How many chart patterns are there in trading?

Each pattern has its own set of rules and strategies to interpret. The 17 chart patterns listed in this resource are one’s technical traders can turn to over and over again, allowing them to take advantage trend reversals and future price movement.

What are stock market chart patterns and why are they important?

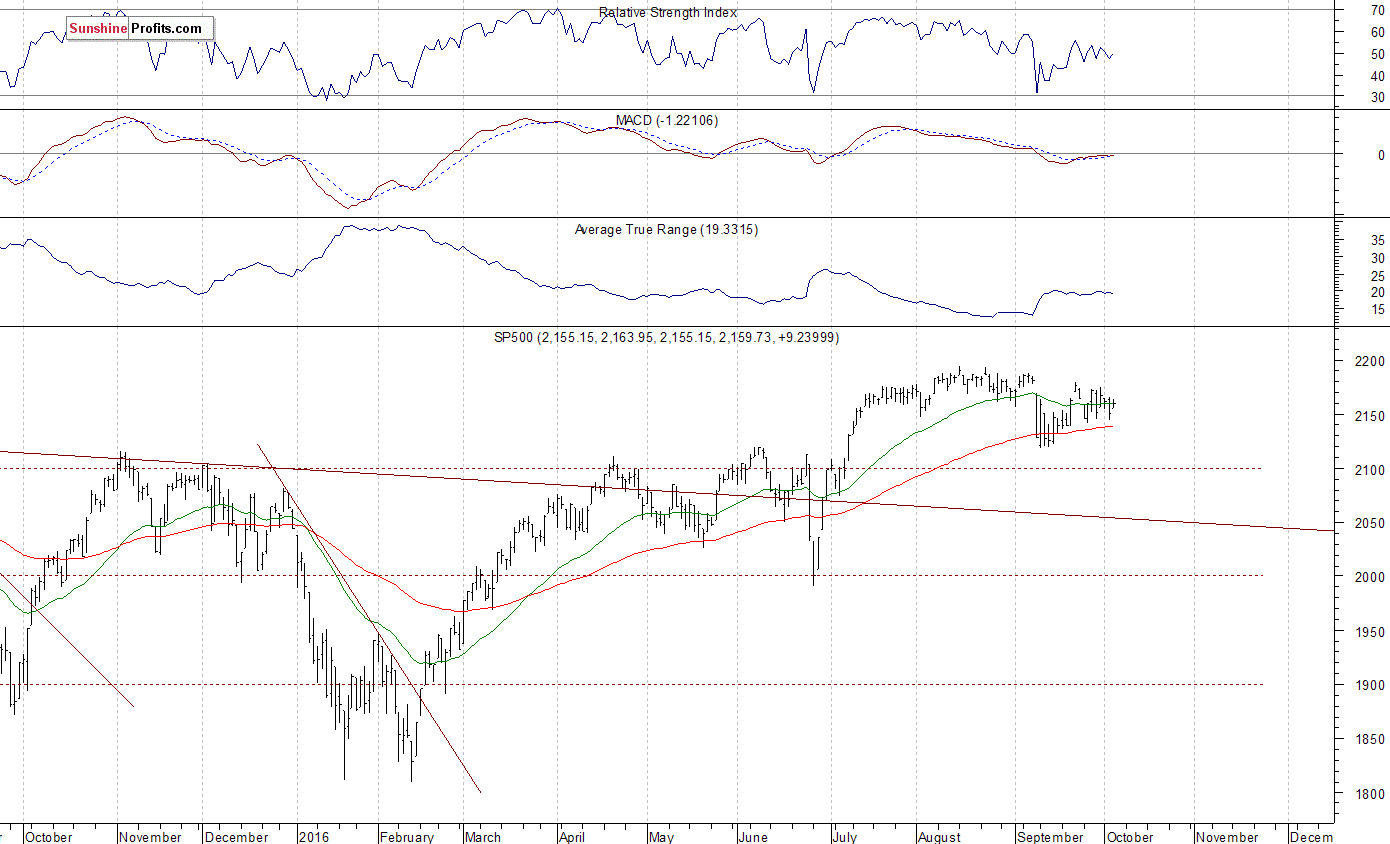

Stock chart patterns are an important trading tool that should be utilised as part of your technical analysis strategy . From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. They can be used to analyse all markets including forex, shares, commodities and more.

How does recurrent neural network predict stock price?

Stock Price Prediction via Discovering Multi-Frequency Trading Patterns KDD ’17, August 13-17, 2017, Halifax, NS, Canada Figure 2: Price prediction with Recurrent Neural Network the temporal context with a suitable length adjusted by the gate units. On the other hand, it models the trading pattern- s with various frequencies in stock market.

