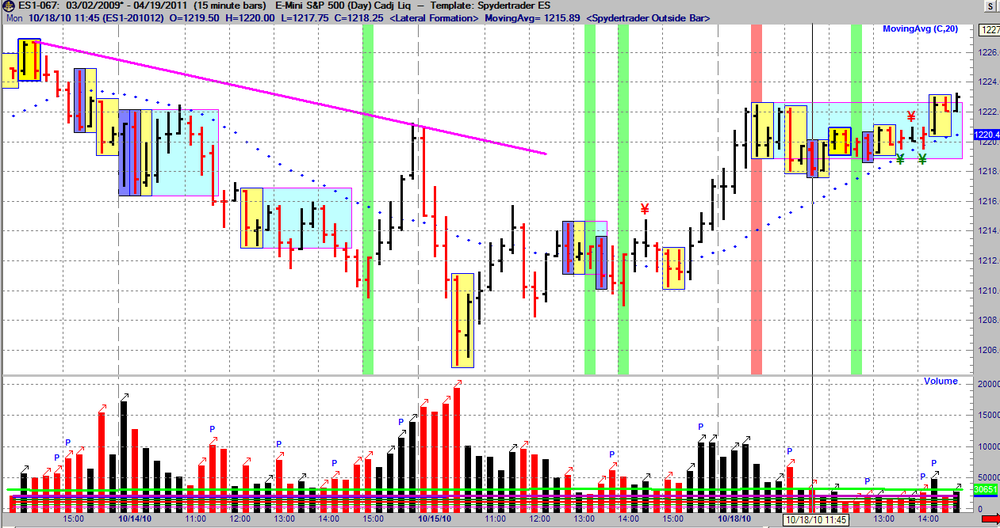

When stock price goes up with low volume or when stock price goes down with low volume the move may be to trap traders or investors. In this chart look at the two candles which are circled. The green candle marks the breakout from the box with high volume.

How does shorting affect a stock price?

Shorting will drive down the price of a stock. Heavy shorting will probably drive the stock price down further. After that, if the company continues to perform poorly, long positions may liquidate and the stock will fall even further. Conversely, if the company reports positive results, a “short squeeze” may occur.

How does trade volume affect stock price?

Trading volume in itself doesn't affect stock price directly, but it does have a huge impact on the way that shares move. Investors who look at thinly traded stocks need to be aware of the heightened volatility involved before they buy. To learn more about stocks and how to start investing,...

How to short sell a stock that is overvalued?

Your prediction is that because of the overvaluation, the price is likely to drop. Your strategy here, when short selling, would be to borrow a certain number of such shares from your broker and then sell those shares on the open market. Now, imagine the price drops down to $275.

How do shorts bring down the price of a stock?

Short sellers are wagering that the stock they are short selling will drop in price. If the stock does drop after selling, the short seller buys it back at a lower price and returns it to the lender. The difference between the sell price and the buy price is the short seller's profit.

What does short sale volume mean for a stock?

The short interest data reflects aggregate short positions held by market participants at a specific moment in time on two discrete days each month, while the Daily Short Sale Volume reflects the aggregate volume of trades executed and reported as short sales on each trade date.

Does shorting cause price to go down?

Shorting will drive down the price of a stock. Heavy shorting will probably drive the stock price down further. After that, if the company continues to perform poorly, long positions may liquidate and the stock will fall even further. Conversely, if the company reports positive results, a “short squeeze” may occur.

What does high short volume indicate?

Short interest, which can be expressed as a number or percentage, is an indicator of market sentiment. Extremely high short interest shows investors are very pessimistic (potentially overly-pessimistic).

What are the most shorted stocks?

Most heavily shorted stocks worldwide April 2022. As of April 2022, the most shorted stock was for the American aviation infrastructure development company Sky Harbour Group Corporation, with 49.88 percent of their total float having been shorted.

What happens if you short a stock and it goes up?

If the stock that you sell short rises in price, the brokerage firm can implement a "margin call," which is a requirement for additional capital to maintain the required minimum investment. If you can't provide additional capital, the broker can close out the position, and you will incur a loss.

Can shorts manipulate a stock?

Key Takeaways. Short-and-distort is an illegal market manipulation scheme that involves shorting a stock and then spreading false information in an attempt to drive down its price.

What is the T 35 rule?

With respect to “delivery against payment” transactions, the broker-dealer has up to 35 calendar days (T+35) to obtain payment “if the security is delayed due to mechanics of the transaction and is not related to the customer's willingness to pay.”

How does short selling affect price?

Shorting occurs when you sell more shares than you own. Since a stock's price is determined by how many people want to buy a share vs. sell one, short selling increases the number of sellers and typically lowers a stock's price.

How many days is a short squeeze?

five daysThe short interest ratio, also called days to cover, means that it will take five days for short sellers to buy back all Medicom shares that have been sold short.

What's a good short ratio?

Typically, investors are looking for a short ratio between 8 and 10 days or higher because it is generally expected that a short ratio of this size is relatively difficult to cover, so the stock will go through a rally before hitting an upswing.

What is a good short ratio for a short squeeze?

A short interest ratio of five or better is a good indicator that short sellers might panic, and this may be a good time to try to trade a potential short squeeze.