As a summary, EPS is found by taking net income and dividing it by weighted average shares outstanding, or WASO. Using the treasury

United States Secretary of the Treasury

The secretary of the treasury is the head of the United States Department of the Treasury which is concerned with all financial and monetary matters relating to the federal government, and, until 2003, also included several major federal law enforcement agencies. This position in the feder…

What is the effect of treasury stock on diluted EPS?

However, there is an effect on shares outstanding, or the WASO. Since net income, the numerator, has a change of zero under the treasury stock method and the weighted average shares outstanding, the denominator, increases, there is a guaranteed decrease in the diluted EPS.

What is the EPs formula for treasury stock?

The EPS formula indicates a company’s ability to produce net profits for common shareholders. (EPS). The treasury stock method implies that the money obtained by the company from the exercising of an in-the-money option is used for stock repurchases.

What is the impact of share repurchase on EPs?

Repurchase Impact on EPS. Since a share repurchase reduces a company’s outstanding shares, its biggest impact is evident in per-share measures of profitability and cash flow such as earnings per share (EPS) and cash flow per share (CFPS).

What are the effects of a treasury stock purchase?

A treasury stock purchase reduces total assets and total equity by equal amounts. Laws are placed on treasury stock purchases to limit a company from reducing its ability to pay its creditors.

Does purchase of treasury stock affect EPS?

By buying back its stock, a firm reduces the number of shares outstanding, which in turn gives each shareholder a larger piece of earnings. Likewise, the lower number of shares can improve EPS and other ratios.

Does purchasing treasury stock decrease earnings per share?

Understanding Treasury Stock (Treasury Shares) Because treasury stock represents the number of shares repurchased from the open market, it reduces shareholders' equity by the amount paid for the stock.

How will retained earnings be affected by purchase of treasury shares?

Treasury stock are shares a company authorizes but does not issue or issues but buys back from investors to reissue and not retire. Treasury stock transactions only decrease retained earnings and only under specific circumstances. Companies cannot increase retained earnings from the sale of treasury stock.

What impact does the purchase of treasury stock have on dividends paid?

Treasury stock is not entitled to dividend payments. Since only shares owned by the issuing company itself are considered treasury stock, it does not make sense to pay dividends to these. Dividend payments to treasury stock would result in the company paying money to itself and would be a non-event.

Does purchasing treasury stock decrease retained earnings?

Treasury stock indirectly lowers retained earnings, as it is subtracted from stockholders' equity.

How will retained earnings be affected by purchase of treasury shares and subsequent sales of treasury shares at higher acquisition costs?