How does the stock price identify multi-frequency patterns?

Actually, the stock price reflects the multi-frequency patterns due to the trading activities performed at different paces. Discovering relevant frequency patterns provides useful clues on the future price trend. However, to the best of our knowledge, none of exist- ing methods of price prediction model distinguish between

How do you pull data from stock market?

Internet Sources for Historical Market & Stock DataYahoo! Finance - Historical Prices. ... Dow Jones Industrial Averages. Historical and current performance data. ... S&P Indices. Historical performance data.IPL Newspaper Collection. ... Securities Industry and Financial Markets Association. ... FINRA: Market Data Center.

Can you download stock market data?

One of the first sources from which you can get historical daily price-volume stock market data is Yahoo finance. You can use pandas_datareader or yfinance module to get the data and then can download or store in a csv file by using pandas.

Is there a free stock API?

About Finnhub Stock API With the sole mission of democratizing financial data, we are proud to offer a FREE realtime API for stocks, forex and cryptocurrency. With this API, you can access realtime market data from stock exchanges, 10 forex brokers, and 15+ crypto exchanges.

Is there a stock market API?

The Investing API (provided by APIDojo) allows developers to access stock data for cryptocurrencies and markets. This API is ideal for tracking price changes and exchange rates.

How do I pull market data into Excel?

Steps to fetch Financial Market Data in ExcelOrganize the Data – Ticker Symbol. Type the particular Ticker Symbol or company name for which you want to fetch data. ... Select Ticker and Convert To Stock. Select the Ticker symbol or symbols to get data. ... Select the Stock parameter for Data.

How do I download stock prices in Excel?

How to Import Share Price Data into an Excel SpreadsheetSTEP 1: Open the Spreadsheet. The Spreadsheet is in XLS so it's backwards compatible to MS Excel 97. ... STEP 2: Enter Stock Codes into Column A. Don't forget to add the correct suffix or prefix as detailed above.STEP 3: Click the “Download Data” Button. A few caveats:

What is the best API for stock data?

6 best stock APIsFinnhub Stock API.Morningstar stock API.Xignite API.Bloomberg API.Google sheet finance.Exegy.

Where can I get stock data for free?

DataYahoo Finance.Google Finance in Google Sheets.IEX Cloud.AlphaVantage.World trading data.Other APIs (Polygon.io, Intrinio, Quandl)

Does Google have a stock API?

The Google Finance Gadget API has been officially deprecated since October 2012, but as of April 2014, it's still active. It is completely dead as of March 2022. Note that if your application is for public consumption, using the Google Finance API is against Google's terms of service.

Does Tradingview have an API?

We don't have an API that gives access to data as of now, but we are planning to add it in the future. Our REST API is meant for brokers who want to be supported on our trading platform.

Does Morningstar have an API?

The Morningstar API Center provides users with direct access to Morningstar Data. By utilizing an API delivery, you can eliminate the need to download and process large data files. Your applications and tools can benefit from the most up to date data that Morningstar has to offer.

Does Google Finance API still work?

To reiterate, the Google Finance API is no longer supported by Google so it's undocumented and unreliable. Therefore, this API is best for private toy applications. Public resources, such as RapidAPI, are a good place to learn about well maintained and available APIs.

How can I download stock data for free?

Here is an updated list of ten new websites that allow you to download free historical data for U.S. stocks.AlphaVantage. ... Financial Content. ... Tiingo. ... Quotemedia. ... Investopedia. ... Macrotrends. ... Wall Street Journal. ... Nasdaq Website.More items...•

Can I download data from Yahoo Finance?

You can view historical price, dividend, and split data for most quotes in Yahoo Finance to forecast the future of a company or gain market insight. Historical data can be downloaded as a CSV file to be used offline, which you can open with Excel or a similar program.

How do I find a stock price on a certain date?

Use the "Historical Stock Price Values" tool on the MarketWatch website to find stock prices for a specific date. Enter the symbol of the stock, or a keyword for the company if you don't know the stock symbol, into the first box in the tool.

How do I download historical data from Interactive Brokers?

2:264:00Download Historical Stock Data using Python | Interactive BrokersYouTubeStart of suggested clipEnd of suggested clipData. We can use the same super simple function to fetch historical data for an options contract asMoreData. We can use the same super simple function to fetch historical data for an options contract as illustrated in this. Example.

How do trendlines work?

Since price patterns are identified using a series of lines and/or curves, it is helpful to understand trendlines and know how to draw them. Trendlines help technical analysts spot areas of support and resistance on a price chart. Trendlines are straight lines drawn on a chart by connecting a series of descending peaks (highs) or ascending troughs (lows).

