What was the impact of the 1929 stock market crash?

May 07, 2014 · Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket. The crash affected many more than the relatively few Americans who invested in the stock market.

How did the stock market crash affect rural America?

Jobs were hard to find. Farmers and rural residents felt the stock market crash as well – people and companies that used to buy food and other agricultural products no longer had the money to buy much of anything. The crash, along with other factors, produced an economic slowdown that lasted over 10 years and became known as "the Great Depression."

What was the worst stock market crash in US history?

What happened to African-American jobs after the stock market crash?

How did the stock market crash affect people's lives?

Effects of the Crash The crash wiped many people out. They were forced to sell businesses and cash in their life savings. Brokers called in their loans when the stock market started falling. People scrambled to find enough money to pay for their margins.

How did the stock market crash change American society?

While New York's actions protected commercial banks, the stock-market crash still harmed commerce and manufacturing. The crash frightened investors and consumers. Men and women lost their life savings, feared for their jobs, and worried whether they could pay their bills.

What did the stock market crash do to the United States?

In October of 1929, the stock market crashed, wiping out billions of dollars of wealth and heralding the Great Depression. Known as Black Thursday, the crash was preceded by a period of phenomenal growth and speculative expansion.

Why did the stock market crash have such a powerful impact on the overall economy?

Why did the stock market crash have such a powerful impact on the overall economy? So much money had been invested into it and so much wealth, both actual and imagined, was bound to it. Why would an investor who had not bought stocks on margin have been in a better position to survive the crash than one who had?

How did the stock market crash simple explanation?

People were buying stocks using credit - Many people were borrowing money to buy stocks (called "margin"). When the market began to fall, they had to sell quickly in order to pay their debts. This caused a domino effect where more and more people had to sell.

How did the great crash contribute to the Great Depression?

The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse of which it was also a symptom. By 1933, nearly half of America's banks had failed, and unemployment was approaching 15 million people, or 30 percent of the workforce.Apr 27, 2021

How did the Great Depression affect American workers?

During the Great Depression, millions of U.S. workers lost their jobs. By 1932, twelve million people in the U.S. were unemployed. Approximately one out of every four U.S. families no longer had an income. In 1930, more than 200,000 evictions took place in New York City alone, as renters could not pay their bills.

When did the stock market crash in the United States?

October 29, 1929On October 29, 1929, "Black Tuesday" hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors.

How did the stock market crash affect people?

Although only a small percentage of Americans had invested in the stock market, the crash affected everyone. Banks lost millions and, in response, foreclosed on business and personal loans, which in turn pressured customers to pay back their loans, whether or not they had the cash.

What were the effects of the 1929 stock market crash?

The prosperous decade leading up to the stock market crash of 1929, with easy access to credit and a culture that encouraged speculation and risk-taking, put into place the conditions for the country’s fall. The stock market, which had been growing for years, began to decline in the summer and early fall of 1929, precipitating a panic that led to a massive stock sell-off in late October. In one month, the market lost close to 40 percent of its value. Although only a small percentage of Americans had invested in the stock market, the crash affected everyone. Banks lost millions and, in response, foreclosed on business and personal loans, which in turn pressured customers to pay back their loans, whether or not they had the cash. As the pressure mounted on individuals, the effects of the crash continued to spread. The state of the international economy, the inequitable income distribution in the United States, and, perhaps most importantly, the contagion effect of panic all played roles in the continued downward spiral of the economy.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

Why did banks fail?

Many banks failed due to their dwindling cash reserves. This was in part due to the Federal Reserve lowering the limits of cash reserves that banks were traditionally required to hold in their vaults, as well as the fact that many banks invested in the stock market themselves.

What was Hoover's agenda?

Upon his inauguration, President Hoover set forth an agenda that he hoped would continue the “Coolidge prosperity ” of the previous administration. While accepting the Republican Party’s presidential nomination in 1928, Hoover commented, “Given the chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation forever.” In the spirit of normalcy that defined the Republican ascendancy of the 1920s, Hoover planned to immediately overhaul federal regulations with the intention of allowing the nation’s economy to grow unfettered by any controls. The role of the government, he contended, should be to create a partnership with the American people, in which the latter would rise (or fall) on their own merits and abilities. He felt the less government intervention in their lives, the better.