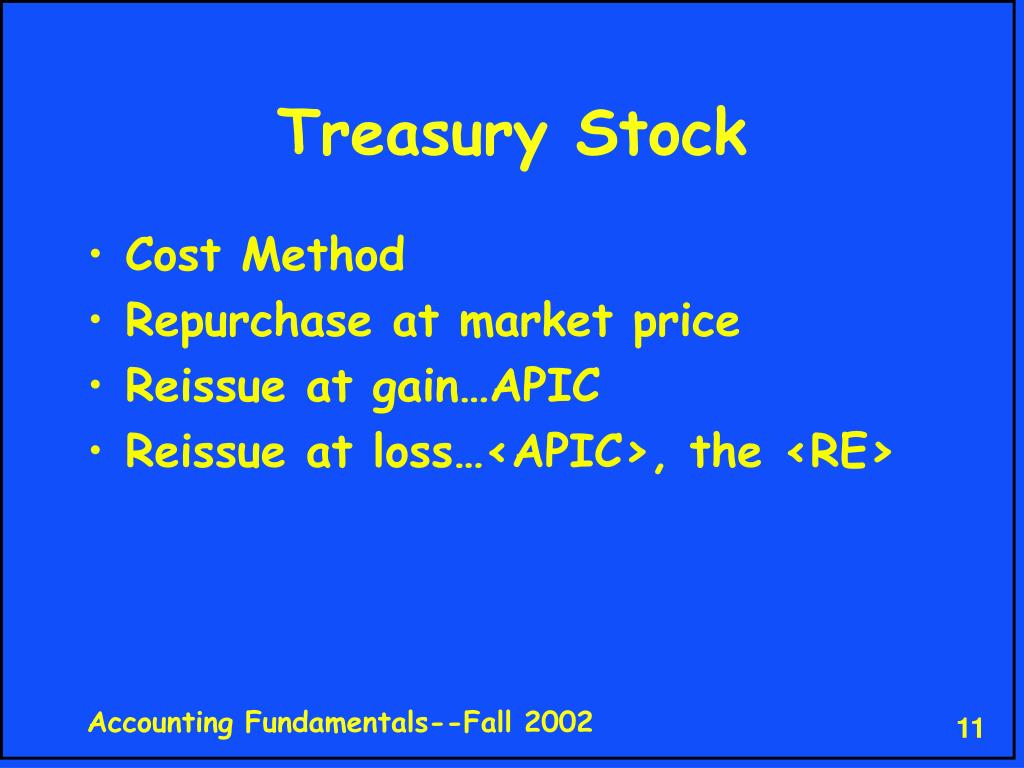

Retained earnings is unaffected. When the treasury stock is subsequently reissued for cash at a price in excess of its acquisition cost, the difference between the cash received and the carrying value (acquisition cost) of the treasury stock is credited to additional paid-in capital.

How do you record treasury stock purchases?

The company can record the purchase of treasury stock with the journal entry of debiting the treasury stock account and crediting the cash account. In this journal entry, the par value or stated value of the stock, as well as the original issued price, is not included with recording the purchase of the treasury stock.

Why would a company purchase treasury stock?

Companies may use treasury stock to pay for an investment or acquisition of competing businesses. These shares can also be reissued to existing shareholders to reduce dilution from incentive compensation plans for employees.

When treasury stock is purchased for an amount greater than its par What is the effect on total shareholders equity?

When treasury stock is purchased for an amount greater than its par, what is the effect on total shareholders' equity? Decrease.

Does stock dividend affect treasury shares?

The stockholders' equity can be calculated from the balance sheet by subtracting a company's liabilities from its total assets. Although stock splits and stock dividends affect the way shares are allocated and the company share price, stock dividends do not affect stockholder equity.

What effect does the purchase of treasury stock have on the balance sheet quizlet?

The purchase of treasury stock has the same effect on the balance sheet as issuing stock does. The purchase of treasury stock by a corporation increases total assets and stockholders' equity. Total stockholders' equity remains the same before and after a stock split.

What is EPS in stock?

The EPS formula indicates a company’s ability to produce net profits for common shareholders. (EPS). The treasury stock method implies that the money obtained by the company from the exercising of an in-the-money option is used for stock repurchases. Repurchasing those shares turns them into treasury stock, hence the name.

Why is EPS diluted?

EPS is diluted due to outstanding in-the-money options. Stock Option A stock option is a contract between two parties which gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period.

What is diluted EPS?

Therefore, the GAAP method is utilized to compute this figure for financial reporting. EPS is diluted due to outstanding in-the-money options. Stock Option A stock option is a contract between two parties which gives the buyer ...

How to find EPS?

As a summary, EPS is found by taking net income and dividing it by weighted average shares outstanding, or WASO. Using the treasury stock method, there is no effect on net income. Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through.

When repurchased common shares, what is the exercise date assumed?

When exercising warrants and options, the exercise date assumed is the start of the reporting period.

What is a stock option writer?

A seller of the stock option is called an option writer, where the seller is paid a premium from the contract purchased by the stock option buyer. and warrants. These allow investors who own them to buy a number of common shares at a price below lower than the current market price.

What happens when treasury stocks are retired?

When treasury stocks are retired, they can no longer be sold and are taken out of the market circulation. In turn, the share count is permanently reduced, which causes the remaining shares present in circulation to represent a larger percentage of shareholder ownership, including dividends and profits.

What is Treasury stock?