How to tell if a trend is continuing?

A continuation pattern can be thought of as a pause during a prevailing trend—a time during which the bulls catch their breath during an uptrend, or when the bears relax for a moment during a downtrend. While a price pattern is forming, there is no way to tell if the trend will continue or reverse. As such, careful attention must be placed on the trendlines used to draw the price pattern and whether price breaks above or below the continuation zone. Technical analysts typically recommend assuming a trend will continue until it is confirmed that it has reversed.

Why are trendlines important?

Trendlines are important in identifying these price patterns that can appear in formations such as flags, pennants and double tops. Volume plays a role in these patterns, often declining during the pattern's formation, and increasing as price breaks out of the pattern.

What are continuation patterns?

If price continues on its trend, the price pattern is known as a continuation pattern. Common continuation patterns include: 1 Pennants, constructed using two converging trendlines 2 Flags, drawn with two parallel trendlines 3 Wedges, constructed with two converging trendlines, where both are angled either up or down

What is trendline on intraday chart?

Trendlines will vary in appearance depending on what part of the price bar is used to "connect the dots." While there are different schools of thought regarding which part of the price bar should be used, the body of the candle bar—and not the thin wicks above and below the candle body—often represents where the majority of price action has occurred and therefore may provide a more accurate point on which to draw the trendline, especially on intraday charts where "outliers" (data points that fall well outside the "normal" range) may exist.

Where do uptrends occur?

Uptrends occur where prices are making higher highs and higher lows. Up trendlines connect at least two of the lows and show support levels below price. Downtrends occur where prices are making lower highs and lower lows. Down trendlines connect at least two of the highs and indicate resistance levels above the price.

How long do triangles last?

These chart patterns can last anywhere from a couple of weeks to several months.

Abstract

Technical analysis of stocks mainly focuses on the study of irregularities, which is a non-trivial task. Because one time scale alone cannot be applied to all analytical processes, the identification of typical patterns on a stock requires considerable knowledge and experience of the stock market.

1. Introduction

According to the efficient market theory, it is practically impossible to infer a fixed long-term global forecasting model from historical stock market information. It is said that if the market presents some irregularities, someone will take advantages of it and this will cause the irregularities to disappear.

3. Wave pattern identification

According to Thomas [14], there are up to 47 different chart patterns, which can be identified in stock price charts. These chart patterns play a very important role in technical analysis with different chart patterns revealing different market trends.

4. Wavelet recognition and matching

Wavelet analysis is a relatively recent development of applied mathematics in 1980s. It has since been applied widely with encouraging results in signal processing, image processing and pattern recognition [16] ). As the waves in stock charts are 1D patterns, no transformation from higher dimension to 1D is needed.

5. Training set collections

Stock chart pattern identification is highly subjective and humans are far better than machines at recognizing stock patterns, which are meaningful to investors. Moreover, extracting chart patterns in the stock time series data is a time consuming and expensive operation.

6. Experimental results

Two set of experiments have been conducted to evaluate the accuracy of the proposed system. The first set evaluates whether the algorithm PXtract is scaleable, and the second set evaluates the performance comparison between using simple multi-resolution matching and RBFNN matching.

7. Conclusion and future works

In this paper, we examined the sensitive factors associated with stock forecast and stressed the importance of chart pattern identification. We have demonstrated how to automate the process of chart pattern extraction and recognition, which has not been discussed in previous studies.

What does it mean when two trend lines meet?

For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. The support line is drawn with an upward trend, and the resistance line is drawn with a downward trend. Even though the breakout can happen in either direction, it often follows the general trend of the market.

What is ascending triangle?

The ascending triangle is a bullish ‘continuation’ chart pattern that signifies a breakout is likely where the triangle lines converge. To draw this pattern, you need to place a horizontal line (the resistance line) on the resistance points and draw an ascending line (the uptrend line) along the support points.

What is a cup and handle?

The cup and handle is a well-known continuation stock chart pattern that signals a bullish market trend. It is the same as the above rounding bottom, but features a handle after the rounding bottom. The handle resembles a flag or pennant, and once completed, you can see the market breakout in a bullish upwards trend.

What does a double bottom mean?

A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. It is a reversal chart pattern as it highlights a trend reversal. After unsuccessfully breaking through the support twice, the market price shifts towards an uptrend.

What is the difference between a descending triangle and a descending triangle?

2. Descending triangle. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. 3. Symmetrical triangle.

When a price signal changes direction, it is a reversal pattern.?

When a price signal changes direction, it is a reversal pattern. However, when a price trend continues in the same direction it is a continuation pattern. Technical analysts have long used chart patterns as a method for forecasting price movements and trend reversals. You can use our pattern recognition software to help inform your analysis.

