How to tell if a stock pays a dividend?

Oct 27, 2014 · Dividends are usually paid in the form of a dividend check. However, they may also be paid in additional shares of stock. The standard …

What stocks pay the highest dividends?

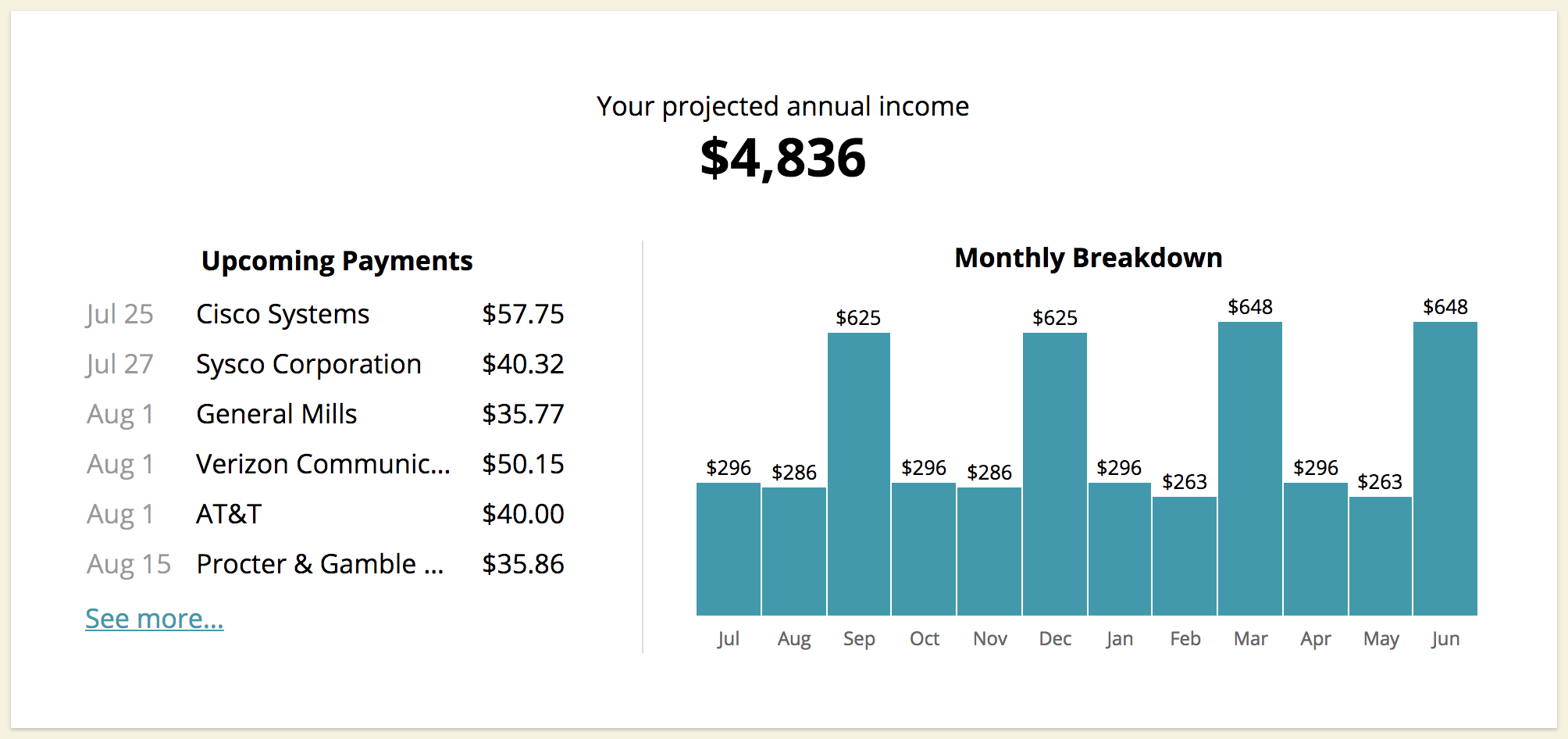

Apr 26, 2021 · To get an idea of how much you can expect to receive, you'll look at the stock's dividend yield. This figure shows the stock's annual dividend as a percentage of the price of one share on a certain date. For example, if you own a stock that's worth $50 and it pays a $0.25 dividend quarterly, that's $1 total for the year.

How do I know if stock pays dividends?

Mar 11, 2022 · How are dividends paid? Cash dividends. This is the most common way to pay dividends. Usually you’ll receive your cash dividends via your brokerage account. Stock dividends. Sometimes companies issue additional shares of stock as a dividend. You should see your additional shares in your brokerage statement. Property dividends.

How do you know which stocks pay dividends?

Apr 07, 2021 · Stock dividends involves the issuance of common stock by a company to pay its common shareholders. The value of these shares is based on their fair market value at the time of issuance. By the way, whether a company pays its shareholders in stock or in cash has no impact on a company’s worth.

How long do you have to hold a stock to get the dividend?

To be eligible for the dividend, you must buy the stock at least two business days before the date of record and own it by the close one business day before the ex-date.

Are stock dividends paid monthly or yearly?

Dividends usually pay out every quarter, although that timetable isn't required for every dividend-paying company. Some opt to pay their investors every month while others pay semi-annually or annually.Jan 28, 2022

Do dividends get paid automatically?

The most common way to get your dividend is that it is paid automatically, directly into the brokerage account where you hold the stock.Dec 23, 2019

Does Amazon pay a dividend?

Amazon doesn't pay dividends to its stockholders, which has been on since its inception. Amazon's major promise to stockholders has always hinged on its potential business growth and expansion into new markets.Sep 17, 2021

How often do you receive dividends?

quarterlyIn the United States, companies usually pay dividends quarterly, though some pay monthly or semiannually. A company's board of directors must approve each dividend. The company will then announce when the dividend will be paid, the amount of the dividend, and the ex-dividend date.

Why do stock prices fall after dividends?

After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Dividends paid out as stock instead of cash can dilute earnings, which can also have a negative impact on share prices in the short term.

What is a good dividend yield?

The average dividend yield on S&P 500 index companies that pay a dividend historically fluctuates somewhere between 2% and 5%, depending on market conditions. 5 In general, it pays to do your homework on stocks yielding more than 8% to find out what is truly going on with the company.

How often can I take dividends from my company?

There's no limit, and no set amount – you might even pay your shareholders different dividend amounts. Dividends are paid from a company's profits, so payments might fluctuate depending on how much profit is available. If the company doesn't have any retained profit, it can't make dividend payments.Jul 20, 2021