Treasury stock, or reacquired stock, is the previously issued, outstanding shares of stock which a company repurchased or bought back from shareholders. The reacquired shares are then held by the company for its own disposition. They can either remain in the company’s possession to be sold in the future, or the business can retire ...

How to repurchase shares of a company?

There are three methods by which a company may carry out the repurchase: 1. Tender offer. The company offers to repurchase a number of shares from the shareholders at a specified price the company is willing to pay, which is most likely at a premium or above market price.

What happens when a company's stock is not performing well?

When the market is not performing well, the company’s stock may be undervalued – buying back the shares will usually boost the share price and benefit the remaining shareholders. 4. Retiring of shares. When treasury stocks are retired, they can no longer be sold and are taken out of the market circulation.

How does a repurchase action affect the value of a company?

The repurchase action lowers the number of outstanding shares, therefore, increasing the value of the remaining shareholders’ interest in the company. The reacquisition of stock can also prevent hostile takeovers when the company’s management does not want the acquisition deal to push through.

What is direct repurchase?

Open market or direct repurchase. Direct buying of shares in the open market. When a company announces the repurchase of stocks, it often causes the share price to increase, which is perceived by the market as a positive outcome. The company then simply proceeds to purchase shares as other investors would on the market.

What is a stock buyback?

A stock buyback, or share repurchase, is one of the techniques used by management to reduce the number of outstanding shares circulating in the market. It benefits the company’s owners and investors because the relative ownership of the remaining shareholders increases. There are three methods by which a company may carry out the repurchase: 1.

What is Treasury stock?

Treasury stock is the name for previously sold shares that are reacquired by the issuing company. When a corporation buys back some of its issued and outstanding stock, the transaction affects retained earnings indirectly.

Why do companies buy back their own stock?

When a corporation buys back some of its own stock, it reduces the number of shares issued and outstanding, increasing the corporation's earnings per share and making its stock more attractive to investors.

What is supply and demand theory?

Supply and demand theory states that if demand for something remains constant and the supply of something decreases, the price will increase. Treasury stock, while decreasing stockholders' equity and retained earnings, can generate a stock price increase in the market.

Can corporations use treasury stock?

Corporations can also use treasury stock to offer employee stock options as part of their compensation packages. Although this effectively lowers dividends, by subtracting treasury stock costs from retained earnings, share prices may increase for stockholders.

Does retained earnings affect dividends?

Since both retained earnings and treasury stock are reported in the stockholders' equity section of the balance sheet, amounts available to pay dividends decline . The cost of treasury stock must be subtracted from retained earnings, reducing amounts the company can distribute to stockholders as dividends.

What happens when you sell treasury stock?

Selling treasury stock always results in an increase in shareholders' equity. What happens when shares are sold at a discount to their cost. The preceding example shows you what happens when a company sells treasury stock at a premium to cost.

How much did Foolish Corporation pay to buy back 100 shares?

Remember, Foolish Corporation originally paid $10 to buy back 100 shares. In the last example, it sold 50 shares of treasury stock for $15 each, a $5 premium to cost. At the end of the last example, shareholders' equity looked like this.

When did companies start buying back stock?

Beginning in the 1980s , however, companies started to return more cash to shareholders by buying back stock. When shares are bought back, the shares go into the "treasury stock" line on the balance sheet. Sometimes, companies buy back stock only to sell it at a later date.

Does selling treasury stock increase equity?

But take notice: Even though the treasury stock was sold at a discount to cost, shareholders' equity increases. That's because selling treasury stock results in an increase in cash with no offsetting liability. Thus, shareholders' equity increases by $100. Again, selling treasury stock always results in an increase in shareholders' equity.

Why can't companies carry treasury stock on the balance sheet?

That's because it is a way of taking resources out of the business by the owners/shareholders, which in turn, may jeopardize the legal rights of creditors . At the same time, some states don't allow companies to carry treasury stock on the balance sheet at all, instead requiring them to retire shares. California, meanwhile, does not recognize ...

What is Treasury stock?

Treasury stock is the cost of shares a company has reacquired. When a company buys back stock, it may resell them later to raise cash, use them in an acquisition, or retire the shares. There’s some discussion around whether treasury stock should be carried on the balance sheet at historical cost or at the current market value.