What is the head and shoulders pattern?

The head and shoulders pattern tries to predict a bull to bear market reversal. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. The trend is then likely to breakout in a downward motion.

What is stock chart pattern?

Stock chart patterns, when identified correctly, can be used to identify a consolidation in the market, often leading to a likely continuation or reversal trend. Traders may use these trendlines to forecast price patterns that can be traded for profit.

How many pattern patterns are there in stock charts?

There are many different continuation and reversal patterns to look out for when reading the stock charts. This list of 17 chart patterns are essential, and knowing them will give an investor a trading edge, so it pays to keep these close. Looking for these chart patterns every day, studying the charts will allow the trader to learn and recognize technical trading strategies in the data and the implications that these patterns imply.

Who is Chris Douthit?

Chris Douthit, MBA, CSPO, is a former professional trader for Goldman Sachs and the founder of OptionStrategiesInsider.com. His work, market predictions, and options strategies approach has been featured on NASDAQ, Seeking Alpha, Marketplace, and Hackernoon.

How to get Stock Market Data for different geographies?

To get stock market data for different geographies, search the ticker symbol on Yahoo finance and use that as the ticker

What is YFinance module?

yfinance module can be used to fetch the minute level stock market data. It returns the stock market data for the last 7 days.

What should the name of the column in a dataframe be?

The name Open, High, Low, Close and Volume should match the column names in your dataframe.

What to do if playback doesn't begin?

If playback doesn't begin shortly, try restarting your device.

How long does it take to model the stock market?

During strategy modelling, you might be required to work with a custom frequency of stock market data such as 15 minutes or 1 hour or even 1 month.

Why is Python important?

Python is quite essential to understand data structures, data analysis, dealing with financial data, and for generating trading signals. For traders and quants who want to learn and use Python in trading, this bundle of courses is just perfect. Disclaimer: All investments and trading in the stock market involve risk.

Is Quandl free?

Quandl has many data sources to get different types of stock market data. However, some are free and some are paid. Wiki is the free data source of Quandl to get the data of the end of the day prices of 3000+ US equities. It is curated by Quandl community and also provides information about the dividends and split.

How can machine learning be used to invest?

The stock market is known as a place where people can make a fortune if they can crack the mantra to successfully predict stock prices. Though it’s impossible to predict a stock price correctly most the time. So, the question arises, if humans can estimate and consider all factors to predict a movement or a future value of a stock, why can’t machines? Or, rephrasing, how can we make machines predict the value for a stock? Scientists, analysts, and researchers all over the world have been trying to devise a way to answer these questions for a long time now.

What is LSTM in RNN?

The LSTM helps the RNN to keep the memory over a long period of time, solving the vanishing and exploding gradient problems. We are not going to talk about it in detail here. You can find the details here.

How many predicted values does the regressor model produce?

So, for this, we predict our full dataset using both the models. The Regressor model produces 2636 predicted values.

Why do we need to drop the 0-50 index from regression?

Our predictions of both models are ready. We need to drop the 0–50 index from the Regression predictions because there are no RNN predictions for those values. We are now ready to merge the results.

Why is there a count of 200 in Yahoo?

In these 200 companies, we will have a target company and 199 companies that will help to reach a prediction about our target company.

What is the date in a stock market feature set?

It will produce a feature set like this. The Date is the index and corresponding to the Date, each ticker’s “Adj Close” value. Now, We will see there are a few empty columns initially. This is because these companies didn’t start to participate in the stock market back in 2010. This will give us a feature set of 200 columns containing 199 company’s values and the Date.

Why scale data?

Now, we scale our data to make our model converge easily, as we have large variations of values in our data set.

Trendlines in Technical Analysis

Continuation Patterns

- A price pattern that denotes a temporary interruption of an existing trend is known as a continuation pattern. A continuation pattern can be thought of as a pause during a prevailing trend—a time during which the bulls catch their breath during an uptrend, or when the bears relax for a moment during a downtrend. While a price pattern is forming, there is no way to tell if the tr…

Reversal Patterns

- A price pattern that signals a change in the prevailing trend is known as a reversal pattern. These patterns signify periods where either the bulls or the bears have run out of steam. The established trend will pause and then head in a new direction as new energy emerges from the other side (bull or bear). For example, an uptrend supported by enthusiasm from the bulls can pause, signifying …

The Bottom Line

- Price patterns are often found when price "takes a break," signifying areas of consolidation that can result in a continuation or reversal of the prevailing trend. Trendlines are important in identifying these price patterns that can appear in formations such as flags, pennants and double tops. Volume plays a role in these patterns, often declining...