How many shares were traded on Black Tuesday?

On Black Tuesday, October 29, stock holders traded over sixteen million shares and lost over $14 billion in wealth in a single day. To put this in context, a trading day of three million shares was considered a busy day on the stock market. People unloaded their stock as quickly as they could, never minding the loss.

When did the Dow Jones Industrial Average peak?

As September began to unfold, the Dow Jones Industrial Average peaked at a value of 381 points, or roughly ten times the stock market’s value, at the start of the 1920s.

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

Who created the Dow Jones Industrial Average?

Dow Jones Industrial Average (Created by: Sam Marshall, Federal Reserve Bank of Richmond) Enlarge. The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds.

Who is Gary Richardson?

1 Gary Richardson is the historian of the Federal Reserve System in the research department of the Federal Reserve Bank of Richmond. Alejandro Komai is a PhD candidate in economics at the University of California, Irvine. Michael Gou is a PhD student in economics at the University of California, Irvine.

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What happened to stock market in 1929?

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

When was the New York Stock Exchange founded?

The New York Stock Exchange was founded in 1817, although its origins date back to 1792 when a group of stockbrokers and merchants signed an agreement under a buttonwood tree on Wall Street.

What was the New Deal?

The relief and reform measures in the “ New Deal ” enacted by the administration of President Franklin D. Roosevelt (1882-1945) helped lessen the worst effects of the Great Depression; however, the U.S. economy would not fully turn around until after 1939, when World War II (1939-45) revitalized American industry.

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What was the cause of the 1929 Wall Street crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it , during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels. Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier ...

What was the Great Depression?

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

What happened in 1929?

In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

What is an encyclopedia editor?

Encyclopaedia Britannica's editors oversee subject areas in which they have extensive knowledge, whether from years of experience gained by working on that content or via study for an advanced degree. ...

What was the unemployment rate in 1932?

According to the Library of Congress, the African-American unemployment rate in 1932 climbed to approximately 50 percent.

What party did African Americans vote for?

For decades prior to the Great Depression, African Americans had traditionally voted for the Republican Party, which was still seen as the party of emancipation from the days of Abraham Lincoln. The presidential election of 1932, ...

How did the Great Depression affect the world?

The Great Depression infiltrated the lives of a generation and those beyond it, with tough lessons needing to be learnt.

What happened in 1929?

In 1929, this is exactly what happened. Run on New York’s American Union Bank. The Bank went out of business on June 30th 1931. The Great Depression started in the United States causing an enormous reduction in the worldwide gross domestic product, which fell in the period from 1929 to 1932 by fifteen percent.

What was the Great Depression?

by Jessica Brain. On Tuesday 29th October 1929 the Wall Street Crash caused a cataclysmic chain of events which affected nearly every country across the globe. The Great Depression, also known as ‘The Slump’ infiltrated every corner of society, affecting people’s lives between 1929 and 1939 and beyond.

Who is Jessica Brain?

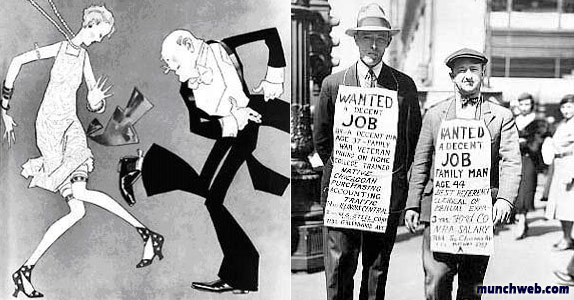

Jessica Brain is a freelance writer specialising in history. Based in Kent and a lover of all things historical. The 1920s or the Roaring Twenties was the decade of boom and bust, of flappers and playboys, jazz and the Charleston, Bertie Wooster and the Great Gatsby, the General Strike and Wall Street Crash.