What are some examples of treasury stocks?

One of the largest examples you'll ever see of treasury stock on a balance sheet is Exxon Mobil Corp. , one of the few major oil companies and the primary descendant of John D. Rockefeller's Standard Oil empire. 5

Why do companies buy back their stock?

Companies buy back their stock to boost their share price, among other objectives. When the company buys back its shares, it has a choice to either sit on those reacquired shares and later resell them to the public to raise cash, or use them in an acquisition to buy competitors or other businesses. 2 .

Is Treasury stock carried at historical cost?

From time to time, certain conversations take place in the accounting industry as to whether or not it would be a good idea to change the rules for how companies carry treasury stock on the balance sheet. At present, treasury stock is carried at historical cost. Some think it should reflect the current market value of the company's shares.

How does a share repurchase affect the financials of a company?

How a Share Repurchase Affects Financial Statements. A share repurchase has an obvious effect on a company’s income statement, as it reduces outstanding shares , but share repurchases can also affect other financial statements.

Why do companies repurchase their shares?

When a company buys back shares, it's generally a positive sign because it means that the company believes its stock is undervalued and is confident about its future earnings.

What does a repurchase of shares mean?

As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. Unlike a dividend hike, a buyback signals that the company believes its stock is undervalued and represents the best use of its cash at that time.

What does it mean when a company buys back its shares?

When a company buys back its shares, it usually means that a firm is confident about its future earnings growth. Profitability measures like earnings per share (EPS) usually experience a huge impact from a share repurchase. Share repurchases can have a significant positive impact on an investor’s portfolio.

Why is a float shrink called a repurchase?

A share repurchase is also known as a float shrink because it reduces the number of a company’s freely trading shares or float .

What happens when a company reduces the number of shares outstanding?

When a company reduces the number of shares outstanding, each of your shares becomes more valuable and represents a greater percentage of equity in the business. It's akin to cutting the same pie with thicker slices. There isn't more pie available, but it's being split up among fewer pieces.

What is a stock buyback program?

Updated February 18, 2021. Through stock buyback programs (also known as share repurchase programs), companies buy back shares of their own stock at market price to retain ownership. Doing so reduces the number of shares outstanding and increases the ownership stake of remaining stockholders.

Is there more pie available?

There isn't more pie available, but it's being split up among fewer pieces. In the corporate world, this "pie" includes all the benefits of holding a stock: company ownership, earnings per share, stock value, and more.

Treasury Stock Method Formula

- Additional shares outstanding = Shares from exercise – repurchased shares Additional shares outstanding = n – (n x K / P) Additional shares outstanding = n (1 – K/P) Where: 1. n= shares from options or warrants that are exercised 2. K= Average exercise share price 3. P= Average share price for the period To learn more, launch our free accounting and finance courses!

Implementing The Treasury Stock Method

- The treasury stock method has certain assumptions: 1. The company repurchases common shares using an average price dictated by the market using the capital obtained when investors exercise their options 2. When exercising warrants and options, the exercise date assumed is the start of the reporting period.

Example

- For example, a company has an outstanding total of in-the-money options and warrants for 15,000 shares. The exercise price of each of these options is $7. The average market price, however, for the reporting period is $10. Assuming all the options and warrants outstanding are exercised, the company will generate 15,000 x $7 = $105,000 in proceeds. Using these proceeds, the company …

Effect on Diluted EPS

- The exercise of in-the-money options and warrants is the most dilutive of all potentially dilutive actions. As a summary, EPS is found by taking net income and dividing it by weighted average shares outstanding, or WASO. Using the treasury stock method, there is no effect on net income, as all proceeds from the repurchase are assumed to be depleted...

More Resources

- We hope this has been a helpful guide to the treasury stock method of calculating diluted shares outstanding. If you’re interested in advancing your career in corporate finance, these CFI articles will help you on your way: 1. What is Financial Modeling? 2. Types of Financial Models 3. IPO Process 4. M&A Process